简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

US Dollar Outlook: DXY Index Eyes Retail Sales Data, Yields

Abstract:US Dollar Outlook: DXY Index Eyes Retail Sales Data, Yields

US DOLLAR OUTLOOK HINGES ON TREASURY YIELDS; RETAIL SALES & CONSUMER INFLATION EXPECTATIONS EYED

US Dollar edged slightly lower on Thursday measuring by the broader DXY Index

Treasury yields pulled back and likely contributed to a slightly weaker US Dollar

Retail sales and consumer sentiment data on deck could rekindle inflation fears

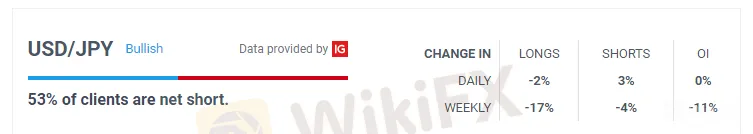

The US Dollar lost upward momentum on Thursday following yesterdays influx of strength. USD price action was largely mixed across the board of major currency pairs with USD/JPY downside offsetting USD/CAD upside. A slight pullback in ten-year Treasury yields likely weighed negatively on USD/JPYwhile sharply lower crude oil prices may have helped guide USD/CAD higher. On balance, the broader DXY Index closed practically flat with a very modest -0.06% decline.

DXY - US DOLLAR INDEX WITH TEN-YEAR TREASURY YIELD OVERLAID: DAILY TIME FRAME (24 DEC 2020 TO 13 MAY 2021)

That said, it is probable that the direction of Treasury yields strongarms where the broader US Dollar heads next. The reversal lower by the US Dollar since the beginning of April coincided with the year-to-date peak in ten-year Treasury yields around 178-basis points. Yesterday‘s red-hot inflation data ignited a breakout in ten-year Treasury yields above 1.65%, but 1.70% continues to present a notable level of resistance. A close above this area could be quite telling of how the bond market feels about inflation overheating and Fed taper risks. In turn, this could fuel a sustained reversal higher by the US Dollar. With FOMC officials continuing to peg rises in inflation as ’largely transitory, however, there could be more headwinds experienced by Treasury yields and the broader US Dollar. Aside from just Treasury yields, it might also be prudent for traders to keep close tabs on US interest rate differentials.

USD PRICE OUTLOOK - US DOLLAR IMPLIED VOLATILITY TRADING RANGES (OVERNIGHT)

Looking ahead to Friday‘s trading session, we have high-impact event risk posed by the release of monthly retail sales and consumer sentiment data. US Dollar implied volatility readings have cooled off from earlier in the week, however, and suggest that there may be less of a reaction by markets relative to Wednesday’s CPI report. I will be curious to see updated inflation expectations detailed in the UofMs consumer sentiment report nonetheless. NZD/USD price action is expected to be one of the more active pairs judging by its overnight implied volatility reading of 10.0%, which compares to its 20-day average reading of 8.9% and ranks in the bottom 40thpercentile of measurements taken over the last 12-months.

==========

WikiFX, a global leading broker inquiry platform!

Use WikiFX to get free trading strategies, scam alerts, and experts experience!

╔════════════════╗

Android : cutt.ly/Bkn0jKJ

iOS : cutt.ly/ekn0yOC

╚════════════════╝

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

GemForex - weekly analysis

The week ahead: The Dollar keeps dictating the markets

USD/JPY reverses lower as risk appetite weighs on US yields, bounces at key 112.50 support

USD/JPY fell back to weekly lows in the 112.50 region on Friday though has since bounced as volumes fade. The pair reversed from as high as the 113.50s as risk appetite deteriorated and drove long-term US yields lower.

US Dollar Leaps on Fed Re-Nomination Pumping Up Treasury Yields. Will USD Keep Going?

The US Dollar rode higher as US yields rose across the curve. Crude oil prices recovered after OPEC+ threw a curve ball. With Thanksgiving almost here, where will USD go on holiday?

Powell stopped the dollar's rally, calming taper fears

Powell stopped the dollar's rally, calming taper fears

WikiFX Broker

Latest News

TradingView Brings Live Market Charts to Telegram Users with New Mini App

Trump tariffs: How will India navigate a world on the brink of a trade war?

Interactive Brokers Launches Forecast Contracts in Canada for Market Predictions

Authorities Alert: MAS Impersonation Scam Hits Singapore

Stocks fall again as Trump tariff jitters continue

INFINOX Partners with Acelerador Racing for Porsche Cup Brazil 2025

Regulatory Failures Lead to $150,000 Fine for Thurston Springer

April Forex Trends: EUR/USD, GBP/USD, USD/JPY, AUD/USD, USD/CAD Insights

March Oil Production Declines: How Is the Market Reacting?

Georgia Man Charged in Danbury Kidnapping and Crypto Extortion Plot

Currency Calculator