简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

【MACRO Insight】U.S. Economic Data and Gold Market Dynamics: Surge in Gold Futures Contract Trading V

Sommario:On Thursday, investors closely watched the release of U.S. initial jobless claims and the Producer Price Index (PPI). The data showed that for the week ending September 7th, the number of initial jobl

On Thursday, investors closely watched the release of U.S. initial jobless claims and the Producer Price Index (PPI). The data showed that for the week ending September 7th, the number of initial jobless claims in the U.S. recorded 230,000, slightly higher than the previous week's 227,000, but in line with market expectations. The August PPI year-over-year rate was recorded at 1.7%, lower than the expected 1.8%, while the month-over-month rate was recorded at 0.2%, exceeding the expected 0.1%. Following the release of these figures, market expectations for a 25 basis point rate cut by the Federal Reserve at the upcoming meeting were strengthened.

In this context, the price of spot gold continued to rise, touching a historical high of $2,550 per ounce, an increase of nearly $40 from the daily low. Spot silver also performed strongly, standing above $29 per ounce, with a daily increase of 2%. Meanwhile, the U.S. Dollar Index gave up all of its intraday gains.

It is worth noting that the data collection period last week included the U.S. Labor Day holiday, which typically leads to fluctuations in the number of jobless claims. However, since falling from an 11-month high of 250,000 in late July, this indicator has remained at a lower level. Furthermore, the number of continued jobless claims in the U.S. for the week ending August 31st was 1.85 million, a slight increase of 5,000. Despite this, the low level of layoffs indicates that the U.S. labor market remains healthy, with businesses still having a strong demand to maintain current staffing levels.

In addition to U.S. economic data, the European Central Bank also announced its second interest rate cut this year on Thursday and lowered its economic growth forecast. This led traders to reduce their expectations for the ECB's interest rates, anticipating another 36 basis point cut before the end of the year. The euro rose against the U.S. dollar, putting pressure on the U.S. Dollar Index.

Ole Hansen, Head of Commodity Strategy at Saxo Bank, stated that the ECB's rate cut, the slight increase in unemployment benefit claims, and the combination of PPI data were enough to push gold prices to a historical high. He added that for the gold market, the start of an interest rate cut cycle could provide support for gold prices, regardless of the magnitude of the rate cut. Lower interest rates are typically beneficial for non-yielding assets like gold and silver. Gold prices have risen more than a fifth this year, with recent strength supported by expectations that the Federal Reserve will soon begin an interest rate cut cycle. Strong demand from central bank purchases and the over-the-counter market has also helped the rebound of this precious metal.

If gold bulls continue to break through the historical high of $2,532, the psychological level of $2,550 will become the new resistance. However, if gold prices face resistance near the $2,530 range again, a correction will follow, and a daily close below the 21-day moving average of $2,503 will negate the short-term bullish outlook. During the U.S. trading session, the price of spot gold once stood above $2,540 per ounce, setting a new historical high. Eric Strand, founder of AuAg Funds, said in an interview that considering the scale of money printing and sovereign debt, he believes the fair value of gold is around $4,000 per ounce. Despite the Federal Reserve's aggressive tightening of monetary policy leading to a significant decrease in money supply, money printing has not stopped, and U.S. debt has swelled to over $35 trillion.

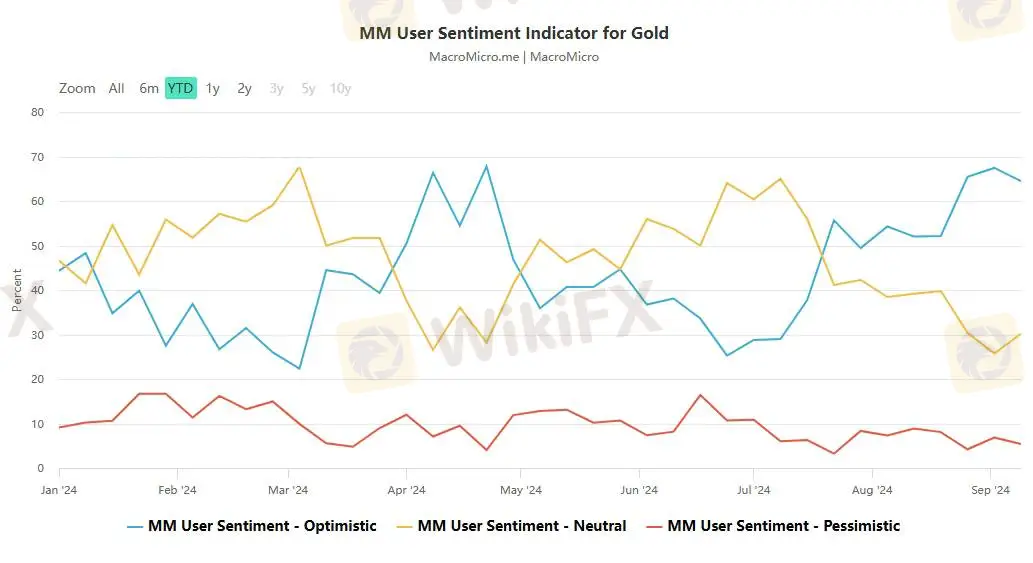

Strand pointed out that despite the Federal Reserve's significant rate hikes to reduce inflationary pressures, the increase in global deficit spending means that consumer prices are unlikely to remain low for a long time. He emphasized that gold and silver are the best protection against money printing, which is why he firmly believes in them. He expects that with the Federal Reserve expected to cut interest rates next week, investors will begin to see the value of holding gold, even at such high prices. He also mentioned that Western investors have only just begun to buy gold, with a global gold allocation of about 1%. If this ratio normalizes to 5%, it will have a revolutionary impact on gold prices.

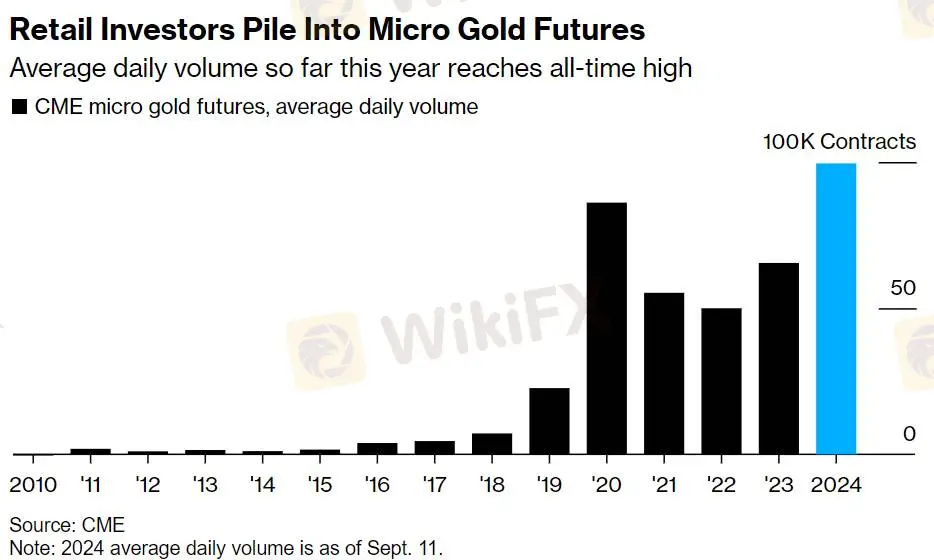

Retail investors are flocking to the micro gold futures contracts of the CME Group, and the price of this precious metal has set a new record. According to data from the largest U.S. derivatives exchange, as of September 11, the average daily trading volume of micro gold futures contracts was 99,527, surpassing the 2020 annual volume, which reached a historical high of 86,101.

Investors are flocking to gold as more and more people expect the Federal Reserve to enter an interest rate cut cycle soon.

In a low-interest-rate environment, gold is often a preferred investment. Gold prices continued to hit new highs on Friday, extending the nearly 2% increase on Thursday, as the U.S. dollar weakened further before the widely expected interest rate cut by the Federal Reserve next week. As of the time of writing, gold was up nearly 0.4% during the day and once stood above the $2,570 mark, although it has since pulled back, but it is expected to rise by 3% this week.

At the same time, retail investor interest is also on the rise. Traders are also weighing two U.S. data released on Thursday, showing an increase in unemployment benefit claims and a slight rise in the August PPI, but the data categories included in the Federal Reserve's preferred inflation indicator performed flatly. It is worth noting that after the “Fed Mouthpiece” article, traders raised their bets on a 50 basis point interest rate cut by the Federal Reserve on September 18 from about 28% before the article to 41%. Investors closing short gold positions may also have driven up gold prices. According to the latest data, as of the week ending September 3, the total short position of hedge funds on New York Mercantile Exchange gold futures was at its highest level in four weeks.

As the gold market continues to heat up, it seems that investor interest in gold will only increase. The rise in gold prices not only reflects the market's concerns about global economic uncertainty but also shows the appeal of gold as a traditional safe-haven asset. The policy moves of the Federal Reserve, geopolitical tensions, and the monetary policies of central banks around the world will continue to affect the trajectory of gold prices. In this context, participants in the gold market need to stay alert and closely monitor the release of economic data and statements by policymakers.

At the same time, investors should also consider diversifying their investment portfolios to reduce potential market risks. Gold, as a long-standing means of storing wealth, will undoubtedly continue to play an important role in investors' asset allocation. Ultimately, the future development of the gold market will depend on the interplay of a variety of complex factors. However, it is certain that with the continuous changes in the global economic and political landscape, the position of gold as a safe-haven asset will become more prominent, and its price fluctuations will continue to attract the attention of investors worldwide.

Disclaimer:

Le opinioni di questo articolo rappresentano solo le opinioni personali dell’autore e non costituiscono consulenza in materia di investimenti per questa piattaforma. La piattaforma non garantisce l’accuratezza, la completezza e la tempestività delle informazioni relative all’articolo, né è responsabile delle perdite causate dall’uso o dall’affidamento delle informazioni relative all’articolo.

WikiFX Trader

FP Markets

FBS

HFM

IQ Option

GO MARKETS

ATFX

FP Markets

FBS

HFM

IQ Option

GO MARKETS

ATFX

WikiFX Trader

FP Markets

FBS

HFM

IQ Option

GO MARKETS

ATFX

FP Markets

FBS

HFM

IQ Option

GO MARKETS

ATFX

Rate Calc