简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

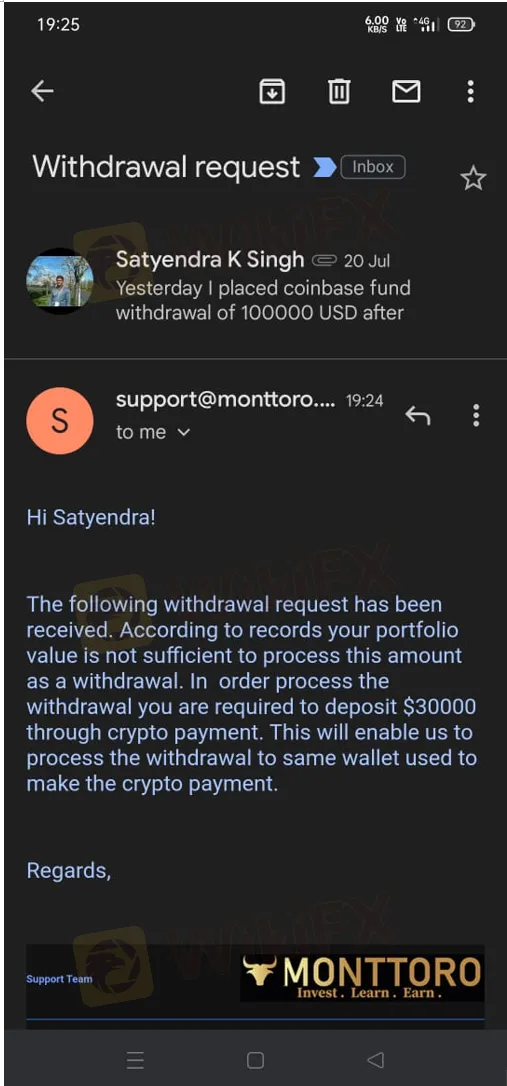

Montorro: Deposit $30K Before Withdrawal Can Be Approved?!

Abstract:Unreliable forex brokers often use devious tactics to cheat their trading clients. Some of them use too-good-to-be-true marketing strategies, whilst some of them force their clients with an ultimatum (continue reading to see an example of this) that leaves them no choice but to conform.

Unreliable forex brokers often use devious tactics to cheat their trading clients. Some of them use too-good-to-be-true marketing strategies, whilst some of them force their clients with an ultimatum (continue reading to see an example of this) that leaves them no choice but to conform.

In this article, WikiFX will be featuring a case regarding a forex broker named Montorro which was received through our customer support team. This victim reports that Montorro allegedly forced him to deposit $30,000 before they could withdraw his funds.

According to Montorros WikiFX profile, it is evident that this is an unregulated forex broker with a low WikiFX score as it does not hold any valid license.

Montorro is a forex broker with its headquarters located in St. Vincent and the Grenadines. Its official website is monttoro.com.

A reminder to all forex traders and/or investors:

It is always important to choose a forex broker that is regulated by an authority body and is operating with valid licenses, to avoid putting yourself and your trading funds at risk.

The first withdrawal experience should have been a red flag for the client. Nevertheless, he was not aware of its severity.

It was too late when the client realized that the situation was becoming absurd but a significant amount of money is at risk now.

It is crucial to stay informed and up-to-date with the traps of devious forex brokers. To learn more about these aspects, read the article here:

https://www.wikifx.com/en/newsdetail/202206141794544736.html

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

The Impact of Interest Rate Decisions on the Forex Market

Interest rate changes determine currency attractiveness, influencing capital flows and exchange rate trends. Understanding this mechanism helps investors navigate the forex market effectively.

How a Housewife Lost RM288,235 in a Facebook Investment Scam

A 47-year-old housewife in Malaysia recently fell victim to an online investment scam, losing a substantial sum of RM288,235 after engaging with a fraudulent scheme advertised on Facebook.

Interactive Brokers Launches Forecast Contracts in Canada for Market Predictions

Interactive Brokers introduces Forecast Contracts in Canada, enabling investors to trade on economic, political, and climate outcomes. Manage risk with ease.

Bank Negara Malaysia Flags 12 New Companies for Unauthorised Activity

Bank Negara Malaysia (BNM) has updated its Financial Consumer Alert List (FCA List) by adding 12 more entities, reinforcing its efforts to warn the public against unregulated financial schemes. Check if your broker made the list!

WikiFX Broker

Latest News

TradingView Brings Live Market Charts to Telegram Users with New Mini App

Trump tariffs: How will India navigate a world on the brink of a trade war?

Interactive Brokers Launches Forecast Contracts in Canada for Market Predictions

Authorities Alert: MAS Impersonation Scam Hits Singapore

Stocks fall again as Trump tariff jitters continue

INFINOX Partners with Acelerador Racing for Porsche Cup Brazil 2025

Regulatory Failures Lead to $150,000 Fine for Thurston Springer

April Forex Trends: EUR/USD, GBP/USD, USD/JPY, AUD/USD, USD/CAD Insights

March Oil Production Declines: How Is the Market Reacting?

Georgia Man Charged in Danbury Kidnapping and Crypto Extortion Plot

Currency Calculator