简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Chainlink establishes support that will launch LINK to $25

Abstract:Most importantly, from an Ichimoku perspective, bulls were able to keep the daily close above the Tenkan-Sen and the Kijun-Sen, creating a fantastic base for higher moves.

Chainlink price closed the Wednesday session with an impressive 7% gain.

Bulls attempted to extend the Wednesday rally but were handily rejected by sellers.

Upside potential remains substantial, while downside risks are more limited.

Chainlink price has experienced some major swing over the past two trading days. Bulls were unable to repeat Wednesday‘s performance but, at the same time, kept LINK’s Thursday losses to a minimum.

Chainlink price develops bullish support structure, but follow-through needed to prevent a continued downtrend

Chainlink price completed several major bullish events on Wednesday‘s close. Wednesday’s close confirmed a breakout above the falling wedge as well as the Tenkan-Sen and Kijun-Sen. But the price action and resistance zones ahead could be choppy, despite the bullish close.

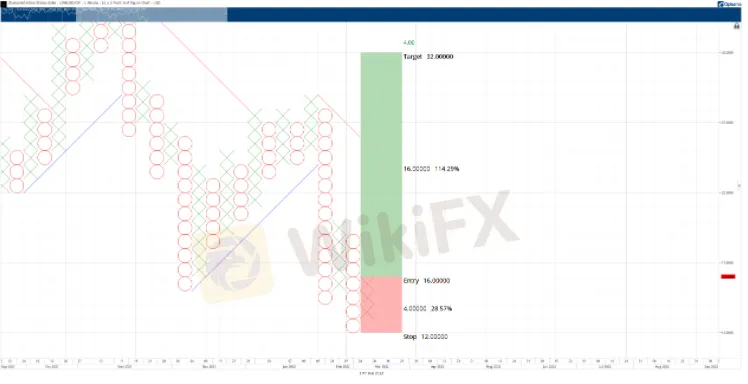

As a result, the $1/3-box Point and Figure chart sheds a little more light and clarifies where the candlestick chart cant – a potential buying opportunity is now present for Chainlink price.

The hypothetical long opportunity for Chainlink price is a buy stop at $16, a stop loss at $12, and a profit target at $32. However, while the profit target at $32 is derived from Point and Figure analysis, LINK is more likely to halt at the $25 value area. $25 is a naturally powerful psychological number, but it also contains the 50% Fibonacci retracement and the Kijun-Sen.

The long idea represents a 4:1 reward for the risk setup. A trailing stop of two to three boxes would help protect any implied profit made post entry. The setup is invalidated if Chainlink price drops to $11. Additionally, Point and Figure does not use volume or time – just price – so a time limit or expectation of ‘when’ is moot.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Will the Euro and US Dollar Reach Parity in 2025?

Euro-dollar parity sparks debate again as 2025 approaches, with multiple factors shaping the exchange rate outlook.

US Dollar Surge Dominates Forex Market

The global forex market continues to show volatility, with the U.S. dollar fluctuating last week but overall maintaining a strong upward trend. How long can this momentum last?

Oil Prices Soar for 5 Days: How Long Will It Last?

Last week, the global oil market saw a strong performance, with Brent crude and WTI crude prices rising by 2.4% and around 5% respectively. Oil prices have now posted five consecutive days of gains. But how long can this rally last?

How Big is the Impact of the USD-JPY Rate Gap on the Yen?

The U.S. Federal Reserve's repeated rate cuts and the narrowing of the U.S.-Japan interest rate differential are now in sight. So, why is the U.S.-Japan interest rate differential so important for the yen’s safe-haven appeal, especially when global economic uncertainty rises?

WikiFX Broker

Latest News

High-Potential Investments: Top 10 Stocks to Watch in 2025

US Dollar Insights: Key FX Trends You Need to Know

Why Is Nvidia Making Headlines Everywhere Today?

Discover How Your Trading Personality Shapes Success

FINRA Charges UBS $1.1 Million for a Decade of False Trade Confirmations

Bitcoin in 2025: The Opportunities and Challenges Ahead

BI Apprehends Japanese Scam Leader in Manila

Big News! UK 30-Year Bond Yields Soar to 25-Year High!

SQUARED FINANCIAL: Your Friend or Foe?

Join the Event & Level Up Your Forex Journey

Currency Calculator