简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

"You can withdraw $100, but not $100,000." VICTORIA CAPITAL shows its true colors yet again.

Abstract:VICTORIA CAPITAL is an online forex broker registered in Australia. It was newly established. Recently, this broker caught our attention because one trader exposed to WikiFX said that this broker did not allow him to withdraw. It is not the first time we have received complaints against this broker. In this article, we will expose this case to you in detail based on the evidence provided by the victim.

About VICTORIA CAPITAL

VICTORIA CAPITAL is an online forex broker registered in Australia. WikiFX has received a lot of complaints against this broker recently. In addition, we find this broker is not regulated and WikiFX has given this broker a low rating of 1.39/10. Please note that investing in an unregulated broker with a low WikiFX score is pretty dangerous for your fund safety.

(VICTORIA CAPITAL)

Description of the case in brief

On trader, Kevin claimed that he has deposited almost 150K dollars into Victoria Capital. He withdraw twice, the first time he withdraws only $100 from Victoria Capital and it went through successfully. The second time, he tried to withdraw $100,000. However, this broker rejected the request and even asked for tax and channel fees.

Evidence gathered from the victim

A guy called Angela Smith on Instagram contacted the trader and lured him to trade forex with Victoria Capital. Angela Smith told the trader that she(he) won a lot when trading forex. See below.

However, when the trade started the trade, he met a serious slippage.

After that, this broker sent an email to Kevin, claiming that it was under maintenance.

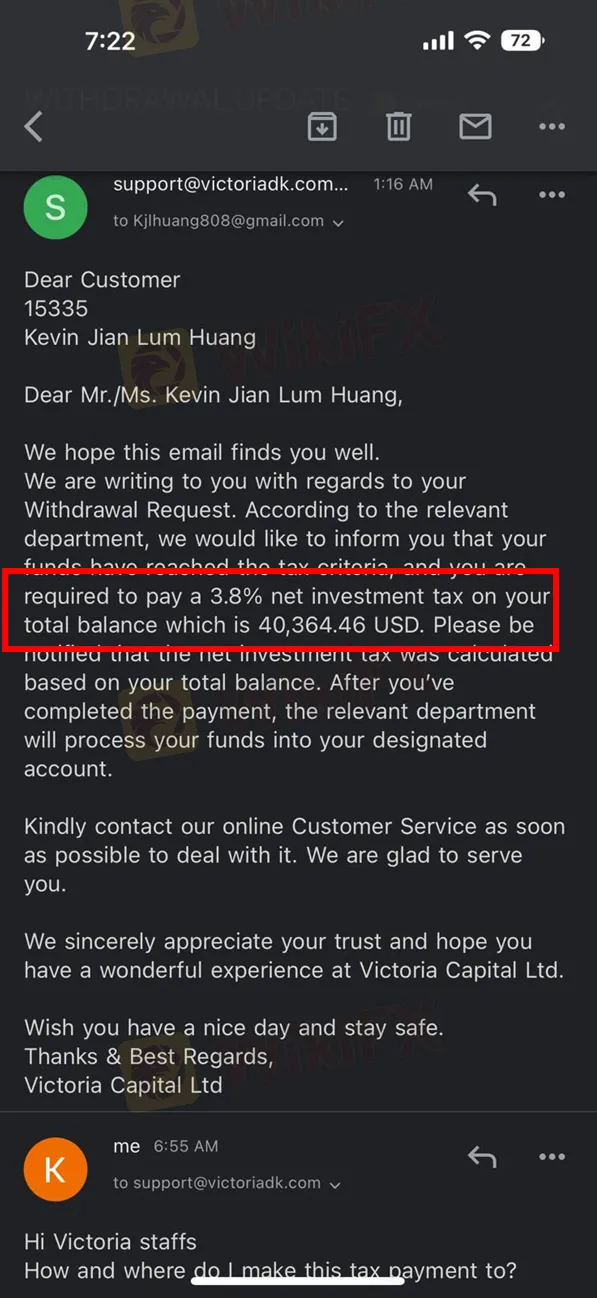

When Kevin ask for a withdrawal, this broker rejected the request and asked him to pay a 3.8% tax and channel fee of 2% of his total balance.

At that moment, the trader found out that the website of VICTORIA CAPITAL is not available. But this broker insisted to asked the trader to pay the fee first. VICTORIA CAPITAL claimed that Kevin must pay the channel fee of more than 20,000 US dollars before he can log in to his account.

According to our investigation, this brokers original name is Rui win, it changed Rui win to VICTORIA CAPITAL not long ago. We do not know the reason why this broker changed its name, but we know that many scam brokers like to change their names in order to cover their disreputable behavior. In addition, we can see that this broker also used a name called “Sophie Capital”. Scam brokers like to change their names often so that they can keep doing their dirty work.

Conclusion

It is not the first time we expose this broker to the public, if you are interested, you can check this link for more information about this broker. https://www.wikifx.com/en/newsdetail/202211231434177449.html

Protecting the legitimate rights and interests of forex traders are always the primary concern of WikiFX. WikiFX exposed this case to the public to remind all traders of the potential risks. After all, what happened to Kevin could happen to any of us. All traders should be vigilant when investing in a broker.

WikiFX keeps track of developments, providing instant updates on individual traders and helping investors avoid unscrupulous brokers. If you want to know whether a broker is safe or not, be sure to open WikiFXs official website (https://www.WikiFX.com/en) or download the WikiFX APP through this link (https://www.wikifx.com/en/download.html) to evaluate the safety and reliability of this broker!

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

INFINOX Partners with Acelerador Racing for Porsche Cup Brazil 2025

INFINOX has teamed up with Acelerador Racing, sponsoring an Acelerador Racing car in the Porsche Cup Brazil 2025. This partnership shows INFINOX’s strong support for motorsports, adding to its current sponsorship of the BWT Alpine F1 Team.

The Impact of Interest Rate Decisions on the Forex Market

Interest rate changes determine currency attractiveness, influencing capital flows and exchange rate trends. Understanding this mechanism helps investors navigate the forex market effectively.

How a Housewife Lost RM288,235 in a Facebook Investment Scam

A 47-year-old housewife in Malaysia recently fell victim to an online investment scam, losing a substantial sum of RM288,235 after engaging with a fraudulent scheme advertised on Facebook.

Interactive Brokers Launches Forecast Contracts in Canada for Market Predictions

Interactive Brokers introduces Forecast Contracts in Canada, enabling investors to trade on economic, political, and climate outcomes. Manage risk with ease.

WikiFX Broker

Latest News

Interactive Brokers Launches Forecast Contracts in Canada for Market Predictions

Authorities Alert: MAS Impersonation Scam Hits Singapore

INFINOX Partners with Acelerador Racing for Porsche Cup Brazil 2025

Billboard Warns of Crypto Scams Using Its Name – Stay Alert!

The Impact of Interest Rate Decisions on the Forex Market

STARTRADER Spreads Kindness Through Ramadan Campaign

Rising WhatsApp Scams Highlight Need for Stronger User Protections

A Trader’s Worst Mistake: Overlooking Broker Reviews Could Cost You Everything

How a Housewife Lost RM288,235 in a Facebook Investment Scam

The Daily Habits of a Profitable Trader

Currency Calculator