简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

KVB Market Analysis | 12 September: GBP/USD Hits 1.3100 on USD Weakness and Fed Cut Hopes

Sommario:Product: EUR/USDPrediction: IncreaseFundamental Analysis:The EUR/USD pair rose above the 1.1050 level on Thursday as markets embraced a risk-on attitude following U.S. Producer Price Index data, boost

Product: EUR/USD

Prediction: Increase

Fundamental Analysis:

The EUR/USD pair rose above the 1.1050 level on Thursday as markets embraced a risk-on attitude following U.S. Producer Price Index data, boosting expectations for a Federal Reserve rate cut next week. Traders are confident the Fed will begin a rate-cutting cycle on September 16.

With EU data being less significant on Friday, Euro traders are taking a breather after the European Central Bank lowered its main rate to 3.65% from 4.25%. The University of Michigans Consumer Sentiment Index will provide insights into U.S. consumer sentiment before the weekends.

In August, the U.S. PPI rose 0.2% month-on-month, with core PPI increasing to 0.3%. Year-on-year, headline PPI eased to 1.7%, below expectations of 1.8%, while core PPI held steady at 2.4%. Initial Jobless Claims increased slightly to 230K.

With PPI inflation remaining low and unemployment claims steady, theres little blocking a Fed rate cut on September 18. The Fed is widely expected to cut rates by 25 basis points, with over 80% odds of this occurring next week, while traders anticipate four total cuts, with December rates expected between 425 and 450 basis points.

Technical Analysis:

If bullish momentum continues, EUR/USD may face initial resistance at the September high of 1.1155 before targeting the 2024 peak of 1.1201 and the 2023 high of 1.1275.

On the downside, the next target is the September low of 1.1001, followed by the preliminary 55-day SMA at 1.0948 and the weekly low of 1.0881. The key 200-day SMA is at 1.0861, followed by the weekly low of 1.0777 and the June low of 1.0666.

The pair's upward trend is expected to continue as long as it stays above the 200-day SMA. The four-hour chart shows a slight increase in positive sentiment, with initial resistance at the 100-SMA at 1.1091, followed by 1.1155 and 1.1190. Immediate support is around 1.1001, then at 1.0949. The relative strength index is above 56.

Product: XAU/USD

Prediction: Increase

Fundamental Analysis:

Gold remains bullish, trading at a record high of around $2,550, supported by a slight pullback in the U.S. Dollar. U.S. data revealed that annual producer inflation fell to 1.7% in August from 2.1% in July.

Spot Gold reached an all-time high of $2,555.11 on Thursday, following the European Central Bank's monetary policy announcement and key U.S. economic figures. While the news had limited impact on the FX market, it provided support for XAU/USD as U.S. indexes struggled after Wall Street opened.

The ECB lowered the deposit rate by 25 basis points to 3.5% and cut the main refinancing rate by 60 basis points to 3.65%. In the U.S., the Producer Price Index (PPI) rose 1.7% year-on-year, below expectations, while Initial Jobless Claims met forecasts at 230K. These figures support a Federal Reserve interest rate cut but dont suggest an aggressive 50 basis point reduction. U.S. Dollar weakened afterward.

Technical Analysis:

XAU/USD is trading just below its record high, maintaining a bullish outlook. The daily chart shows it has found support around a rising 20 Simple Moving Average for six days, while the 100 and 200 SMAs continue to trend upward, further below. Technical indicators have gained bullish momentum and have room for further increases.

On the 4-hour chart, the risk is tilted upward. The 20 SMA is rising above a flat 100 SMA, which is over $30 below the current price, while the 200 SMA is also climbing below the others. Technical indicators, including the Relative Strength Index, are showing strong upward movement, nearing overbought levels, but there are no signs of bullish exhaustion. Buyers are likely to take advantage of pullbacks, aiming for higher highs.

Product: GBP/USD

Prediction: Increase

Fundamental Analysis:

GBP/USD rose above 1.3100 on Thursday as the U.S. Dollar weakened amid increased risk appetite. U.S. Producer Price Index data met market expectations but didn't clarify inflation trends, supporting hopes for a Federal Reserve rate cut.

On Friday, the UK will release Consumer Inflation Expectations, while the U.S. focuses on the Michigan Consumer Sentiment Index for September, with markets looking for a positive shift ahead of next weeks Fed meeting.

In August, U.S. PPI increased by 0.2% month-on-month, and core PPI rose 0.3%. Year-on-year, headline PPI eased to 1.7%, below the expected 1.8%. The Fed is anticipated to cut rates by 25 basis points on September 18, with over 80% odds for this outcome.

Technical Analysis:

GBP/USD capitalized on the U.S. Dollar's weakness on Thursday, rising back above the 1.3100 level after briefly falling below it earlier this week. The pair stabilized mid-week, bouncing just above the 1.3000 mark.

Price action remains bullish, with bids well above the 50-day Exponential Moving Average at 1.2970. Although short pressure has kept the price below recent multi-year highs just above 1.3250, a further decline to the 200-day EMA at 1.2757 seems increasingly unlikely.

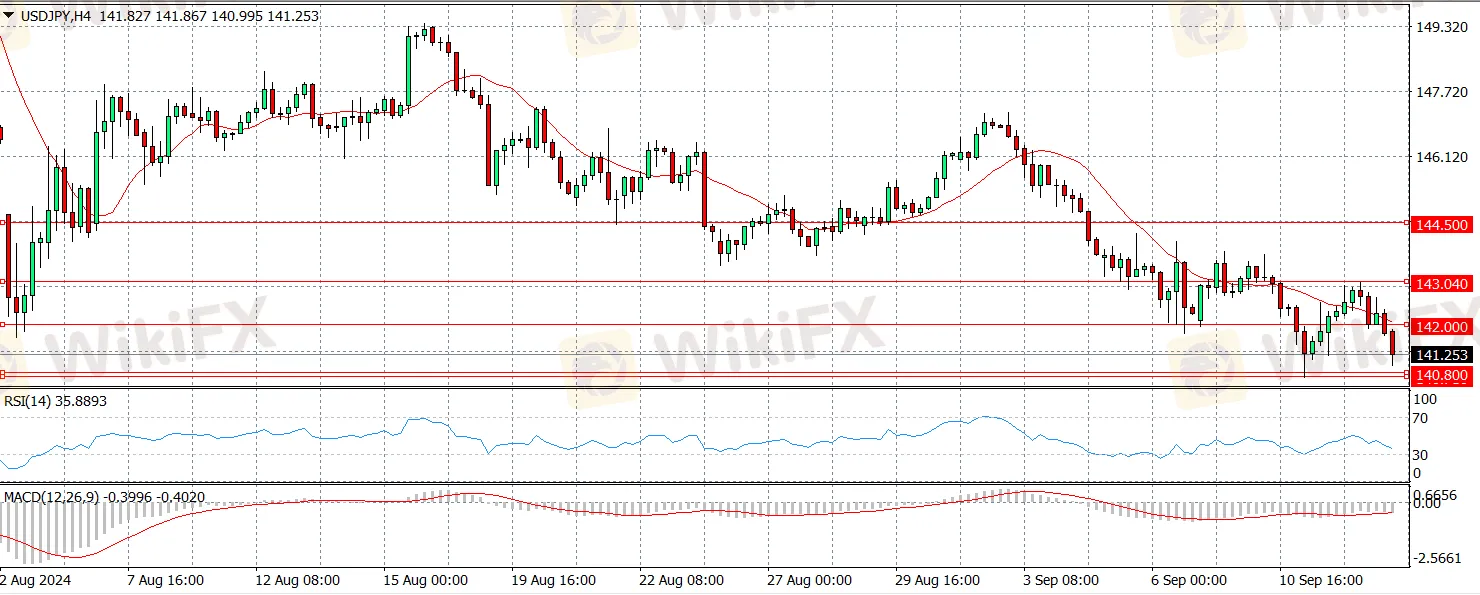

Product: USD/JPY

Prediction: Decrease

Fundamental Analysis:

The USD/JPY pair weakened further, dropping below the mid-141.00s during the Asian session on Friday, moving closer to the year-to-date low reached earlier this week. The current market conditions favor bearish traders, supporting a continuation of the downtrend seen over the past two months.

The U.S. Dollar hit a new weekly low as expectations rise for a more aggressive rate cut by the Federal Reserve next week, following softer-than-expected U.S. Producer Price Index data. Markets now see over a 40% chance of a 50 basis point cut at the September meeting, keeping U.S. Treasury yields near 2024 lows, which pressures the dollar.

Conversely, the Japanese Yen benefits from the Bank of Japan's hawkish signals, suggesting possible future rate hikes if the economy meets forecasts. BoJ board member Naoki Tamura stated that ending the easy policy is still a long way off. This creates a significant divergence from the dovish Fed outlook, prompting the unwinding of Japanese Yen carry trades and contributing to the downward pressure on the USD/JPY pair.

Technical Analysis:

The USD/JPY pair shows a downward trend, but after Wednesday's long tail, it may experience an upward correction and test key resistance levels.

Bears are still in control, as indicated by the Relative Strength Index, which, while flat, suggests potential consolidation ahead.

If USD/JPY closes below 142.00, it could drop towards the September 11 low of 140.71. If that level is breached, the next target would be the cycle low of 140.25 from December 28, 2023, followed by 140.00.

On the upside, initial resistance is at 142.00. If surpassed, the next targets are the September 12 high of 143.04, the Tenkan-Sen at 143.96, and Senkou Span A at 144.50.

Market Analysis Disclaimer:

The market analysis provided by KVB Prime Limited is for informational purposes only and should not be construed as investment advice or a recommendation to buy or sell any financial instrument. Trading forex and other financial markets involves significant risk, and past performance is not indicative of future results.

KVB Prime Limited does not guarantee the accuracy, completeness, or timeliness of the information provided in the market analysis. The content is subject to change without notice and may not always reflect the most current market developments or conditions.

Clients and readers are solely responsible for their own investment decisions and should seek independent financial advice from qualified professionals before making any trading or investment decisions. KVB Prime Limited shall not be liable for any losses, damages, or other liabilities arising from the use of or reliance on the market analysis provided.

By accessing or using the market analysis provided by KVB Prime Limited, clients and readers acknowledge and agree to the terms of this disclaimer.

RISK WARNING IN TRADING

Transactions via margin involve products that use leverage mechanisms, carry high risks, and are certainly not suitable for all investors. THERE IS NO GUARANTEE OF PROFIT on your investment, so be wary of those who guarantee profits in trading. You are advised not to use funds if you are not prepared to incur losses. Before deciding to trade, ensure that you understand the risks involved and also consider your experience.

Disclaimer:

Le opinioni di questo articolo rappresentano solo le opinioni personali dell’autore e non costituiscono consulenza in materia di investimenti per questa piattaforma. La piattaforma non garantisce l’accuratezza, la completezza e la tempestività delle informazioni relative all’articolo, né è responsabile delle perdite causate dall’uso o dall’affidamento delle informazioni relative all’articolo.

WikiFX Trader

VT Markets

FP Markets

Octa

ATFX

EC Markets

OANDA

VT Markets

FP Markets

Octa

ATFX

EC Markets

OANDA

WikiFX Trader

VT Markets

FP Markets

Octa

ATFX

EC Markets

OANDA

VT Markets

FP Markets

Octa

ATFX

EC Markets

OANDA

Rate Calc