简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

【MACRO Insight】Tonight We Welcome Two "Data Bombs" Again, Will the Federal Reserve's Interest Rate Cut Expectations Be Reassessed?

Sommario:the latest release of CPI data in the United States has led to increased expectations in the market that the Federal Reserve will cut rates by 25 basis points at the September meeting, while expectations for a 50 basis point rate cut have weakened. Market analysts estimate that the specific rate cut by the Federal Reserve will be determined by the August employment data to be announced, and Federal Reserve Chairman Powell may pave the way for a rate cut at the Jackson Hole symposium. Although th

The latest release of the CPI data in the United States has led to a significant adjustment in the market's expectations for a Federal Reserve rate cut in September. Market participants generally believe that the possibility of the Federal Reserve cutting rates by 25 basis points at the September meeting has increased, while expectations for a 50 basis point rate cut have diminished. Behind this expectation adjustment is the continuous decline in the U.S. inflation rate, which provides the Federal Reserve with more policy flexibility.

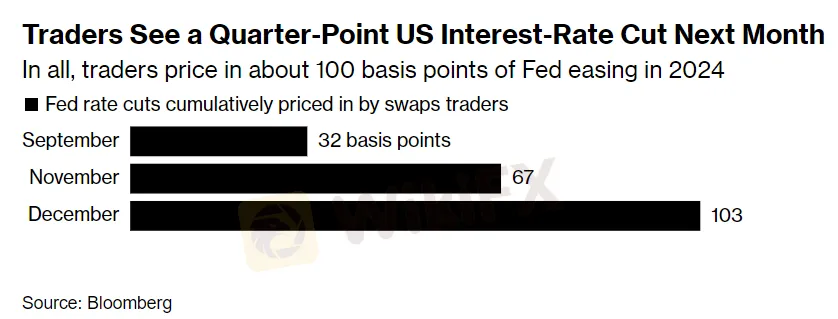

Specifically, market analysts estimate that the average rate cut expected by the Federal Reserve at the September meeting is 32 basis points, which is a downward adjustment from the previous day's expectations. This expectation adjustment is reflected in the bond market, where U.S. Treasury bonds generally rose on Wednesday, especially with the decline in the yield of 5-year Treasury bonds, showing the market's reassessment of future interest rate levels. David Kelly, Chief Global Strategist at J.P. Morgan Asset Management, pointed out in a television interview that the weakening inflation data further confirms the alleviation of the inflation problem, a trend reflected in the bond market. He mentioned that the CPI data is close to expectations, which is manifested in the bond market as a “sell the news” phenomenon.

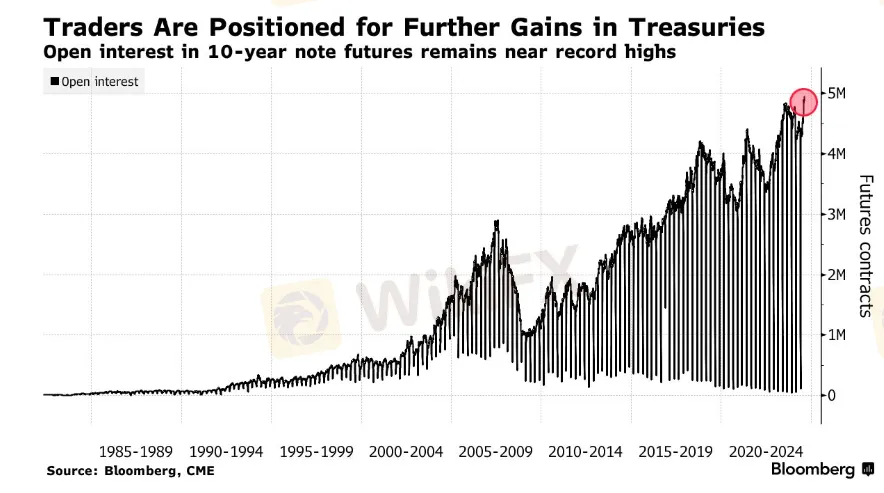

In the bond market, the yield on the policy-sensitive 2-year Treasury bonds rose to 3.95%, while the yields on 5-year and 30-year Treasury bonds showed a downward trend, especially with the 30-year Treasury bond yield falling by 4 basis points. This change reflects that futures traders are reducing their expectations for a substantial rate cut by the Federal Reserve, and their open contracts are consistent with the profit positions of bond traders in the U.S. Treasury market. In addition, the flow of options trading related to the Secured Overnight Financing Rate (SOFR) shows that traders are unwinding their bets on a 50 basis point rate cut. SOFR is a key indicator closely following the Federal Reserve's policy path.

Market participants seem to be adjusting their dovish bets, as the pricing in the swap market tends towards a 25 basis point rate cut, rather than 50 basis points. Before the release of the core CPI data for July, the market had already adjusted its expectations for the Federal Reserve's rate cut. The core CPI in July increased by 3.2% year-on-year, which is the lowest growth rate since the beginning of 2021 and is in line with economists' expectations, further supporting the trend of the Federal Reserve continuing to cut rates.

Wall Street analysts generally believe that although the CPI data has paved the way for a 25 basis point rate cut in September, the possibility of a 50 basis point rate cut has not been completely ruled out. They emphasize that the economic data to be released in the coming weeks, including weekly initial jobless claims and retail sales data, as well as Federal Reserve Chairman Powell's speech at Jackson Hole, will provide important clues for determining the direction of the Federal Reserve's policy. Analysts also point out that although the CPI data shows easing inflationary pressures, the market still has disagreements on whether the Federal Reserve will take more substantial rate cut measures. They expect that if future economic data continues to show economic slowdown, the Federal Reserve may consider a more substantial rate cut.

It can be seen that market analysts are closely monitoring the upcoming economic data and speeches by Federal Reserve officials in order to better predict the next policy direction of the Federal Reserve. They believe that the dynamics of the job market and consumer spending will be key factors affecting the Federal Reserve's decision-making. In addition, the retail sales data on Thursday and the employment report for August will be important indicators for assessing the economic situation and the direction of the Federal Reserve's policy.

Under such general expectations, the Federal Reserve will lay the foundation for the rate cut action in September at the Jackson Hole symposium next week, and the specific rate cut will depend on the employment data to be released a week later in August. Krishna Guha, Vice Chairman of Evercore ISI, explained to customers that Federal Reserve Chairman Powell will tend to take an “active” rate cut stance, rather than “passive” response. However, the specific details of the rate cut and the degree of policy easing need to be finally determined after the employment data for August is announced.

Guha emphasized that the current Federal Reserve pays more attention to employment data rather than inflation data, and the upcoming employment data will directly affect the Federal Reserve's enthusiasm for rate cuts. Powell is expected to follow tradition and provide clues on monetary policy in the opening speech at the Jackson Hole meeting. Although the U.S. stock market experienced a sharp drop at the beginning of August, the market has recovered most of it and has maintained a robust growth trend within the year. The panic at the beginning of August was partly due to the employment report for July falling short of expectations, as well as the violent closing of the popular yen carry trade, but stock investors remain optimistic about the prospects for continued economic growth.

At the same time, the federal funds futures market has priced in a series of substantial rate cuts, reflecting concerns in the market that the Federal Reserve may need to take proactive action to deal with a sharp economic downturn. Scott Helfstein, Director of Investment Strategy at Global X, pointed out in a report that the overall CPI is below 3% for the first time since March 2021. Chairman Powell should celebrate this victory at the Jackson Hole meeting and try to persuade the market to cut rates by 25 basis points in September. However, the current interest rate market is priced for a nearly 50 basis point rate cut in September, but the Federal Reserve may not achieve this expected result.

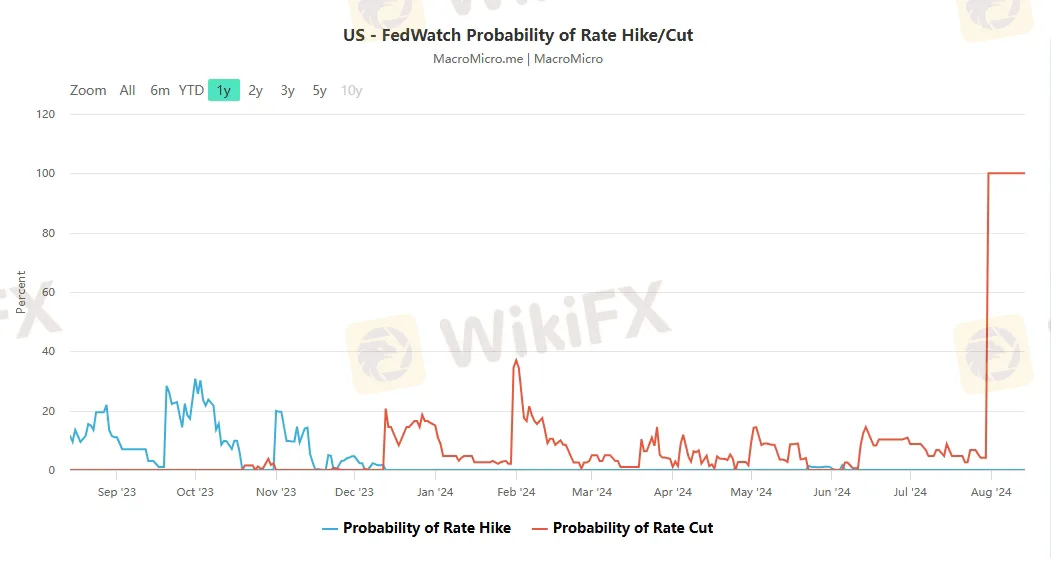

After the CPI data was announced this Wednesday, interest rate futures traders began to reduce their expectations for a 50 basis point rate cut in September. According to the FedWatch tool of CME, the probability of a substantial rate cut is now about 43%, down from 53% on Tuesday and 69% a week ago, while the probability of a 25 basis point rate cut has risen to 57%.

Two former Federal Reserve officials said that according to the current situation, it is very likely that the Federal Reserve will lower the federal funds rate by 25 basis points at the September meeting. The former chairman of the Kansas City Federal Reserve, George, believes that there is not likely to be a larger rate cut in September. Although the July CPI report is good, inflation is still high and the economy is still resilient, providing time for policy adjustment. Former Vice Chairman of the Federal Reserve Blind agreed, saying that unless the employment report for August is very bad, a 25 basis point rate cut in September will be the basic expectation.

He also mentioned that if the economic situation deteriorates significantly before the Federal Reserve's September meeting, policymakers may take more substantial rate cut measures, but currently, he and the Federal Reserve do not have such expectations. Looking at the weaker-than-expected July employment report released by the U.S. Department of Labor some time ago, the market began to price in a 50 basis point rate cut by the Federal Reserve in September, and expectations for emergency rate cuts during the meeting have risen sharply. However, the recent frequent statements of Federal Reserve officials show that they are more optimistic about the economic outlook.

Guha is even more detailed in his report on how he thinks the Federal Reserve will respond to the employment data in August:

l If the August employment report is better than July, the Federal Reserve will cut rates by 25 basis points in each of the remaining three meetings of the year, and cut rates by another 25 basis points in the first quarter of next year as needed.

l If the August employment data continues to show a weak trend, the Federal Reserve may cut rates by 50 basis points in both September and November.

l If the employment market data shows signs of collapse, the Federal Reserve may cut rates by 200-250 basis points before December.

In summary, the latest release of CPI data in the United States has led to increased expectations in the market that the Federal Reserve will cut rates by 25 basis points at the September meeting, while expectations for a 50 basis point rate cut have weakened. Market analysts estimate that the specific rate cut by the Federal Reserve will be determined by the August employment data to be announced, and Federal Reserve Chairman Powell may pave the way for a rate cut at the Jackson Hole symposium. Although the U.S. stock market experienced a sharp drop at the beginning of August, the market has recovered and maintained robust growth, and investors remain optimistic about the prospects for continued economic growth. The federal funds futures market has priced in substantial rate cuts, reflecting concerns about economic weakness. Krishna Guha of Evercore ISI believes that if the August employment data is strong, the Federal Reserve will cut rates gradually; if the data is weak, there may be a more substantial rate cut. Former Federal Reserve officials also believe that unless the August employment report is extremely poor, a 25 basis point rate cut in September is the basic expectation.

Disclaimer:

Le opinioni di questo articolo rappresentano solo le opinioni personali dell’autore e non costituiscono consulenza in materia di investimenti per questa piattaforma. La piattaforma non garantisce l’accuratezza, la completezza e la tempestività delle informazioni relative all’articolo, né è responsabile delle perdite causate dall’uso o dall’affidamento delle informazioni relative all’articolo.

WikiFX Trader

IC Markets Global

HFM

IQ Option

Tickmill

Vantage

EC Markets

IC Markets Global

HFM

IQ Option

Tickmill

Vantage

EC Markets

WikiFX Trader

IC Markets Global

HFM

IQ Option

Tickmill

Vantage

EC Markets

IC Markets Global

HFM

IQ Option

Tickmill

Vantage

EC Markets

Rate Calc