简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Avoid Signing Up This Unlicensed FX Broker Monfex

Abstract:Choosing a reliable broker is the first step toward successful forex trading. Finding a reputable broker is tough enough, but the growing number of brokers makes things much more complicated. This article outlines how scam brokers, such as "Monfex," fool customers with bogus information, attract them into profitable agreements, steal their money, and then flee.

A Brief Overview of Monfex

Monfex (https://www.monfex.com/) is an offshore broker that offers online trading in a variety of financial markets. The broker, which was founded in 2018, promises to provide over 200 trading assets. Forex, commodities, equities, indices, and cryptocurrency are among the markets it supports. Clients have access to a web-based trading interface that is also available on mobile devices. The instructional library of the broker, which includes blogs, drinks, and how-to instructions, is also included in the packages. Customers may contact the company's customer service via phone or email. However, the broker does not provide a live chat service.

Is Monfex Regulated?

Nowhere in the world is the broker regulated.

It originally claimed to be a subsidiary of SWISS-SVG HOLDING LTD and to be subject to “regulations” issued by the Financial Services Authority of Saint Vincent and the Grenadines (SVG FSA). After being discovered by multiple independent reviews, the corporation seems to have deleted the material from its website.

Notably, the SVGFSA does not license forex traders or brokers, nor does it manage, monitor, oversee, or authorize foreign firms engaged in forex trading or brokerage. As a result, even if it had not removed the information concerning the SVG FSA, it was still an unregulated broker.

Client Feedback Received by WikiFX

Monfex, like many other scam brokers, has a bad reputation among its traders. Some of the company's concerns include fund withdrawal delays, slow transaction executions, slippage issues, and bad customer support.

View all complaints by following this link: https://www.wikifx.com/en/exposure/exposure/3626588079.html

What Makes Monfex a Scam?

Monfex looks to be a fraud for a variety of reasons.

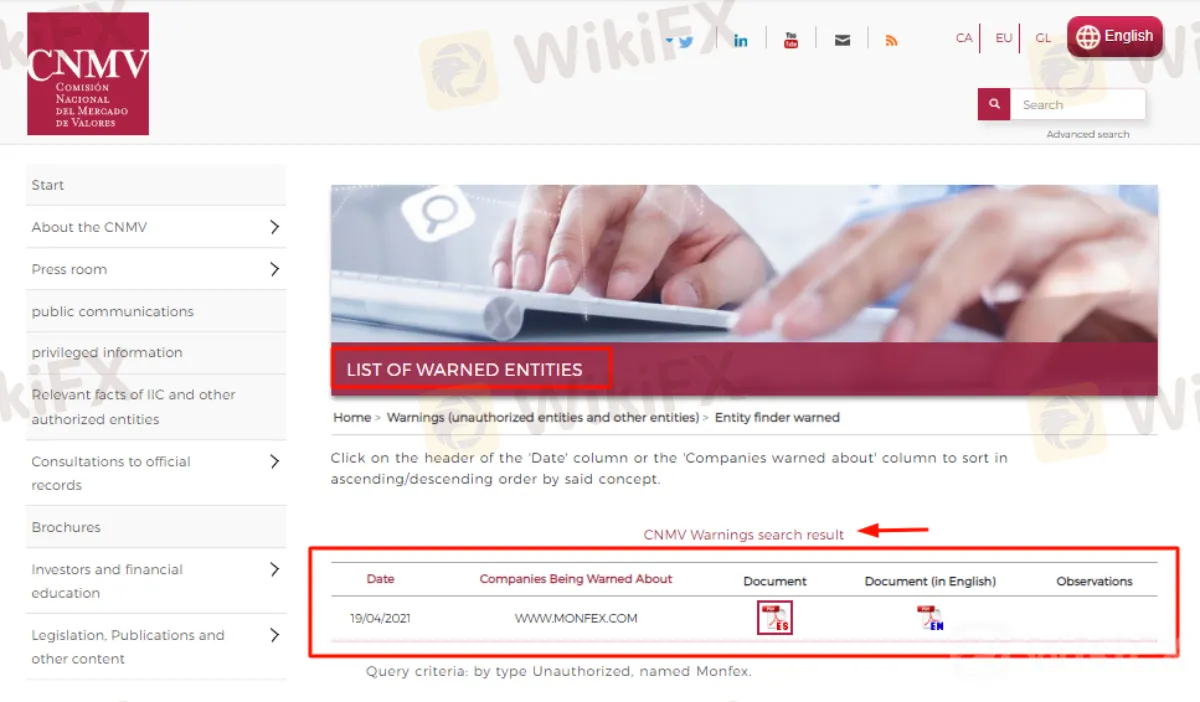

First and foremost, the Spanish National Securities Market Commission (CNMV) has informed the corporation about its improper activities in the nation.

Second, there is no access to any recognized third-party trading platforms, such as MetaTrader or cTrader, via the broker. Instead, it requires customers to utilize its custom-built online interface to access the markets, which entails some risk.

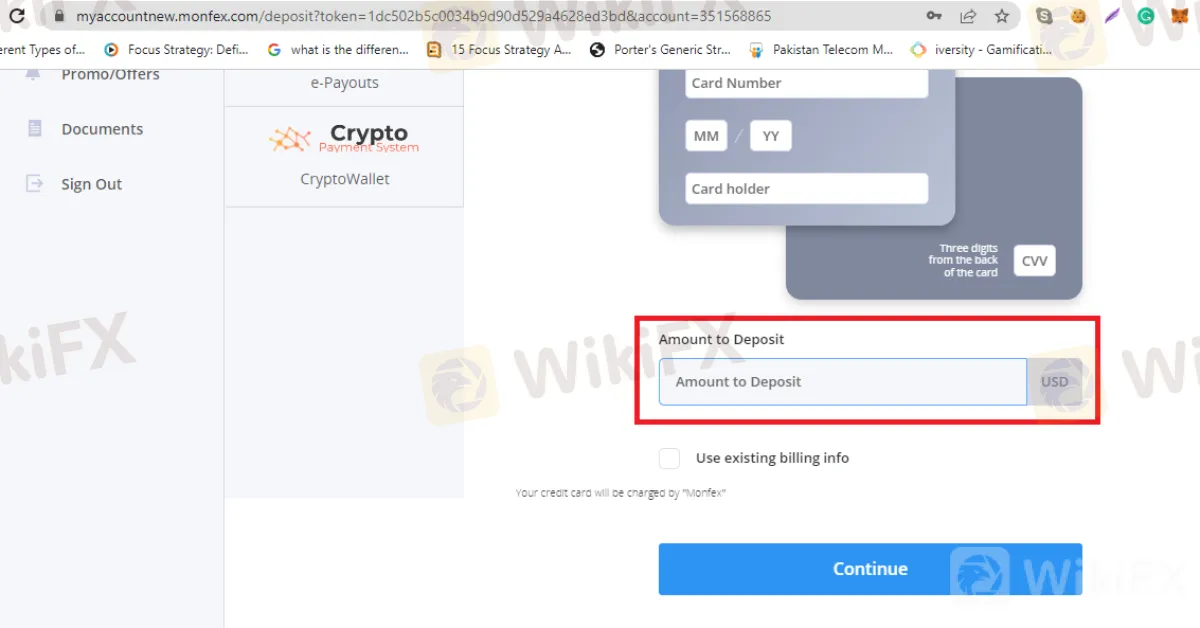

Third, the firm does not need you to provide KYC papers before depositing cash into your account. Legitimate brokers do not enable customers to use the site until they have submitted the necessary documentation and verified their accounts. That is not the case with Monfex. You may put as much money as you like into your account since the broker knows it will not refund a single cent.

Fourth, it is an uncontrolled entity with no fixed location. There is no information available about the company's physical address.

Finally, negative customer feedback reflects the company's inadequate code of behavior.

How does Monfex Scam Customers?

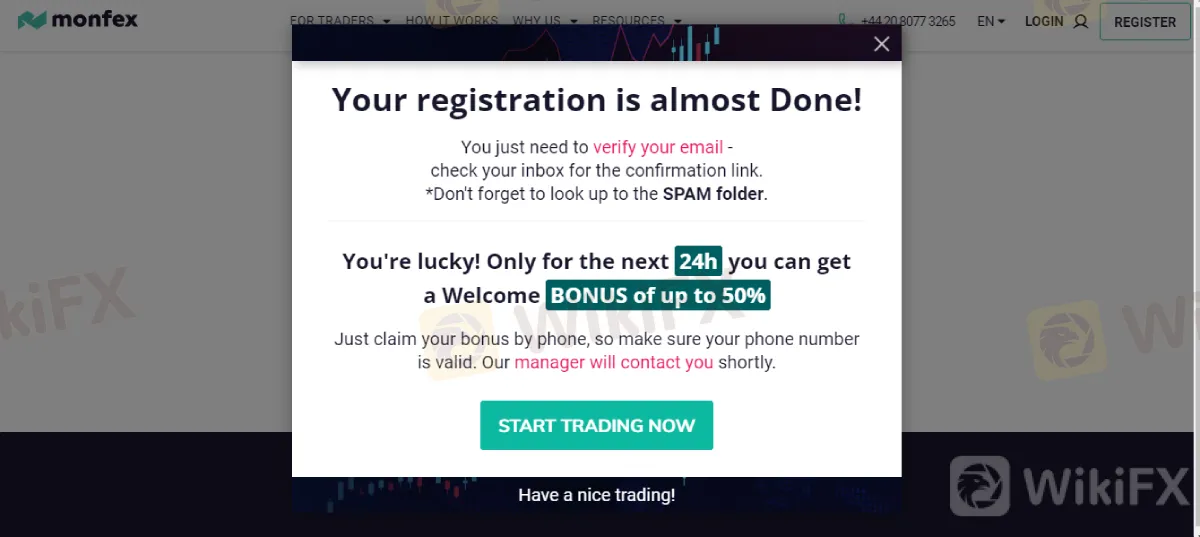

When you join up with the firm, a flash screen appears informing you that you are one of the lucky clients who may get a 50% bonus. Everyone who registers with the broker receives the same message.

The broker's marketing staff will then contact you through email or phone. A guy pretending to be your account manager approaches you and requests deposits. The fraudster pressures you to contribute a specified amount to obtain the bonus offer. However, once you've filled out your account, your money is gone forever since the fraudster never returns it to you.

About WikiFX

WikiFX is a platform for searching worldwide corporate financial information. Its primary duty is to give the included foreign exchange trading organizations with basic information searching, regulatory license seeking, the credit assessment, platform identification, and other services.

Over 39,000 brokers, both licensed and unregistered, are listed on the network. WikiFX's staff has been hard at work with 30 financial authorities from across the world to verify that the information supplied is factual and correct.

In conclusion

We've investigated a number of fraud companies, and we think Monfex is one of them. Despite being identified as a scam company several times and obtaining a warning from a regulator, it continues to operate. Perhaps the firm expects to capture more customers until authorities aggressively take down its domain. In any case, please be advised to avoid it.

Stay tuned for more broker news.

Download the WikiFX App from the App Store or Google Play Store.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Related broker

Read more

Hawkish vs. Dovish Policies: What They Mean for the Economy & Traders

Two terms often emerge during central bank policy discussions: hawkish and dovish. These descriptors reflect the differing approaches central banks may take regarding monetary policy. Traders, especially in the forex market, pay close attention to these stances because of their significant impact on currency strength, inflation, interest rates, and overall market sentiment. But what do these terms mean, and are they inherently good or bad for a country's economy?

How Sentiment Analysis Powers Winning Forex Trades in 2024

Learn how sentiment analysis powers successful forex trades in 2024 by interpreting market emotions and anticipating price movements to create profitable strategies.

TICKMILL FREE WEBINAR ON US ELECTION 2024

The 2024 US election is expected to have a significant impact on the Forex market. Therefore, on November 3, 2024, the well-known broker Tickmill will host a free webinar on US Election 2024. There are only a few seats available.

STARTRADER PRIME: Your Trusted Partner in Institutional Liquidity Solutions

With extensive experience in the financial market, STARTRADER PRIME is highly knowledgeable about the needs of institutional businesses. The brand has gained trust from clients in over 200 regions by providing tailored liquidity solutions. Institutional clients require solutions designed according to their unique business needs, and STARTRADER PRIME offers such solutions, giving clients a real competitive edge in the market.

WikiFX Broker

Latest News

STARTRADER PRIME: Your Trusted Partner in Institutional Liquidity Solutions

How Sentiment Analysis Powers Winning Forex Trades in 2024

Can Blockchain Technology Protect Your Money from Risk?

Trump vs. Harris: Whose policies are Better for US stock investors?

MyTrade Founder Guilty of Crypto Manipulation

Why is the U.S. election on a Tuesday in November?

TMGM – Featured Broker in WikiFX SkyLine Guide

FX Guys Aims to Ride Solana's Surge: A New DeFi Project Tracking SOL's Growth

Fear, Greed, and Decision-Making in Forex Trading

TICKMILL FREE WEBINAR ON US ELECTION 2024

Currency Calculator