简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Australian Dollar Analysis: AUD/USD Gyrates Following Mixed Jobs Data

Abstract:AUD/USD, AU EMPLOYMENT TALKING POINTS

Australian employment change comes in at -30,600 against a previous gain of 77,000

The Australian unemployment rate falls to 5.5%, however labor force participation also dropped

AUD/USD pushed lower Wednesday following a wave of risk-off sentiment across all asset classes

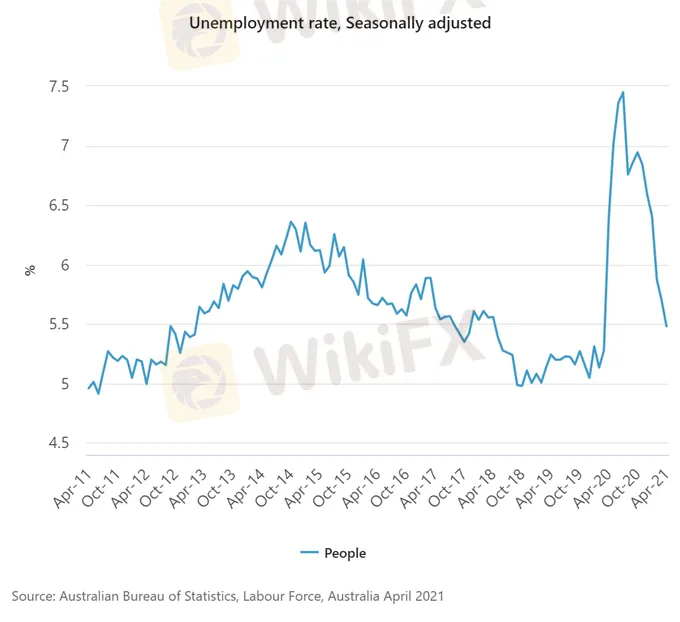

Australian employment data largely disappointed on Thursday as total employment decreased by 30,600 jobs, against an expected gain of 15,000 jobs for April. Despite the miss, the countrys unemployment rate dropped to 5.5%, down 0.2% from March. Perhaps a green shoot in the reading was the gain in full-time employment, which grew in April by 33,800. Of note, the end of the domestic “JobKeeper” subsidy program will present a headwind to further significant employment gains. Experts labeled the program as a key factor in the sharp decline in Australian unemployment over the last 6 months.

AUSTRALIAN EMPLOYMENT TRENDS

Despite the significant improvement in economic conditions in Australia, Reserve Bank of Australia (RBA) officials remain adamant that interest rate hikes will not take place until employment and inflation quotas are met. RBA officials will pay serious attention to the changes in the labor market, particularly the decrease in labor force participation. Participation dropped from 66.3% in March to 66.0% in April. In RBA minutes released this week, officials hinted at a willingness to alter bond buying, but committed to no rate hikes until 2024.

The Australian dollar came under pressure Wednesday as FOMC minutes mentioned tapering of asset purchases, specifically the fact that multiple FOMC participants believe taper talk should take place over the next few meetings. Markets reacted immediately, with the US dollar catching an immediate bid on the news. Any significant strength in the Greenback may be enough to see AUD/USD break below the neckline of a head and shoulders (H&S) pattern that has been forming since late April. Currently, the neckline stands around 0.7700. For more on this H&S pattern, please click here for insight from Rich Dvorak.

AUD/USD 4 HOUR CHART

More news coming soon on WikiFX APP -

Android: https://bit.ly/3kyRwgw

iOS: https://bit.ly/wikifxapp-ios

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Weekly Fundamental Gold Price Forecast: Hawkish Central Banks a Hurdle

WEEKLY FUNDAMENTAL GOLD PRICE FORECAST: NEUTRAL

Gold Prices at Risk, Eyeing the Fed’s Key Inflation Gauge. Will XAU/USD Clear Support?

GOLD, XAU/USD, TREASURY YIELDS, CORE PCE, TECHNICAL ANALYSIS - TALKING POINTS:

British Pound (GBP) Price Outlook: EUR/GBP Downside Risk as ECB Meets

EUR/GBP PRICE, NEWS AND ANALYSIS:

Dollar Up, Yen Down as Investors Focus on Central Bank Policy Decisions

The dollar was up on Thursday morning in Asia, with the yen and euro on a downward trend ahead of central bank policy decisions in Japan and Europe.

WikiFX Broker

Latest News

Revolut X Expands Crypto Exchange Across Europe, Targeting Pro Traders

Broker Review: Is Exnova Legit?

Capital.com Shifts to Regional Leadership as CEO Kypros Zoumidou Steps Down

Crypto Scammer Pleads Guilty in $73 Million “Pig Butchering” Fraud

CWG Markets Got FSCA, South Africa Authorisation

Amazon launches Temu and Shein rival with \crazy low\ prices

CySEC Warns Against Unauthorized Investment Firms in Cyprus

Why Even the Highly Educated Fall Victim to Investment Scams?

Warning Against Globalmarketsbull & Cryptclubmarket

FBI Raids Polymarket CEO’s Home Amid 2024 Election Bet Probe

Currency Calculator