简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

【MACRO Insight】The Japanese economy is facing challenges, and the central bank may raise interest rates to address the depreciation of the yen

Sommario:Some self-media suggest that Japan's exchange rate may be influenced by the United States, and believe that there is a high possibility of the yen depreciating. They believe that the depreciation of the yen is beneficial for economic development. Despite the political turmoil in Japan, the economy is not easily being "harvested," and businesses benefit from the depreciation of the yen. The depreciation of the yen reflects Japan's long-term economic difficulties, but it is not being "harvested."

Some self-media suggest that Japan's exchange rate may be influenced by the United States, and believe that there is a high possibility of the yen depreciating. They believe that the depreciation of the yen is beneficial for economic development. Despite the political turmoil in Japan, the economy is not easily being “harvested,” and businesses benefit from the depreciation of the yen. The depreciation of the yen reflects Japan's long-term economic difficulties, but it is not being “harvested.” Public opinion on depreciation is neutral, supporting further depreciation. The depreciation of the yen affects businesses, and the future trend needs to be closely monitored.

From 2010 to 2024, the Japanese yen exchange rate experienced drastic fluctuations. In 2011, the Great East Japan Earthquake and the Fukushima nuclear power plant accident led to the yen's appreciation, with 1 US dollar exchanging for 75 yen. However, due to the impact of the disasters and economic downturn, the yen exchange rate started to decline and fell to 130 yen by 2015. After 2015, it stabilized around 120 yen, but experienced another decline in 2022. On April 29, 2024, 1 US dollar could be exchanged for 160 yen. After government intervention, the exchange rate rose to 151 yen on May 2, and then fell back to 155 yen on May 20.

Around May 2024, the Japanese government intervened in the foreign exchange market twice. The first intervention occurred on April 29, adjusting the yen exchange rate from 160 yen to 153 yen and 151 yen against the US dollar, injecting 5 trillion yen and 3 trillion yen respectively. Around the Golden Week holiday in May, another intervention exceeding 8 trillion yen was implemented. Experts predict that the yen exchange rate may fluctuate between 160 and 185 yen, with a higher likelihood of depreciation than appreciation.

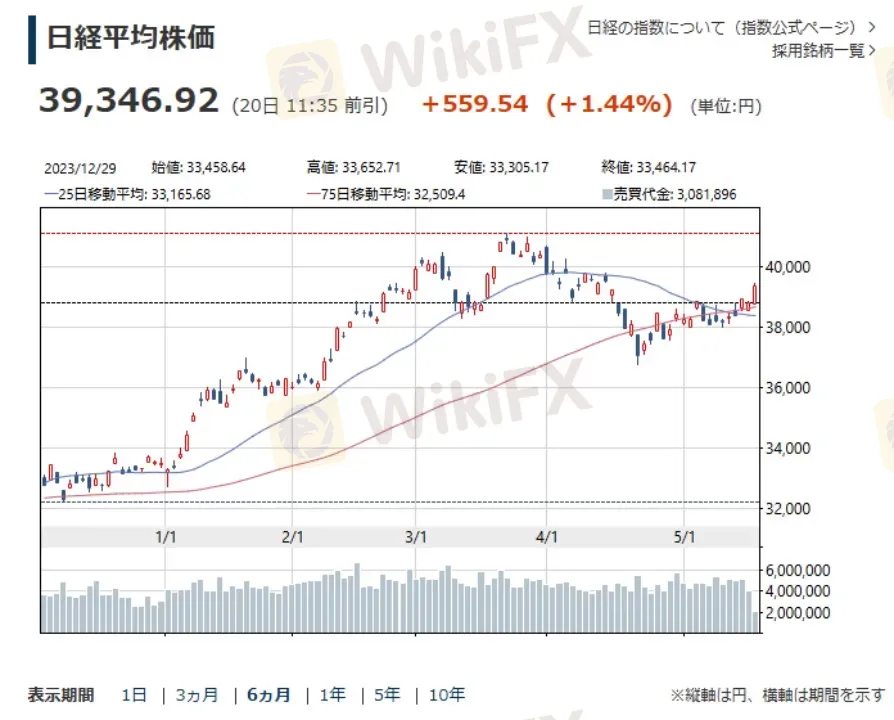

The Bank of Japan believes that the depreciation of the yen has limited impact on prices and inflation, and continues to monitor exchange rate movements. The government is flexibly managing exchange rate fluctuations to earn profits by holding US treasuries and cash. Politicians are discussing ways to profit from exchange rate changes, with debates focusing on expanding military capabilities or improving people's livelihoods. Meanwhile, the Japanese stock market is performing well, attracting foreign investments and driving stock prices higher amid a fervent market atmosphere.

Despite the yen depreciation, there has been no significant mergers and acquisitions by companies from countries like the United States into Japanese firms. Some Chinese investors have faced losses in the Japanese real estate market. Japanese cutting-edge technology talent has largely not moved to other countries, with most university students finding jobs and companies facing labor shortages. It is not easy to directly compare Japan with other countries, as the Bank of Japan's intervention is seen as weak and the stock market's outlook remains uncertain, requiring in-depth analysis of macro and microeconomic changes.

The Bank of Japan will have to take further tightening measures in the coming months as the 10-year government bond yield rises above 1%, inflation exceeds the 2% target, and interest rate hikes may be implemented in the short term. It is expected that by the end of 2026, the 10-year government bond yield will rise to 2%. The market is closely watching the speed of interest rate hikes and the magnitude of yield increases by the Bank of Japan. The large short-term interest rate differential between the US and Japan continues to attract investors for arbitrage trading, despite the softness of the yen.

The Bank of Japan may raise interest rates and implement quantitative tightening measures at its policy meeting. The central bank's reduction in bond purchases has led to upward pressure on yields. The meeting is scheduled for this Thursday. The Bank of Japan is caught in a dilemma as surging inflation prompts tighter policies, but it also needs to avoid a spike in government bond yields. The next policy meeting is set to be held on June 13-14.

Disclaimer:

Le opinioni di questo articolo rappresentano solo le opinioni personali dell’autore e non costituiscono consulenza in materia di investimenti per questa piattaforma. La piattaforma non garantisce l’accuratezza, la completezza e la tempestività delle informazioni relative all’articolo, né è responsabile delle perdite causate dall’uso o dall’affidamento delle informazioni relative all’articolo.

WikiFX Trader

Vantage

Pepperstone

FBS

ATFX

GO MARKETS

FP Markets

Vantage

Pepperstone

FBS

ATFX

GO MARKETS

FP Markets

WikiFX Trader

Vantage

Pepperstone

FBS

ATFX

GO MARKETS

FP Markets

Vantage

Pepperstone

FBS

ATFX

GO MARKETS

FP Markets

Rate Calc