简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

How to Start Trading with Vantage: Account Types, Demo Account, and Withdrawal

Abstract:Vantage is an online forex broker that offers trading services for individuals and institutions around the world. The company was founded in 2009 and is headquartered in Australia, with additional offices in the United Kingdom, the Cayman Islands, and China. Vantage provides a variety of trading instruments, including 1,000+ CFDs on forex, indices, precious metals, soft commodities, energy, ETFs, share CFDs, and bonds, and offers multiple trading platforms, such as MetaTrader 4 and MetaTrader 5. Besides, the broker also provides rich and solid educational resources.

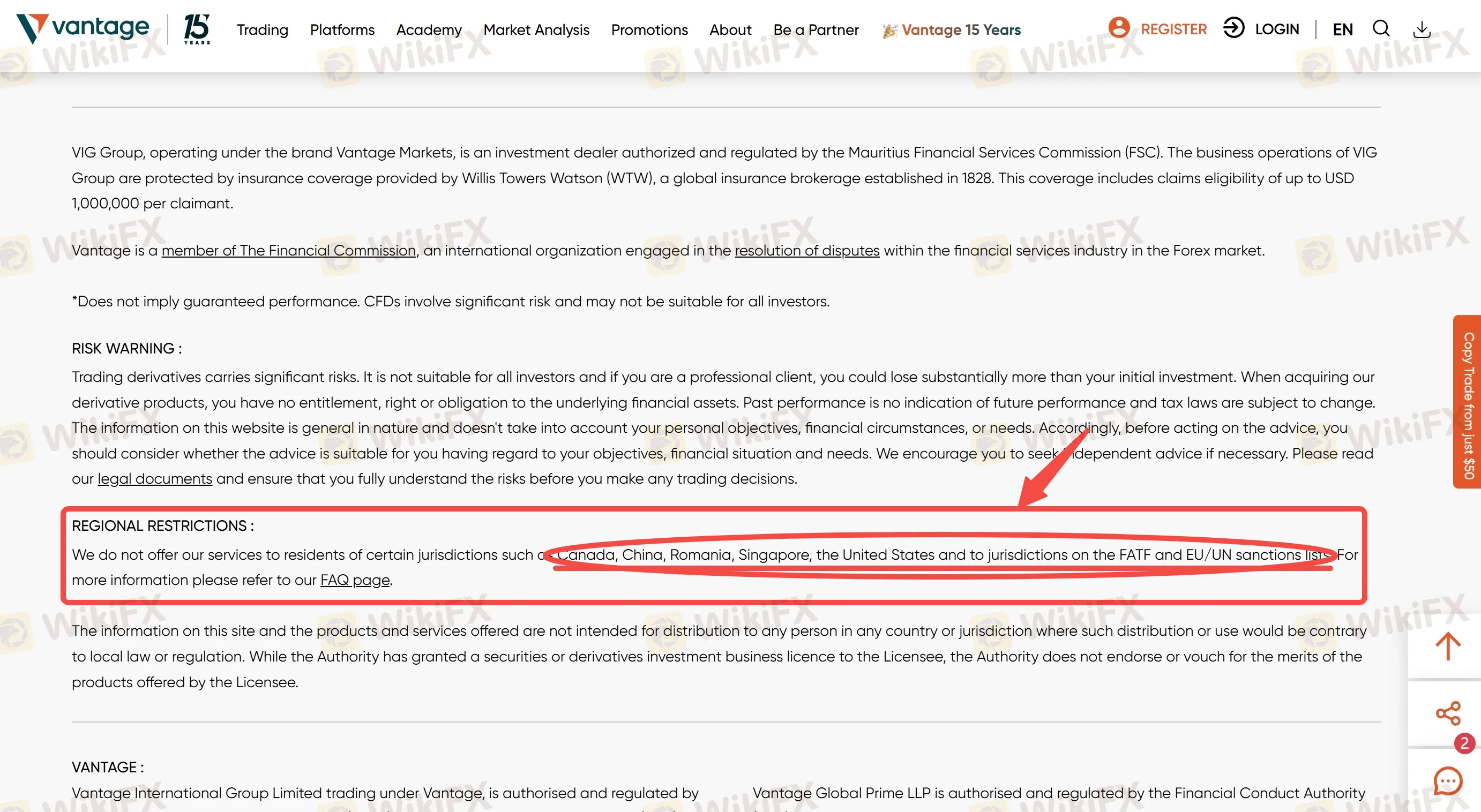

Note: Vantage does not offer service to residents of certain jurisdictions such as Canada, China, Romania, Singapore, the United States and jurisdictions on the FATF and EU/UN sanctions lists.

Vantage Review at a Glance

| Vantage at a Glance |

| Founded | 2009 |

| Registered | Australia |

| Regulation | ASIC, FCA, CIMA/VFSC (Offshore), FSCA (General Registration) |

| Vantage Markets | 1,000+ CFDs on forex, indices, precious metals, soft commodities, energy, ETFs, share CFDs, bonds |

| Demo Account | ✅ |

| Account Type | Pro ECN, Raw ECN, Standard, Cent, Premium, Swap free |

| Account Minimum | $50 |

| Maximum Leverage | 1:500 |

| Trading Costs | From 1.1 pips & commission-free (Standard account) |

| Trading Platforms | Vantage App, MT4/MT5, TradingView, ProTrader |

| Copy Trading | ✅ |

| Payment Methods | Visa, MasterCard, Apple Pay, Google Pay, PayPal, Neteller, Skrill, Fasapay, Perfect Money, JCB, bit wallet, Sticpay, India UPI, Bank Transfer, International ETF, Domestic Fast Transfer (Australia Only), Astropay, Broker-to-Broker Transfer |

| Deposit & Withdrawal Fee | Free for most |

Vantage is an online forex broker that offers trading services for individuals and institutions around the world. The company was founded in 2009 and is headquartered in Australia, with additional offices in the United Kingdom, the Cayman Islands, and China. Vantage provides a variety of trading instruments, including 1,000+ CFDs on forex, indices, precious metals, soft commodities, energy, ETFs, share CFDs, and bonds, and offers multiple trading platforms, such as MetaTrader 4 and MetaTrader 5. Besides, the broker also provides rich and solid educational resources.

Is Vantage Safe and Legit?

Yes. Vantage is a legitimate broker with over 15 years of market experience. Vantage clients' funds are held in a segregated account with a top-tier bank. Vantage also offers indemnity insurance and negative balance protection.

More importantly, Vantage is currently regulated by five regulatory authorities in five countries, including:

- Australia Securities & Investment Commission (ASIC)

- Financial Conduct Authority (FCA) in the United Kingdom

- Cayman Islands Monetary Authority (CIMA) in the Cayman Islands

- Financial Sector Conduct Authority (FSCA) in South Africa

- Vanuatu Financial Services Commission (VFSC)

You can verify Vantage's regulatory status and explore more details on WikiFX.

| Regulated Country | Regulated by | Current Status | Regulated Entity | License Type | License No. |

| ASIC | Regulated | VANTAGE GLOBAL PRIME PTY LTD | Market Making (MM) | 000428901 |

| FCA | Regulated | Vantage Global Prime LLP | Straight Through Processing (STP) | 590299 |

| CIMA | Offshore Regulated | Vantage International Group Limited | Straight Through Processing (STP) | 1383491 |

| FSCA | General Registration | VANTAGE MARKETS (PTY) LTD | Financial Service Corporate | 51268 |

| VFSC | Offshore regulated | Vantage Global Limited | Retail Forex License | 700271 |

Vantage Account

Demo Account

Like most brokers, Vantage also offers free demo accounts, which allow you to trade in a risk-free environment with virtual funds up to $100k.

There is no expiry date and you can have two demo account types, demo Standard STP and demo Raw ECN.

| Vantage Demo Account Feature | |

| Trading Platform | MetaTrader 4/5 |

| Account Opening Fee | ❌ |

| Account Type | Standard STP, Raw ECN |

| Account Currency | USD, GBP, CAD, AUD, EUR, SGD, NZD, JPY, HKD |

| Leverage | 100:1, 200:1, 300:1, 400:1, 500:1 |

| Account Balance | $1,000, $2,500, $5k, $10k, $25k, $50k, $100k |

| Account Duration | No limit |

Note: You cannot withdraw your profits from your demo accounts because they are virtual funds, not real money. Demo accounts are only for testing, not for making money.

Account Types

Vantage offers multiple live account types, including Raw ECN, Standard STP, Pro ECN, and Cent accounts.

Each account type has its unique features, so the best trading account varies from one individual to another, as it depends on your personal needs and goals as a trader.

Specifically, if you are a beginner, the Standard STP account and Cent account may be your suitable choice. Both account types have a minimum deposit requirement of only $50. If you have some trading experience, you can choose the Raw ECN or Pro ECN account.

There are no charges for opening any of the trading accounts.

The available currencies include AUD, USD, GBP, EUR, SGD, CAD, NZD, JPY, HKD, and PLN.

Check the following Vantage trading account comparison table to find the similarities and differences:

| Vantage Trading Account Comparison | ||||

| Account Type | Raw ECN | Standard STP | Pro ECN | Cent |

| Suitable for | Experienced traders | Novice traders | Professional traders | Any level |

| Minimum Deposit | $50 | $50 | $10,000 | $50 |

| Accepted Currencies | AUD, USD, GBP, EUR, SGD, CAD, NZD, JPY, HKD, PLN | |||

| Spread | From 0.0 pips | From 1.1 pips | From 0.0 pips | |

| Commission | From $3.00 per lot per side | ❌ | From $1.50 per lot per side | From $0 - $3.00 per lot per side |

| Free Access to Vantage ProTrader Platform | ✔ | Available for clients who meet the requirements | ✔ | ✔ |

| Competitive Prices | ✔ | Refer to account type description | ✔ | ✔ |

| Exclusive Expert Support | ✔ | ❌ | ✔ | ✔ |

| Free Technical Analysis | ✔ | Available for clients who meet the requirements | ✔ | ❌ |

| Stop-out Level | 20% | 50% | 20% | / |

Additionally, Vantage also offers Swap Free and Premium accounts.

The Swap Free account is suitable for traders of any level. You can deposit only $50 and then enjoy trading with free swaps and tight spread from 0.0 pips. However, you should note that additional fees, such as an administration fee, for holding overnight trade positions may be deducted from your account balance.

The Premium account is suitable for experienced traders, which requires a $500 minimum deposit, but offers leverage up to 2000:1, spread from 0.0 pips, 30% margin call, and 0% stop-out level.

Vantage Demo Account Opening (Step by Step)

Vantage does not offer a dedicated entry for opening a demo account on its homepage. Traders can only enter the general account opening process by clicking on 'REGISTER' or 'JOIN US NOW', and then click on 'Practice Trading' to open a demo account.

To more intuitively show the process of opening a demo account with Vantage, we have conducted a test, and each step is accompanied by a corresponding screenshot, you can follow the following process step by step.

Step 1: Visit Vantage's website.

Step 2: Click on 'Practice Trading'.

Step 3: Fill in your email address.

Step 4: Fill in your personal information.

To be specific,

Step 1: Go to Vantage's official website and click on 'REGISTER' or 'JOIN US NOW'.

Step 2: Click on 'Practice Trading'.

Step 3: Fill in your email address. Then click on 'CONTINUE'.

Step 4: Fill in your personal information, including your name, country, and phone number.

You can also customise your demo account, including trading platform, account type, account currency, leverage, and account balance.

Then click on 'CREATE ACCOUNT'.

Vantage Trading Account Opening (Step by Step)

Opening a live trading account requires more detailed information than opening a demo account and requires waiting for Vantage to verify your identity.

After that, there is also a suitability test, which is not included in the account opening process of most brokers, but Vantage requires you to do this test to help you better determine if all your choices are right for you.

Once you've done that, you'll be able to fund your account with a minimum deposit of $50.

Now, follow the step-by-step guide below to sign up for a Vantage trading account.

Step 1: Visit Vantage's website.

Step 2: Fill in contact information.

Step 3: Fill in your personal information.

Step 4: Fill in the personal details.

Step 5: Fill in the main residential address.

Step 6: Fill in employment, investment objectives, investment needs and financial details.

Step 7: Configurate your account.

Step 8: Fund your account by clicking on 'Deposit' or 'Funds'.

To be specific,

Step 1: Go to Vantage's official website and click on 'REGISTER' or 'JOIN US NOW'.

Step 2: Fill in the required info, including your country, email address, email verification code, and password.

Choose your account type, individual or company.

You also need to read the Vantage Privacy Policy carefully. Tick that you are not a US resident and have agreed to the Privacy Policy.

Then click on 'CREATE ACCOUNT'.

Step 3: Fill in your personal information, including your first name, last name, and phone number.

Choose your account type, individual, company, or SMSF/TRUST.

Then click on 'CREATE ACCOUNT'.

Step 4: Fill in the personal details.

Apart from the first name, last name, email address, and phone number that you have filled in before, you also need to choose your nationality and date of birth.

Step 5: Fill in the main residential address, including your address, province/state, city/suburb, and postcode. Then click on 'Next'.

Step 6: Answer 10 yes-or-no questions about employment, investment objectives, investment needs and financial details. Then click on 'Next'.

Step 7: Configurate your account.

Choose your trading platform (MetaTrader 4 or MetaTrader 5), account type (Standard, Raw, TradingView, or Perpetual), and account currency (USD, AUD, GBP, EUR, or NZD).

Tick that you have read and agreed to the Terms and Conditions.

Then click on 'Next'.

Step 8: After that, you need to verify your identity and do a suitability quiz. Then, you can fund your account by clicking on 'Deposit' or 'Funds'.

Vantage Deposit & Withdraw

Vantage Deposit

Vantage supports multiple funding methods, not only credit/debit cards, popular e-wallets, and bank transfers, but also crypto wallets.

Only Neteller and Skrill deposits may be subject to some fees, while free for all other methods.

You can find more detailed info on Vantage deposits in the table below:

| Vantage Deposit Methods | Available Currencies | Deposit Fees | Deposit Processing Time | |

| Visa/MasterCard | AUD, USD, GBP, EUR, SGD, JPY, NZD, CAD, PLN | ❌ | Instant |

| Apple Pay/Google Pay | USD, GBP, CAD, AUD, EUR, SGD, NZD, HKD, JPY | ||

| PayPal | AUD, USD, GBP, EUR | Within 24 business hours | |

| Neteller | AUD, USD, GBP, EUR, SGD | Subject to Neteller's fees | Instant |

| Skrill | USD, EUR, GBP, CAD | Subject to Skrill's fees | Within 24 business hours |

| Fasapay | USD | ❌ | Instant |

| Perfect Money | EUR, USD | Within 24 business hours | |

| JCB | JPY | Instant | |

| bitwallet | JPY, EUR, USD | Within 24 business hours | |

| Sticpay | USD, GBP, CAD, AUD, EUR, SGD, NZD, HKD, JPY | ||

| India UPI | USD, INR | ||

| Bank Transfer* | USD | ||

| Japan Bank Transfer | USD, JPY | ||

| International ETF | AUD, USD, GBP, EUR, SGD, JPY, NZD, CAD, PLN | 2-5 business days | |

| Domestic Fast Transfer (Australia Only) | AUD | Up to a few hours, during AEST business hours | |

| AstroPay | USD + most local currencies | Instant | |

| Broker-to-Broker Transfer | AUD, USD, GBP, EUR, SGD, JPY, NZD, CAD | 3-5 business days | |

*Bank Transfer in Vietnam, Thailand, Malaysia, Nigeria, Philippines, Brazi, South Africa, Uganda, Kenya, Ghana, Japan, and Mexico.

Vantage Withdraw

Vantage accepts withdrawals via credit/debit card, international bank transfers, cryptocurrency (USDT/BTC), local bank transfers, and e-wallet.

To see the most current withdrawal methods available to you, please log in to your client portal. There, you'll find a comprehensive list of all the withdrawal options Vantage offers, along with detailed instructions for each method.

The minimum withdrawal amount is $30/3,000 JPY. However, if your account balance is below $30, you can withdraw the full remaining balance.

Vantage does not charge withdrawal fees, except for withdrawals via international bank transfers, which incur a fee of 20 units of the account currency (150 HKD/3,000 JPY).

Withdrawal times vary based on the chosen withdrawal method. Please refer below:

| Vantage Withdrawal Methods | Withdrawal Time |

| Credit/Debit card | 1-3 business days |

| International bank transfers | Up to 5 business days |

| Cryptocurrency (USDT/BTC) | 0-2 business days |

| Local bank transfers | 1-3 business days |

| E-wallet |

How to Withdraw Money from Vantage? (Step by Step)

You can withdraw money from Vantage on the client portal or Vantage app.

① Withdraw On the client portal

Step 1: Log in to the client portal.

Step 2: Click “Funds” in the left menu and select “Withdrawal”.

Step 3: Choose the account from which you want to withdraw money.

Step 4: Enter the amount you wish to withdraw.

Step 5: Select your preferred withdrawal method.

Step 6: Provide the required information and click on “Withdraw now”.

② Withdraw On the Vantage app

Step 1: Tap on your “Profile”.

Step 2: Select “Funds” and then tap “Withdraw”.

Step 3: Choose the account from which you want to withdraw money.

Step 4: Enter the amount you wish to withdraw.

Step 5: Select your preferred withdrawal method.

Step 6: Provide the required information and click the “Done” button.

Note: Before making any withdrawals, please ensure you have sufficient funds in your account. Ongoing trades in a loss position, a low margin balance, and other factors may affect your ability to request a withdrawal.

Additionally, you can only make the withdrawal once your proof of identity (POI) and proof of address (POA) documents have been successfully verified.

Vantage vs Other Australian Brokers

We compared Vantage's key points (regulation, product offering, demo account, account minimum, maximum leverage, trading platform, copy/social trading, and suitable traders) with three other Australian brokers, IC Markets, TMGM, and Think Markets.

See a more detailed comparison of Vantage's alternatives below:

| Logo |  |  |  |  |

| Broker | Vantage | IC Markets | TMGM | Think Markets |

| Regulation | ASIC, FCA, CIMA/VFSC (Offshore), FSCA (General Registration) | ASIC, CySEC | ASIC, VFSC (Offshore) | ASIC, FSA, FCA, CySEC, FSA (Offshore) |

| Segregated Account | ✔ | - | - | - |

| Negative Balance Protection | ✔ | - | - | - |

| Demo Account | ✔($100,000 virtual credit) | ✔ | ✔ | ✔ |

| Islamic Account | - | ✔ | ✔ | ✔ |

| Account Minimum | $50⭐ | $200 | $100 | $50⭐ |

| Maximum Leverage | 1:500 | 1:1000 | 1:1000 | 1:500 |

| Average Trading Cost (EUR/USD) | 1.1 pips | 0.8 pips⭐ | 1.6 pips | 0.8 pips⭐ |

| MetaTrader 4 (MT4) | ✔ | ✔ | ✔ | ✔ |

| MetaTrader 5 (MT5) | ✔ | ✔ | ✔ | ✔ |

| cTrader | ❌ | ✔ | ❌ | ❌ |

| TradingView | ✔ | ✔ | ❌ | ✔ |

| Proprietary Platform | Vantage App, ProTrader | ❌ | TMGM App | ThinkTrader |

| Copy/Social Trading | ✔ | ✔ | ❌ | ✔ |

| Promotion | ✔ | ❌ | ❌ | ❌ |

| Best for | Beginners | Experienced traders | Experienced traders | Beginners |

FAQs

Is Vantage legal in the UK?

Yes. Vantage is regulated by the FCA in the UK. It is also regulated by ASIC in Australia, CIMA in the Cayman Islands, VFSC in Vanuatu, and FSCA in South Africa. You can refer to detailed info about Vantage regulation in the 'Is Vantage Legit and Safe' section.

Does Vantage have a demo account?

Yes. Vantage demo accounts have virtual funds up to $100k and no expiry date.

Which account type is best in Vantage?

In fact, no best account type, only the most suitable account. You can choose the account type based on your needs. For example, Standard STP and Cent accounts are good for beginners to get started.

What is the highest leverage on Vantage?

Vantage offers leverage up to 500:1 for most account types, while the Premium account holders can enjoy leverage up to 2000:1.

What is the minimum deposit in Vantage?

$50.

What is the minimum withdrawal from Vantage?

$30/3,000 JPY.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Related broker

WikiFX Broker

Latest News

Exposing the Top 5 Scam Brokers of March 2025: A Closer Look by WikiFX

Gold Prices Climb Again – Have Investors Seized the Opportunity?

Webull Launches SMSF Investment Platform with Zero Fees

Australian Regulator Warns of Money Laundering and Fraud Risks in Crypto ATMs

The Withdrawal Trap: How Scam Brokers Lure Victims into Paying More

FCA to Investors: Think Twice Before Trusting These Brokers

Trump\s tariffs: How could they affect the UK and your money

Trump gambles it all on global tariffs he\s wanted for decades

TradingView Brings Live Market Charts to Telegram Users with New Mini App

HTFX Spreads Joy During Eid Charity Event in Jakarta

Currency Calculator