简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

【MACRO Insight】Predicting the Timing and Magnitude of Interest Rate Cuts - The Fed's Monetary Policy and Economic Data Showdown

Sommario:Federal Reserve Chairman Jerome Powell's speech at the Jackson Hole Annual Meeting is highly anticipated, with the market predicting that he will send a signal to cut interest rates to address the slowdown in employment growth and inflation issues. The latest data shows that the U.S. employment market is performing worse than expected, while inflation, although somewhat relieved, is still high. The Fed discussed the possibility of rate cuts in the July meeting minutes, which has attracted high a

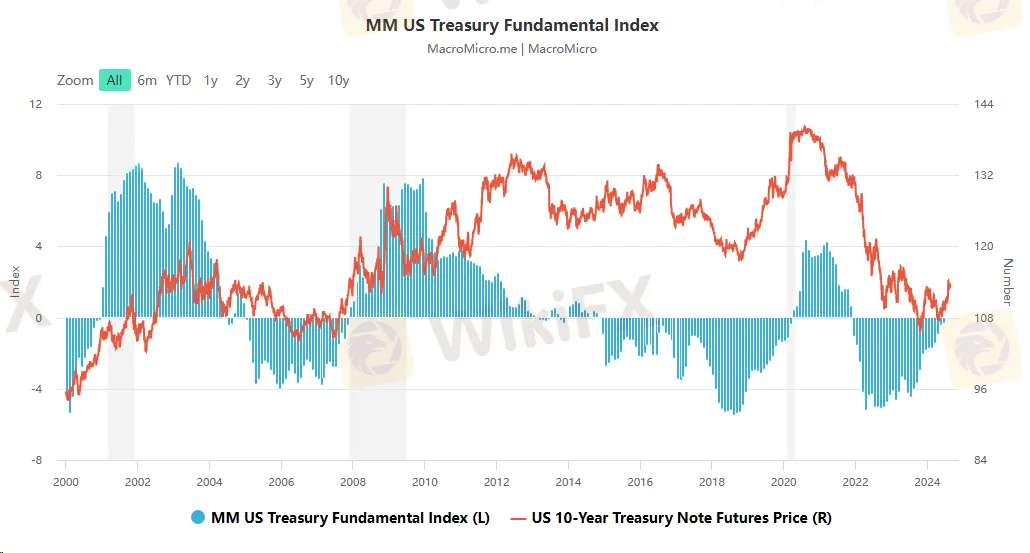

This week, the global financial market's attention is focused on the upcoming speech by Federal Reserve Chairman Jerome Powell at the Jackson Hole Annual Meeting. The market widely anticipates that Powell will pave the way for the Fed's interest rate cut actions and reassure investors that policymakers can prevent a significant economic slowdown. The significance of this speech lies not only in its initiation of the Fed's next phase in combating inflation but also in its timing amidst high-risk situations in the U.S. Treasury market.

The U.S. Bureau of Labor Statistics' preliminary report on non-farm employment and wages for the first quarter of 2024 shows that U.S. employment growth is much weaker than initially reported. Data indicates that the total non-farm employment in the U.S. for March 2024 was revised downward by 818,000 people, marking the largest revision since 2009. This correction is limited to the private sector, with significant employment declines in professional and business services, the information industry, leisure and hospitality, and manufacturing.

Despite this, the inversion of the U.S. Treasury yield curve between the 2-year and 10-year bonds has deepened, indicating market concerns about the economic outlook. Economists point out that initial employment data may have been exaggerated due to various factors, including adjustments for business creations and closures, and how to calculate unauthorized immigrant workers.The revised data may once again raise concerns among market and economists, who believe that the labor market is deteriorating much faster than initially expected. Against this backdrop, Powell and his colleagues face the challenge of appropriately adjusting monetary policy just seven weeks before the U.S. presidential election. They need to shift focus increasingly towards the cooling labor market after years of focusing on price pressures. Joseph Brusuelas, Chief Economist at RSM US LLP, suggests that the market needs to hear from Powell about the Fed's stance on potential policy shifts.

Investors have been on edge, trying to predict the speed and magnitude of future interest rate cuts. Labor market data from July triggered severe market fluctuations in early August, with the S&P 500 index falling more than 6% over three trading days. U.S. Treasuries rose as traders predicted that the Fed would initiate rate cuts in September, with a significant reduction of 50 basis points.

Powell's speech will be crucial as the rationale for the Fed's rate cut in September must be strong enough to counter political pressures surrounding the Fed during this year's election. This may involve pointing out the slowdown in the labor market and weak economic growth. However, Laura Rosner-Warburton, Senior Economist at MacroPolicy Perspectives, stated that he would not want to send overly negative signals about the economic outlook, “To prevent negative signals, the Fed needs to be very clear in its communication.”Traders currently expect the Fed to cut rates by 25 basis points next month and anticipate a total reduction of 75 to 100 basis points by the end of the year, lower than the 100 to 125 basis points predicted on August 2nd. Powell and other Fed officials have repeatedly emphasized that policy decisions will be “guided” by all upcoming data releases. Before the Fed's Open Market Committee meeting on September 17th to 18th, they will also receive a non-farm employment report and two inflation data reports.

In the recently released July FOMC minutes, the Fed revealed its assessment of the current economic situation and future policy direction. The minutes showed that the vast majority of officials believe that a rate cut in September might be appropriate, reflecting concerns about the potential further deterioration of the labor market. Although some officials were inclined to cut rates immediately at the July meeting, the decision was ultimately made to maintain interest rates to seek greater confidence that the inflation rate could reach the 2% target.

The minutes emphasized progress in inflation, noting that inflation has eased somewhat over the past year but remains high. Participants observed that inflation has made some further progress towards the committee's 2% target, especially as core goods prices stabilized after rising at the beginning of the year, and housing service price inflation has also slowed significantly. These factors have strengthened participants' confidence in the continued progress of inflation towards the target. The supply and demand conditions in the labor market continue to balance, with the unemployment rate rising, but the monthly job growth rate remains stable. However, some participants pointed out that reported employment growth may have been exaggerated, and actual employment growth may be below the level required to maintain the unemployment rate unchanged. The rebalancing of labor market conditions has also benefited from the expansion of labor supply, including an increase in labor force participation rates and strong immigration.

In terms of financial stability, participants believe it is necessary to monitor the vulnerabilities of the financial system. They pointed out that the banking system is sound but there are risks related to unrealized losses on securities, reliance on uninsured deposits, and interconnections with non-bank financial intermediaries. Futures markets reflect that the Fed will cut rates by about 100 basis points for the remainder of this year. After the release of the minutes, the US dollar index fell below the 101 mark, and the yield on the 10-year U.S. Treasury fell by 5.3 basis points to 3.765%, hitting a two-week low. Spot gold received a mild short-term increase in buying.

Economists generally believe that the Fed is getting closer to conquering high inflation. However, few economists believe that Powell or other Fed officials are ready to declare “mission accomplished.” The pace of the Fed's rate cuts in the coming months will depend on economic data. The government's report this month stated that the number of hires in July was much lower than expected, and the unemployment rate reached 4.3%, the highest in three years, triggering concerns that the U.S. economy might fall into a recession. Subsequently, healthier economic reports, including a further decline in inflation and strong retail sales growth, largely dispelled these concerns.

Wall Street traders currently expect the Fed to cut rates by 100 basis points this year, and given that there are only three meetings left in the year, this means there may be a 50 basis point rate cut. Some economists point out that if there are signs of further slowing in hiring, the possibility of the Fed cutting rates by 50 basis points in September will increase. The next employment report will be released on September 6th, after the Jackson Hole meeting, but before the Fed's next meeting in mid-September. Matthew Luzzetti, Chief U.S. Economist at Deutsche Bank, stated that given the Fed's focus on economic data, it would be difficult for Powell to commit to a specific path in advance at Jackson Hole. This indicates that although the market widely expects the Fed to cut rates, the specific path and magnitude of the rate cut will still depend on future economic data and changes in the global economic environment.

Federal Reserve Chairman Jerome Powell's speech at the Jackson Hole Annual Meeting is highly anticipated, with the market predicting that he will send a signal to cut interest rates to address the slowdown in employment growth and inflation issues. The latest data shows that the U.S. employment market is performing worse than expected, while inflation, although somewhat relieved, is still high. The Fed discussed the possibility of rate cuts in the July meeting minutes, which has attracted high attention from the financial market. It is expected that there may be a rate cut of 100 basis points within the year, and the specific decision will be based on subsequent economic data.

Disclaimer:

Le opinioni di questo articolo rappresentano solo le opinioni personali dell’autore e non costituiscono consulenza in materia di investimenti per questa piattaforma. La piattaforma non garantisce l’accuratezza, la completezza e la tempestività delle informazioni relative all’articolo, né è responsabile delle perdite causate dall’uso o dall’affidamento delle informazioni relative all’articolo.

WikiFX Trader

XM

IC Markets Global

STARTRADER

FXTM

EC Markets

Octa

XM

IC Markets Global

STARTRADER

FXTM

EC Markets

Octa

WikiFX Trader

XM

IC Markets Global

STARTRADER

FXTM

EC Markets

Octa

XM

IC Markets Global

STARTRADER

FXTM

EC Markets

Octa

Rate Calc