简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Crude Oil Futures: Rebound likely very near-term

Abstract:Crude Oil Futures: Rebound likely very near-term

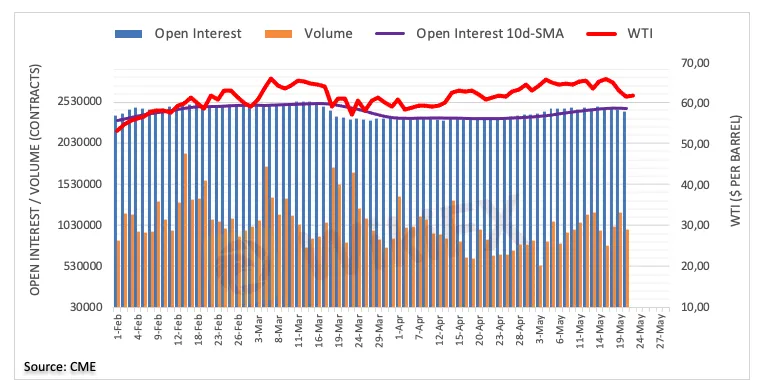

Open interest in Crude Oil prices dropped for the second session in a row on Thursday, this time by around 21.6K contracts according to preliminary readings from CME Group. In the same line, volume shrunk by around 216.4K contracts after two daily advances in a row.

WTI now targets the $67.00 markPrices of the WTI extended the leg lower for yet another session on Thursday, finding contention around the $61.70 region. The move, however, was on the back of shrinking open interest and volume, allowing for an imminent change of direction in prices. Against this, the Mays peak near the $67.00 mark per barrel now emerges as the next hurdle of note in the short-term.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Inflation hot at 13-year high, what will happen to gold?

Inflation hot at 13-year high, what will happen to gold?

Optimism Ahead Of Bank Of Canada Decision

Optimism Ahead Of Bank Of Canada Decision

FX Week Ahead - Top 5 Events: Chinese, Mexican, US Inflation Rates; BOC & ECB Rate Decisions

FX Week Ahead - Top 5 Events: Chinese, Mexican, US Inflation Rates; BOC & ECB Rate Decisions

Find Your Forex Entry Point: 3 Entry Strategies To Try

Find Your Forex Entry Point: 3 Entry Strategies To Try

WikiFX Broker

Latest News

Germany's Election: Immigration, Economy & Political Tensions Take Centre Stage

WikiFX Review: Is IVY Markets Reliable?

Brazilian Man Charged in $290 Million Crypto Ponzi Scheme Affecting 126,000 Investors

ATFX Enhances Trading Platform with BlackArrow Integration

Become a Full-Time FX Trader in 6 Simple Steps

IG 2025 Most Comprehensive Review

Construction Datuk Director Loses RM26.6 Mil to UVKXE Crypto Scam

SEC Drops Coinbase Lawsuit, Signals Crypto Policy Shift

Should You Choose Rock-West or Avoid it?

Scam Couple behind NECCORPO Arrested by Thai Authorities

Currency Calculator