简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Economic Outlook of the Eurozone in 2020 Is Expected to Be Steady

Ikhtisar:In 2020, economic growth of the Eurozone and the world in general will also depend on how global trade talks turn out, particularly whether negotiations between various global players, including Britain and the European Union, can eliminate uncertainties in international trade.

European Central Bank(ECB) Executive Board member Isabel Schnabel said the Eurozone‘s inflation is estimated to be slowly inching towards the central bank’s target range. Monetary policy and increasing loans may prop up prices in the medium term, and Eurozones economy, supported by easing monetary measures, is estimated to see a 1.1% growth this year.

Germany‘s economy resumed marginal growth after declining for 3 months, while Spain and France both experienced considerable expansion. New jobs have been growing for the first time in 4 months, while business confidence also improved. Britain also had some good news, as the service sector’s index last December has been revised upwards, while new orders have seen the largest increase in 5 months. Inflation is expected reach 1.6% in 2022 as economic expansion accelerates.

In 2020, economic growth of the Eurozone and the world in general will also depend on how global trade talks turn out, particularly whether negotiations between various global players, including Britain and the European Union, can eliminate uncertainties in international trade.

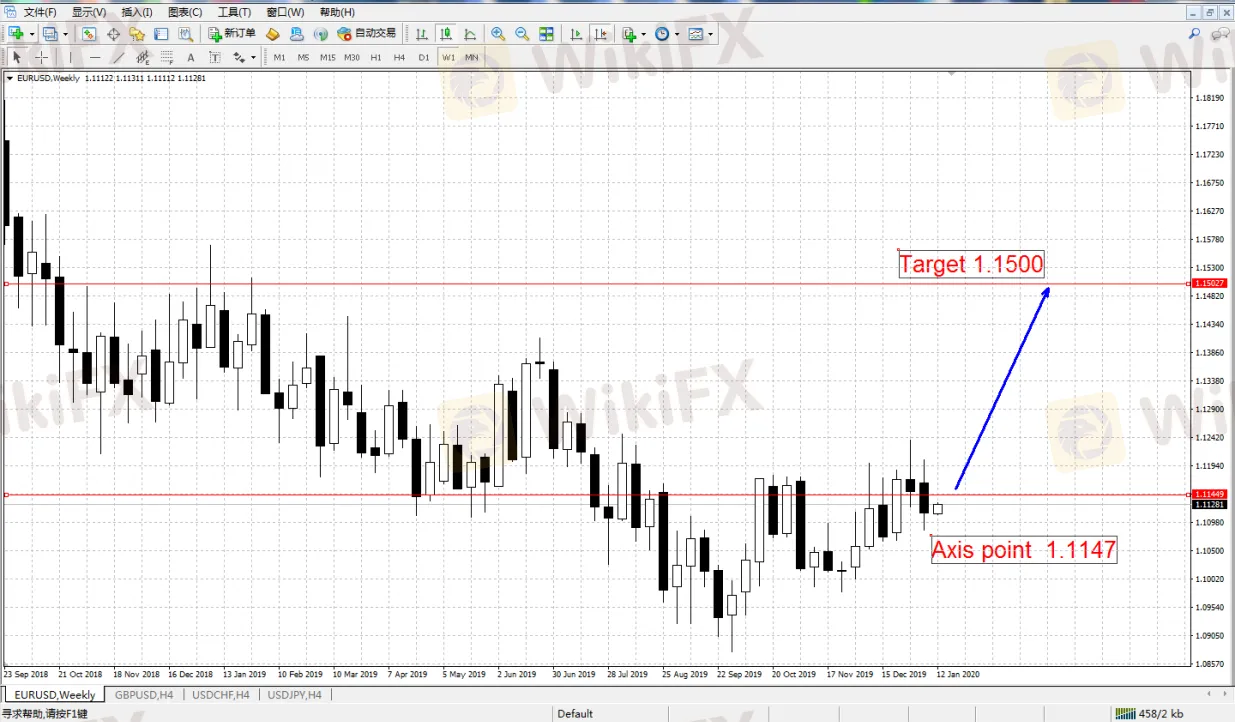

Technically, 1.1147 will be the axis point for EUR/USD in the first half of the year. Based on stabilized Eurozone economic data, weakened US dollar and reduced systematical risks, it‘s likely that the euro will slightly rise to above 1.15. On the other hand, US President Donald Trump’s policies have boosted USD above fair level for at least the past 2 years, but as the influence of these policies eventually declines, USD is also expected to return to a fair level. After the initial impacts of fiscal stimulus eventually faded, US economy growth may not reach its full potential.

Disclaimer:

Pandangan dalam artikel ini hanya mewakili pandangan pribadi penulis dan bukan merupakan saran investasi untuk platform ini. Platform ini tidak menjamin keakuratan, kelengkapan dan ketepatan waktu informasi artikel, juga tidak bertanggung jawab atas kerugian yang disebabkan oleh penggunaan atau kepercayaan informasi artikel.

Baca lebih banyak

Join and GET 2100 WikiBit for free on Christmas Day!

Countdown 24 hours!

Data Ekonomi Menjadi Aneh? Bagian II

Masalah serupa berlaku untuk "survei pendirian," yang B.L.S. gunakan untuk mentabulasi angka pertumbuhan pekerjaan. Agensi mensurvei sekitar 145.000 bisnis dan agensi pemerintah tentang berapa banyak karyawan yang mereka miliki dalam daftar gaji.

Data Ekonomi Menjadi Aneh? Bagian I

Amerika Serikat mengalami keruntuhan yang tak terduga dalam aktivitas ekonominya. Itu yang kita tahu. Tetapi lebih dari itu bahkan dalam resesi normal, alat-alat yang harus kita pahami apa yang terjadi pada perekonomian menjadi terdistorsi atau lebih sulit untuk ditafsirkan, karena berbagai alasan.

Corona Menyentuh Ekspor, Perdagangan Jepang Turun 99% Pada Maret

Surplus perdagangan Jepang turun 99 persen di bulan Maret dari tahun sebelumnya karena masalah virus corona memukul ekspor ke mitra dagang utamanya, data resmi menunjukkan Senin.

WikiFX Broker

Berita Terhangat

WikiFX Mengucapkan Selamat Hari Raya Idul Fitri 1446 H, Mohon Maaf Lahir dan Batin

Broker StoneX Meningkatkan Investasi Perbankan dan Perdagangan Dengan Akuisisi Benchmark

Interactive Brokers Menambahkan Bursa Efek Ljubljana Dan Mengintegrasikan CoacsConnect

Nilai Tukar