简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Three Types of Fintech Scams You Should Know About: an OctaFX Guide

Abstract:Fintech is evolving its security measures all the time. Yet, fraudsters are still present in the industry. Learn what types of scams are on the rise now and how to protect yourself from them.

The growing fintech market is constantly developing ways to protect clients from scams, hackers, and fraudsters. In 2020-2021, a 70% increase in payment fraud attacks across fintech products was recorded, with a 200% rise in the sector of digital wallets and a 140% surge involving cryptocurrency exchanges. With that in mind, it has become clear that users need to know how they can protect themselves. This extensive guide by OctaFX is here to help.

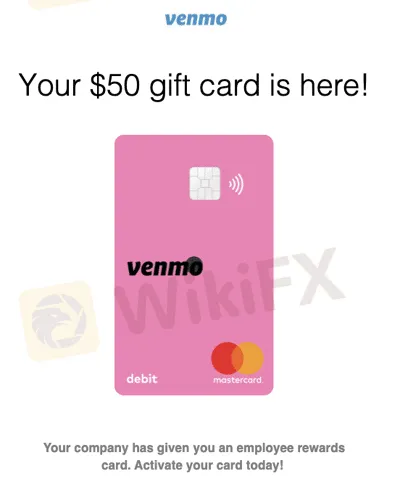

The first type of online fraud traders need to be aware of is phishing, usually an email from a service or organisation you are expected to trust, such as your bank, a broker, or a payment system. This email attempts to steal your personal information, such as bank card details or make you install some malware to later demand ransom for decrypting your files or unblocking your system.

Heres how it may look:

Another type of cyberattack involves a copycat, a clone of the actual broker or another fintech service, created specifically to scam inattentive internet users. Such sites may only differ from the original one by a single letter in the web address (for instance, easyinvesting.com and easylnvesting.com with ‘i’ and ‘l’ looking nearly the same) with their content almost or entirely identical. Yet, when it comes to making a deposit, the money—along with your bank card details—goes to fraudsters.

Regulators and brokers regularly notify users about copycats. Nevertheless, one has to be cautious and check everything one more time before making a deposit.

The third type of scam that you can stumble upon online involves creating a one-day scam company, such as a Forex broker or a crypto exchange. The company exists to lure unsuspecting users into making deposits and either steal them all at once, disappearing the next day, or charge enormous trading fees that quickly empty your wallet even if your trades are successful.

It‘s quite easy to spot a scam broker. Such companies never have a long history of providing financial services, and usually, you won’t find them mentioned in the media. Scam brokers do not receive awards from acknowledged international publications and organisations.

As for charitable initiatives, they are something that Forex scams never do. You can inspect a long-standing broker such as OctaFX and find that it has worked for more than ten years, received numerous awards, and is regularly mentioned in the media, primarily due to its global charitable projects

Here are some additional measures that will help you protect yourself from the popular types of cyberattacks mentioned above.

To identify the authenticity of brokers local pages, use their domain-checker extensions (e.g. Google Chrome extension for OctaFX). If the domain name is different, this is a fraudulent website, or someone uses intellectual property illegally.

When you see the brokers logo online, double-check the domain name. Always assume that fraudsters will be using some version of the brand name to try and trick you.

Be careful when on social media. Broker‘s official social media accounts are usually listed on their official website. Unfortunately, multiple copycats appear daily, so it’s important to stay vigilant, especially when engaging with Telegram and Facebook groups.

Cross-check the news published on the web about special offers and partner activities with official information on the broker‘s website and social networks. If it’s not mentioned there, most likely, you are about to be scammed.

All your payments must be processed through the Personal Area on the broker‘s official website or in their official apps. This is most likely a scam if someone asks to send payments through other means or channels, like messenger apps or personal transfers. Don’t hesitate to report such a person to authorities or the brokers Customer Support.

Do not share any personal information on the internet before youve thoroughly researched the service/site/organisation requesting it.

Be careful when opening suspicious emails. Never download and open any files that come from unknown email addresses.

About OctaFX

OctaFX is a global broker providing online trading services worldwide since 2011. It offers commission-free access to financial markets and a variety of services already utilised by clients from 150 countries who have opened more than 12 million trading accounts. Free educational webinars, articles, and analytical and risk management tools they provide help clients reach their investment goals.

The company is involved in a comprehensive network of charity and humanitarian initiatives, including the improvement of educational infrastructure and short-notice relief projects supporting local communities and small to medium enterprises.

On a side note, OctaFX has also won more than 50 awards since its foundation, including the 2021 ‘Best Forex Broker Asia’ award from Global Banking and Finance Review and the 2021 ‘Best ECN Broker’ award from World Finance.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

The Daily Habits of a Profitable Trader

Every professional trader follows a structured approach to ensure they are well-prepared, disciplined, and able to seize opportunities with confidence. Whether you are a seasoned investor or an aspiring trader, adhering to a robust daily checklist can significantly enhance your performance. Use this checklist to check if you are a qualified trader

The Impact of Interest Rate Decisions on the Forex Market

Interest rate changes determine currency attractiveness, influencing capital flows and exchange rate trends. Understanding this mechanism helps investors navigate the forex market effectively.

How a Housewife Lost RM288,235 in a Facebook Investment Scam

A 47-year-old housewife in Malaysia recently fell victim to an online investment scam, losing a substantial sum of RM288,235 after engaging with a fraudulent scheme advertised on Facebook.

A Trader’s Worst Mistake: Overlooking Broker Reviews Could Cost You Everything

In today’s digital age, reviews influence nearly every decision we make. When purchasing a smartphone, television, or home appliance, we pore over customer feedback and expert opinions to ensure we’re making the right choice. So why is it that, when it comes to choosing an online broker where real money and financial security are at stake many traders neglect the crucial step of reading reviews?

WikiFX Broker

Latest News

The Withdrawal Trap: How Scam Brokers Lure Victims into Paying More

FCA to Investors: Think Twice Before Trusting These Brokers

Trump\s tariffs: How could they affect the UK and your money

Trump gambles it all on global tariffs he\s wanted for decades

TradingView Brings Live Market Charts to Telegram Users with New Mini App

Trump tariffs: How will India navigate a world on the brink of a trade war?

Interactive Brokers Launches Forecast Contracts in Canada for Market Predictions

Authorities Alert: MAS Impersonation Scam Hits Singapore

IG Group Acquires Freetrade for £160M to Expand UK Investment Market

U.S. March ISM Manufacturing PMI Released

Currency Calculator