简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

NZD/USD refreshes weekly top above 0.7000 despite sluggish markets

Abstract:NZD/USD refreshes weekly top above 0.7000 despite sluggish markets

NZD/USD stays firm around eight-day top, prints three-day winning streak.

Downbeat US Treasury yields keep greenback pressured.

Challenges to risk gain less attention amid Good Friday holiday.

US Employment data, bond moves become the key.

NZD/USD leads major currency gainers, up 0.21% to 0.7033, during the early Fridays trading. Even if Good Friday restricts the market moves, with holidays in Australia and New Zealand, the extended US dollar weakness seems to play its role in favoring the kiwi buyers.

US dollar index (DXY) stays on the back foot below 93.00, near 92.90 by the press time, as the US 10-year Treasury yield remains pressured close to 1.67%. Its worth mentioning that the key bond coupon dropped the most in five weeks the previous day and favored USD bears.

While searching for catalysts, global ire over the conviction of veteran Hong Kong Activists and the coronavirus (COVID-19) vaccine chatters from the US should have played their role.

US Depart of Statement condemned the arrests of key democratic personalities in Hong Kong while the Senate Majority Leader Mitch McConnell pushed Biden Administration to gather international support to take punitive actions against China due to the said instance.

Elsewhere, US health expert Dr. Anthony Fauci said that the US may not need the AstraZeneca vaccine even if it gets regulatory approval for usage. The news renewed vaccine jitters as the Anglo-Swedish vaccine is among the top covid cure.

Its worth mentioning that the S&P 500 Futures print mild gains, following the Wall Street benchmarks, whereas stocks in China and Japan portray aftershocks of the US infrastructure spending announcement.

Although off in Australia and New Zealand challenges NZD/USD traders the most, Chinas active day, amid tension surrounding Hong Kong, can entertain the pair traders. However, nothing line the US employment data, up for publishing at 12:30 GMT.

Read: US Nonfarm Payrolls March Preview: Optimism and evidence this time?

Technical analysis

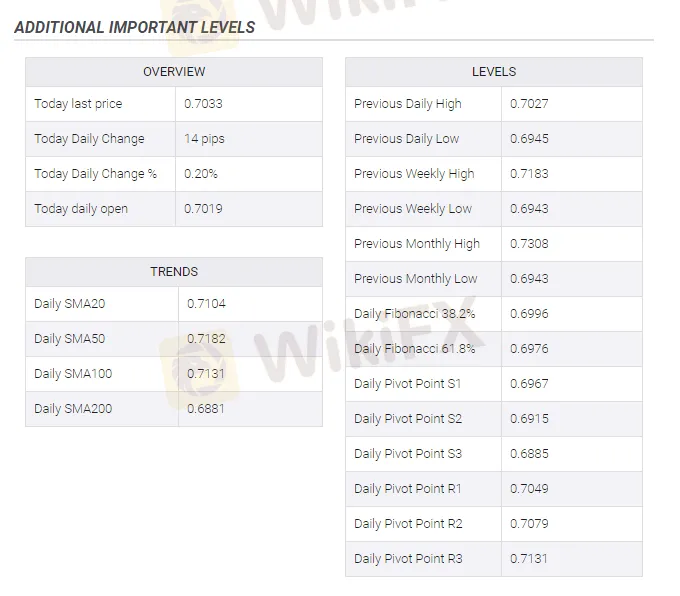

A daily close beyond 0.7030, comprising late December lows, becomes necessary for NZD/USD bulls to attack early March bottom surrounding the 0.7100 threshold.

----------------

WikiFX, the world's No.1 broker inquiry platform!

Use WikiFX to get free trading strategies, scam alerts, and experts experience!

Android : cutt.ly/Bkn0jKJ

iOS : cutt.ly/ekn0yOC

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Easy Trading Online Awarded “Best Forex Broker - Asia” at Wiki Finance EXPO 2024 Hong Kong

We are thrilled to announce that Easy Trading Online has been awarded the “Best Forex Broker - Asia” at the Wiki Finance EXPO 2024 Hong Kong! This prestigious recognition underscores our commitment to excellence and dedication to providing top-notch services to our clients.

Celebrating Excellence of Easy Trading Online at 2024 FastBull Awards Ceremony

On the evening of April 28, Easy Trading Online proudly received the 'Most Trusted Forex Broker' award at the BrokersView 2024, hosted by Fastbull. This accolade is a testament to our steadfast dedication to providing reliable and superior trading services in the forex and CFD brokerage industry.

Easy Trading Online Shines as Gold Sponsor at BrokersView Expo Dubai 2024

The BrokersView Expo Dubai 2024 is a premier event in the financial industry, bringing together top financial institutions, brokers, and technology providers from around the globe. As the Gold Sponsor of BrokersView Expo Dubai 2024, Easy Trading Online took the opportunity to showcase our latest products, service technologies, and core competitive advantages in the forex trading field.

Easy Trading Online at the Wiki Gala Night

On the 23rd of March, the Easy Trading Online family had the distinguished pleasure of being the Table Sponsor at the prestigious Wiki Gala Night. As we reflect on the event, it’s with a sense of pride and joy that we share the highlights and our takeaways from an evening that was as inspiring as it was splendid.

WikiFX Broker

Latest News

Interactive Brokers Launches Forecast Contracts in Canada for Market Predictions

Authorities Alert: MAS Impersonation Scam Hits Singapore

INFINOX Partners with Acelerador Racing for Porsche Cup Brazil 2025

The Impact of Interest Rate Decisions on the Forex Market

Billboard Warns of Crypto Scams Using Its Name – Stay Alert!

STARTRADER Spreads Kindness Through Ramadan Campaign

Rising WhatsApp Scams Highlight Need for Stronger User Protections

A Trader’s Worst Mistake: Overlooking Broker Reviews Could Cost You Everything

How a Housewife Lost RM288,235 in a Facebook Investment Scam

The Daily Habits of a Profitable Trader

Currency Calculator