简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Russia to Ease Crypto Asset Taxes as Sanctions Bite Deeper

Abstract:The Russian government is adjusting its digital asset tax rates in an effort to encourage more adoption as avenues of traditional finance are being increasingly blocked off.

A proposed draft law will drop VAT for local crypto companies by 35%.

Russia is trying to encourage more crypto adoption in the face of financial sanctions.

Crypto markets have shed 46% since the war in Ukraine began.

Russia is increasingly turning to digital assets as Western-imposed sanctions, and financial restrictions continue to erode its ability to transact with other nations.

On June 28, Russian lawmakers approved draft legislation that would potentially exempt issuers of crypto assets from value-added tax (VAT). Currently, the tax rate for companies conducting digital asset transactions is 20%.

Under the new rate, this will be dropped to 13% for Russian exchanges on the first 5 million rubles (around $US94,000) annually. Foreign exchanges and crypto asset companies will be subject to 15% VAT, according to local media.

Russia Opening to Crypto

The Russian central bank, like most others around the world, has taken a harsh stance against cryptocurrencies. In February, financial regulators issued the first digital assets license for local platform Atomyze Russia, and one for leading lender Sberbank followed.

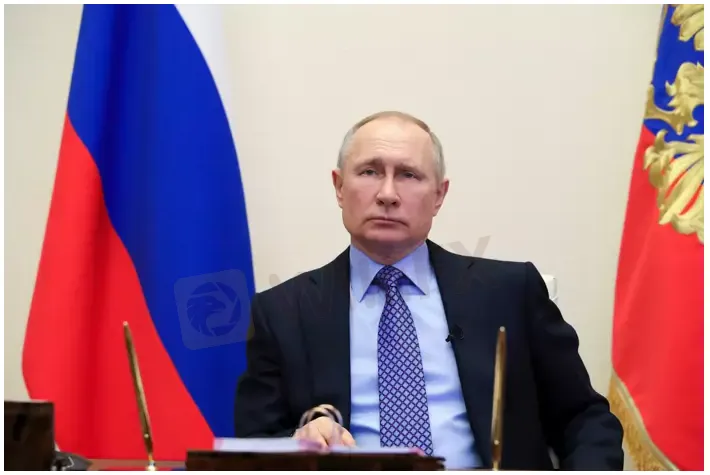

In addition to the tax cuts for issuers, the draft law approved by State Duma members also establishes tax rates on income earned from the sale of crypto assets. However, the legislation must still be reviewed by the upper house and signed by President Vladimir Putin to become law.

The law, if passed, will establish specifics regarding digital asset operations and what the government calls utilitarian digital rights (UTR), which it considers similar to securities.

The move comes as financial restrictions continue to hamper the country‘s ability to transact globally in the wake of Vladimir Putin’s invasion of Ukraine. Most major Russian banks have been blocked from the international payments channel, SWIFT.

Anti-crypto U.S. politicians used the premise that Russia would pivot to crypto to evade sanctions in an effort to further crack down on them, but it simply hasnt happened yet.

Russias financial woes are worsening as this week, it defaulted on its foreign debt for the first time since the Bolshevik revolution, also known as the October Revolution in 1917. Russia failed to pay interest on two bonds during a 30-day grace period that expired on June 26.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Navigating the Intersection of Forex Markets, AI Technology, and Fintech

The financial world is transforming, driven by the rapid integration of artificial intelligence (AI) and innovative fintech solutions. This change is most apparent in forex markets, where algorithmic trading and deep learning are redefining strategies, risk management, and decision-making. In this article, we explore how AI-driven technologies are not only revolutionizing forex trading but are also propelling fintech innovations that enhance customer experiences, bolster security, and unlock new market opportunities.

The One Fear That’s Costing You More Than Just Profits

The fear of missing out (FOMO) is NOT what you think it is! Read the three lesser-discussed components that contribute greatly to FOMO trading!

Why More People Are Trading Online Today?

Discover why online trading is booming with tech, AI, and a push for financial freedom. From stocks to crypto, it’s a thrilling hustle for all.

Bitpanda Secures Full Broker-Dealer License in Dubai

Bitpanda has officially obtained a full broker-dealer license from the Dubai Virtual Assets Regulatory Authority (VARA), marking a significant milestone in its international expansion. This approval, which follows preliminary authorization granted three months earlier, enables the European digital asset exchange to introduce its comprehensive suite of virtual asset services to investors in the United Arab Emirates (UAE).

WikiFX Broker

Latest News

Why Are Financial Firms Adopting Stablecoins to Enhance Services and Stability?

Experienced Forex Traders Usually Do This Before Making a Lot of Money

Octa vs XM:Face-Off: A Detailed Comparison

When High Returns Go Wrong: How a Finance Manager Lost RM364,000

Bridging Trust, Exploring Best—WikiEXPO Hong Kong 2025 Wraps Up Spectacularly

Interactive Brokers Expands Crypto Trading with Solana, XRP, Cardano, and Dogecoin

Fidelity Investments Explores Stablecoin Innovation in Digital Assets Sector

Why More People Are Trading Online Today?

SEC Ends Crypto.com Probe, No Action Taken by Regulator

Broker Comparison: FXTM vs XM

Currency Calculator