简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Large Investors Building Heavy Short Positions for Bitcoin (BTC)

Abstract:The Bitcoin (BTC) price is down another 3% on the backdrop of unfavorable global macros and rising inflation. So if you think that this might be the right time to average, you might want to wait a little bit more.

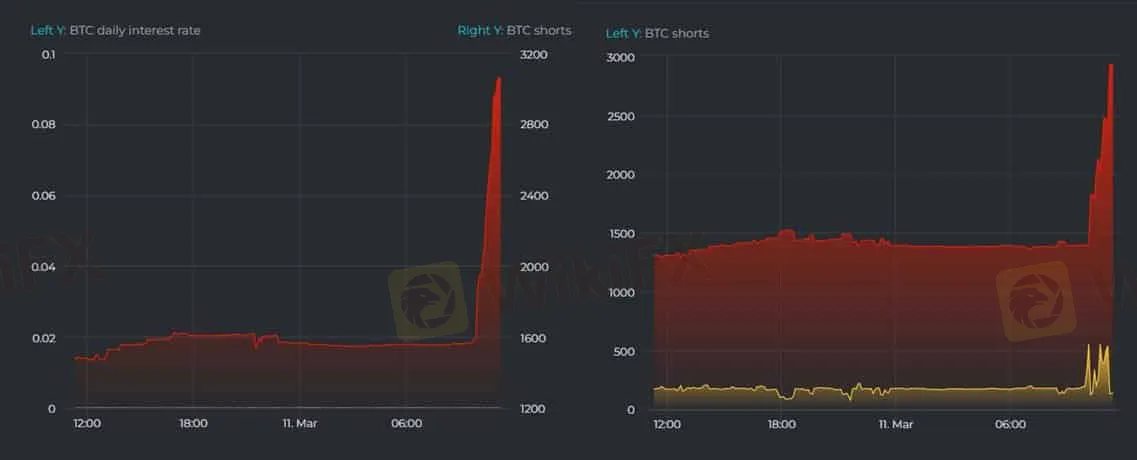

According to datamish, in the past 2 hours, some large investors (or institutions) have borrow about 1,500 BTC from Bitfinex for short positions. At present, a total of 3,063 BTC have been lent, and most of the short positions are non-hedging.

The worlds largest cryptocurrency Bitcoin has been gripped under strong volatility over the last two weeks. In this period, the Bitcoin price surged past $40,000 levels twice, however, it failed to hold it and has been trading under pressure on the downside.

However, if the massive build-up of the short positions turns true, we can see Bitcoin heading under $35,000 and all the way further to $30,000. Many analysts havent ruled out the possibility that the BTC price can once again touch under $30K levels.

Bitcoin Levels to Watch

We have seen Bitcoin showing large volatility in the range between $35K-$45K. However, every time it approaches $45K, it faces strong resistance to head lower. Crypto analyst Lark Davis explains:

I dont think that there is much to get excited about until we see Bitcoin cross back above this zone of resistance, and ideally back above the 200 day moving average. Until then, I will just keep stacking.

On the other hand, with the growing inflation numbers, the market will continue to be volatile going ahead. The Fed interest rate hikes are expected in the coming weeks and months and this time it could be more aggressive due to higher inflation.

While Bitcoin serves a great investment for the long term, one needs to be patient with all the short-term volatility.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

The Impact of Interest Rate Decisions on the Forex Market

Interest rate changes determine currency attractiveness, influencing capital flows and exchange rate trends. Understanding this mechanism helps investors navigate the forex market effectively.

How a Housewife Lost RM288,235 in a Facebook Investment Scam

A 47-year-old housewife in Malaysia recently fell victim to an online investment scam, losing a substantial sum of RM288,235 after engaging with a fraudulent scheme advertised on Facebook.

Interactive Brokers Launches Forecast Contracts in Canada for Market Predictions

Interactive Brokers introduces Forecast Contracts in Canada, enabling investors to trade on economic, political, and climate outcomes. Manage risk with ease.

Bank Negara Malaysia Flags 12 New Companies for Unauthorised Activity

Bank Negara Malaysia (BNM) has updated its Financial Consumer Alert List (FCA List) by adding 12 more entities, reinforcing its efforts to warn the public against unregulated financial schemes. Check if your broker made the list!

WikiFX Broker

Latest News

The Withdrawal Trap: How Scam Brokers Lure Victims into Paying More

FCA to Investors: Think Twice Before Trusting These Brokers

Trump\s tariffs: How could they affect the UK and your money

Trump gambles it all on global tariffs he\s wanted for decades

TradingView Brings Live Market Charts to Telegram Users with New Mini App

Trump tariffs: How will India navigate a world on the brink of a trade war?

Interactive Brokers Launches Forecast Contracts in Canada for Market Predictions

Authorities Alert: MAS Impersonation Scam Hits Singapore

IG Group Acquires Freetrade for £160M to Expand UK Investment Market

U.S. March ISM Manufacturing PMI Released

Currency Calculator