Abstract:Discover the top 15 UK Forex brokers in 2023 as ranked by the WikiFX App. Gain insights into regulatory compliance, trading fees, and other essential factors for well-informed trading decisions.

Introduction

The Forex market, with its trillions of dollars in daily trading volume, is a dynamic and lucrative arena for investors and traders. However, navigating this vast financial landscape necessitates the expertise of a reliable Forex broker. In the United Kingdom, where Forex trading is a popular investment choice, choosing the right broker is paramount. In this article, we will explore the top 15 UK Forex brokers in 2023, as ranked by the WikiFX App. We aim to provide you with valuable insights to help you make informed decisions in your trading journey.

In today's volatile financial markets, selecting a reputable Forex broker is crucial. This article aims to shed light on the top 15 Forex brokers in the UK for 2023, as per the WikiFX App rankings. We will delve into their offerings, regulatory compliance, user ratings, and much more to assist you in finding the perfect broker.

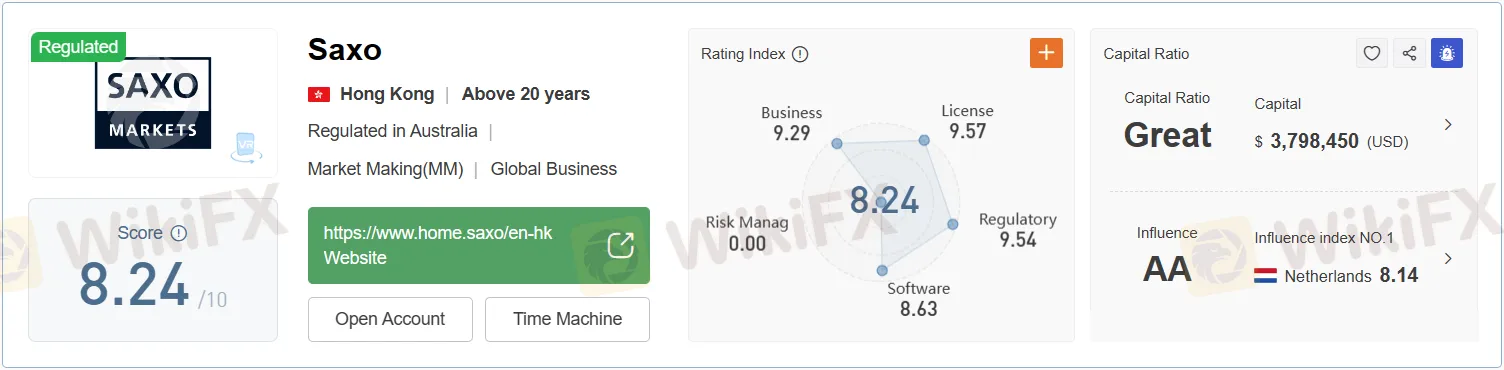

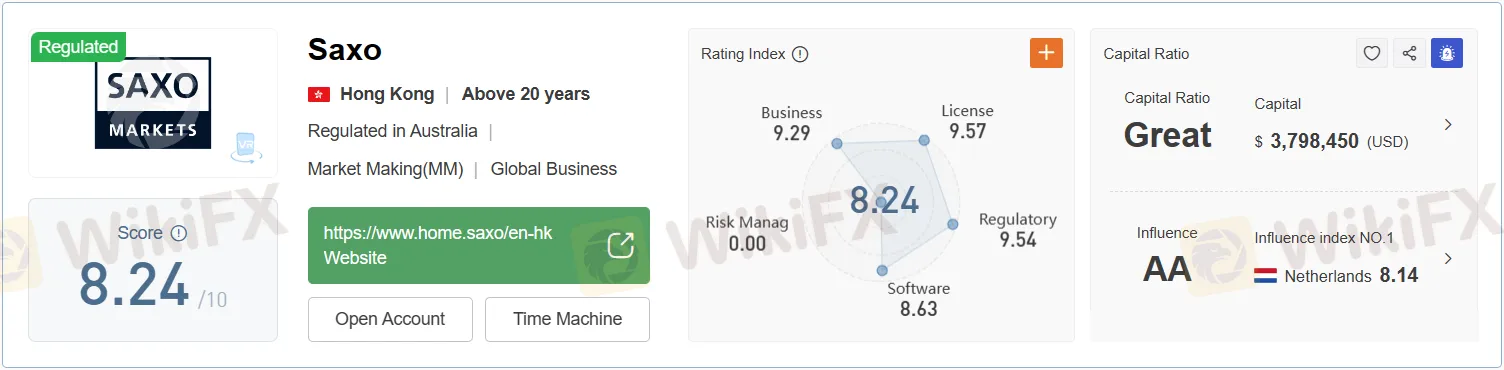

Before we dive into the rankings and detailed descriptions, it's important to understand the criteria that WikiFX App employs to rank these brokers. Factors such as regulatory compliance, trading fees, customer support, and user reviews play a significant role in determining the standings.

List of Top 15 UK Forex Brokers in 2023

Here is a list of the top 15 UK Forex brokers in 2023, according to the WikiFX App ranking:

Forex Brokers Brief Description

Now, let's take a closer look at each of these brokers and their standout qualities:

Ranking Criteria and Analysis

Criteria Explained

Understanding the criteria used by the WikiFX App to rank these brokers is essential. The ranking criteria encompass several key aspects:

Regulatory Compliance: The regulatory body overseeing a broker's operations is a crucial factor in determining its legitimacy and trustworthiness.

Trading Fees and Spreads: Trading costs significantly impact a trader's profitability. Low fees and tight spreads are generally favorable.

Trading Platforms: The quality and diversity of trading platforms offered by a broker can enhance the trading experience.

Suitability for Beginners: For new traders, a broker's educational resources and user-friendly interface are vital.

Regulatory Oversight: Brokers must be regulated by reputable authorities to ensure the safety of clients' funds.

Customer Support: Efficient and responsive customer support is essential, especially during critical trading moments.

Account Types: Brokers that offer a variety of account types cater to a broader range of traders.

Deposit and Withdrawal Options: Flexible deposit and withdrawal options make it convenient for traders to manage their funds.

Financial Security: Ensuring the safety of client funds through segregation and insurance is paramount.

User Ratings: User reviews and ratings provide insights into a broker's reliability and customer satisfaction.

Comparative Analysis

Each broker's performance in these criteria varies. While some excel in providing educational resources, others may stand out for low trading costs or diverse account types. Understanding these differences can help traders make informed decisions based on their individual needs and preferences.

Detailed FAQs

Now, let's address some frequently asked questions related to the top 15 UK Forex brokers in 2023:

1. How do the top 15 UK Forex brokers in 2023 compare in terms of trading fees and spreads?

The trading fees and spreads among the top 15 UK Forex brokers in 2023 vary. Some brokers, like Exness, are known for their tight spreads and low fees, while others, such as CPT Markets, offer zero-commission trading. Traders should carefully evaluate these factors based on their trading style and preferences.

2. What types of trading platforms are offered by the top 15 UK Forex brokers in 2023?

These brokers provide a diverse range of trading platforms to cater to different trader needs. From user-friendly interfaces offered by FOREX.com to advanced tools provided by ActivTrades, there's a platform to suit every trading style and level of expertise.

3. Are the top 15 UK Forex brokers in 2023 suitable for beginners?

Yes, several of these brokers, including FXCM and Trade Nation, are known for their beginner-friendly features, educational resources, and user-friendly interfaces. These qualities make them suitable choices for novice traders.

4. What regulatory bodies oversee the top 15 UK Forex brokers listed by WikiFX App in 2023?

All the brokers listed in the top 15 are regulated by the Financial Conduct Authority (FCA) in the UK. This regulatory oversight ensures that they adhere to strict financial and operational standards.

5. How do the customer support services of the top 15 UK Forex brokers in 2023 compare?

Customer support quality varies among brokers, but brokers like Taurex and OANDA are known for their dedicated and responsive support teams. Efficient customer support is crucial for addressing any issues or queries that traders may have.

6. What account types are available with the top 15 UK Forex brokers in 2023?

These brokers offer a variety of account types, including standard, mini, micro, and more. Each account type caters to different trading preferences, risk levels, and capital sizes, providing flexibility to traders.

7. What are the deposit and withdrawal options for the top 15 UK Forex brokers in 2023?

The brokers offer various deposit and withdrawal methods, including bank transfers, credit/debit cards, e-wallets, and other convenient options. This ensures that clients can manage their funds efficiently and securely.

8. How do the top 15 UK Forex brokers in 2023 ensure the security of client funds?

Brokers prioritize the security of client funds by adhering to stringent regulatory requirements. This includes segregating client funds from company funds and offering insurance to protect against unforeseen events.

9. What are the unique features of each of the top 15 UK Forex brokers in 2023?

Each broker has its unique features, such as Exness' low fees, Spreadex's specialization in financial spread betting and CFDs, and STARTRADER's social trading community. These features cater to specific trading preferences and goals.

10. How have the top 15 UK Forex brokers in 2023 been rated by users?

User ratings and reviews vary, but overall, these brokers tend to receive positive feedback from clients. User reviews often highlight reliability, trustworthiness, and the quality of services offered.

11. What educational resources do the top 15 UK Forex brokers in 2023 provide?

Brokers like FXCM and OANDA offer extensive educational resources, including webinars, articles, video tutorials, and trading courses. These resources empower traders to enhance their skills and knowledge.

12. Have there been any major changes in the ranking of UK Forex brokers in 2023 compared to previous years?

The specific changes in broker rankings may vary from year to year based on broker performance and market dynamics. It's advisable to review the latest rankings for the most accurate information.

13. What trends are observed among the top 15 UK Forex brokers in 2023?

Trends in the Forex industry include the adoption of advanced trading technologies, increased focus on customer education, efforts to reduce trading costs, and sustainability initiatives. Staying updated on these trends can help traders make informed decisions.

User Reviews and Ratings

User reviews and ratings provide valuable insights into the performance and reliability of Forex brokers. While individual experiences may vary, examining common praises and concerns can offer a better understanding of what to expect. The top 15 UK Forex brokers in 2023 generally receive positive feedback for their adherence to regulatory standards, customer service quality, and diverse offerings. However, traders should conduct their due diligence and consider their specific trading needs when choosing a broker.

Trust and Reliability

When evaluating Forex brokers, trust and reliability are paramount. Regulatory oversight by the FCA ensures that these brokers adhere to strict standards and practices, safeguarding the interests of traders. Additionally, user feedback serves as a crucial indicator of a broker's trustworthiness. To establish trust, brokers must consistently deliver on their promises, maintain financial stability, and prioritize customer satisfaction.

Trends and Future Outlook

As we navigate the ever-evolving world of Forex trading, several trends have emerged among the top 15 UK Forex brokers in 2023:

Technological Innovations: Brokers are embracing advanced trading technologies, including AI-driven analytics and algorithmic trading tools, to enhance the trading experience.

Educational Focus: The emphasis on trader education continues to grow, with brokers offering a wide range of resources to empower traders of all skill levels.

Reduced Trading Costs: Brokers are striving to reduce trading costs through tighter spreads and lower fees, making Forex trading more accessible to a broader audience.

Social Trading: Social trading communities, such as STARTRADER, are becoming more prevalent, enabling traders to share insights and strategies.

Sustainability: Some brokers are incorporating sustainable practices into their operations, aligning with broader societal and environmental goals.

The future of Forex trading in the UK appears promising, with these trends shaping the industry's landscape. Traders should stay informed and adapt to these changes to thrive in the dynamic Forex market.

Conclusion

In the world of Forex trading, choosing the right broker is a critical decision that can greatly impact your success. The top 15 UK Forex brokers in 2023, as ranked by the WikiFX App, offer a diverse range of options, catering to traders with varying preferences and objectives.

When selecting a broker, it's essential to consider factors such as regulatory compliance, trading costs, trading platforms, and user reviews.

Remember that the best broker for you depends on your individual needs and trading style. Whether you're a beginner seeking educational resources or an experienced trader looking for advanced tools, there is a broker on this list that can meet your requirements. By conducting thorough research and staying informed about industry trends, you can make an informed choice and embark on a successful Forex trading journey in the UK.