简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Bitcoin Crashes to A Low of $31,663

Abstract:Bitcoin saw a correction of over 27% from its 24-hour high of $43,546 to a low of $31,663 before jumping back up to $37,902 at press time, still more than 12% lower.

Bitcoin (CRYPTO: BTC) saw a major price crash today, bringing other cryptocurrencies and related crypto stocks down with it as well.

What Happened?

According to CoinMarketCap data, Bitcoin saw a correction of over 27% from its 24-hour high of $43,546 to a low of $31,663 before jumping back up to $37,902 at press time, still more than 12% lower.

Bitcoins Latest Crash: Not the First, Not the Last

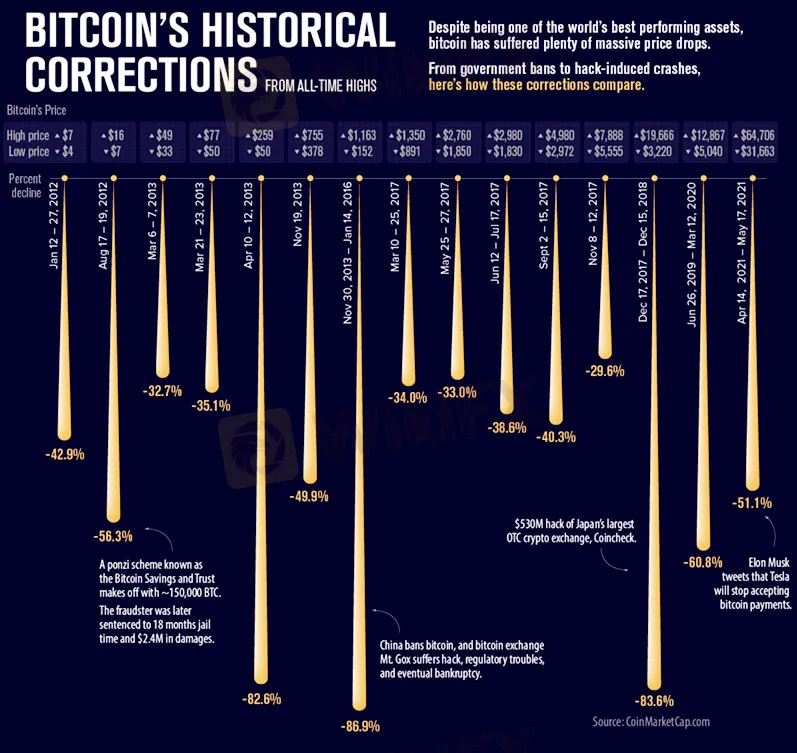

While bitcoin has been one of the worlds best performing assets over the past 10 years, the cryptocurrency has had its fair share of volatility and price corrections.

Using data from CoinMarketCap, this graphic looks at bitcoins historical price corrections from all-time highs.

With bitcoin already down ~15% from its all-time high, Elon Musks tweet announcing Tesla would stop accepting bitcoin for purchases helped send the cryptocurrency down more than 50% from the top, dipping into the $30,000 price area.

Crypto Cycle Top or Bull Run Pullback?

It‘s far too early to draw any conclusions from bitcoin’s latest drop despite 30-40% pullbacks being common pit stops across bitcoins various bull runs.

While this drop fell a bit more from high to low than the usual bull run pullback, bitcoins price has since recovered and is hovering around $39,000, about a 40% drop from the top.

Whether or not this is the beginning of a new downtrend or the ultimate dip-buying opportunity, there has been a clear change in sentiment (and price) after Elon Musk tweeted about bitcoins sustainability concerns.

The Decoupling: Blockchain, not Bitcoin

Bitcoin and its energy intensive consensus protocol “proof-of-work” has come under scrutiny for the 129 terawatt-hours it consumes annually for its network functions.

Some other cryptocurrencies already use less energy-intensive consensus protocols, like Cardano‘s proof-of-stake, Solana’s proof-of-history, or Nyzos proof-of-diversity. With the second largest cryptocurrency, Ethereum, also preparing to shift away from proof-of-work to proof-of-stake, this latest bitcoin drop could mark a potential decoupling in the cryptocurrency market.

In just the past two months, bitcoins dominance in the crypto ecosystem has fallen from over 70% to 43%.

While the decoupling narrative has grown alongside Ethereum‘s popularity as it powers NFTs and decentralized finance applications, it’s worth noting that the last time bitcoin suffered such a steep drop in dominance was the crypto markets last cycle top in early 2018.

For now, the entire crypto market has pulled back, with the total cryptocurrency space‘s market cap going from a high of $2.56T to today’s $1.76T (a 30% decline).

While the panic selling seems to have finished, the next few weeks will define whether this was just another dip to buy, or the beginning of a steeper decline.

- END -

Stay tuned on WikiFX, more news coming soon!

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

Elderly Trader Loses RM2.1M in WhatsApp Forex Scam

Spotware Unveils cTrader Store, Global Marketplace for Algo Creators

Gigamax Scam: Tracking Key Suspects in RM7 Million Crypto Fraud

WikiFX Review: Is IQ Option trustworthy?

CFI Partners with MI Cape Town, Cricket Team

Doo Financial Expands Reach with Indonesian Regulatory Licenses

Quadcode Markets: Trustworthy or Risky?

5 Questions to Ask Yourself Before Taking a Trade

Avoid Fake Websites of CPT Markets

Webull Canada Expands Options Trading to TFSAs and RRSPs

Currency Calculator