简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

The Fast and the Profitable: Unpacking Algo-Trading and HFT

Abstract:Algorithmic trading and High-Frequency Trading (HFT) leverage computer algorithms to execute trades, providing speed, precision, and error reduction. Despite benefits, concerns include market fairness and flash crashes. Future developments involve AI, quantum computing, and blockchain, promising growth and challenges.

Algorithmic trading and High-Frequency Trading (HFT) have revolutionized the financial markets in recent years, leveraging sophisticated algorithms and lightning-fast computing technology to facilitate trading activities. As we delve deeper into these fascinating subjects, it's crucial to address all possible topics and questions that emerge in this space.

To begin, algorithmic trading, often dubbed “algo-trading,” involves using computer algorithms to initiate trades. These algorithms are designed to follow predefined instructions based on variables like time, price, volume, and other market conditions. Traditional traders would find it challenging to process such vast amounts of data manually and execute trades with the same precision and speed.

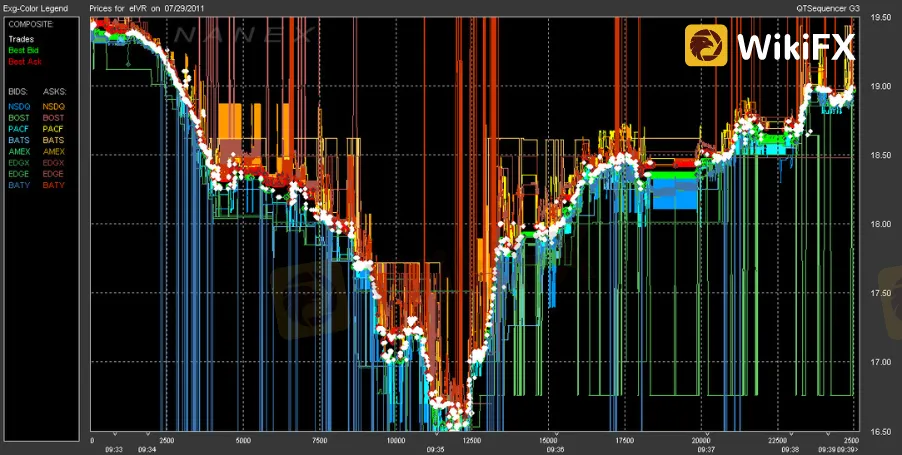

HFT, a subset of algorithmic trading, employs advanced algorithms and high-speed computer technology to transact a large number of orders within microseconds. By capitalizing on minuscule price differences across different markets and the speed of execution, HFT firms can generate significant profits.

So, why are algorithmic trading and HFT popular?

They offer numerous advantages. To begin with, they limit the risk of human errors in trading decisions, which may be caused by emotional bias or an inability to assimilate information quickly enough. Second, they can analyze enormous amounts of data in real-time, enabling better decision-making. Finally, they give speed and efficiency, which is especially vital in today's fast-paced trading environment.

Despite these advantages, there are concerns. Market fairness is a significant issue, with critics arguing that HFT gives an unfair advantage to firms that can afford expensive technology. Moreover, the potential for “flash crashes,” as seen in 2010 when the Dow Jones plummeted nearly 1000 points before quickly recovering, also poses risks. These crashes can occur when HFTs initiate a large number of trades in a short period, leading to significant market volatility.

Next, how are algorithmic trading strategies developed?

They are typically based on mathematical models that use historical and real-time data to predict market movements. Some common strategies include mean reversion, momentum trading, and statistical arbitrage. These strategies are rigorously backtested using historical data before being deployed in live markets.

With the growing significance of data in finance, machine learning has made its way into algorithmic trading as well. Traders may create more complex and adaptable trading strategies by utilizing algorithms that can learn from and make judgments based on data. However, despite its promise, machine learning in trading is still in its infancy and is not without obstacles, such as overfitting and data quality concerns.

Regulation is another critical aspect. Given the potential risks associated with algorithmic trading and HFT, regulators worldwide have implemented measures to promote market integrity and protect investors. For instance, measures like circuit breakers can halt trading when extreme price volatility is detected. However, authorities must strike a fine balance between encouraging innovation and limiting risk.

Finally, what does the future hold for algorithmic and high-frequency trading?

With the arrival of technologies such as artificial intelligence, quantum computing, and blockchain, the environment of algorithmic trading and HFT is expected to grow even further. These technologies promise to improve the accuracy, security, and speed of trading algorithms, therefore opening up new financial frontiers. However, they also present new challenges, from ethical considerations to cybersecurity concerns.

In conclusion, algorithmic trading and HFT represent a fundamental change in the way financial markets are traded, providing considerable advantages while posing new obstacles. Looking forward, the interaction of technology and finance will continue to drive the progress of these trading strategies. It is critical for everyone, from traders to regulators, to remain on top of these changes in order to create an innovative and fair trading environment.

Download and install the WikiFX App on your smartphone to stay updated on the latest news.

Download the App here: https://social1.onelink.me/QgET/px2b7i8n

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Top Forex Brokers for Low-Cost Trading in 2025

Find the best Forex brokers for 2025 with low spreads, zero commissions, and no hidden fees. Simplify your trading journey with insights and the WikiFX app!

Participate Now in ForexCup Trading Championship

FXOpen announced the trading competition called ForexCup Trading Championship 2025 for traders. You can join, trade, and compete for exciting prizes. Here are the details

What the Movie Margin Call Taught Traders About Risk and Timing

The 2011 film Margin Call offers a gripping portrayal of the early hours of the 2008 financial crisis, set within a Wall Street investment firm. While the film is a fictionalised account, its lessons resonate strongly with traders and finance professionals. For one trader, watching the film had a lasting impact, shaping how they approached risk, decision-making, and the harsh realities of the financial world.

Why More Traders Are Turning to Proprietary Firms for Success

Over the past decade, one particular avenue has gained significant popularity: proprietary trading, or prop trading. As more traders seek to maximize their earning potential while managing risk, many are turning to proprietary firms for the resources, capital, and opportunities they offer. In this article, we’ll explore why an increasing number of traders are choosing proprietary trading firms as their preferred platform for success.

WikiFX Broker

Latest News

Fake ‘cyber fraud online complaint’ website Exposed!

Day Trading Guide: Key Considerations

NAGA Launches CryptoX: Zero Fees, 24/7 Crypto Trading

Scam Alert: 7 Brokers You Need to Avoid

AvaTrade Launches Advanced Automated Trading Tools AvaSocial and DupliTrade

What Determines Currency Prices?

Why More Traders Are Turning to Proprietary Firms for Success

How to Use an Economic Calendar in Forex Trading

MC Markets Review 2025

T4Trade Enhances Forex Trading with Advanced Tools for 2025

Currency Calculator