简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

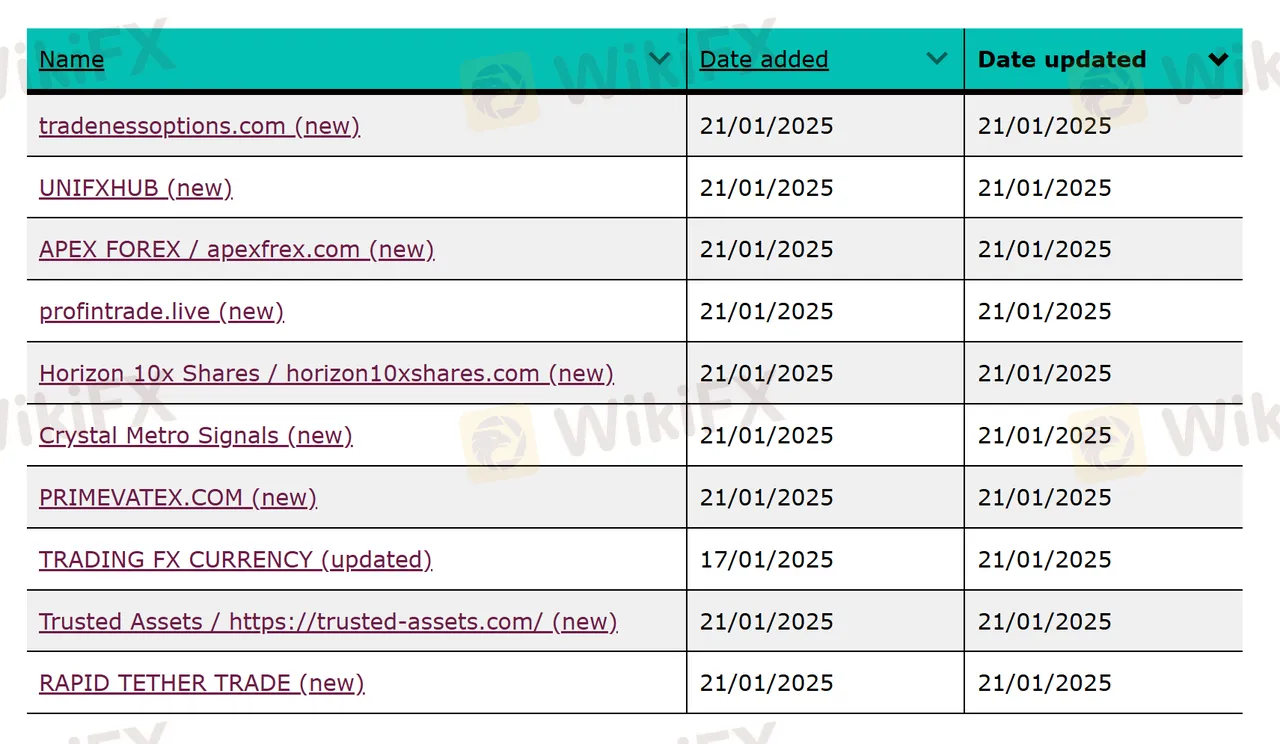

FCA Warning List: 10 New Unregulated Forex Brokers Added

Abstract:On 21 January, 2025, the Financial Conduct Authority (FCA), the UK's primary financial regulator, expanded its warning list to include 10 additional unlicensed forex brokers that operate outside of the FCA regulation. The FCA warning lists, updated on a daily basis, remain an important tool intended not only to protect consumers but also to alert the financial services industry. When an FCA warning emerges, it signals red flags like unsolicited investment pitches, promises of unrealistic returns, or pressure tactics. The addition of these 10 new entities comes amid growing concerns over the rise of unauthorized online forex brokers, particularly those operating through overly complex online interfaces yet riddled with bugs and aggressive social media marketing campaigns. Let's catch a glimpse of those on the list.

On 21 January, 2025, the Financial Conduct Authority (FCA), the UK's primary financial regulator, expanded its warning list to include 10 additional unlicensed forex brokers that operate outside of the FCA regulation. The FCA warning lists, updated on a daily basis, remain an important tool intended not only to protect consumers but also to alert the financial services industry. When an FCA warning emerges, it signals red flags like unsolicited investment pitches, promises of unrealistic returns, or pressure tactics.

The addition of these 10 new entities comes amid growing concerns over the rise of unauthorized online forex brokers, particularly those operating through overly complex online interfaces yet riddled with bugs and aggressive social media marketing campaigns. Let's catch a glimpse of those on the list.

Details of 10 New Unregulated Forex Brokers Issued

No.1 Tradeness Options

| Broker | Tradeness Options |

| Logo |  |

| Founded in | 2024 |

| Registered in | St.Vincent and the Grenadines |

| Services Offered | Investment ConsultancyForex Investment, Cryptocurrency Trading |

| Min.Deposit | N/A |

| Trading Platform | N/A |

| Website | https://www.tradenessoptions.com/ |

| support@tradenessoptions.com | |

| Address | Tradness Options Company reg 22747 IBC 2015 with registered address Suite 305, Griffith Corporate Centre, P.O. Box 1510, Beachmont Kingstown, St. Vincent and the Grenadines. |

No.2 UNIFXHUB

| Broker | UNIFXHUB |

| Logo |  |

| Founded in | 2024 |

| Registered in | St.Vincent and the Grenadines |

| Services Offered | Investment ConsultancyForex Investment, Cryptocurrency Trading |

| Min.Deposit | N/A |

| Trading Platform | N/A |

| Website | https://www.unifxhub.com/ |

| info@unifxhub.com | |

| Address | Company reg Unifxhub 22747 IBC 2015 with registered address Suite 305, Griffith Corporate Centre, P. O. Box 1510, Beachmont Kingstown, St. Vincent and the Grenadines. |

No.3 APEX FOREX

| Broker | APEX FOREX |

| Logo |  |

| Founded in | 2024 |

| Registered in | St.Vincent and the Grenadines |

| Services Offered | Investment ConsultancyForex Investment, Cryptocurrency Trading |

| Min.Deposit | N/A |

| Trading Platform | N/A |

| Website | www.apexfrex.com |

| support@swiftedgefx.com | |

| Address | Apex Forex Company reg 22747 IBC 2015 with registered address Suite 305, Griffith Corporate Centre, P.O. Box 1510, Beachmont Kingstown, St. Vincent and the Grenadines. |

No.4 profintrade.live

| Broker | profintrade.live |

| Logo |  |

| Founded in | 2024 |

| Registered in | St.Vincent and the Grenadines |

| Services Offered | Investment ConsultancyForex Investment, Cryptocurrency Trading |

| Min.Deposit | N/A |

| Trading Platform | N/A |

| Website | www.profintrade.live |

| support@profintrade.live | |

| Address | Pro Fin Trade Company reg 22747 IBC 2015 with registered address Suite 305, Griffith Corporate Centre, P.O. Box 1510, Beachmont Kingstown, St. Vincent and the Grenadines. |

No.5 Horizon 10x Shares

| Broker | Horizon 10x Shares |

| Logo |  |

| Founded in | 2024 |

| Registered in | St.Vincent and the Grenadines |

| Services Offered | Investment ConsultancyForex Investment, Cryptocurrency Trading |

| Min.Deposit | N/A |

| Trading Platform | N/A |

| Website | https://horizon10xshares.com/ |

| support@horizon10xshares.com | |

| Address | Horizon-10x Shares Company reg 22747 IBC 2015 with registered address Suite 305, Griffith Corporate Centre, P.O. Box 1510, Beachmont Kingstown, St. Vincent and the Grenadines. |

No.6 Crystal Metro Signals

| Broker | Crystal Metro Signals |

| Logo |  |

| Founded in | 2024 |

| Registered in | St.Vincent and the Grenadines |

| Services Offered | Investment ConsultancyForex Investment, Cryptocurrency Trading |

| Min.Deposit | N/A |

| Trading Platform | N/A |

| Website | www.crystalmetrosignals.online |

| support@crystalmetrosignals.online | |

| Address | Crystalmetrosignals Company reg 22747 IBC 2015 with registered address Suite 305, Griffith Corporate Centre, P.O. Box 1510, Beachmont Kingstown, St. Vincent and the Grenadines. |

No.7 PRIMEVATEX.COM

| Broker | PRIMEVATEX.COM |

| Logo |  |

| Founded in | 2024 |

| Registered in | UK |

| Services Offered | Crypto-based assets, Forex |

| Min.Deposit | $50 |

| Trading Platform | N/A |

| Website | www.primevatex.com |

| admin@primevatex.com | |

| Address | The Stable Yard Vicarage Road, Stony Stratford, Milton Keynes, Buckinghamshire, England, MK11 1BN. |

No.8 TRADING FX CURRENCY

| Broker | TRADING FX CURRENCY |

| Logo |  |

| Founded in | 2024 |

| Registered in | UK |

| Services Offered | Forex, Shares, Soft Commodity, Indices |

| Min.Deposit | N/A |

| Trading Platform | MT4, MT5 |

| Website | www.tradingfxcurrency.com |

| support@tradingfxcurrency.com | |

| Address | UK:Tradingfxcurrency UK Ltd, city of London, UNITED KINGDOM, EC2V 5BQUS: Tradingfxcurrency 16020, W BLUEMOUND ROAD FOUNTAIN SQUARE PLAZA, BROOKFIELD, UNITED STATES OF AMERICA, WI 53005 |

No. 9 Trusted Assets

| Broker | Trusted Assets |

| Logo |  |

| Founded in | 2024 |

| Registered in | UK |

| Services Offered | Cryptocurrency |

| Min.Deposit | £10,000 |

| Trading Platform | N/A |

| Website | https://trusted-assets.com |

| Phone | 02030317662 |

| support@trusted-assets.com | |

| Address | UK: 20 St Dunstan's Hill, London, EC3R 8HLShibuya City, Jingumae, 1 Chome−5−8, Jingumae Tower BldgAustralia: Civic Tower, 66 Goulburn St, Sydney, NSW, 2000 |

No.10 RAPID TETHER TRADE

| Broker | RAPID TETHER TRADE |

| Logo |  |

| Founded in | 2024 |

| Registered in | Canada |

| Services Offered | Crypto Trading, Investment Solution |

| Min.Deposit | $100 |

| Trading Platform | N/A |

| Website | https://rapidtethertrade.com/ |

| Phone | 447497489965 |

| support@rapidtethertrade.com | |

| Address | 24040 Camino Del Avion, Suite E324, Monarch Beach, CA 92629 |

10 New Unlicensed Forex brokers Added to Reveal -Similarities Shared

Born in Shady Areas-Registered in St.Vincent and the Grendines

10 new unlicensed forex brokers, most of them with entities registered in Saint Vincent and the Grendines, a shady place with booming unregulated brokers. Compared to some stricter jurisdictions, this offshore area features a more lenient regulatory environment for forex trading, coupled with its cheaper operating costs, tax advantages, all making it a treasure home to new forex brokers who start their defrauding career.

That said, the registration region, generally sets regulated brokers apart from vast unlicensed ones. Scam brokers within this area frequently pretend to be legit ones to confuse traders, boasting they are regulated too. Compared with these unlicensed ones, most regulated brokers tend to born in strict jurisdictions like Australia (ASIC), UK (FCA), US (SEC) and they provide much higher level of safety. For most investors, especially retail investors, these regulated brokers should be the first choice when trading online.

“Elobrate” Website-Riddled with Bugs

Another similarity of these forex brokers share lie in their “elaborate” webpages. These websites promote that they provides diverfised services, including Forex Trading, Cryptocurrency Investments, Stock & Commodity investments, Real Estate Investment & Development.

Upon visiting these suspicious platforms, you'll find no essential trading information like software options, account types, or fee structures. Instead, the sites bombard visitors with pop-up notifications of supposed withdrawals and profits. This deceptive tactic aims to create FOMO (fear of missing out) and pressure potential victims into depositing funds, revealing the platform's true fraudulent nature.

Unrelistic Returns-Too Much Promotional Content

Scam brokers' websites often display manipulative pop-ups showing supposed withdrawals: “Someone from the US just withdrew $2,000,” “New withdrawal from Germany: $14,000,” etc. They use persuasive buzzwords like “Guaranteed ROI,” “Instant Withdrawals,” and “Fast & Secure” to lure victims. Remember, anyone promising guaranteed returns or unreliability in online trading is hiding their real colours. Because they know full well that they are a hoax, all they want to do is take advantage of you by promising you impossible results.

Social Media Scams-Spreading False Promises

Unlicensed forex brokers are becoming more adept at using social media to find unsuspecting customers. Sites like Google and Bing display their ads when people type in phrases like “secure investments” or “fast returns.” The brokers do not possess the necessary licenses to offer the advertised services, so the ads are intentionally deceptive. Even though they only pay a small amount to social media sites for ads, they have the ability to fool investors into giving them a large amount of money by making themselves look credible in search results.

Limited Contact Channel- Never Get Responded

A basic email address is all they supply. Yes. Over time, you come to realise that contacting them is absolutely impossible. In reality, they are able to function more covertly and postpone or disregard customer issues when they communicate by email. Remember that the only time you were greeted with enthusiasm and politeness was when you decided to invest. They will vanish at a later date, and the email they gave you will no longer work to contact them. The major objective of unlicensed brokers is to successfully scam you and then disappear, hence they regularly use this strategy. They will never again pretend after they have accomplished their mission.

How to Protect Yourself?

Protecting yourself from unauthorized brokers requires diligent research and proactive verification. The first critical step is checking the broker's legitimacy through official regulatory registers, with the FCA register being the primary resource for UK-based financial firms.

To verify a broker's credentials, visit the FCA's official website and use their “Financial Services Register” search function. Input the broker's name to confirm their authorized status, checking for their precise regulatory permissions and company details. A legitimate FCA regulated forex broker will have a clear, verifiable presence on this register. Let take the broker, IG (a 100% fca regulated forex broker in the industry) for example:

When you put the name of an unlicensed or unauthorized forex broker into the search bar, the outcome will be: this broker is not authorized to give you a risk warning. Here, let's take the UK-registered broker, Trading Currency, for example:

Another important thing is to watch for key warning signs that might indicate an unauthorized or potentially fraudulent broker: unrealistic investment offers, promises of guaranteed high returns, instant withdrawals, extremely high minimum deposit requirements, fast and secure funding, guaranteed ROIs, lack of transparent contact information, and absence of clear regulatory documentation. When encountering these warning signs, it suggests that you are facing scammers and extra vigilance should be taken.

For international broker verification, some useful resources like the Financial Action Task Force (FATF) lists, ESMA's (European Securities and Markets Authority) investment firm database, and specific country regulators such as the SEC in the United States, ASIC in Australia, and CySEC in Cyprus. Cross-referencing multiple regulatory databases provides comprehensive protection against unauthorized trading platforms. Compared with your hard work on it, WikiFX ( with the database of over 60,000 brokers listed) has made this job much easier where you can just input the broker name into the search bar, a clear result will show up to tell regulated forex brokers from unregulated ones.

What to Do If being Scammed?

If you've been defrauded by an unregulated broker or purely scam brokers, you can take immediate and strategic action as below:

First, gather any and all records of your dealings, such as invoices, correspondence, and transactions, to help prove your identity. Halt ongoing transactions and explore chargeback alternatives with your bank regarding fraudulent payments. In case of a possible investigation by regulators or courts, save all evidence carefully.

Secondly, contact the Financial Conduct Authority (FCA) directly using any of these methods: consumer.queries@fca.org.uk, their consumer hotline at 0800 111 6768, or their dedicated online reporting form at www.fca.org.uk/consumers/report-scam-unauthorized-firm. Give detailed information regarding the broker, the transactions, and any correspondence that may indicate fraudulent behaviour.

For comprehensive assistance, contact Action Fraud (the UK's national fraud reporting center) at 0300 123 2040 or through their online reporting tool. Additionally, seek legal advice from financial dispute resolution services like the Financial Ombudsman Service, which can help investigate and potentially recover funds from unauthorized financial entities.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Interactive Brokers Expands Crypto Trading with Solana, XRP, Cardano, and Dogecoin

Interactive Brokers adds Solana, XRP, Cardano, and Dogecoin to its platform, enabling U.S. and U.K. clients to trade crypto 24/7 with low fees.

Fidelity Investments Explores Stablecoin Innovation in Digital Assets Sector

Fidelity Investments tests a stablecoin, joining major financial firms in the booming crypto sector. Discover how this impacts digital payments and blockchain adoption.

Hantec Markets Launches InsightPro: AI-Powered Real-Time Trading Signal Tool for Traders

Hantec Markets introduces InsightPro, an AI-powered trading tool offering real-time market insights, signals, and analysis for better trading success.

Broker Comparison: FXTM vs XM

Choosing the right broker is a critical decision for traders. This article compares FXTM and XM based on basic information, regulatory status, leverage, trading platforms, account types, spreads and commissions, customer service, AI tools, and recent updates. We aim to present an unbiased overview so that you can choose the best broker suited to your needs.

WikiFX Broker

Latest News

How Crypto Trading Transforms FX and CFD Brokerage Industry

FCA Warns Against 10 Unlicensed or Clone Firms

CySEC Warns Against 14 Unlicensed Investment Websites

Top Currency Pairs to Watch for Profit This Week - March 31, 2025

Will natural disasters have an impact on the forex market?

Philippines Deports 29 Indonesians Linked to Online Scam Syndicate in Manila

Exposed: Deceptive World of Fake Trading Gurus – Don’t Get Fooled!

AI-Powered Strategies to Improve Profits in Forex Trading

Stock Market Trading Volume Drops by 97.58 Billion Naira This Month

Why does your mood hinder you from getting the maximum return from an investment?

Currency Calculator