简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

FXPRIMUS: Withdrawal Issues Met with 0 Support

Abstract:A recent experience by one trader has unveiled a troubling side of the industry, exposing the issues at FXPRIMUS and the vital role that WikiFX plays in resolving disputes.

In the fast-paced world of online trading, traders entrust their hard-earned money to brokers with the expectation of swift and seamless transactions. However, a recent experience by one trader has unveiled a troubling side of the industry, underscoring the significance of responsive customer service and the vital role that WikiFX plays in resolving disputes.

Investor embarked on their journey with FXPRIMUS, depositing $2000 and diligently following the broker's guidance, which resulted in a healthy profit of $3000. Eager to reap the rewards of their efforts, Investor initiated a $5000 withdrawal request.

What should have been a simple process spiraled into a nightmare as Investor found themselves unable to complete the withdrawal. Anxious and frustrated, they turned to FXPRIMUS's customer service for help. Here's where the problem escalated; Investor's calls for assistance went unanswered. Their messages and pleas seemed to fall into a void, intensifying their already precarious situation.

This unresponsiveness from FXPRIMUS's customer service further complicated Investor's predicament, exposing a critical issue in the industry. Reliable and responsive customer support is vital for traders to address concerns and resolve issues efficiently. In its absence, traders like Investor are left in a state of vulnerability and distress.

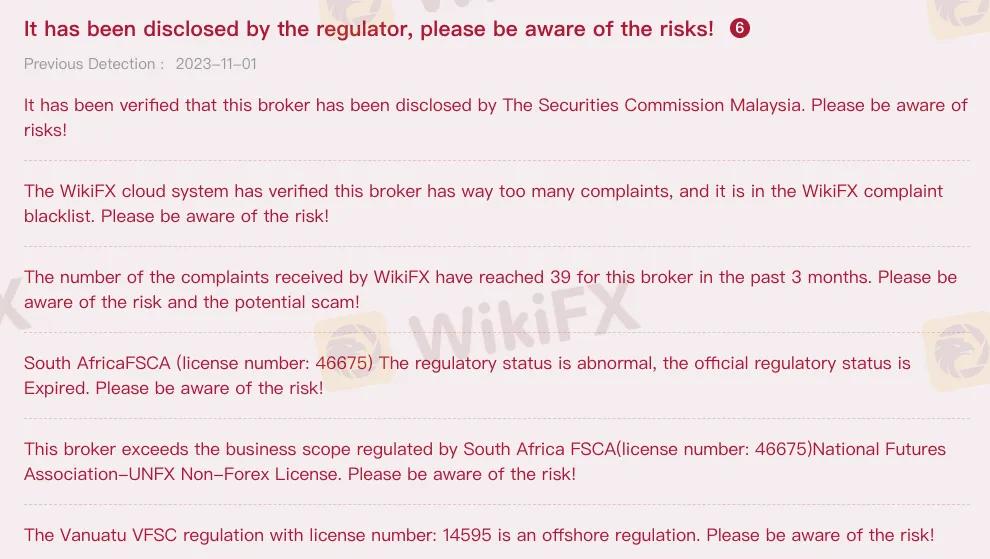

WikiFX is a renowned global forex regulatory query platform that houses verified information of over 50,000 brokers. Based on the database of WikiFX, FXPRIMUS has a low WikiScore, which further indicates that it is a broker with low credibility. For this trader, had he taken a moment to review WikiFX before getting involved with FXPRIMUS, he might have avoided the current distress he is going through.

In addition to aiding individuals in their immediate concerns, WikiFX's Exposure service is on a larger mission. It is dedicated to bolstering transparency and accountability in the financial industry. WikiFX acts as a watchdog in the industry, scrutinizing brokers to uncover any unethical or fraudulent practices. When traders report issues, it helps shed light on brokers engaging in dubious activities. By exposing unscrupulous brokers, WikiFX raises awareness about potential pitfalls and risks in the market. This information is invaluable for traders, helping them make informed decisions and avoid falling victim to untrustworthy brokers.

In essence, WikiFX's Exposure service serves as a vital bridge between traders facing unresolved disputes and potential solutions. It not only provides a platform for sharing grievances but also contributes to the broader mission of ensuring transparency, accountability, and safety in the financial industry.

Stop waiting and get your free WikiFX mobile application from Google Play or App Store now!

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

President Marcos’ POGO Ban Leads Philippines Exits FATF Grey List

The Philippines exits the FATF grey list after President Marcos’ POGO ban and anti-money laundering reforms, boosting investor confidence and OFW opportunities.

Chinese Fugitives Arrested in Philippines POGO Scam Raid

Thirteen Chinese fugitives linked to POGO scams arrested in Pasay, Philippines. PAOCC reveals their crimes, raising concerns over illegal entry despite the ban.

Canada to Enforce Retaliatory Tariffs if U.S. Duties Persist

Canada is striking back! If U.S. tariffs persist, Canada will impose retaliatory duties, escalating tensions in North American trade.

Unbelievable! Is the Yen Really Gaining Strength?

Recently, the yen exchange rate has once again broken through the 150 yen per U.S. dollar mark, sparking heated discussions about its appreciation.

WikiFX Broker

Latest News

How Do You Make Money in the Forex Market in March 2025

Europe’s High-Stakes Gamble: Can It Bridge the U.S.-Ukraine Divide?

Crypto Trading: New Trend among Indian Youth

Botbro Creator, Lavish Chaudhary Unveils New Project

Is TUOTENDA a cryptocurrency scam primarily targeting men over the age of 50?

Canada to Enforce Retaliatory Tariffs if U.S. Duties Persist

Unbelievable! Is the Yen Really Gaining Strength?

First UK Criminal Conviction for Unregistered Crypto ATMs Involves Over £2.5 Million

Consob Exercises MICAR Authority for the First Time, Shutting Down Unregistered Crypto Website

TD Bank Appoints Guidepost Solutions for AML Compliance Oversight

Currency Calculator