Score

Hankotrade

Belize|5-10 years|

Belize|5-10 years| https://hankotrade.com/

Website

Rating Index

Influence

Influence

A

Influence index NO.1

United States 8.22

United States 8.22Contact

Licenses

Licenses

No valid regulatory information, please be aware of the risk!

- It has been verified that this broker currently has no valid regulation. Please be aware of the risk!

Basic Information

Belize

BelizeAccount Information

Users who viewed Hankotrade also viewed..

XM

- 10-15 years |

- Regulated in Australia |

- Market Maker (MM) |

- MT4 Full License

GO MARKETS

- Above 20 years |

- Regulated in Australia |

- Market Maker (MM) |

- MT4 Full License

FP Markets

- 15-20 years |

- Regulated in Australia |

- Market Maker (MM) |

- MT4 Full License

FBS

- 5-10 years |

- Regulated in Australia |

- Market Maker (MM) |

- MT4 Full License

Website

hankotrade.com

Server Location

United States

Website Domain Name

hankotrade.com

Server IP

67.225.220.141

Company Summary

| Registered in | St. Vincent and the Grenadines |

| Regulated by | No effective regulation at this time |

| Year(s) of establishment | 2-5 years |

| Trading instruments | Forex pairs, commodities, cryptocurrencies, CFDs |

| Minimum Initial Deposit | $10 |

| Maximum Leverage | 1:500 |

| Minimum spread | 0.0 pips onwards |

| Trading platform | MetaTrader4, MetaTrader5 |

| Deposit and withdrawal method | Cryptocurrencies |

| Customer Service | Email, phone number, address, live chat |

| Fraud Complaints Exposure | Yes |

It is important to note that the information provided in this review may be subject to change due to the constant updating of the company's services and policies. In addition, the date on which this review was generated may also be an important factor to consider, as information may have changed since then. Therefore, readers are advised to always verify updated information directly with the company before making any decision or taking any action. Responsibility for the use of the information provided in this review rests solely with the reader.

In this review, if there is a conflict between the image and the text content, the text content should prevail. However, we recommend that you open the official website for further consultation.

Pros and cons of Hankotrade

Pros:

Competitive spreads and commissions on various account types.

Wide range of trading instruments, including forex, commodities, cryptocurrencies, and CFDs.

High leverage of up to 1:500 offered to traders.

No deposit or withdrawal fees charged by the company.

Efficient customer service through various channels, including live chat, phone, Skype, and email.

Educational resources available to traders, such as the economic calendar, forex calculator, and VPS service.

Easy and secure payment options available, including cryptocurrencies.

Cons:

Limited information available on the company's regulation and licensing.

Limited range of trading platforms, with only MetaTrader4 and MetaTrader5 available.

No bonus or promotional offers available for traders.

No information available on the company's trading history or performance.

Limited options for Islamic accounts.

No information available on the company's ownership and management.

Limited range of educational resources compared to other forex brokers.

What type of broker is Hankotrade?

| Advantages | Disadvantages |

| Hankotrade offers tight spreads and fast execution due to its Market Making model. | As a counterparty to its clients' trades, Hankotrade has a potential conflict of interest that may lead to decisions that are not in the best interest of its clients. |

Hankotrade is an online forex and CFD broker that operates as a market maker, meaning they act as the counterparty to their clients' trades. As a market maker, they are able to provide their clients with fixed spreads, which can be advantageous for traders who prefer more predictable trading costs. However, some traders may prefer an ECN broker, which provides access to more transparent and variable spreads. While Hankotrade operates as a market maker, they also offer Negative Balance Protection to their clients, which helps protect them from excessive losses beyond their account balance. Additionally, Hankotrade offers a range of account types, educational resources, and customer support options to help traders of all levels make informed trading decisions.

General information and regulation of Hankotrade

Hankotrade is an online CFD broker that allows for fast execution of trades by sending client orders directly to liquidity providers. Hankotrade is an unregulated broker so far.

In the following article, we will analyse the characteristics of this broker in all its dimensions, providing you with easy and well-organised information. If you are interested, read on.

Market instruments

| Advantages | Disadvantages |

| Diverse range of trading instruments including forex, commodities, cryptocurrencies, and CFDs | Hankotrade is not regulated by any financial authority |

| The inclusion of cryptocurrencies offers traders access to a potentially high-growth asset class | Limited information available about the trading conditions for certain instruments |

| Commodities trading offers traders the ability to diversify their portfolio and hedge against inflation | Limited educational resources available for traders looking to learn more about trading these instruments |

| CFDs allow traders to speculate on price movements without owning the underlying asset |

In terms of the trading instruments available, Hankotrade offers a diverse range of options, including forex, commodities, cryptocurrencies, and CFDs. This allows traders to potentially profit from different market conditions and take advantage of various trading opportunities. The inclusion of cryptocurrencies is a particular advantage as it offers traders access to a potentially high-growth asset class. However, it's important to note that Hankotrade is not regulated by any financial authority, which could be a disadvantage for some traders who prioritize safety and security. Additionally, there is limited information available about the trading conditions for certain instruments, which could make it difficult for traders to make informed decisions. It's also worth noting that Hankotrade does not offer the popular trading platform MetaTrader 4 and has limited educational resources available for traders looking to learn more about trading these instruments.

Spreads, commissions and other costs

| Advantages | Disadvantages |

| Low spreads on some account types | Lack of transparency regarding the cost structure |

| Commission-free trading on some account types | ECN account has commission charges |

| Ultra-low commissions on ECN Plus account | High minimum deposit for ECN Plus account |

| Negative balance protection | No information on other fees such as withdrawal or inactivity fees |

When it comes to spreads, commissions, and other costs, Hankotrade offers competitive pricing for traders. The STP account has low spreads from 0.7 pips, and it does not charge any commissions. On the other hand, the ECN account has tighter spreads from 0.0 pips but charges $2 per side per $100k traded. The ECN Plus account offers ultra-low commissions of $2 per side per $100k traded, making it an attractive option for high-volume traders. However, it requires a minimum deposit of $1000, which may not be feasible for all traders. It is also worth noting that Hankotrade provides negative balance protection to traders, ensuring that they do not lose more than their account balance. Unfortunately, the broker lacks transparency regarding its cost structure, and there is no information on other potential fees such as withdrawal or inactivity fees. Overall, Hankotrade offers competitive pricing for traders, but more transparency regarding its costs would be appreciated.

Trading accounts available in Hankotrade

| Advantages | Disadvantages |

| Access to multiple account types to suit different needs | Limited account funding options |

| Low minimum deposit requirement for STP account | Limited trading platforms available |

| Commission-free trading on STP account | ECN and ECN Plus accounts require higher minimum deposits |

| Tight spreads and competitive commissions on ECN account | Commission charged on ECN and ECN Plus accounts |

| Ultra-low commissions on ECN Plus account | Limited information on the company's trading conditions and fees |

| Negative balance protection provided on all account types | Not regulated by any financial authority |

| Swap-free Islamic account option available on all account types |

Hankotrade offers its clients a range of account types to suit different trading needs. The STP account is a commission-free option with a minimum deposit requirement of just $10. This account type provides access to global markets with spreads starting from 0.7 pips. The ECN account offers tight spreads and competitive commissions, with a minimum deposit requirement of $100. Commission of $2 per side per $100k traded is charged on this account type. The ECN Plus account is designed for traders looking for ultra-low commissions, with commission charged at just $2 per side per $100k traded. The minimum deposit requirement for this account type is $1000. All account types provide negative balance protection, and a swap-free Islamic account option is available. The company also offers a demo account for clients to practice trading strategies without risking real funds. It is important to note, however, that Hankotrade is not regulated by any financial authority, and there is limited information available on the company's trading conditions and fees.

Trading platform(s) that Hankotrade offers

| Advantages | Disadvantages |

| MetaTrader4 is widely used and supported by many brokers | MetaTrader4 is an older platform and may not offer all the latest features |

| MetaTrader4 has a large online community and extensive library of custom indicators and expert advisors | MetaTrader4 does not support certain types of trading instruments, such as stocks and futures |

| MetaTrader4 is known for its stability and reliability | MetaTrader4 has a limit on the number of chart windows that can be open at one time |

| MetaTrader5 offers more advanced features such as more timeframes and additional order types | MetaTrader5 is not yet as widely supported as MetaTrader4 and may not be available with all brokers |

| MetaTrader5 is faster and more efficient than MetaTrader4 due to its improved coding and architecture | MetaTrader5's programming language is not compatible with MetaTrader4's, meaning that any custom indicators or expert advisors will need to be re-coded |

When it comes to trading platforms, Hankotrade offers two of the most popular options in the industry: MetaTrader4 and MetaTrader5. MetaTrader4 is the more widely used of the two and is known for its stability and reliability. It has a large online community and extensive library of custom indicators and expert advisors that traders can use to enhance their trading strategies. On the other hand, MetaTrader5 offers more advanced features, such as more timeframes and additional order types, making it a popular choice among more experienced traders. It also supports more trading instruments than MetaTrader4, including stocks and futures, which is a significant advantage. However, MetaTrader5's more complex interface may be overwhelming for beginners, and it is not yet as widely supported as MetaTrader4, meaning that it may not be available with all brokers.

Maximum leverage of Hankotrade

| Advantages | Disadvantages |

| Allows traders to control larger positions with smaller investments | High leverage can amplify both profits and losses |

| Can potentially lead to higher returns | Can increase the risk of margin calls and stop-outs |

| Provides more trading opportunities | Traders need to have a good understanding of risk management to effectively use high leverage |

| Can be attractive for traders with limited capital | Regulators may impose restrictions on maximum leverage offered by brokers |

Hankotrade offers a maximum leverage of up to 1:500, which can provide traders with greater trading opportunities and potentially higher returns. With higher leverage, traders can control larger positions with smaller investments. However, it's important to note that high leverage also amplifies both profits and losses, and can increase the risk of margin calls and stop-outs. Therefore, traders need to have a good understanding of risk management and be cautious when using high leverage. It's also worth mentioning that some regulators may impose restrictions on the maximum leverage offered by brokers, so it's important to check the regulations in the jurisdiction where the broker is registered.

Deposit and Withdrawal: methods and fees

| Advantages | Disadvantages |

| No charges on deposits and withdrawals | Limited payment options |

| Fast processing time for withdrawals (within 1 working day) | Only feasible payment methods are cryptocurrencies |

| Hassle-free and efficient forex trading experience | Absence of traditional payment methods like credit/debit cards |

| Increased security and privacy with cryptocurrency | Some users may not be familiar with cryptocurrency transactions |

Hankotrade offers a convenient and hassle-free experience when it comes to deposits and withdrawals. The absence of any charges on these transactions adds to the appeal of the forex broker. Moreover, Hankotrade ensures fast processing times for withdrawals, which means that clients can access their funds quickly without any unnecessary delays. However, it is worth noting that Hankotrade's payment options are limited to cryptocurrencies, which might be unfamiliar to some users. Additionally, traditional payment methods such as credit/debit cards are not supported, which could be a disadvantage for those who prefer using them. Nonetheless, the use of cryptocurrencies adds an extra layer of security and privacy, which is a plus for traders who value anonymity and protection of their financial information.

Educational resources in Hankotrade

| Advantages | Disadvantages |

| Economic calendar provides real-time updates on market-moving events and helps traders make informed decisions | Lack of variety in educational resources beyond economic calendar, forex calculator, and VPS |

| Forex calculator helps traders calculate risk and potential profits for trades | No educational content tailored to specific skill levels or learning styles |

| VPS hosting provides a reliable and secure connection for automated trading strategies | No interactive or personalized educational resources |

| Availability of these resources at no extra cost to clients | Limited information on how to effectively use the educational resources |

Hankotrade offers a range of educational resources to help traders stay informed and make better decisions. These resources include an economic calendar, a forex calculator, and VPS hosting for automated trading strategies. The economic calendar provides real-time updates on important market-moving events, including economic data releases, central bank announcements, and other geopolitical events. The forex calculator helps traders calculate their risk and potential profits for each trade. VPS hosting provides a reliable and secure connection for automated trading strategies.

While these resources can be helpful, Hankotrade does not offer a wide variety of educational content beyond the economic calendar, forex calculator, and VPS hosting. Additionally, there is no educational content tailored to specific skill levels or learning styles. The lack of interactive or personalized educational resources can also be a disadvantage for traders looking to improve their skills and knowledge.

Customer service of Hankotrade

| Advantages | Disadvantages |

| Multiple contact options available (live chat, phone, email, Skype) | No 24/7 customer support |

| Physical address provided for two locations | No FAQ section on website |

| Quick response times on Live Chat and phone support | No dedicated mobile app for customer support |

| Support available in multiple languages | No social media customer support |

Hankotrade provides multiple channels for customer care, including live chat, phone, Skype, and email. The company provides physical addresses for both its St. Vincent and Dubai locations. Response times are generally quick, and the customer support team can assist clients in multiple languages. However, Hankotrade does not offer 24/7 customer support, and there is no FAQ section on its website. The company also does not have a dedicated mobile app for customer support, and it does not provide customer support through social media. Overall, while Hankotrade's customer care options are decent, there is room for improvement in terms of round-the-clock support and more extensive self-help resources.

Conclusion

Overall, Hankotrade is a forex and CFD broker that offers its clients a wide range of financial instruments to trade on, including forex, commodities, cryptocurrencies, and CFDs. The company offers different account types, including STP, ECN, and ECN Plus accounts, which have different deposit requirements, commissions, and spreads. Hankotrade also offers its clients a choice between two trading platforms, MetaTrader4 and MetaTrader5, and a maximum leverage of 1:500. The company has a transparent and straightforward deposit and withdrawal policy, with no charges on deposits and withdrawals, and withdrawals are processed within one working day. In terms of educational resources, Hankotrade offers its clients an economic calendar, forex calculator, and VPS. The customer care team is available 24/5 and can be reached through phone, email, live chat, or Skype. However, the company is not regulated by any financial authority, and its registered office is in St. Vincent and the Grenadines, which may pose some risks for potential clients.

Frequently asked questions about Hankotrade

Q. Is Hankotrade a regulated company?

A. No, Hankotrade is not regulated by any financial authority.

Q. What is the minimum deposit required to open an account with Hankotrade?

A. The minimum deposit required to open an account with Hankotrade is $10 for the STP account, $100 for the ECN account, and $1000 for the ECN Plus account.

Q. What are the trading platforms offered by Hankotrade?

A. Hankotrade offers its clients the popular MetaTrader 4 (MetaTrader4) and MetaTrader 5 (MetaTrader5) platforms for trading.

Q. Does Hankotrade charge any fees on deposits or withdrawals?

A. No, Hankotrade does not charge any fees on deposits or withdrawals for its clients.

Q. What is the maximum leverage offered by Hankotrade?

A. Hankotrade offers a maximum leverage of up to 1:500.

Q. Does Hankotrade offer negative balance protection?

A. Yes, Hankotrade offers negative balance protection to its clients to protect them from potential losses exceeding their account balance.

Keywords

- 5-10 years

- Suspicious Regulatory License

- Global Business

- High potential risk

News

Exposure HankoTrade Case Review

Recently, WikiFX has unleashed two articles about HankoTrade and its possible downfall. In this article, we are connecting the clues to help you better understand this broker.

2023-12-14 11:21

Exposure Alert: HankoTrade Facing Possible Downturn

Amidst an unsettling climate in the online trading community, HankoTrade, a prominent trading platform, has become the subject of intense scrutiny. Recent reports and discussions on social media point to allegations of price manipulation, a critical issue in the digital trading world. These allegations, if true, could undermine the trust and integrity crucial to online trading platforms.

2023-12-13 08:30

Exposure Alert: The Rising Issues of HankoTrade

The risk of HankoTrade when investing has been rising recently. Issues of being unable to withdraw funds, price manipulation, and accounts suddenly closing

2023-11-29 17:56

News WikiFX Review: Is Hankotrade an Attractive Broker Or Just Another Scam?

Hankotrade is a forex broker offering a series of financial instruments to its clients. Is this broker OK to invest in? WikiFX intends to tell you more about this broker that you may not know before.

2022-08-30 17:02

News BANKS CURB FX ACCESS AS RESERVES FALL TO A SEVEN-MONTH LOW

The country's external reserves fell to $38.57 in billion as of May 25, 2022, a seven-month low, according to information acquired from the Central Bank of Nigeria. According to results, as scarcity bites deeper, the country's external reserves necessary to safeguard the naira's value are pushing banks to restrict access to foreign currency to visitors and other authorized users.

2022-06-16 16:44

News Guide on how to trade bullions in the forex market today

Bullions refer to highly volatile pairs such as Gold and Silver. Given the fact that the US dollar has been pegged against these two pairs, any trader who wants to make profits while trading the bullions will have to pay close attention to the dollar index. This is because the bullions move in opposite directions to the US dollar. A strong dollar index will impact the Bullions negatively and vice-versa.

2022-06-07 13:53

Comment 13

Content you want to comment

Please enter...

Comment 13

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now

iamjayylopezz

Philippines

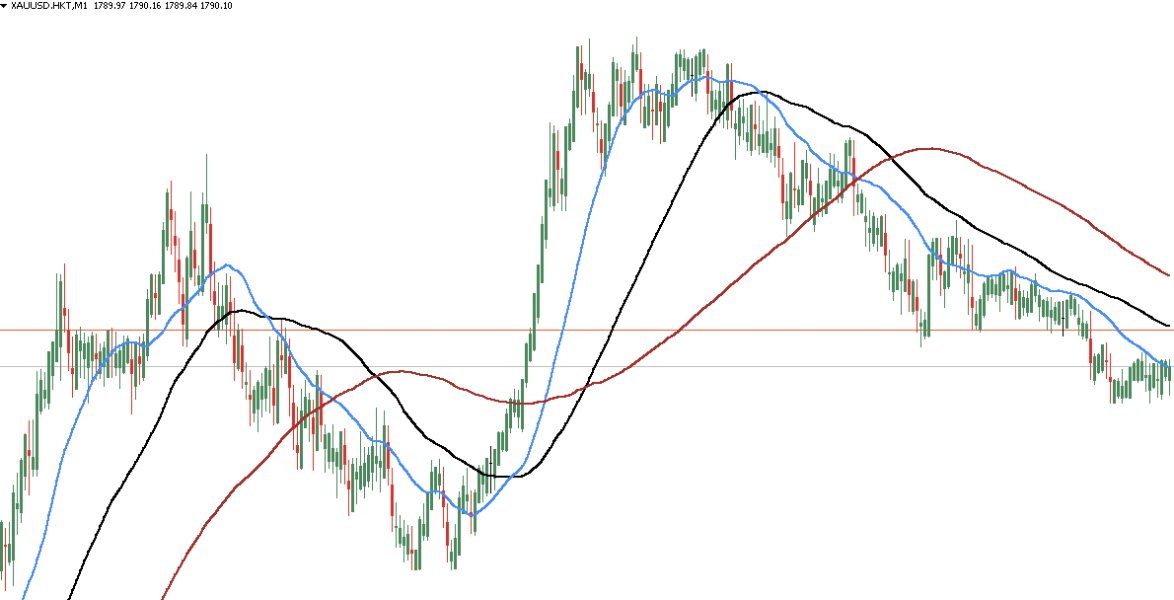

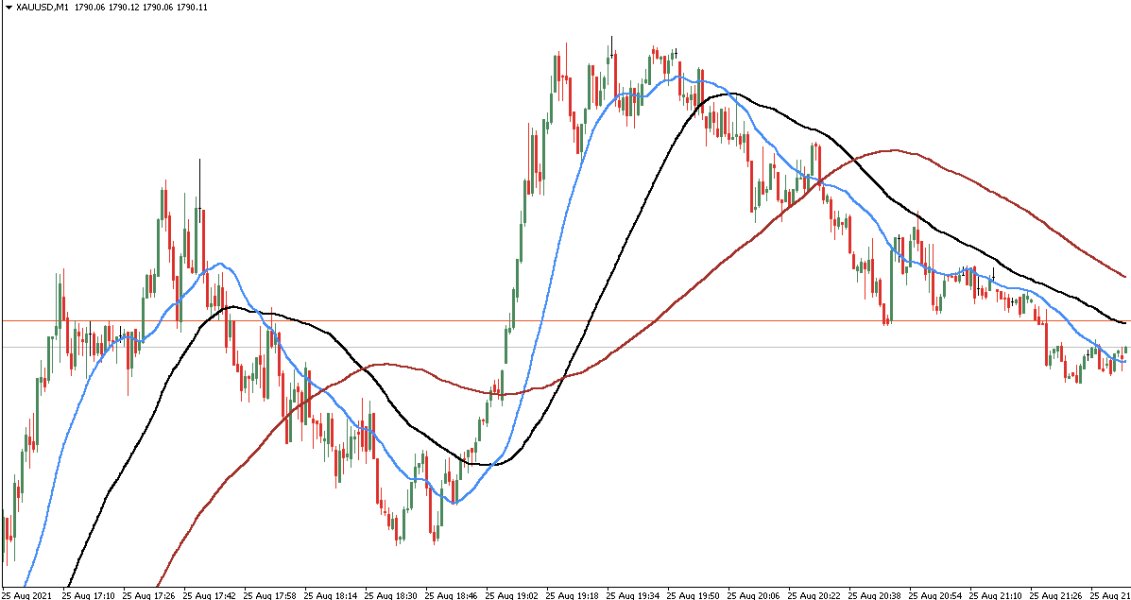

opened a demo account on Hankotrade yesterday and today I noticed manipulated MT4 chart in the 1 minute timeframe. The first chart is from Hankotrade .. look at all those green candles.. The one below is from LQDFx ..Even a toddler will know that the Hankotrade chart is cooked. STAY AWAY FROM HANKOTRADE

Exposure

2021-08-27

Mayaz Ahmad

Bangladesh

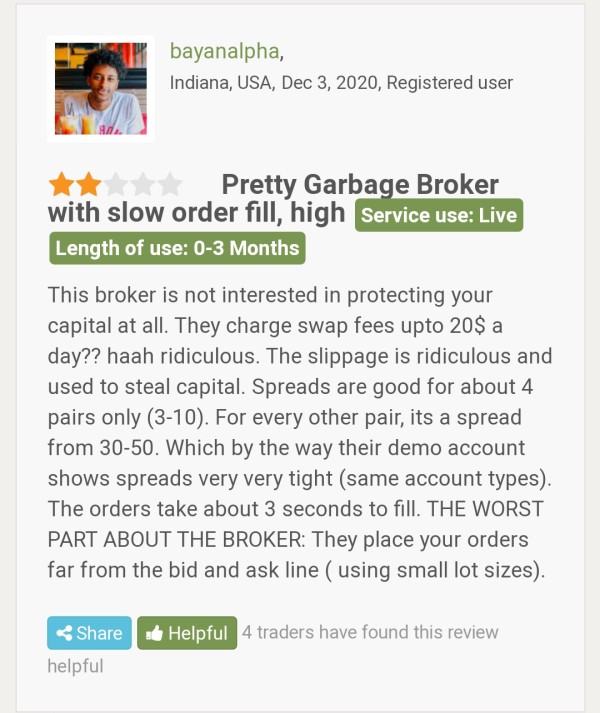

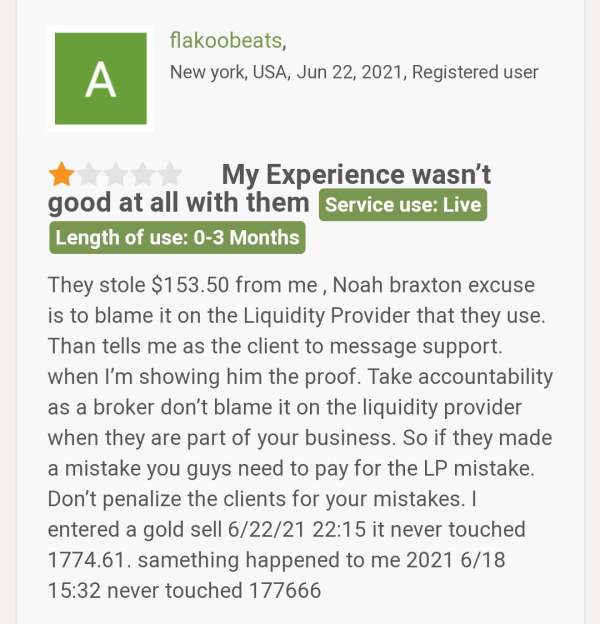

They charge high swap fees, high spreads, severe slippage and place order slow and far away from the bid.

Exposure

2021-08-17

Mayaz Ahmad

Bangladesh

A client has lost a lot $ from his account and this broker has blamed the client for it instead of admitting it themselves. The client claims he had a terrible experience with this broker.

Exposure

2021-07-11

ChristopheS

France

The customer service at HankoTrade is accommodating and polite. They've met all my requirements, and I'm quite pleased with the service. Overall, everything is good.

Positive

2023-12-17

Gilbert Heb

Germany

I traded with HankoTrade a while back and I'm still impressed. Their trading platform is the generic MT5/MT4 which okay ,but the edge they have is that orders are executed rapidly, and their customer service is top-notch.

Positive

2023-11-06

Andree770

Germany

An area where HankoTrade really stands out is the MT5 Trading Platform, which offers a range of additional order types. I've found the Buy Stop-Limit and Sell Stop-Limit orders to be particularly useful in managing my trades.

Positive

2023-10-15

Ewald

Canada

HankoTrade is a bit of a mixed bag. While the MetaTrader 5 Bitcoin Account and the commodity/energy pairs provide a great deal of flexibility and potential.The Forex spreads are generally tight, and the platform is user-friendly. HankoTrade provides a decent trading experience, but it's essential to be aware of the potential risks like latency and slippage.

Positive

2023-08-24

Blaise

Canada

there are no transaction costs. This allows me to hold positions in currency pairs such as GBPUSD and CHFJPY for days, without worrying about transaction costs eating into my gains.

Positive

2023-05-24

RosarioD

France

I have to give a shoutout to Hanko Trade's support team. They've been helpful and responsive throughout my time trading with them, which has made my experience that much more enjoyable.

Positive

2023-04-23

梧桐树下

New Zealand

The various trading conditions offered by Hankotrade are very competitive. But neither on wikifx nor on the company's website, I found no information about the regulatory agency, so the company is probably not regulated. Investing here can be dangerous.

Positive

2023-02-20

一个好运的人

Malaysia

Hankotrade is the only place where without ant any interference you trade. A straightforward way to trade. Deposit is very easy at first it used to take some time now they have changed the methods also there is help in hand everyone is very efficient. Though I haven't made any withdrawals because I am very new to trading I keep losing money which is my problem. I am sure withdrawal will be as easy as a deposit.

Positive

2023-02-16

FX1188641415

United States

The various trading conditions offered by this company are really attractive, but I think the most important thing is safety! What's the point of having other trading terms if you've been scammed out of your money?

Positive

2022-12-20

王权富贵

Ecuador

Hankotrade does not speak Spanish and I have seen people say that it is a scam. To be safe, I would not invest here.

Positive

2022-12-16