简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Meta Trader 4: The Complete Guide

Abstract:Meta Trader 4 is considered by many to be the gold standard brand for forex trading platforms. Retail traders who have signed up with multiple brokers will have likely run into a trading platform driven by Meta Trader

Getting Started with Meta Trader 4

Meta Trader 4 is intuitive and relatively easy to use. You can start by opening a demonstration account that allows you to test drive the system without making a deposit. You simply need to provide a broker that uses Meta Trader Platforms, your personal information including your email and they will send you a login and password to open a demonstration account.

A demonstration account uses demonstration money and allows you to see how the platform works without risking real capital. Dont be afraid to place multiple trades so you understand how to execute and order and view your positions.

The first page you see when you open Meta Trader 4, can be customized as your default page. You might want to see forex quotes along with a chart as an example. On the left side is a quote sheet. It shows you a list of products that you can trade through the MT4 platform.

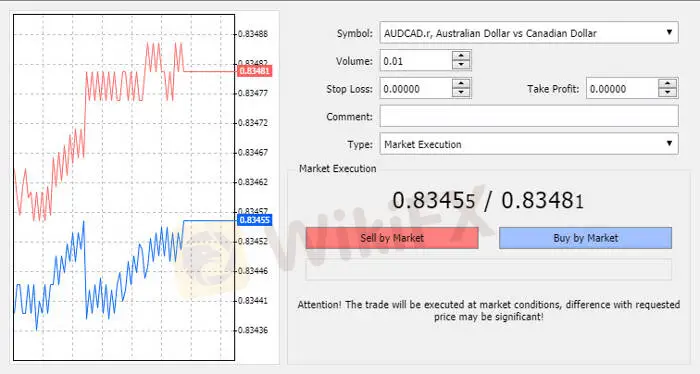

You can double-click on any of the items on the quote sheet and it will bring up an order page. Here you can see a graph of a tick chart along with the asset you are planning to trade. You can fill in your volume and place a stop loss and take profit orders. This allows you to set your risk management before you even place your trade.

Additionally, you can have a 1-click trading box in the upper left side that allows you to instantly place a trade. You can place your trade using market execution or pending order. You also can determine the volume of your trade. Below is the bid-offer spread. As a market taker, you buy on the offer (the blue) and sell on the bid (the red).

Navigating through Meta Trader 4 is intuitive and designed to give you easy access to all of the destinations available on the platform. You can customize your home page to see any page, including seeing your positions.

The demo account has a tab system on the bottom left, that opens to the common tab, where you can see charts of the major currency pairs. You can change that to see daily, weekly or any intra-day period. You can create several tabs that provide a view that you want to see.

Above the tabs is a navigator that allows you to see technical indicators as well as expert advisors and scripts. Technical indicators allow you to perform technical analysis of different assets. An expert advisor is a system that can be back-tested to understand the performance of an automated trading signal over time. Scripts allow you to drive alerts and run automated trading scenarios.

If you double-click in indicators in the menu of the navigator, you will a plenty of technical indicators that can be customized. In the graph above, the MACD (moving average convergence divergence) indicator is shown, along with a pop up of a custom input that you can use to change the standard MACD.

You can change the number of units (days, weeks, months, etc…) as inputs along with the colors used to generate a MACD indicator. The MACD shows both the MACD lines as well as the MACD histogram. There are dozens of technical indicators. You can save your favorite indicators into a tab and name favorites.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Bank Negara Malaysia Flags 12 New Companies for Unauthorised Activity

Bank Negara Malaysia (BNM) has updated its Financial Consumer Alert List (FCA List) by adding 12 more entities, reinforcing its efforts to warn the public against unregulated financial schemes. Check if your broker made the list!

TradingView Brings Live Market Charts to Telegram Users with New Mini App

TradingView has launched a mini app on Telegram, making it easier for users to track market trends, check price movements, and share charts.

March Oil Production Declines: How Is the Market Reacting?

Oil production cuts in March are reshaping the market. Traders are closely watching OPEC+ decisions and supply disruptions, which could impact prices and future production strategies.

How to Calculate Leverage and Margin in the Forex Market

Leverage amplifies both potential profits and risks. Understanding how to calculate leverage and margin helps traders manage risks and avoid forced liquidation.

WikiFX Broker

Latest News

Exposing the Top 5 Scam Brokers of March 2025: A Closer Look by WikiFX

Gold Prices Climb Again – Have Investors Seized the Opportunity?

Webull Launches SMSF Investment Platform with Zero Fees

Australian Regulator Warns of Money Laundering and Fraud Risks in Crypto ATMs

The Withdrawal Trap: How Scam Brokers Lure Victims into Paying More

FCA to Investors: Think Twice Before Trusting These Brokers

Trump\s tariffs: How could they affect the UK and your money

Trump gambles it all on global tariffs he\s wanted for decades

TradingView Brings Live Market Charts to Telegram Users with New Mini App

HTFX Spreads Joy During Eid Charity Event in Jakarta

Currency Calculator