Score

BSV

United Kingdom|2-5 years|

United Kingdom|2-5 years| https://bsvglobal.cc/

Website

Rating Index

Contact

Licenses

Licenses

No valid regulatory information, please be aware of the risk!

- It has been verified that this broker currently has no valid regulation. Please be aware of the risk!

Basic Information

United Kingdom

United KingdomUsers who viewed BSV also viewed..

MiTRADE

- 10-15 years |

- Regulated in Australia |

- Market Maker (MM)

CPT Markets

- 10-15 years |

- Regulated in United Kingdom |

- Market Maker (MM) |

- MT4 Full License

Pepperstone

- 10-15 years |

- Regulated in Australia |

- Market Maker (MM) |

- MT4 Full License

VT Markets

- 5-10 years |

- Regulated in Australia |

- Market Maker (MM) |

- MT4 Full License

Website

bsvglobal.cc

Server Location

United States

Website Domain Name

bsvglobal.cc

Server IP

172.67.201.140

Genealogy

VIP is not activated.

VIP is not activated.Relevant Enterprises

Company Summary

| BSV | Basic Information |

| Company Name | BSV Global Investing Limited |

| Founded in | 2018 |

| Headquarters | United Kingdom |

| Regulations | Suspected fake clone |

| Tradable Assets | Forex, precious metals, crude oil, commodities, stocks, indices |

| Account Types | Standard, ECN, VIP |

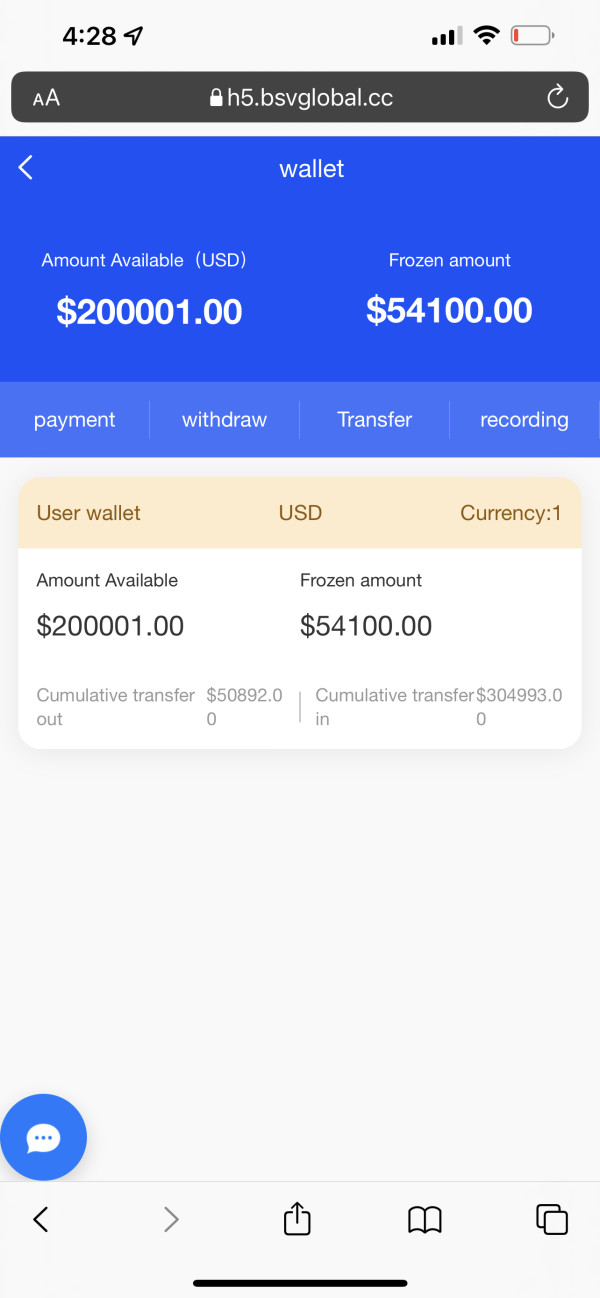

| Minimum Deposit | £100 (Standard), £500 (ECN), £20,000 (VIP) |

| Maximum Leverage | 1:400 |

| Spreads | Not specified |

| Commission | Not specified |

| Deposit Methods | Visa, MasterCard, Skrill, Neteller, Perfect Money, CASHU, Bank Wire, and more |

| Trading Platforms | MetaTrader 5 (MT5) |

| Customer Support | Online chat, Email: services@bsvglobal.cc, Monday to Friday, 08:00 AM to 10:00 PM (Hong Kong time, GMT+8) |

| Education Resources | Educational articles, video tutorials, webinars, economic calendar |

| Bonus Offerings | None |

General Information

BSV Global Investing Limited is an online foreign exchange trading platform providing investment services and activities for customer. BSV Global Investing Limited is supervised by the British Government and its company number is 13453338. This companys service targets include financial customers, hedge funds, manager accounts and individual customers.

BSV caters to traders of different experience levels by offering three distinct account types: Standard, ECN, and VIP, each with varying minimum deposit requirements. Leverage options are available, with different levels offered based on the trading instruments chosen. However, the broker does not provide specific details regarding spreads or commissions, which could be a concern for traders seeking transparency in their trading costs.

The trading platform offered by BSV is the MetaTrader 5 (MT5), a well-known and reputable platform in the financial industry. MT5 is known for its advanced charting tools, technical indicators, and accessibility for traders of varying expertise levels. While BSV offers some educational resources, including articles, video tutorials, webinars, and an economic calendar, it's important to note that there are no bonus offerings mentioned. In conclusion, BSV provides access to a wide array of trading opportunities, but traders should remain vigilant due to the lack of valid regulation and the suspicious claims related to regulatory licenses.

Is BSV Legit?

BSV does not currently have valid regulation. Additionally, the United States NFA regulation (license number: 0543530) claimed by this broker is suspected to be a clone and may not be valid. Traders and investors should exercise caution and be aware of the associated risks when considering dealing with an unregulated broker or one with suspicious regulatory claims. Regulatory oversight is essential for ensuring the security and protection of traders' funds and interests.

Pros and Cons

BSV presents traders with a mix of advantages and concerns. On the positive side, the broker offers a diverse range of tradable assets and provides various account types to cater to different traders' needs. Additionally, they invest in educational resources, including articles, video tutorials, and webinars, which can be valuable for traders looking to enhance their skills. However, it's essential to exercise caution as BSV lacks valid regulation, and there are suspicions surrounding the legitimacy of their claimed regulatory licenses. Moreover, the limited information provided about spreads and commissions raises transparency concerns, which traders should carefully consider before engaging with this broker.

| Pros | Cons |

|

|

|

|

|

|

Market Instruments

BSV Global Investing Limited provides CFD trading of foreign exchange and gold, crude oil, commodities, stocks, indices and other products.

1. Foreign Exchange (Forex): BSV offers CFD trading in the foreign exchange market, providing access to numerous currency pairs. This includes major, minor, and exotic pairs, allowing traders to speculate on the price movements of various global currencies.

2. Precious Metals: Traders can engage in CFD trading of precious metals such as gold. This enables them to participate in the market for valuable commodities without the need for physical ownership.

3. Crude Oil: BSV offers CFDs on crude oil, providing exposure to the energy market. Traders can speculate on the price fluctuations of crude oil without the logistical complexities of physical oil trading.

4. Commodities: In addition to crude oil, BSV likely provides CFDs on other commodities, although specific details about the range of available commodities are not provided.

5. Stocks: BSV clients can potentially trade CFDs on individual stocks. This allows for exposure to equity markets and the ability to speculate on the price movements of specific companies' shares.

6. Indices: CFDs on stock indices are offered by BSV. These indices represent baskets of stocks and provide traders with an opportunity to track and speculate on the overall performance of major financial markets.

Here is a comparison table of trading instruments offered by different brokers:

| Broker | BSV | RoboForex | FxPro | IC Markets | Exness |

| Forex | Yes | Yes | Yes | Yes | Yes |

| Commodities | Yes | Yes | Yes | Yes | Yes |

| Crypto | No | Yes | Yes | Yes | Yes |

| CFD | No | Yes | Yes | Yes | Yes |

| Indexes | Yes | Yes | Yes | Yes | Yes |

| Stock | Yes | Yes | Yes | Yes | Yes |

| ETF | No | Yes | No | Yes | No |

| Options | No | No | Yes | No | No |

Minimum Deposit

BSV does not tell us its minimum initial deposit requirement, and most brokers would require their traders to fund at least $100 or equivalent amount to start real trading.

Account Types

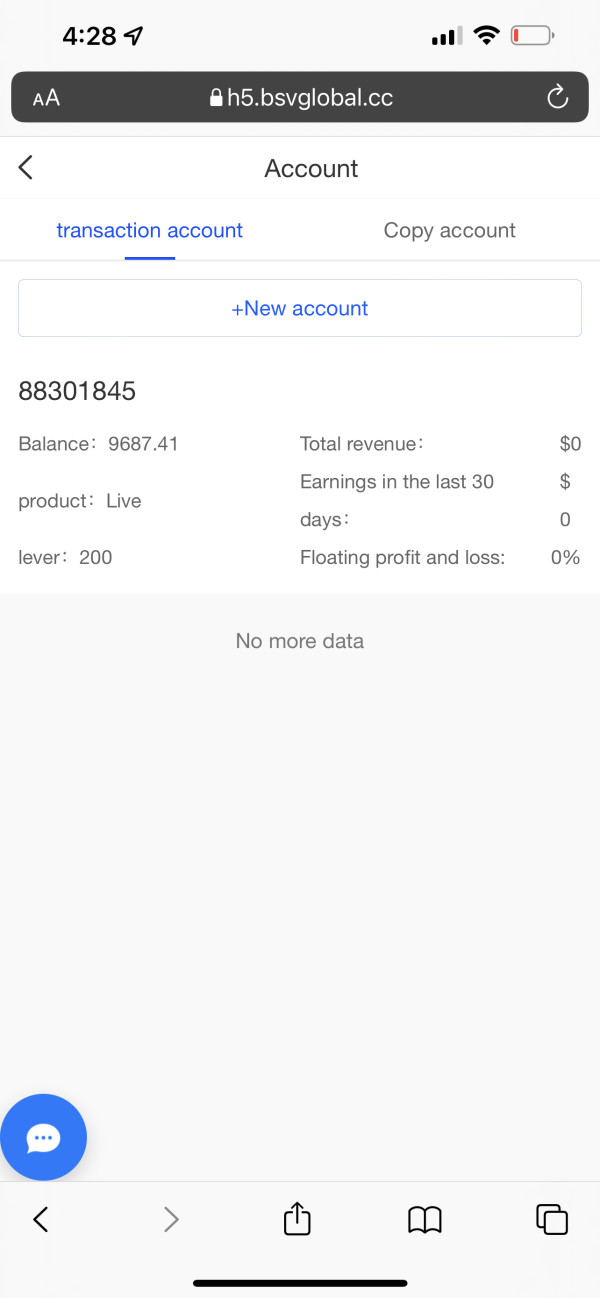

BSV offers three main account types:

Standard Account: This is the most basic account type, and it is suitable for both beginners and experienced traders. Standard accounts have a minimum deposit requirement of £100, and they offer a range of trading products, including forex, stocks, indices, and commodities.

ECN Account: ECN accounts are designed for experienced traders who are looking for the best possible execution prices. ECN accounts have a minimum deposit requirement of £500, and they charge a commission on each trade.

VIP Account: VIP accounts are designed for high-volume traders who are looking for the best possible trading experience. VIP accounts have a minimum deposit requirement of £20,000, and they offer a range of benefits, such as a dedicated account manager, personalized trading plans, and exclusive trading webinars.

Leverage

As for trading leverage, BSV offers three leverage options. The trading leverage for major currency pairs, gold and silver in Lever 1 option, Lever 2 option, and Lever 3 option is up to 100 times, 200times, and 400 times, respectively. The leverage for index trading, natural gas trading, and shares trading remain the same, that is, 50 times for index and natural gas, 20 times for shares.

Spreads & Commissions

In terms of spreads and commissions, BSV does not make this part clear. The available data does not offer a clear breakdown of the spreads or commissions that traders may encounter when using the platform. Typically, spreads refer to the difference between the buying (ask) and selling (bid) prices of a financial instrument, and commissions are fees charged for opening and closing trades. These factors play a crucial role in determining the overall cost of trading with a broker.

Given the absence of specific information regarding spreads and commissions, potential traders should exercise caution and seek clarity from the broker directly or through its official website. Understanding the cost structure is vital for traders to make informed decisions and assess the competitiveness of BSV's offerings in comparison to other brokers in the market.

Trading Platform Available

When it comes to trading platform available, BSV Global Investing provides MT5 trading platform, which is one of the most widely used online trading platforms with the highest reputation in the world. Its powerful graphic function, trading indicators and intelligent Trading (EAS) are widely loved by investors, and can be applied to all traders with different levels of experience. Traders can keep abreast of the latest developments of global foreign exchange margin and contract for difference (CFD) at any time, and trade quickly through MT5 anytime, anywhere.

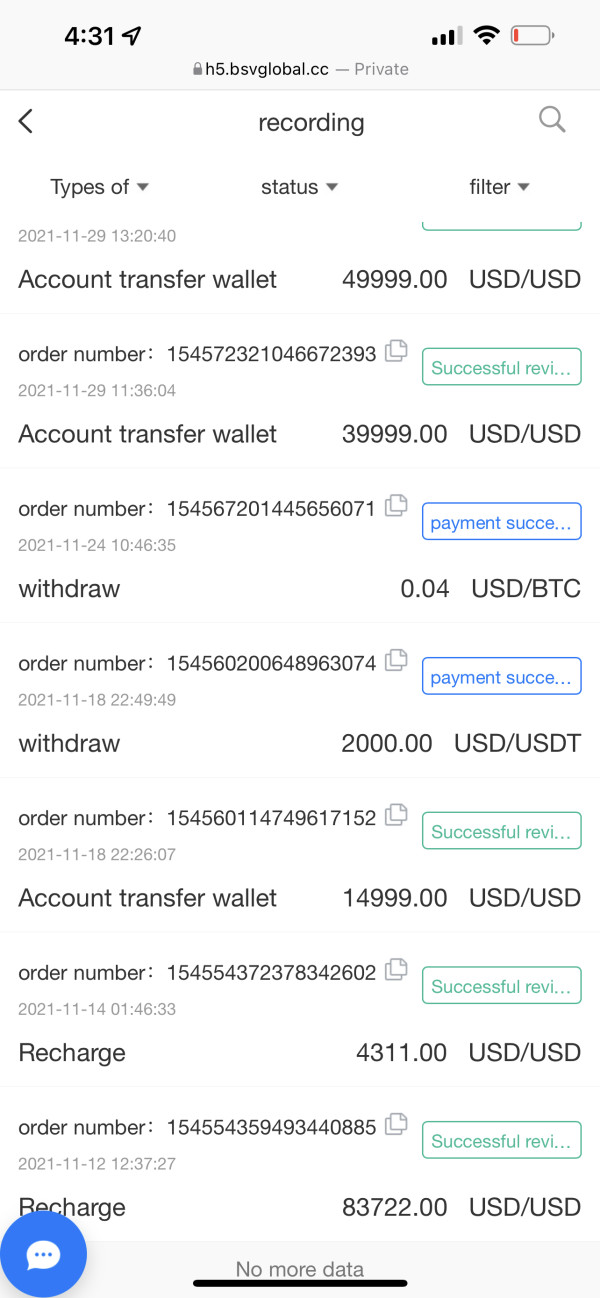

Deposit & Withdraw Methods

BSV offers a variety of payment methods to facilitate both deposits and withdrawals on their platform. These methods include widely recognized options such as Visa and MasterCard, providing traders with the convenience of using their credit or debit cards for transactions. Additionally, the availability of e-wallets like Skrill and Neteller adds flexibility to the funding process, allowing for swift and secure transfers.

Furthermore, BSV supports alternative payment solutions such as Perfect Money and CASHU, catering to a broader range of clients with varying preferences. For those who prefer traditional banking methods, Bank Wire transfers are also accepted. The inclusion of multiple deposit and withdrawal options can enhance the accessibility and convenience of managing funds within the BSV trading ecosystem.

Customer Service

BSV offers a multilingual customer support and they can be quickly reached through online chat, and email: ervices@bsvglobal.cc. Customer service time (Hong Kong (GMT+8)): Monday to Friday, 08:00am to 10:00 pm. Company Address: Unit G25 Waterfront Studios, 1 Dock Road, London, United Kingdom, E16 1AH.

Educational Resources

BSV provides a range of educational resources aimed at helping traders enhance their knowledge and skills in the financial markets. These resources are designed to cater to traders of various experience levels and include:

1. Educational Articles: BSV offers a collection of articles covering a wide range of topics related to trading, financial markets, and investment strategies. These articles provide insights and knowledge to help traders make informed decisions.

2. Video Tutorials: Traders who prefer visual learning can benefit from video tutorials. These tutorials cover various aspects of trading, including platform navigation, technical analysis, and trading strategies. They offer a convenient way to grasp key concepts.

3. Webinars: BSV conducts webinars on various trading subjects, featuring expert speakers and market analysts. These live online sessions provide traders with the opportunity to interact with industry professionals, ask questions, and gain insights into current market conditions and trading techniques.

4. Economic Calendar: BSV offers an economic calendar that tracks important economic events and announcements from around the world. This calendar helps traders stay informed about events that may impact financial markets, enabling them to make well-informed trading decisions.

Conclusion

In conclusion, BSV offers a diverse range of tradable assets and multiple account types, making it potentially appealing to a wide range of traders. They also invest in educational resources to support trader development. However, significant concerns arise due to the lack of valid regulation and suspicions surrounding the legitimacy of claimed regulatory licenses. Additionally, the absence of detailed information about spreads and commissions raises transparency issues, posing potential risks for traders. Therefore, caution and thorough research are advisable for those considering BSV as their trading platform.

FAQs

Q: Is BSV a regulated broker?

A: No, BSV does not currently hold valid regulation. There are also suspicions surrounding its claimed United States NFA regulation.

Q: What tradable assets are available with BSV?

A: BSV offers a variety of tradable assets, including forex, precious metals, crude oil, commodities, stocks, and indices.

Q: What are the account types offered by BSV?

A: BSV provides three main account types: Standard, ECN, and VIP, each with its minimum deposit requirement and features.

Q: What is the maximum leverage offered by BSV?

A: BSV offers leverage of up to 1:400 for certain instruments, but the maximum leverage varies by trading instrument.

Q: Are there educational resources available for traders?

A: Yes, BSV offers educational resources such as articles, video tutorials, webinars, and an economic calendar to assist traders in improving their skills and knowledge.

Keywords

- 2-5 years

- Suspicious Regulatory License

- Suspicious Scope of Business

- High potential risk

Comment 2

Content you want to comment

Please enter...

Comment 2

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now