简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Two Enemies against the Market

Abstract:Two enemies have been controlling the Forex market for ages. We now break how these forces work.

Two enemies have been controlling the Forex market for ages. We now break how these forces work.

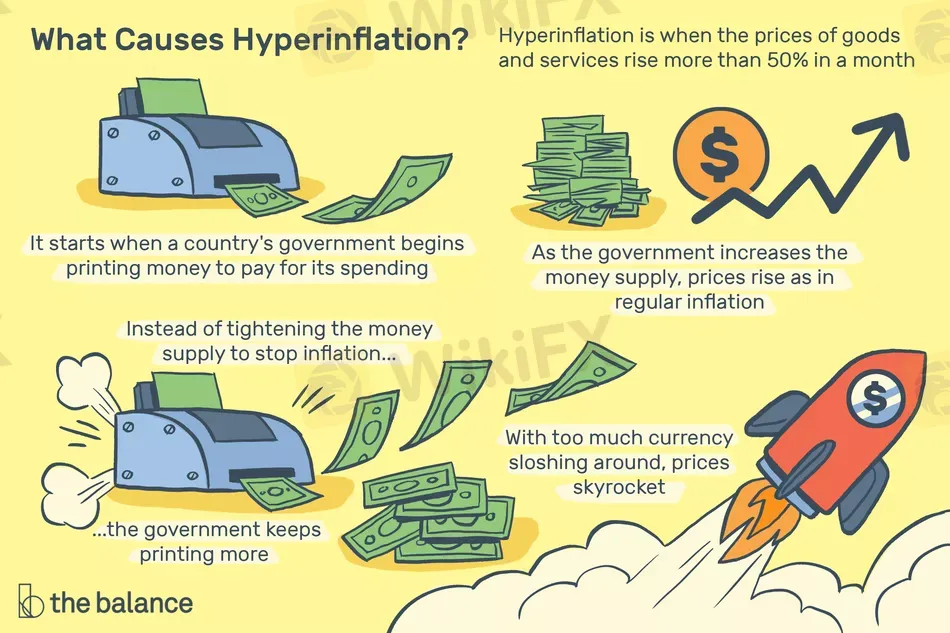

Hyperinflation

Before discussing the specific impact of inflation and deflation on the economy, we need to know about the background knowledge. Inflation and deflation are monetary phenomena. The fluctuation of commodity prices is mainly affected by market supply and demand. The well-known quantity theory of money in economics points out that the price index is determined by economic output, the stock of nominal money, and the velocity of money circulation. Therefore, when a country‘s economy has sustained inflation, it can be considered that the driving force is the continued rapid growth of the central bank’s money supply.

Deflation

In fact, the harm of deflation is simple. If everyone knew that commodity prices were to fall tomorrow, most people wouldnt consume or invest today. They might buy some commodities with relatively low demand elasticity, such as daily necessities and today's dinner, etc. But for some high-priced durable goods, consumers may have to carefully consider whether to consume them immediately or wait for a price reduction. This reflects the real interest rate mentioned above. Even if the bank deposit interest rate is zero (such as in Japan), if prices continue to fall, consumers will still hold on to their money. If consumers believe that deflation will exist for a long time, then the total economic demand will remain persistently below the equilibrium level, indicating a long-term recession.

It is not difficult to find that the harm of deflation is far greater than moderate inflation. The public's fear of inflation mostly stems from the illusion that real purchasing power has increased due to the economic crisis in hyperinflation countries and deflation. Hyperinflation is not the culprit of economic crises. Deep-seated economic problems are the driving force. In contrast, deflation can directly cause recession and decrease the effectiveness of the central bank's monetary policy. The outcome is beyond underestimation. When the macro economy is in recession, the small amount of additional purchasing power that individuals gain may not be enough to make up for the loss of unemployment and wage cuts. Deflation is even more terrifying both for the economy as well as for the individual.

This is the reason why the central banks of developed economies keep the CPI stable at 2%. So the movements of CPI and interest rate usually reflect the value of currencies.

WikiFX is a global Forex inquiry platform that provides real-time rankings of Forex brokers. So if you are seeking a broker to start your Forex trading journey, please search the detailed information about the broker on the WikiFX.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

For ex market and trading bots

The world of forex trading is a complex world of currencies, commodities, index funds, and many other assets and indicators that can wipe all your money in seconds if you are not up to date with market conditions, international trends, events, and simply what the US president saying this morning.

The USD Analysis In clash With The Fed's Monetary Policy

What will happen to the USD pair in the days to come ?

Most Used For ex Indicators by Expert Traders

We are all aware of the buzz of how huge the forex market is, it is worth trillions. Yet, loss is so common with beginning traders while expert traders make lots of profits from their trades. Following every advice, tip and insight could be blamed for the loss beginning traders face. However, it all bounces back to the experience. The one thing that helps expert traders make big profits.

How to Identify and Avoid For ex Scams

Do you know the Forex market is the largest financial market in the world, with over $5 trillion traded every single day? At the click of a button you can instantly trade on hundreds currencies, including the US dollar, Euro, British pound, Japanese Yen, etc.

WikiFX Broker

Latest News

Revolut X Expands Crypto Exchange Across Europe, Targeting Pro Traders

Broker Review: Is Exnova Legit?

Capital.com Shifts to Regional Leadership as CEO Kypros Zoumidou Steps Down

Crypto Scammer Pleads Guilty in $73 Million “Pig Butchering” Fraud

CWG Markets Got FSCA, South Africa Authorisation

Amazon launches Temu and Shein rival with \crazy low\ prices

CySEC Warns Against Unauthorized Investment Firms in Cyprus

Why Even the Highly Educated Fall Victim to Investment Scams?

Warning Against Globalmarketsbull & Cryptclubmarket

FBI Raids Polymarket CEO’s Home Amid 2024 Election Bet Probe

Currency Calculator