简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

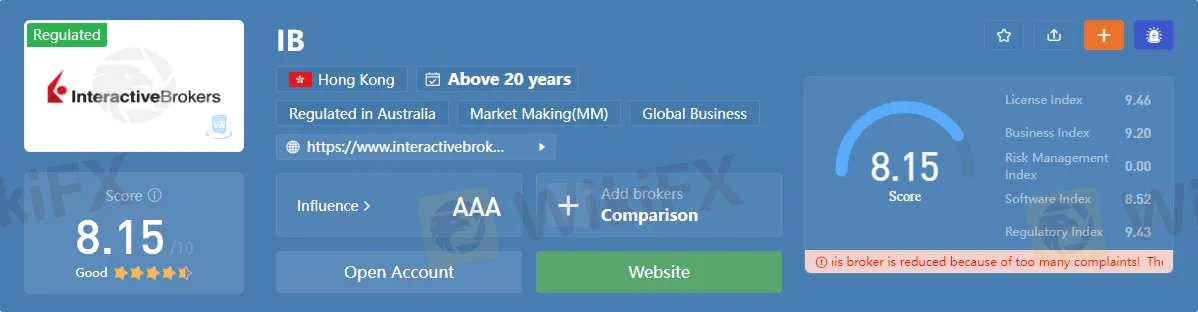

Taiwan SINOPAC Brokerage Teams Up with Interactive Brokers for Algo, US Stocks, and ETFs Trading

Abstract:Interactive Brokers Group Inc. announced its appointment as SinoPac Securities' principal international broker.

Collaboration between SinoPac and Interactive Brokers

Sinopac institutional and individual customers may trade US equities, ETFs, and Fixed Income products, as well as access over 90 stock markets globally through Interactive Brokers. This collaboration between Interactive Brokers LLC and Sinopac expands Interactive Brokers' reach in the APAC region and adds Taiwan to the company's global customer base of over 200 nations and territories.

“We are excited to collaborate with Sinopac and offer Interactive Brokers' worldwide trading skills and knowledge to Taiwan,” said Milan Galik, CEO of Interactive Brokers. “We realize the benefit of collaborating with a prominent broker with local knowledge and look forward to meeting the demands of this key market and its investors.”

Interactive Brokers' robust trading platforms, superior technology, and capabilities will benefit Taiwanese investors. Interactive Brokers allows customers to trade fractional shares of qualifying US and European equities as well as ETFs, and it supports over 100 order types, including algorithmic trading, which is presently unavailable via other Taiwanese brokers.

Trading benefits

Overnight Trade Hours on the IBKR Eos ATS allows clients to trade certain US ETFs 24 hours a day, five days a week (IBEOS). Overnight Trade Hours allow Asian investors to access US equity markets throughout their trading day and react to market-moving news at practically any time. The cooperation with Sinopac also allows Interactive Brokers customers to trade Taiwanese stocks through Sinopac Securities.

Introducing Brokers all over the globe utilize Interactive Brokers' Prime Broker services to help them operate their operations more efficiently and serve their customers more affordably. Introducing Brokers may use Interactive Brokers' professional, white-branded trading platform to decrease operating, brokerage, and clearing expenses while acquiring global electronic market access.

Recently, interactive brokers released a statement about their crypto trading service expanding to Hong Kong.

Full details: https://www.wikifx.com/en/newsdetail/202302157824305400.html?source=fma3

About Interactive Brokers

Interactive Brokers is a brokerage firm that provides online trading services for individuals and institutions. They offer a wide range of financial products, including stocks, options, futures, currencies, and bonds, as well as access to global markets.

Interactive Brokers is known for its low commission rates, advanced trading platforms, and extensive market research and analysis tools. The company's platform is designed for active traders and provides access to a broad range of financial products and markets.

About SinoPac

Sinopac Securities is a Taiwanese investment bank and securities firm that offers a range of financial services, including brokerage, investment banking, wealth management, and proprietary trading. The company was founded in 2002 and is headquartered in Taipei, Taiwan.

Sinopac Securities is a subsidiary of Sinopac Holdings, which is one of the largest financial holding companies in Taiwan. The company has a strong presence in the Taiwanese market and also has operations in Hong Kong and Singapore.

Install the WikiFX App on your smartphone to stay updated on the latest news.

Download link: https://www.wikifx.com/en/download.html?source=fma3

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Justice Served: Illegal Investment Scheme Ends in RM28 Million Repayment

The Kuala Lumpur High Court has ruled that a Singaporean businessman, Chan Cheh Shin, must return RM28 million to 122 Malaysian investors after the court determined that his investment operations were conducted illegally.

RM900,000 Scammed: The Hidden Dangers of Online Investment Schemes

A 53-year-old factory manager from Malaysia has fallen victim to an online investment scam, losing over RM900,000 of her savings. This case underscores the growing threat of online scams preying on unsuspecting individuals.

Tokyo Police Arrest 4 for Unregistered FX Trading Scheme

Four men in Tokyo were arrested for running an unregistered FX trading operation, collecting over ¥1.6 billion from 1,500 investors.

Doo Group Expands Its Operations with CySEC License

Doo Financial, part of Doo Group, receives a CySEC license, allowing FX/CFD services in Europe. This strengthens its global presence and regulatory standards.

WikiFX Broker

Latest News

Why Even the Highly Educated Fall Victim to Investment Scams?

Warning Against Globalmarketsbull & Cryptclubmarket

BSP Shuts Down Uno Forex Over Serious AML Violations

ACY Securities Expands Global Footprint with South Africa Acquisition

Tokyo Police Arrest 4 for Unregistered FX Trading Scheme

Rupee gains against Euro

Axi Bids AUD 52M to Acquire Low-Cost Broker SelfWealth, Outbidding Competitor Bell Financial

Crypto Influencer's Body Found Months After Kidnapping

US Regulators Tighten Oversight on Bank Anti-Money Laundering Efforts

Doo Group Expands Its Operations with CySEC License

Currency Calculator