简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Make Money in Forex Without Trading?!

Abstract:This article delves into three distinct methodologies that can be harnessed as effective conduits for generating revenue within the Forex landscape without involving trading.

Navigating the volatile terrain of the Foreign Exchange (Forex) market often entails encountering both profitable gains and unforeseen losses. For many, the prospect of substantial losses has deterred inexperienced individuals from committing to long-term Forex trading endeavours. As the question of “how to generate income from Forex without direct trading” gains traction, alternative strategies emerge to cater to such queries.

This article delves into three distinct methodologies that can be harnessed as effective conduits for generating revenue within the Forex landscape. These methodologies, commonly recognized by multiple appellations, encompass copy trading, embarking on a Forex brokerage venture, and engaging in affiliate programs alongside contributing comments, reviews, and posts across diverse information portals.

Copy trading, interchangeably referred to as social trading, presents an advantageous avenue for novice individuals to navigate the intricate Forex realm. This method involves mirroring the trading practices of seasoned traders, enabling less-experienced traders to potentially profit from their expertise. The appeal of copy trading lies in its potential to mitigate risks associated with a lack of experience. Nevertheless, it's imperative to acquaint oneself thoroughly with these methods, as insufficient understanding could expose one to financial losses. Effective practice and diligent study of a chosen trader's trading system remain pivotal to achieving success.

Strategies for Selecting an Appropriate Trader to Follow:

Identify the most followed professional traders.

Scrutinize the profitability of their followers.

Prioritize traders with consistent monthly performance.

Becoming a Forex broker entails orchestrating transactions between buyers and sellers, engendering income regardless of market fluctuations. In an era characterized by technological leaps, a competitive landscape prevails due to burgeoning technological advancements employed by contemporary brokers. A robust technology infrastructure and substantial capital are essential prerequisites to thrive in this domain. This endeavour holds the potential for significant revenue generation driven by brokerage fees. Moreover, offering educational resources, customer support, insightful analyses, and diverse account options can augment the broker's profitability.

Thriving within an affiliate program necessitates a commitment to studying and mastering the nuances of Forex trading. Individuals can position themselves as sought-after consultants for Forex transactions by accumulating expertise. Trust and recognition hinge upon diligent interaction with clients, answering queries, and providing value-driven advice. Reputation-building is the cornerstone of success in this endeavour, enabling the consultant to attract a broader clientele. Charging consultation fees or providing affiliate links for registration, upfront or post-advice, can bolster revenue streams. Earning a reputable stature is the principal challenge within the affiliate program methodology. This endeavour demands dedication, exemplified by promptly addressing queries, sharing relevant Forex insights, and contributing informative articles. Persistence and proactive engagement are the bedrock for cultivating a profitable consultancy endeavour.

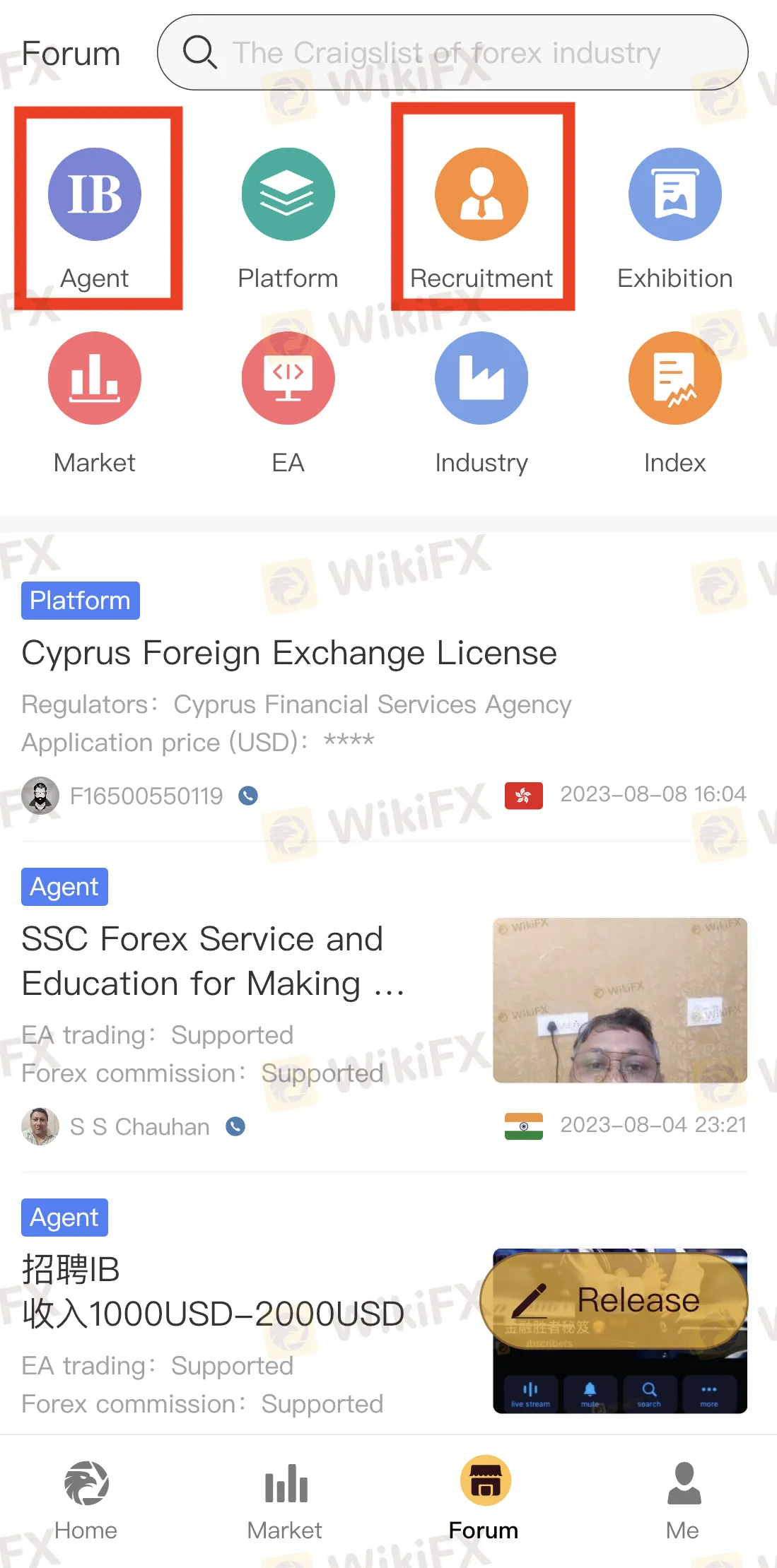

Download the free WikiFX mobile application to find more opportunities at our Forum!

In conclusion, the journey to profit in the Forex realm need not be limited to active trading. Embracing alternative strategies such as copy trading, venturing into brokerage, and participating in affiliate programs presents a diversified approach to financial gain. Each pathway necessitates a unique skill set and diligent efforts, underpinned by an unwavering commitment to mastering the intricate dynamics of the Forex landscape. By harnessing these methodologies, individuals can achieve their financial aspirations without directly engaging in traditional trading practices.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

The Ultimate Guide to Automated Forex Trading in 2025

Modern markets are revolutionized by automated trading systems, which now execute 70-85% of all transactions. These advanced automated trading software solutions, commonly called trading robots or Expert Advisors (EAs), leverage algorithmic precision for automatic trading across forex, stocks, and commodities 24/7. By removing emotional interference and executing trades in microseconds, auto forex trading platforms create fair opportunities for all market participants. For those new to automated trading for beginners, these systems provide disciplined, backtested strategies while significantly reducing manual effort.

Will natural disasters have an impact on the forex market?

The forex market is known for its rapid responses to global events, but the influence of natural disasters, such as earthquakes and typhoons, can be less straightforward. While headlines may scream about catastrophic damage and economic disruption, the long-term effects on currency values often depend on a blend of immediate shock and underlying economic fundamentals.

How Reliable Are AI Forex Trading Signals From Regulated Brokers?

Discover how reliable AI Forex trading signals are and why using a regulated broker boosts their effectiveness. Learn key factors to evaluate accuracy and enhance your trading.

Top Currency Pairs to Watch for Profit This Week - March 31, 2025

Discover the top 5 currency pairs to trade for profit this week, March 31, 2025—USD/JPY, EUR/USD, GBP/USD, AUD/USD, USD/CHF—with simple strategies and best times.

WikiFX Broker

Latest News

How Crypto Trading Transforms FX and CFD Brokerage Industry

UK would not hesitate to retaliate against US tariffs - No 10 sources

FCA Warns Against 10 Unlicensed or Clone Firms

CySEC Warns Against 14 Unlicensed Investment Websites

Top Currency Pairs to Watch for Profit This Week - March 31, 2025

Will natural disasters have an impact on the forex market?

Philippines Deports 29 Indonesians Linked to Online Scam Syndicate in Manila

Navigating the Intersection of Forex Markets, AI Technology, and Fintech

Exposed: Deceptive World of Fake Trading Gurus – Don’t Get Fooled!

AI-Powered Strategies to Improve Profits in Forex Trading

Currency Calculator