简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Something you need to know about Fusion Markets

Abstract:What does Fusion Markets look like? If you want to know whether Fusion Markets is a reliable forex broker or not, please continue to read.

In this article

WikiFX provides inquiry services in the forex field.

WikiFX evaluates the reliability of Fusion Markets based on the facts.

What is WikiFX?

| WikiFX is an authoritative global inquiry platform providing basic information inquiry and regulatory license inquiry. |

| WikiFX is able to evaluate the safety and reliability of more than 31,000 global forex brokers. |

| WikiFX gives you a huge advantage while seeking the best forex brokers. For more information, such as the review and exposure of brokers, please visit our website (https://www.WikiFX.com/en) |

To explore whether Fusion Markets is a scammer or not, we evaluated Fusion Markets from different aspects, such as regulatory status, exposure, etc.

1. Evaluate the reliability of Fusion Markets based on its general information and regulatory status.

(source: Fusion Markets website)

To understand Fusion Markets better, we explore Fusion Markets by analyzing three main perspectives:

A. General Info of Fusion Markets

B. Regulatory Status

C. Fund Security

A. General Info of Fusion Markets.

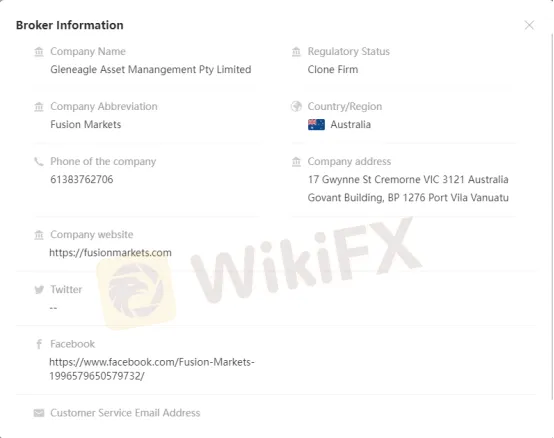

Fusion Markets s general info has been shown below:

(source: WikiFX)

(source: WikiFX)

Located in Melbourne, Australia, Fusion Markets is the brainchild of a collection of veteran forex traders. Fusion Markets offers to trade in currency pairs, precious metals, commodities, etc.

According to Fusion Markets website, it supports four languages: English, Thai, Chinese and Spanish.

Trading Platform

In terms of their trading platform, Fusion Markets preference is for MetaTrader 4 (MT4) software.

Deposit & Withdrawal

Fusion Markets offers a range of payment methods – some are region-specific, particularly the Asia Pacific region such as Thailand and Malaysia where tailored payment options are available. The popular methods are Visa and Mastercard.

Customer Service

The Fusion Markets customer support can be reached through telephone: +61 3 8376 2706, email: help@fusionmarkets.com, as well as some social media platforms including Facebook, Instagram, and YouTube. The Melbourne Headquarters Address is 17 Gwynne St, Cremorne VIC 3121, Australia.

Trading Hours

Fusion Markets is open from Monday to Friday. Session times vary based on the market hours of their products, but these are all listed on the companys website under their Trading Conditions section.

(source : WikiFX)

B. Regulatory Status

The legitimate license of Fusion Markets

(source: Fusion Markets website)

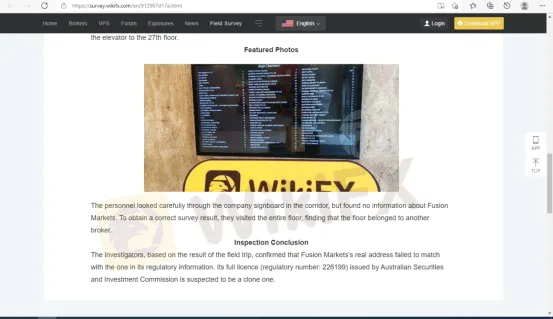

Fusion Markets claims that it is regulated by Australian Securities and Investment Commission (226199) and Vanuatu Financial Services Commission (40256). However, according to WikiFX, The claimed ASIC regulatory (license number: 226199) is a clone firm. Therefore, Fusion Markets regulatory status is suspicious.

(source: WikiFX)

(source: WikiFX)

C. Fund Security

Account segregation is imperative since it allows traders to have access to their funds all the time. Even if the broker is bankrupt, traders will still be capable of getting their money back.

Unfortunately, we don‘t find the specific information about how Fusion Markets secures clients’ assets. It also doesnt mention segregation account either.

2. The feedback from Twitter

To figure out whether Fusion Markets is a scammer or not, we made a survey about Fusion Markets on Twitter.

Reviews on Twitter:

(source: Twitter)

It seems that Fusion Markets has an official Twitter account, which was registered in May 2019. It follows nobody and only has 62 followers. As of March 2nd 2022, there is only one tweet.

3. Exposure related to Fusion Markets on WikiFX

On WikiFX, the Exposure consists of feedback from traders. A bad track record of brokers can be checked via Exposure. WikiFXs Exposure function helps you get feedback from other traders and remind you of the risks before it starts.

WikiFX currently doesnt have exposure related to Fusion Markets.

4. Special survey about Fusion Markets from WikiFX

A. Scoring Criteria

WikiFX gives brokers a score from 0 to 10. The higher the score is, the more reliable the broker is.

| The Scoring Criteria of Brokers on WikiFX |

| License index: reliability and value of licenses |

| Regulatory index: license regulatory strength |

| Business index: enterprise stability and operational capability |

| Software index: trading platform,instruments etc |

| Risk Management index: the degree of asset security |

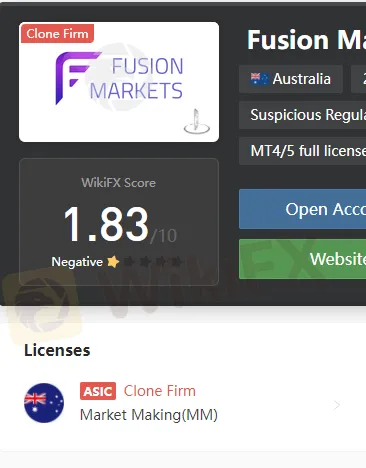

According to WikiFX, Fusion Markets has been given a very low rating of 1.83/10.

(source:WikiFX)

Please note that the broker with such a low score can be a potential scammer.

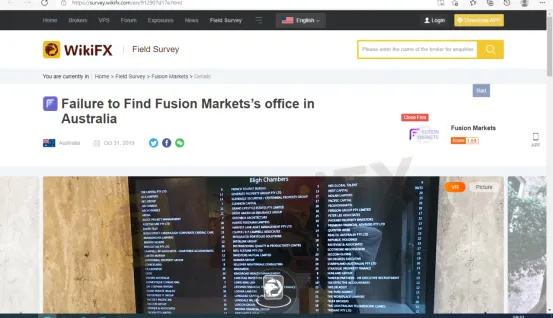

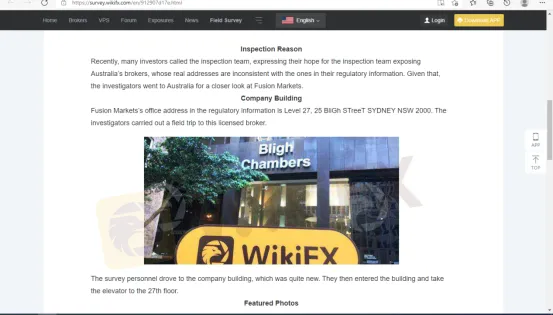

B. Field Investigation

To help you fully understand the broker, WikiFX also investigates the brokers by sending surveyors to the brokers physical addresses.

On WikiFX, you can visually check the physical addresses of brokers by pressing the “Survey” button.WikiFX did make a field survey on

Fusion Markets in 2019, but failed to find the office at their business address.

(source: WikiFX)

C. WikiFX Alerts

| The claimed ASIC regulatory (license number: 226199) is a clone firm |

| The number of this broker's negative field survey reviews has reached 1 |

(source: WikiFX)

5. Conclusion:

We dont advise you to invest with Fusion Markets as its regulatory license is a clone. If you want to know more information about the reliability of certain brokers, you can open our website (https://www.WikiFX.com/en). Or you can download the WikiFX APP for free through this link (https://www.wikifx.com/en/download.html). Running well in both the Android system and the IOS system, the WikiFX APP offers you the easiest and most convenient way to seek the brokers that you are curious about.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

The Daily Habits of a Profitable Trader

Every professional trader follows a structured approach to ensure they are well-prepared, disciplined, and able to seize opportunities with confidence. Whether you are a seasoned investor or an aspiring trader, adhering to a robust daily checklist can significantly enhance your performance. Use this checklist to check if you are a qualified trader

How a Housewife Lost RM288,235 in a Facebook Investment Scam

A 47-year-old housewife in Malaysia recently fell victim to an online investment scam, losing a substantial sum of RM288,235 after engaging with a fraudulent scheme advertised on Facebook.

A Trader’s Worst Mistake: Overlooking Broker Reviews Could Cost You Everything

In today’s digital age, reviews influence nearly every decision we make. When purchasing a smartphone, television, or home appliance, we pore over customer feedback and expert opinions to ensure we’re making the right choice. So why is it that, when it comes to choosing an online broker where real money and financial security are at stake many traders neglect the crucial step of reading reviews?

Interactive Brokers Launches Forecast Contracts in Canada for Market Predictions

Interactive Brokers introduces Forecast Contracts in Canada, enabling investors to trade on economic, political, and climate outcomes. Manage risk with ease.

WikiFX Broker

Latest News

The Withdrawal Trap: How Scam Brokers Lure Victims into Paying More

FCA to Investors: Think Twice Before Trusting These Brokers

Trump\s tariffs: How could they affect the UK and your money

Trump gambles it all on global tariffs he\s wanted for decades

TradingView Brings Live Market Charts to Telegram Users with New Mini App

Trump tariffs: How will India navigate a world on the brink of a trade war?

Interactive Brokers Launches Forecast Contracts in Canada for Market Predictions

Authorities Alert: MAS Impersonation Scam Hits Singapore

Stocks fall again as Trump tariff jitters continue

IG Group Acquires Freetrade for £160M to Expand UK Investment Market

Currency Calculator