简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

【MACRO Insight】Ray Dalio advocates hard assets, the future roles of gold and Bitcoin

Abstract:Billionaire investor Ray Dalio recently expressed concerns about potential “unresolved debt problems” in global finance and suggested that investors turn to hard assets such as gold and Bitcoin. Dalio

Billionaire investor Ray Dalio recently expressed concerns about potential “unresolved debt problems” in global finance and suggested that investors turn to hard assets such as gold and Bitcoin. Dalio, the founder of Bridgewater Associates, one of the world's largest hedge funds, said in a speech at a financial conference in Abu Dhabi that he would invest in “hard currencies” such as gold and Bitcoin while avoiding debt assets.

Dalio pointed out that the debt of all major countries, including the United States, has reached “unprecedented heights” and stressed that the current level will not be sustainable. He believes that it is impossible for these countries not to have a debt crisis in the next few years, which will cause the value of the currency to fall sharply. He reminded investors: “I believe there may be an unresolved debt problem,” and suggested avoiding debt assets such as bonds and holding some hard currencies like gold and Bitcoin.

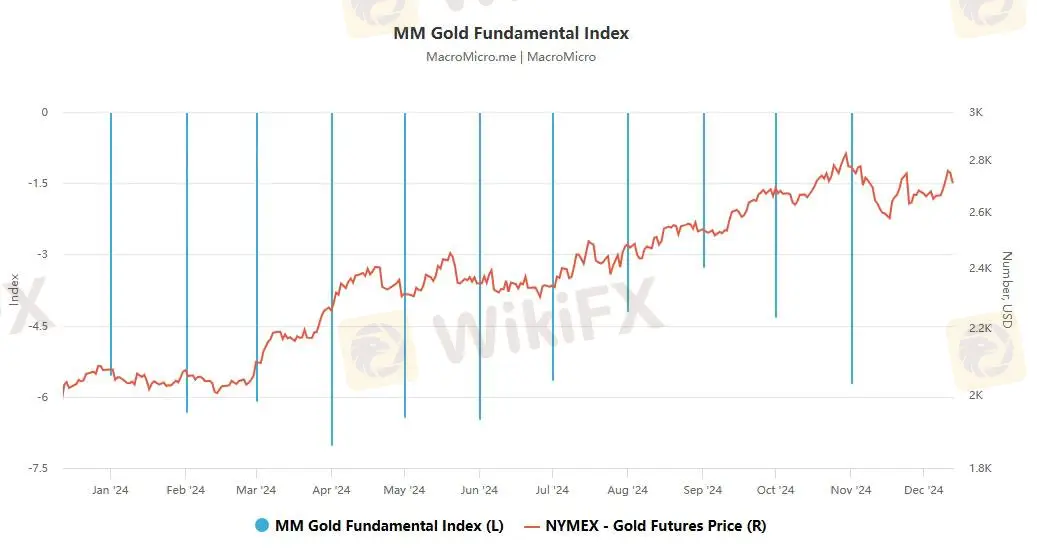

In times of increased economic uncertainty, investors tend to increase their investment in gold to protect assets from currency depreciation. Dalio previously believed that cryptocurrencies like Bitcoin would not be as successful as people hoped, but in recent years he has become a major supporter of Bitcoin and said in 2022 that it is reasonable to allocate 2% of Bitcoin in the portfolio to hedge against inflation.

Meanwhile, research firm Bernstein believes that Bitcoin may eventually replace gold. Gautam Chhugani, an analyst at the company, wrote in a report: “We expect Bitcoin to replace gold in the next decade and become the premier 'store of value' asset in the new era, and become a permanent part of institutional multi-asset allocation and the standard for corporate financial management.” This view echoes the views of Federal Reserve Chairman Powell, who has also compared Bitcoin with gold, claiming that Bitcoin is not a competitor to the US dollar, but a competitor to gold.

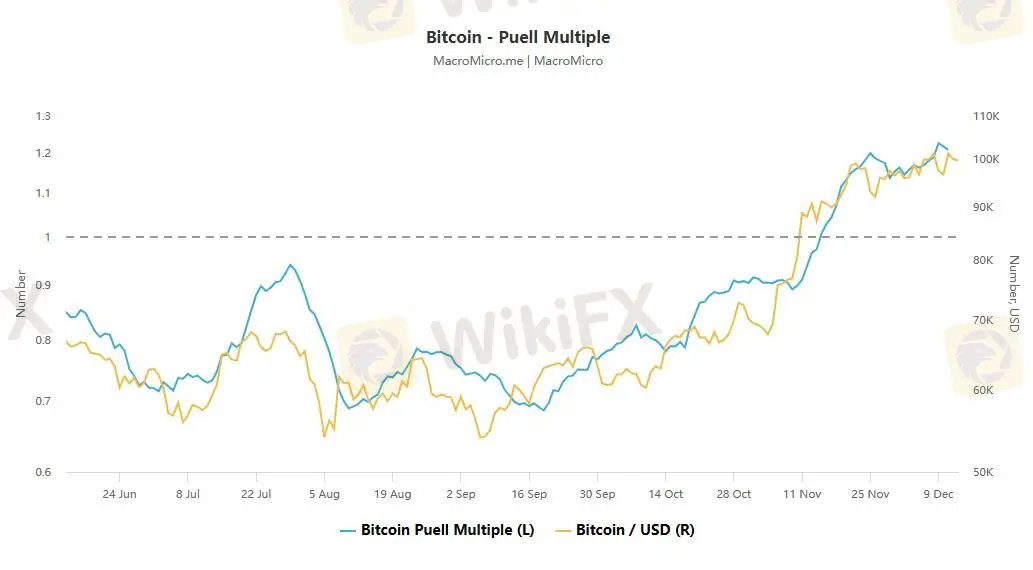

Bernstein‘s forecast comes after Bitcoin hit $100,000 for the first time ever, extending its huge gains through 2024. The world’s largest digital currency is up 141% year-to-date, thanks in large part to bets that the incoming Trump administration will be more friendly to the cryptocurrency industry since the Nov. 5 U.S. election.

Gil Luria, head of technology research at A. Davidson, also believes that Bitcoin's main application is a means of storing value, which can replace gold as a hedge against declining economic stability. Although Bitcoin prices are currently less correlated with inflation and more correlated with other risk assets, Luria believes that Bitcoin is “primarily driven by adoption,” which he believes is “loosely correlated” with market drivers.

After Bitcoin broke through the important psychological level of $100,000, there has been an increasing number of bullish comments. Bernstein expects Bitcoin to reach $200,000 by the end of 2025. Standard Chartered Bank also believes that the price of this cryptocurrency may double by the end of next year. The bank's analyst Geoff Kendrick said in a report on Thursday that its target price of Bitcoin in 2025 is set at around $200,000 is “achievable.”

Kendrick wrote: “We would become more bullish if Bitcoin were to be more quickly adopted by US pension funds, global sovereign wealth funds (SWFs), or potentially the US Strategic Reserve Fund. Through 2025, we expect institutional flows to continue at or above 2024 levels. MicroStrategy is moving forward with its $42 billion three-year plan, so its 2025 purchases should match or exceed 2024 levels.”

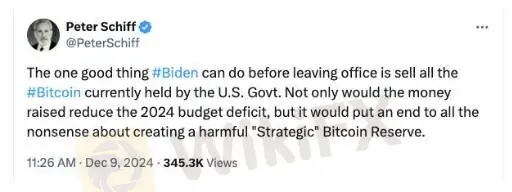

However, not everyone is optimistic about the rise of Bitcoin. Peter Schiff, a gold supporter, urged that the impact of building a Bitcoin reserve on the United States could be “harmful.” Schiff urged the Biden administration to divest its Bitcoin holdings before Trump takes office in 2025. He suggested on social media on December 9 that Biden could do “one good thing” before leaving office, which is to sell all the Bitcoin currently held by the US government. “The funds raised will not only reduce the budget deficit in 2024, but also end all the nonsense about creating a harmful 'strategic' Bitcoin reserve,” Schiff said.

With the rise of Bitcoin and the rising global debt levels, investors and analysts are re-evaluating traditional asset allocation strategies, and more and more people are paying attention to the potential of cryptocurrencies such as Bitcoin as safe-haven assets and inflation hedging tools. At the same time, as a long-standing hard currency, gold's role in the future financial market cannot be ignored, and many investors and analysts remain optimistic about the long-term value and stability of gold. Peter Schiff's views remind us that it is very important to consider the potential risks and returns of different assets in investment decisions.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

Forex Trading: Scam or Real Opportunity?

The Hidden Tactics Brokers Use to Block Your Withdrawals

Beware: Online Share Buying Scam Costs 2,791,780 PHP in Losses

5 things I wish someone could have told me before I chose a forex broker

Unmasking a RM24 Million Forex Scam in Malaysia

U.S., Germany, and Finland Shut Down Garantex Over Money Laundering Allegations

Gold Prices Fluctuate: What Really Determines Their Value?

Dollar Under Fire—Is More Decline Ahead?

What Impact on Investors as Oil Prices Decline?

Is the North Korea's Lazarus Group the Biggest Crypto Hackers or Scapegoats?

Currency Calculator