简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

WikiFX Reviews Sophie Capital Financial Trading Pty Ltd

Abstract:Explore the alarming case of Sophie Capital Financial Trading Pty Ltd, an unregulated online trading broker that has vanished, leaving clients unable to access their funds, shedding light on the risks associated with unregulated brokers in the financial industry.

Sophie Capital Financial Trading Pty Ltd (Sophie Capital) was a self-proclaimed online trading broker. It offered a range of trading instruments, including forex, CFDs, and stocks. The broker also offered a maximum leverage ratio of 1:500, allowing traders to control larger positions relative to their deposited funds.

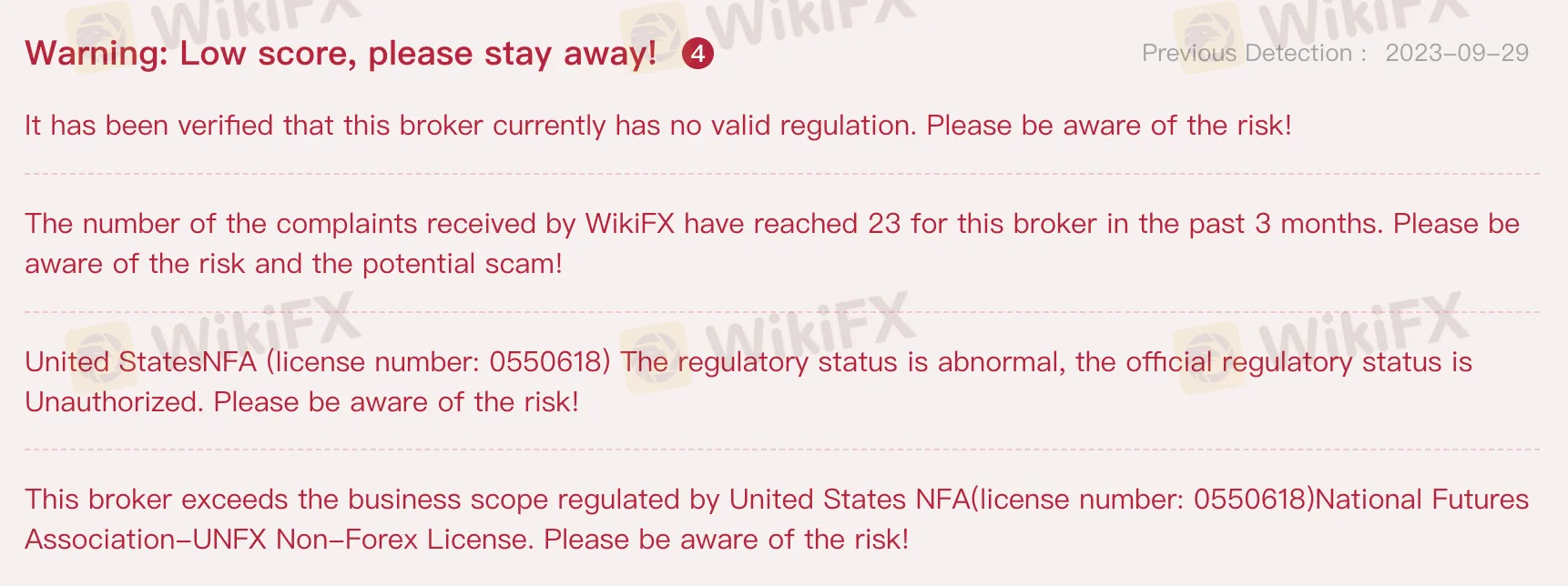

However, Sophie Capital was not regulated by any financial authority. This meant that clients were not protected by any regulatory safeguards, and there was a high risk that they could lose their entire investment.

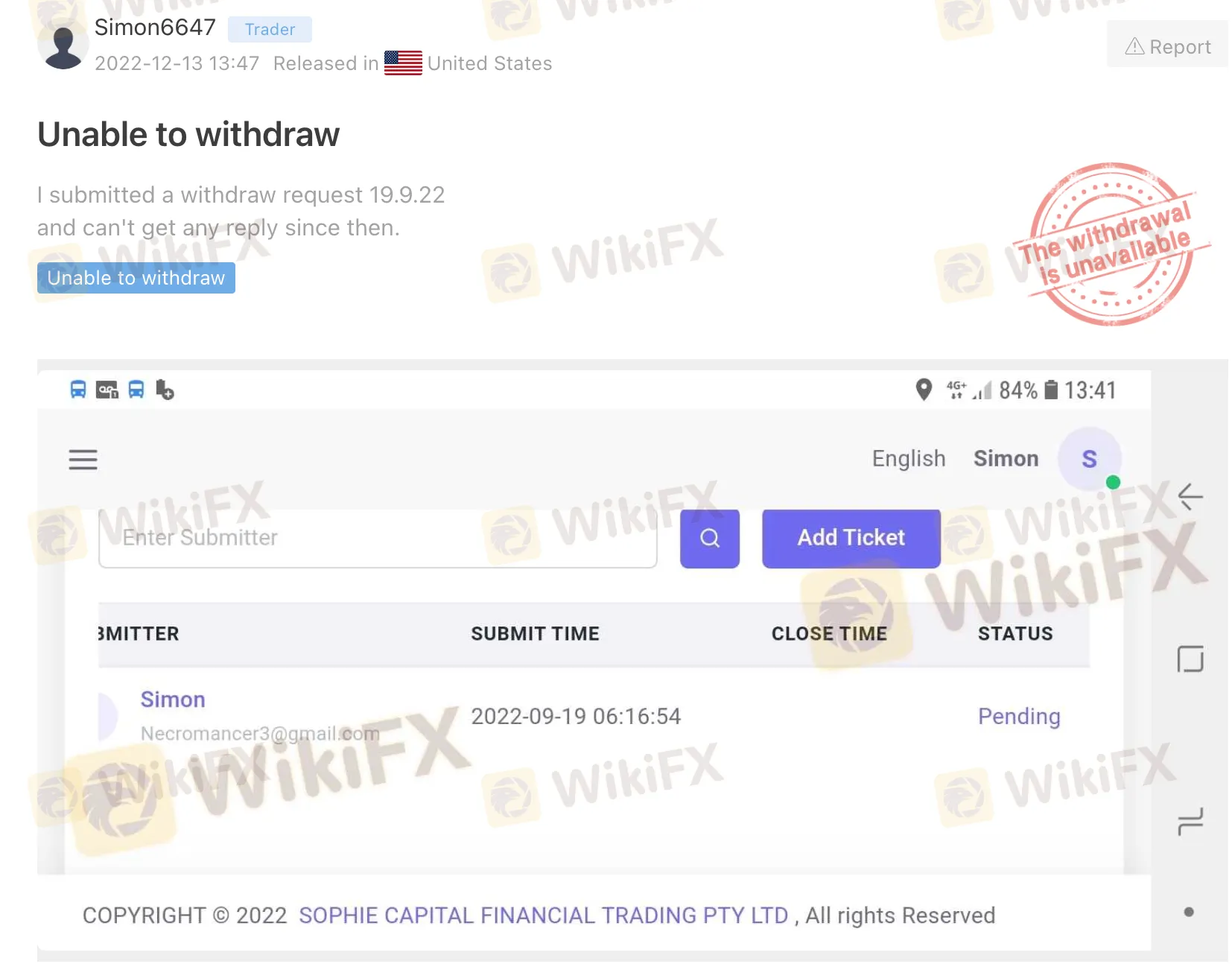

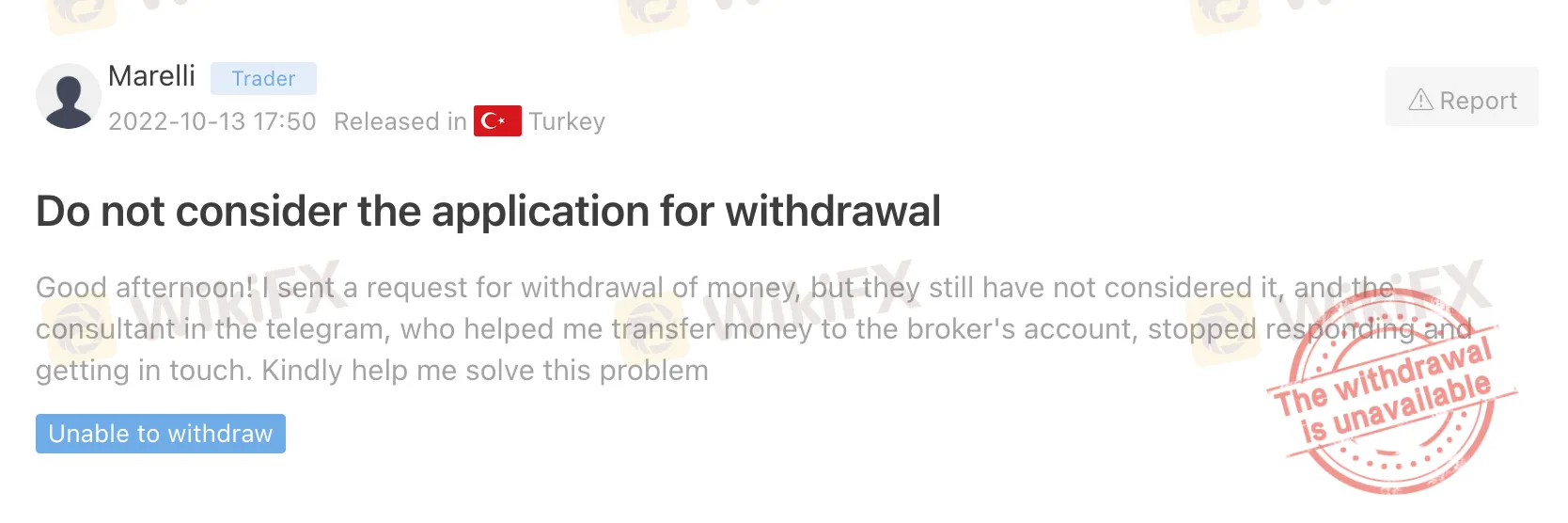

In addition, Sophie Capital has now disappeared from the internet. Its website is no longer accessible, and its customer support channels are unresponsive. Clients of Sophie Capital have reported that they have been unable to withdraw their funds from their accounts. Some clients have also reported that they have been unable to contact the broker's customer support team.

This suggests that Sophie Capital was a fraudulent broker that was operating a scam.

The fact that Sophie Capital is unregulated is a major red flag for investors. Unregulated brokers are not subject to the same oversight and regulations as regulated brokers, and they are therefore more likely to engage in fraudulent or unethical practices.

In the case of Sophie Capital, it appears that the broker has simply disappeared with clients' funds. This is a classic example of a “scam broker.” Scam brokers typically lure investors in with promises of high returns and low risk. However, once investors deposit their funds, the broker disappears or makes it impossible for investors to withdraw their money.

Unregulated brokers pose a significant risk to traders, often resulting in financial losses and frustration. Fortunately, traders now have a powerful ally in their quest for secure trading options: WikiFX. This free application and website offer a comprehensive suite of tools to help traders make informed decisions and avoid falling victim to unscrupulous entities like Sophie Capital.

One of the key features that sets WikiFX apart is its ability to provide users with up-to-date information on the regulatory status of brokers. Let's take Sophie Capital as an example. A user can simply enter the name of the broker into the WikiFX platform, and it will reveal a crucial piece of information - Sophie Capital is not regulated by any financial authority. This initial revelation serves as a glaring red flag, signalling to the user that caution is warranted. Trading with an unregulated broker exposes investors to a multitude of risks, including the potential loss of their hard-earned capital. WikiFX's regulatory status check is the first line of defence against such risks.

Beyond regulatory status, WikiFX offers users the invaluable resource of real-time trader reviews. These reviews are a treasure trove of insights into the experiences of other traders who have interacted with brokers like Sophie Capital. Traders often report their grievances, and in the case of Sophie Capital, some have revealed that they were unable to withdraw their funds. This serves as yet another red flag for prospective traders. When multiple users report similar issues, it becomes clear that the broker may not have their clients' best interests at heart. WikiFX's user-generated reviews empower traders with collective knowledge, allowing them to make informed decisions and avoid brokers with questionable practices.

To further fortify the defence against unregulated brokers, WikiFX maintains a comprehensive blacklist of fraudulent and unregulated forex brokers. Sophie Capital, in this case, would undoubtedly find its place on this list. When a broker appears on WikiFX's blacklist, it's a crystal-clear warning sign to traders. This list is continuously updated, ensuring that traders stay current with the ever-evolving landscape of financial markets. Utilizing this blacklist, users can confidently steer clear of brokers that have been deemed high-risk by the WikiFX community.

In conclusion, the WikiFX free application and website are invaluable tools for traders seeking to protect their investments in the world of online trading. WikiFX empowers traders with knowledge and insights that can help them avoid falling victim to unregulated brokers like Sophie Capital. In an industry where financial security is paramount, WikiFX stands as a guardian of trust and transparency, ensuring that traders can navigate the markets with confidence and peace of mind.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

INFINOX Partners with Acelerador Racing for Porsche Cup Brazil 2025

INFINOX has teamed up with Acelerador Racing, sponsoring an Acelerador Racing car in the Porsche Cup Brazil 2025. This partnership shows INFINOX’s strong support for motorsports, adding to its current sponsorship of the BWT Alpine F1 Team.

The Daily Habits of a Profitable Trader

Every professional trader follows a structured approach to ensure they are well-prepared, disciplined, and able to seize opportunities with confidence. Whether you are a seasoned investor or an aspiring trader, adhering to a robust daily checklist can significantly enhance your performance. Use this checklist to check if you are a qualified trader

Authorities Alert: MAS Impersonation Scam Hits Singapore

MAS scam alert: Scammers impersonate officials, causing $614K losses in Singapore since March 2025. Learn how to spot and avoid this impersonation scam.

Billboard Warns of Crypto Scams Using Its Name – Stay Alert!

Billboard warns against fake crypto scams using its brand. Learn how to spot fraud and protect yourself from fake promotions.

WikiFX Broker

Latest News

TradingView Brings Live Market Charts to Telegram Users with New Mini App

Trump tariffs: How will India navigate a world on the brink of a trade war?

Interactive Brokers Launches Forecast Contracts in Canada for Market Predictions

Authorities Alert: MAS Impersonation Scam Hits Singapore

Stocks fall again as Trump tariff jitters continue

INFINOX Partners with Acelerador Racing for Porsche Cup Brazil 2025

Regulatory Failures Lead to $150,000 Fine for Thurston Springer

April Forex Trends: EUR/USD, GBP/USD, USD/JPY, AUD/USD, USD/CAD Insights

March Oil Production Declines: How Is the Market Reacting?

Georgia Man Charged in Danbury Kidnapping and Crypto Extortion Plot

Currency Calculator