简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Forex Broker News May 14

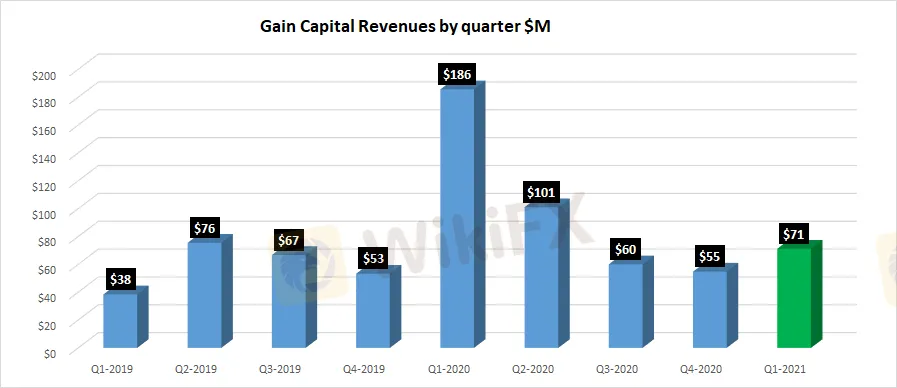

Abstract:Gain Capital produces $71 million of revenue for StoneX in Q2-2021.

Gain Capital, and its Forex.com and City Index brands, produced $71.2 million of StoneX‘s record $471.4 million of Revenue in the company’s latest financial quarter to March 31, 2021. (That would be StoneXs Q2-2021, with the company having a September 30 fiscal year end).

The StoneX-Gain Capital acquisition has been looking better and better each quarter for the company. StoneX spent $236 million to buy Gain Capital in mid 2020, and has already brought in more than half that amount in Revenues for the company, in just the last six months. Revenues from Gain Capital were $54.8 million last quarter (ending December 31, 2020), such that the latest quarter of Jan-Feb-Mar 2021 was up by 30%.

StoneX FX and CFD trading volumes – coming mainly from the Gain Capital brands – were $11.1 billion ADV, up from $10.7 billion ADV the previous quarter. That translates into monthly trading volumes of about $240 billion at Forex.com and City Index.

Overall in Q2-2021, StoneX reported record results. Sean M. OConnor, CEO of StoneX Group Inc., stated,

“I believe this quarter represents the strongest core operating performance in our history, with record operating revenues, a 41% increase in net income versus the prior year and a 26.7% ROE on stated book value. This quarter demonstrates our efforts to build a diversified global franchise with growth in operating revenues and income across all of our operating segments. We continue to increase both our number of clients and their underlying volumes, which we feel positions us for success in the future.”

During the three months ended March 31, 2021, the company completed the transfer of the majority of the operations of Gains U.K. domiciled subsidiaries into StoneX Financial Ltd. and subsequently closed out our derivative transactions, realizing a $1.2 million loss on the derivative positions and an offsetting $3.1 million foreign currency gain on revaluation for the three months ended March 31, 2021.

Stay tuned, more global news coming soon!

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

WikiFX Broker

Latest News

Interactive Brokers Launches Forecast Contracts in Canada for Market Predictions

Authorities Alert: MAS Impersonation Scam Hits Singapore

INFINOX Partners with Acelerador Racing for Porsche Cup Brazil 2025

The Impact of Interest Rate Decisions on the Forex Market

Billboard Warns of Crypto Scams Using Its Name – Stay Alert!

STARTRADER Spreads Kindness Through Ramadan Campaign

How a Housewife Lost RM288,235 in a Facebook Investment Scam

Rising WhatsApp Scams Highlight Need for Stronger User Protections

A Trader’s Worst Mistake: Overlooking Broker Reviews Could Cost You Everything

The Daily Habits of a Profitable Trader

Currency Calculator