简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

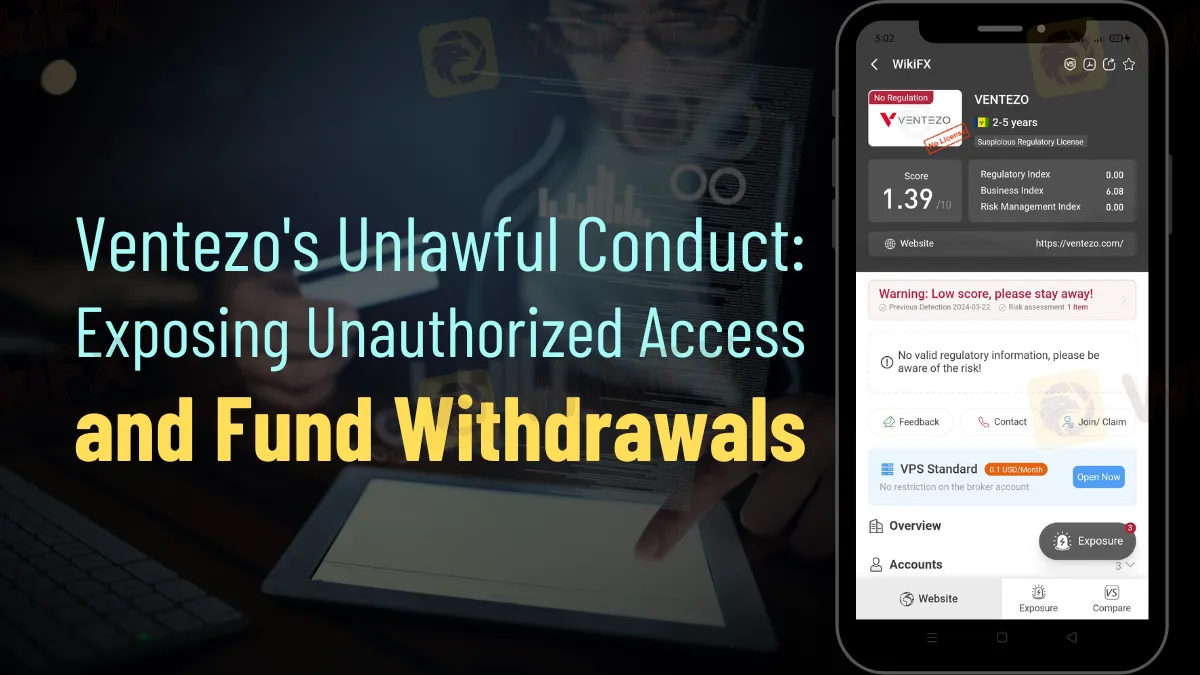

Ventezo's Unlawful Conduct: Exposing Unauthorized Access and Fund Withdrawals

Abstract:Victim exposes Ventezo for unauthorized withdrawal of $851.38, underscoring risks with unregulated brokers in the financial sector.

A Filipino victim has made a shocking disclosure that exposes the questionable activities of Ventezo, a CFD broker that claims to be regulated in Saint Vincent and the Grenadines. This jurisdiction has a poor reputation for regulating trading-related financial activity, including binary options and cryptocurrencies; thus, this assertion is dubious. Potential financial malfeasance and regulatory evasion are an ongoing problem in the industry that becomes apparent from the victim's experience.

The matter in question relates to the unapproved access and withdrawal of cash, namely $851.38, from Ventezo's country manager in the Philippines. On December 6, 2023, the victim got an email notifying them of the completion of a withdrawal—a transaction they had neither approved nor known about until that point—bringing this upsetting episode to light.

Upon the victim's login, it turned out that the withdrawal had occurred against their volition. The unauthorized access and withdrawal of funds constitute a significant breach of trust and demonstrate Ventezo's flagrant disregard for ethical standards and customer security.

Adding to the problem, the victim's brother-in-law was the victim of another fraudulent transaction that included the withdrawal of $637.75, or six hundred thirty-seven US dollars and seventy-five cents. Not only have these acts caused financial damage, but they have also damaged the faith that customers and staff have in financial institutions.

Ventezo ignored and did not say anything when the victim tried to get justice and accountability. After getting vague answers to their questions through the company's chat support, the victim communicated through WhatsApp with Ventezo's owner and CEO, Mr. Ivan Novoselov. They asked for help and an explanation, but unfortunately, they did not get an answer.

To safeguard themselves from unethical activities, investors require stringent regulatory oversight together with solid security measures, as demonstrated in this example. People have doubts about Ventezo's commitment to its client's welfare and the integrity of its business transactions due to its timid and irresponsible management.

The importance of transparency, oversight, and safeguarding consumers in shaping the future of the financial sector is significant. Instances like this highlight the precarious position of consumers and the critical need for regulatory bodies to take prompt action to halt businesses that violate the law and exploit their clients.

Prospective buyers and financiers would do well to take notice of this case since it highlights the importance of conducting thorough research before committing capital to any organization and the risks associated with dealing with brokers who do not possess the necessary licenses. While the plight of the Filipino victim is tragic, it is crucial to recognize that it is indicative of a bigger problem that requires immediate attention if we are to put an end to more instances of exploitation and loss.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Anti-Scam Groups Urge Tougher Action on Fraudsters in UK

Anti-scam groups demand tougher police action on fraudsters as UK fraud rates surge 19%, targeting millions in a penalty-free crime spree exposed by a $35m scam leak.

Philippines Deports 29 Indonesians Linked to Online Scam Syndicate in Manila

Online scam groups in the Philippines trick Filipinos into gambling and love scams, from Manila to Bacolod, causing trafficking and pain as police fight back.

Why does your mood hinder you from getting the maximum return from an investment?

Investment decisions are rarely made in a vacuum. Aside from the objective data and market trends, our emotions—and our overall mood—play a crucial role in shaping our financial outcomes. Whether you’re feeling overconfident after a win or anxious after a loss, these emotional states can skew your decision-making process, ultimately affecting your investment returns.

How Reliable Are AI Forex Trading Signals From Regulated Brokers?

Discover how reliable AI Forex trading signals are and why using a regulated broker boosts their effectiveness. Learn key factors to evaluate accuracy and enhance your trading.

WikiFX Broker

Latest News

How Crypto Trading Transforms FX and CFD Brokerage Industry

UK would not hesitate to retaliate against US tariffs - No 10 sources

FCA Warns Against 10 Unlicensed or Clone Firms

CySEC Warns Against 14 Unlicensed Investment Websites

Top Currency Pairs to Watch for Profit This Week - March 31, 2025

Will natural disasters have an impact on the forex market?

Philippines Deports 29 Indonesians Linked to Online Scam Syndicate in Manila

Navigating the Intersection of Forex Markets, AI Technology, and Fintech

Exposed: Deceptive World of Fake Trading Gurus – Don’t Get Fooled!

AI-Powered Strategies to Improve Profits in Forex Trading

Currency Calculator