简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

KVB Market Analysis | 15 August: Gold Prices Drop Sharply Following U.S. CPI Report and Fed Rate Cut Expectations

Sommario:Spot XAU/USD dropped nearly $18, closing below $2,450, after the latest U.S. CPI report reduced hopes for a significant Fed rate cut. The CPI rose 0.2% in July, with a notable increase in rent, particularly "owner's equivalent rent," which accelerated to 0.36%, contributing to the market's disappointment.

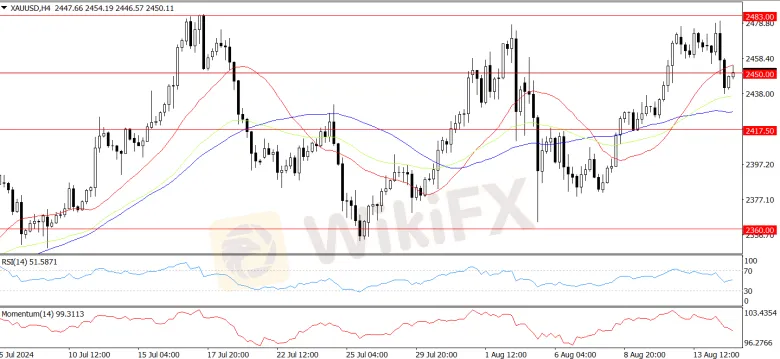

Product: XAU/USD

Prediction: Decrease

Fundamental Analysis:

Even though the U.S. dollar remained mostly steady, spot XAU/USD dropped sharply by nearly $18, closing below $2,450. The latest U.S. CPI report dampened expectations of a significant rate cut by the Federal Reserve next month, leading to a steep decline in gold prices on Wednesday. The U.S. Bureau of Labor Statistics reported that the Consumer Price Index (CPI) rose 0.2% in July from the previous month and 2.9% year-over-year. The surprising part of the CPI report was the accelerating rise in rent, which caused some disappointment in the market. In June, the “owner's equivalent rent” data was the lowest since 2021, but it accelerated to 0.36% in July.

Technical Analysis:

Technical indicators have lost upward momentum but are still in positive territory. The Relative Strength Index (RSI) is turning downward, but it hasnt confirmed another wave of decline yet. XAU/USD prices continue to move above all their moving averages, with the 20-day Simple Moving Average (SMA) currently flat around $2,417.5. Technical indicators have pulled back sharply from near overbought levels and are now hovering around the midline, showing some loss of bearish momentum but still trending downward. Meanwhile, gold has dropped below its 20-period SMA, around $2,455. The 100-period and 200-period SMAs remain below the current gold price, suggesting that a more significant drop is less likely at this point.

Product: USD/JPY

Prediction: Increase

Fundamental Analysis:

Japanese Prime Minister Fumio Kishida announced on Wednesday that he will not run in the upcoming Liberal Democratic Party (LDP) leadership election, emphasising the need for a new party image. He pledged full support to the new leader. This announcement has introduced short-term political uncertainty, which could impact Japanese stocks. Meanwhile, the U.S. Bureau of Labor Statistics reported that consumer prices rose by 0.2% in July, as expected, mainly due to higher energy costs. Following this news, USD/JPY rose 0.34% to 147.24, though the currency pair briefly faced pressure after Kishida's decision not to seek re-election.

Technical Analysis:

USD/JPY is trading around $146.80 on Wednesday. The 14-day Relative Strength Index (RSI) is at 30, indicating a possible correction. For support, USD/JPY could test the seven-month low of $141.69 from August 5, with further support at $140.25. On the upside, the pair may encounter resistance at the nine-day EMA near $147.45. If it breaks above this level, bearish momentum could weaken, allowing the pair to move toward the 50-day EMA at $153.40. There's also potential to test the resistance at $154.50, where previous support has now turned into resistance.

Product: EUR/USD

Prediction: Decrease

Fundamental Analysis:

EUR/USD briefly rallied to a new seven-month high before easing back toward the 1.1000 level on Wednesday. The pair surged past $1.1000 and reached $1.1050 after the pan-EU GDP growth came in as expected. However, EU industrial production remained weak, and US CPI inflation met forecasts but still left markets disappointed. US headline CPI inflation was 2.9% year-over-year in July, slightly below the expected 3.0%, while core CPI inflation edged down to 3.2% annually from the previous 3.0%, as anticipated by the markets.

Technical Analysis:

The EUR/USD pair is likely to keep rising if it stays above the crucial 200-day SMA. It may aim to test the 2024 high of $1.1047and then move toward the December 2023 peak of 1.1139. On the downside, the next target is the 200-day SMA at 1.0837, followed by the weekly low of 1.0777 and the June low of 1.0666, before reaching the May low of 1.0649.The four-hour chart indicates a strong pick-up in the positive bias. The initial resistance level is $1.1047, before $1.1132.

Product: BTC/USD

Prediction: Increase

Fundamental Analysis:

The U.S. government transferred 10,000 Bitcoin to Coinbase Prime, causing panic in the crypto market and dropping Bitcoin's price to around $59,000. On April 2, the U.S. government moved 31,800 Bitcoin to another wallet and has since distributed the funds to different addresses. According to Arkham Intelligence, the U.S. government still holds over $1 billion in Bitcoin related to the Silk Road. In November 2022, authorities arrested James Zhong and seized 50,000 Bitcoin connected to the Silk Road. The last known sale from these reserves occurred in March 2023, when the U.S. sold 9,861.17 Bitcoin.

Technical Analysis:

Bitcoin is struggling to stay above the $60,000 mark, which suggests that sellers are active at higher levels. Although Bitcoin looks “promising,” its trend is lagging behind gold by about three months, so it may take some time to regain upward momentum. Bitcoin is currently in the second stage of a bull market cycle. If it follows the patterns of previous cycles, its upward trend could continue until the third quarter of 2025. Sellers might try to push Bitcoin down to the key support level at $55,724. This level could attract significant buying interest. If Bitcoin bounces back from $55,724, buyers may try to push the price above the moving averages again. On the downside, a break and close below $55,724 could signal the start of a deeper correction, potentially leading to a drop toward $49,000.

Market Analysis Disclaimer:

The market analysis provided by KVB Prime Limited is for informational purposes only and should not be construed as investment advice or a recommendation to buy or sell any financial instrument. Trading forex and other financial markets involves significant risk, and past performance is not indicative of future results.

KVB Prime Limited does not guarantee the accuracy, completeness, or timeliness of the information provided in the market analysis. The content is subject to change without notice and may not always reflect the most current market developments or conditions.

Clients and readers are solely responsible for their own investment decisions and should seek independent financial advice from qualified professionals before making any trading or investment decisions. KVB Prime Limited shall not be liable for any losses, damages, or other liabilities arising from the use of or reliance on the market analysis provided.

By accessing or using the market analysis provided by KVB Prime Limited, clients and readers acknowledge and agree to the terms of this disclaimer.

RISK WARNING IN TRADING

Transactions via margin involve products that use leverage mechanisms, carry high risks, and are certainly not suitable for all investors. THERE IS NO GUARANTEE OF PROFIT on your investment, so be wary of those who guarantee profits in trading. You are advised not to use funds if you are not prepared to incur losses. Before deciding to trade, ensure that you understand the risks involved and also consider your experience.

Disclaimer:

Le opinioni di questo articolo rappresentano solo le opinioni personali dell’autore e non costituiscono consulenza in materia di investimenti per questa piattaforma. La piattaforma non garantisce l’accuratezza, la completezza e la tempestività delle informazioni relative all’articolo, né è responsabile delle perdite causate dall’uso o dall’affidamento delle informazioni relative all’articolo.

WikiFX Trader

Pepperstone

FP Markets

GO MARKETS

Tickmill

FOREX.com

IC Markets Global

Pepperstone

FP Markets

GO MARKETS

Tickmill

FOREX.com

IC Markets Global

WikiFX Trader

Pepperstone

FP Markets

GO MARKETS

Tickmill

FOREX.com

IC Markets Global

Pepperstone

FP Markets

GO MARKETS

Tickmill

FOREX.com

IC Markets Global

Rate Calc