简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Usd/Jpy – Look For Sell Opportunity|Influencer Forex Analysis•Jasper Njuguna

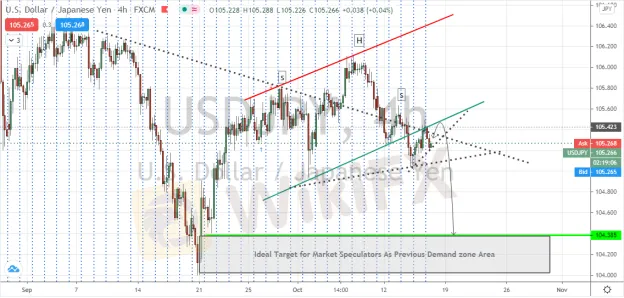

Abstract:Market speculators may be setting up for a nice sell setup and sell-off run today as we view a head and shoulder pattern clearly playing out inside an ascending channel and a nice clean retest of the neckline.

Market speculators may be setting up for a nice sell setup and sell-off run today as we view a head and shoulder pattern clearly playing out inside an ascending channel and a nice clean retest of the neckline.

Current price action and structure is below the 50 moving average with the band holding of now twice, and acting as nice technical confluence for bearish trade setup confirmation especially for near on point entry and risk management on risk:reward scenarios during and at closing of todays Asian trading session and at the start of London trading session.

4 Hour chart;

Previous demand zone levels block between price handle level 104.385 and price handle 104.0 may be on sights for sellers profit target zone and in the interim, price handle level of 104.8 may portend to be short target bet.

Of course, ones discretion and risk management is advised.

Jasper Njuguna is a self-taught discretionary financial markets trader. With cumulative 5 years experience trading the markets and out of which, one and a half years of that as a prop trader, trading large and mid-cap American equities at one of the DAY TRADE THE WORLD offices.

Prior to switching career interest to trading, I have 9 years of experience in senior management roles driving small to large business development and B2B relations in creating and implementing; learning & development solutions, programs, organizational strategies & frameworks, and blended learning approaches for companies and institutions in Africa.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

22 things you need to know as a Beginner in the Forex Market| Influencer Forex Analysis•Bola Akinya

Forex trading has caused large losses to many inexperienced and undisciplined traders over the years. You need not be one of the losers. Here are twenty forex trading tips that you can use to avoid disasters and maximize your potential in the currency exchange market.

Two Concerns Non-Negligible After Thanksgiving| Influencer Forex Analysis•Jasper Lo

It is reported that the US Food and Drug Administration has scheduled a meeting of its Vaccines and Related Biological Products Advisory Committee on Dec. 10 to discuss the request for emergency use authorization of a Covid-19 vaccine from Pfizer. If nothing else, an approval would immediately allow the first Americans to get a vaccine on Dec. 11.

Inevitable Flaws Hidden in Demo Account

There are some disadvantages of virtual accounts during forex trading. If these drawbacks are ignored by traders, they may experience unexpected losses even in real trading.

Trading at the Right Time

The most obvious difference between the forex market and other trading markets is the constant trading hours and the unconstrained trading places. Trading at the right time helps generate a great profit.

WikiFX Broker

Latest News

BI Apprehends Japanese Scam Leader in Manila

Bitcoin in 2025: The Opportunities and Challenges Ahead

Join the Event & Level Up Your Forex Journey

Is There Still Opportunity as Gold Reaches 4-Week High?

Bitcoin miner\s claim to recover £600m in Newport tip thrown out

Good News Malaysia: Ready for 5% GDP Growth in 2025!

How to Automate Forex and Crypto Trading for Better Profits

Breaking News! Federal Reserve Slows Down Interest Rate Cuts

Beware: Pig Butchering Scam Targeting Vulnerable Individuals

This Economic Indicator Sparks Speculation of a Japan Rate Hike!

Currency Calculator