简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Norway central bank to buy currency for wealth fund for first time since 2013

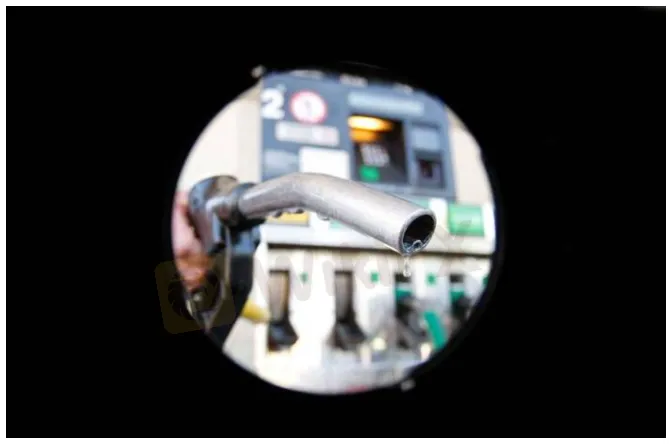

Abstract:Norway‘s central bank said on Thursday it would buy foreign currency for its sovereign wealth fund in April, the first time it has done so in almost nine years, amid a surge in the country’s oil and gas revenues, weakening the crown currency.

Norges Bank plans to exchange 2 billion crowns ($231.9 million) per day into foreign currency, which will in turn be invested abroad by the wealth fund, already the worlds largest with assets of $1.3 trillion.

A spike in the price of petroleum, Norways main export, has led to a big inflow of tax revenue that exceeded government spending.

Economists have said a switch to buying foreign exchange, and thus selling crowns, may weaken the currency. Norges Bank says its transactions are done for fiscal reasons on behalf of the state, and are not to be regarded as market intervention.

The crown weakened to 9.70 against the euro at 0819 GMT from 9.61 ahead of the announcement.

“EURNOK moves higher and short-end rates move lower as structural liquidity is set to improve substantially at that pace,” Danske Bank economist Kristoffer Lomholt tweeted, referring to the euro/crown exchange rates.

Norges Bank last sold crowns in the third quarter of 2013, but was forced the following year to start buying instead, exchanging foreign currency earned from petroleum and the wealth fund into crowns to fund Norways growing fiscal spending.

The central bank has since continued to buy crowns on a daily basis, except for some months when it neither bought nor sold any currency.

“On behalf of the Ministry of Finance, Norges Bank carries out the necessary foreign exchange transactions related to petroleum revenue spending over the central government budget and saving in the (wealth fund),” the central bank said.

Norway is western Europes largest oil and gas producer with daily output of some 4 million barrels of oil equivalent.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

PayPal Expands PYUSD Transfers to Ethereum and Solana

PayPal's PYUSD stablecoin can now transfer across Ethereum and Solana, enhancing flexibility for users through a LayerZero cross-chain integration.

Broker Review: Is Exnova Legit?

A forex broker named Exnova has recently come to our attention. This broker is registered in Saint Vincent and the Grenadines and started its business in 2021. In this article, we will dig into this broker deeply and provide some information if you are interested.

Capital.com Shifts to Regional Leadership as CEO Kypros Zoumidou Steps Down

Capital.com transitions to a regional leadership model as Kypros Zoumidou steps down, promoting Christoforos Soutzis as CEO of its Cyprus operations.

eToro Launches Global-Edge Smart Portfolio: A Balanced Approach to Growth and Stability

Online trading platform eToro has recently unveiled its latest investment offering—the Global-Edge Smart Portfolio. This new addition to eToro’s extensive portfolio options provides investors with a balanced approach to investing by combining global stocks and bonds, tailored for those looking for growth and stability.

WikiFX Broker

Latest News

ATFX Expands LATAM Presence with New Mexico Office

CySEC Warns against Public Review Websites

Former Alameda Executives Hand Over Assets in FTX Creditor Recovery Effort

Tradeweb and TSE Partnership Enhances Access to Japanese ETFs

JUST Finance and UBX Launch Multi-Currency Stablecoin Exchange

XM Revamps Website with Sleek Design and App Focus

TradingView & Mexico’s Uni. Partnership, to Enhance Financial Education

Something You Need to Know About SogoTrade

Global Shift in Cryptocurrency Taxation: Italy and Denmark Chart New Paths

Webull Introduces 24/5 Overnight Trading to Extend U.S. Market Access

Currency Calculator