简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

RCG Markets Review 2025:Is It Safe to Trade with?

Abstract:Enter RCG Markets, a relatively young yet active forex brokers based in South Africa has gained considerable attention among retail investors in recent years. While the broker offers some attractive features - including low minimum deposits, support for MT4 and MT5 platforms, high leverage options, and generous bonuses - these appealing characteristics don't tell the whole story. Despite these enticing offerings, it seems that RCG Markets has failed to earn strong ratings within the industry based on its overall performance and track record.

There is a telling joke in trading circles: “What are the most valuable assets in the market? Retail investors-They get cut down like leeks and grow back right now.” This rings especially true in forex trading, where the promise of quick profits and easy market access continues to draw in wave after wave of retail investors. With so many eager investors putting their money on the line, choosing a safe broker becomes crucial.

Enter RCG Markets, a relatively young yet active forex brokers based in South Africa has gained considerable attention among retail investors in recent years. While the broker offers some attractive features - including low minimum deposits, support for MT4 and MT5 platforms, high leverage options, and generous bonuses - these appealing characteristics don't tell the whole story. Despite these enticing offerings, it seems that RCG Markets has failed to earn strong ratings within the industry based on its overall performance and track record.

Company details are listed as below:

| Broker Name | RCG Markets |

| Founded in | 2018 |

| Regulations | FSCA (Out of operation scope) |

| Min. Deposit | R50 |

| Products | Forex, Indices, Shares, Commodities and Energies |

| Trading Platforms | MetaTrader 4 & 5 |

| Trading Cost | Spreads from 0.1 pips as advertised |

| Leverage | 2000:1 |

| Payment Options | Bank Wire, B2B in Pay, OZOW, Paystack, Skrill, Neteller, Virtual Pay |

| Promotions or Bonus | Yes |

Is RCG Market Legit?

RCG Market Regulation

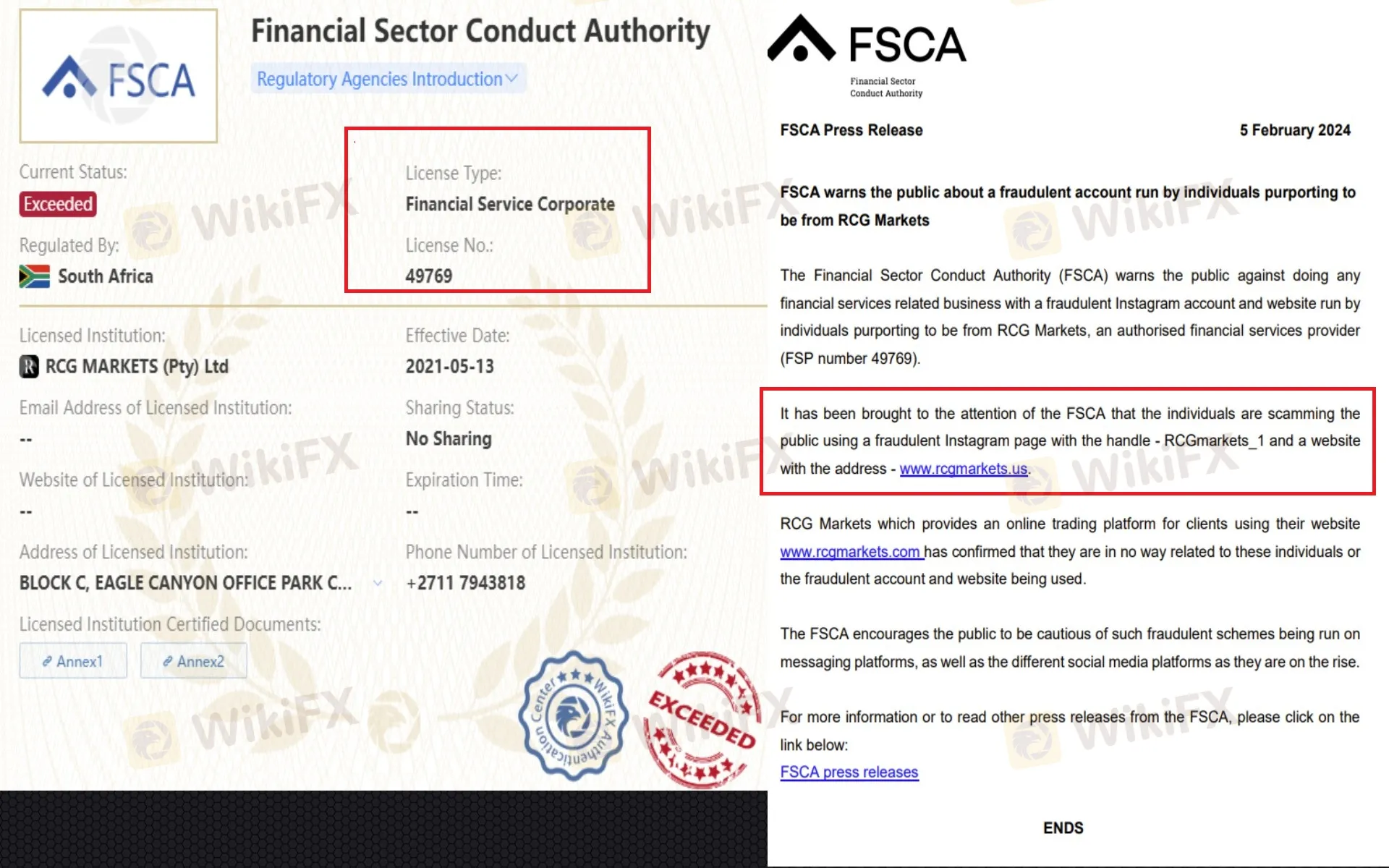

RCG Markets is a trading brand operated by RCG MARKETS (Pty) Ltd, a South Africa-based company that is relatively new to the forex industry. While RCG Markets claims to be fully regulated by the Financial Sector Conduct Authority (FSCA), they only possess a Financial Service Corporate license, which does not cover their forex trading services. And thats why WikiFX has classified them as operating beyond their authorized scope and gave it a very low score of 2.27/10.

Furthermore, the FSCA has issued a warning about RCG Markets' deceptive practices, specifically noting that the broker has used an unauthorized Instagram page and website to mislead potential investors.

These issues paint a clear picture of whats really going on-this broker seems built on a foundation of unethical practice.

WikiFX Field Investigation

WikiFX field survey also revealed some troubling evidence suggesting that this broker may have registered a false address.

On September 14th, 2023, the WikiFX field survey team conducted an on-site investigation at RCG MARKETS' registered address: Block C, Eagle Canyon Office Park, Corner Christiaan De Wet Road, Randpark Ridge, Johannesburg 2154, South Africa. During the visit, no evidence of RCG MARKETS' presence was found at this location. Moreover, when questioned, security guards at the office park stated they had no knowledge of the company operating there.

More details can be find here on WikiFX: RCG Markets Field Investigation

RCG Marekts-Tracking Its Unethical Practices

- RCG Markets was reportedly established in Sanlton, Africa in 2018. However, a Whois search reveals that their domain (rcgmarkets.com) was only registered on March 24th, 2021.

- In 2023, WikiFX flagged RCG Markets as exceeding the limitations of their FSCA license, which suggests the broker have been engaging in unauthorized activities.

- A WikiFX field survey conducted on September 14th, 2023, confirmed that the registered address for RCG Markets was fake. This further undermines trust in the company.

- On February 5th, 2024, the FSCA (Financial Sector Conduct Authority) issued a risk warning for RCG Markets. The warning cited the use of fraudulent websites and social media (Instagram) to mislead investors.

- Later on September 14th 2023, WikiFX field survey team paid a visit to its registered address and confirmed that it was a fake one.

- In 5th February 2024 , FSCA issued a risk warning for RCG Markets s involving using fraudulent website and Instagram to misled investors.

RCG Markets Minimum Deposit

RCG Markets asks for the minimum deposit of R50 to open a real trading account, approximately equal to USD$2.8 or GPB 2.2. Honestly, this requirement is incredibly low, which sounds very inspiring for traders, especially beginners, to have a try on this platform.

However, the reality is that many forex brokers, especially those who operate under loose regulation, have a low entry threshold, primarily to attract more traders without adequately considering the potential risks these traders may face later.

Compare with popular South African brokers like FP Markets, Exness, and FXTM, we may find out RCG Markets, though asks for the lowest account minimum, is not that safe to trade with based on its worrying regulatory status and extremely high leverage.

RCG Markets Login

RCG Markets offers the option to open a real account, or a demo account. Of course, we advise that new beginners should always choose the demo one first to minimize risks associated with their freshness and this brokers temptation.

Overall, opening a demo account on the RCG Markets is not complex, similar to many other platforms. Simply provide your personal information and select your preferred trading platform (MT4 or MT5) and base currency (USD, ZAR, or GBP). Please note that only one type of demo account is on offer: RCG Demo Classic.

RCG Markets offers a total of 6 real account options, all starting from R50, a moderately low amount. Three of the accounts are conducted on MetaTrader 4 platform, while the other three are conducted on the Metatrader 5 trading platforms.

To open a real account, your personal data, phone number, and email address are needed. You will typically need to verify your identity by uploading clear copies of your identification documents (e.g., passport, driver's license) and proof of residence. Once registered successfully, login will be simple, entering your username and password in the provided fields to access your trading account.

RCG Markets Review on Products

RCG Markets provide access to markets including forex (over 70 currency pairs), indices, shares (no real shares) , commodities and energies. Overall, this broker offers some popular and mainstream products, though not in good variety.

Notably, this broker provides sky- high leverage up to 2000:1 to encourage those who start small. Though it is appealing, it can be risky for investors involved in online trading. Many forex brokers operating under loose regulatory frameworks deliberately offer extremely high leverage to entice investors, showing little concern for their potential losses.

| Products | Offered |

| Currencies | √ |

| Indices | √ |

| Shares | √ |

| Commodities | √ |

| Energies | √ |

| Cryptocurrencies | × |

| Futures | × |

| ETFs | × |

Asides from regular products offered, RCG Markets also provides prop firm trading to invite skilled traders to make investments. Successful traders can expect to share profits with the firm on a favorable 85/15 basis, with 85% of the profits accruing to the trader, a generous offer.

RCG Markets Review on Fees

Trading fees (spreads and commissions)

RCG Markets employ a zero-commission model for most of its accounts except the RCG ECN. And spreads, as advised, are not wide. Specifically, The Classic and Zero Cent accounts charge a fixed 1 pip spread with no commission. The RAW and ECN accounts feature zero spread, though the ECN account includes a $7 commission per trade. The ROYAL 100 and Imperial Bonus 200 accounts maintain a 1 pip spread without additional commissions, while offering bonus incentives of 100% and 200% respectively.

However, this fee information on its website is largely playing the role of promotion, and this broker is so astute that it does not tell the specifical spread and trading costs for all the available instruments.

Besides, we have found that the liquidity provider of RCG Markets is RocketX, a decentralized exchange aggregator, which does not have its own order book or liquidity pool

Fees on deposits and withdrawal

RCG Markets claims that it does not levy any fees on deposits or withdrawals. While the payment page outlines several common funding and withdrawal methods, it lacks a clear indication of associated fees. This is atypical compared to the practices of many big players in the industry.

This tactic, omitting or minimizing fee disclosure, is frequently observed among forex brokers operating in poorly regulated or unregulated markets. Their primary objective is to attract new clients who are price-sensitive by downplaying the cost implications of their services. This lack of transparency may be intentional, enabling the broker to capitalize on hidden charges.

Other Fees Involved

Also, this broker's silence on key fees - like inactivity charges, account opening costs, and currency conversions - makes it hard for traders to understand their true trading costs.

Review on RCG Markets Withdrawals

The withdrawal issue matters for you to measure whether a forex broker is safe or not, as reliable withdrawals minimize the risk of your funds being trapped within the broker's system. Conversely, a broker that makes it difficult to withdraw funds may be hiding something, such as financial instability or fraudulent activities.

On the “Deposit & Withdrawal” page, RCG Markets only list its deposit and withdrawal methods, and does not specify withdrawal details like fees associated and speed. In some cases, the lack of clear information about withdrawal fees could be a red flag.

What‘s worse, negative reviews on RCG Markets’ withdrawals are easily collected on some famous review platforms. These reports suggest a concerning pattern where the broker appears to systematically prevent customers from withdrawing their funds through various means - whether technical barriers, false approvals followed by cancellations, or outright rejections. Overall, these cases point to a common theme of withdrawal obstacles and a lack of transparency and reality from this broker.

RCG Markets Review on Platforms

RCG Markets says it employs both MetaTrader 4 (desktop and mobile versions) and MetaTrader 5 (WebTrader, Desktop and Mobile versions) equipped with charting tools, automated strategies, and real-time market analysis.

RCG Markets Web Platform

RCG Markets' web-based MT5 platform provides convenient market access without software installation. While offering fewer advanced features than its desktop counterpart, the intuitive interface is ideal for traders prioritizing simplicity and accessibility.

RCG Markets Desktop Platforms

MT4 stands out with its robust feature set, including real-time copy trading signals, VPS hosting for automated trading, and over 3,200 trading signals. The platform comes equipped with 30 built-in indicators and 24 analytical tools for thorough market analysis.

MT5 takes functionality further with 38 indicators, 44 graphical objects, and extensive timeframe options across 21 intervals. Its unlimited charting capabilities and minute-by-minute price tracking make it suitable for both novice and experienced traders.

RCG Markets Mobile Platforms

RCG Markets' MT5 mobile app keeps traders connected on the go, combining essential trading tools with advanced technical analysis features. The platform's robust functionality and intuitive interface make it ideal for traders who need professional-grade performance in a mobile package.

Overall, While RCG Markets performs well in offering both MT4 and MT5, its score could be further enhanced by including beginner-friendly platforms such as cTrader and TradingView.

| Platforms | Offered |

| MetaTrader 4 | Yes |

| MetaTrader 5 | Yes |

| MetaTrader 4 Web | No |

| MetaTrader 5 Web | Yes |

| MetaTrader 4 Mobile App | Yes |

| MetaTrader 5 Mobile App | Yes |

| cTrader | No |

| Tradingview | No |

RCG Markets Customer Support

RCG Markets says it offers 12/6 customer support yet primarily through phone, whatsapp, emails and a support ticket system, no online chat provided. Phone calls and emails often have slower response times and lack the real-time interactivity and immediate feedback that online chat provides. Additionally, phone calls and emails can be less convenient for sharing multimedia content like images, videos, and files, which are easily shared within most online chat interfaces.

Conclusion

Overall, RCG Markets seems not to be an ideal option for investors- sketchy regulation and a concerning lack of real trading data don't inspire confidence. Furthermore, it is equipped with some “elaborate” tactics targeting potential investors. Online trading involves much risks, choosing a reliable one is not easy, and that's where WikiFX comes in handy - with its database of close to 60,000 brokers, you can quickly verify a broker's regulatory status and track record with just a few clicks.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

TradingView Brings Live Market Charts to Telegram Users with New Mini App

Trump tariffs: How will India navigate a world on the brink of a trade war?

Interactive Brokers Launches Forecast Contracts in Canada for Market Predictions

Authorities Alert: MAS Impersonation Scam Hits Singapore

Stocks fall again as Trump tariff jitters continue

INFINOX Partners with Acelerador Racing for Porsche Cup Brazil 2025

Regulatory Failures Lead to $150,000 Fine for Thurston Springer

April Forex Trends: EUR/USD, GBP/USD, USD/JPY, AUD/USD, USD/CAD Insights

March Oil Production Declines: How Is the Market Reacting?

Georgia Man Charged in Danbury Kidnapping and Crypto Extortion Plot

Currency Calculator