简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

KVB Market Analysis | 1 October: USD/JPY Retreats to 143.50 Amid Economic Data and Fed Expectations

Sommario:Product: EUR/USDPrediction: IncreaseFundamental Analysis:EUR/USD is struggling to gain support, holding near 1.1150 ahead of a key EU inflation report on Tuesday, while investors focus on the upcoming

Product: EUR/USD

Prediction: Increase

Fundamental Analysis:

EUR/USD is struggling to gain support, holding near 1.1150 ahead of a key EU inflation report on Tuesday, while investors focus on the upcoming Non-Farm Payrolls data. The pair retreated from Fridays gains, falling nearly a cent from above 1.1200 to around 1.1110 by the end of the North American session on Monday. This decline followed a rebound in the U.S. Dollar, which recovered from an initial drop to 100.15, as U.S. yields rose.

Despite stimulus announcements in China, risk-linked assets remained flat. Market participants expect further easing from the Federal Reserve in November and December, while the ECB acknowledged persistent inflation. If the Fed cuts rates further, it may support EUR/USD, but the U.S. economy is expected to outperform Europe, limiting dollar weakness.

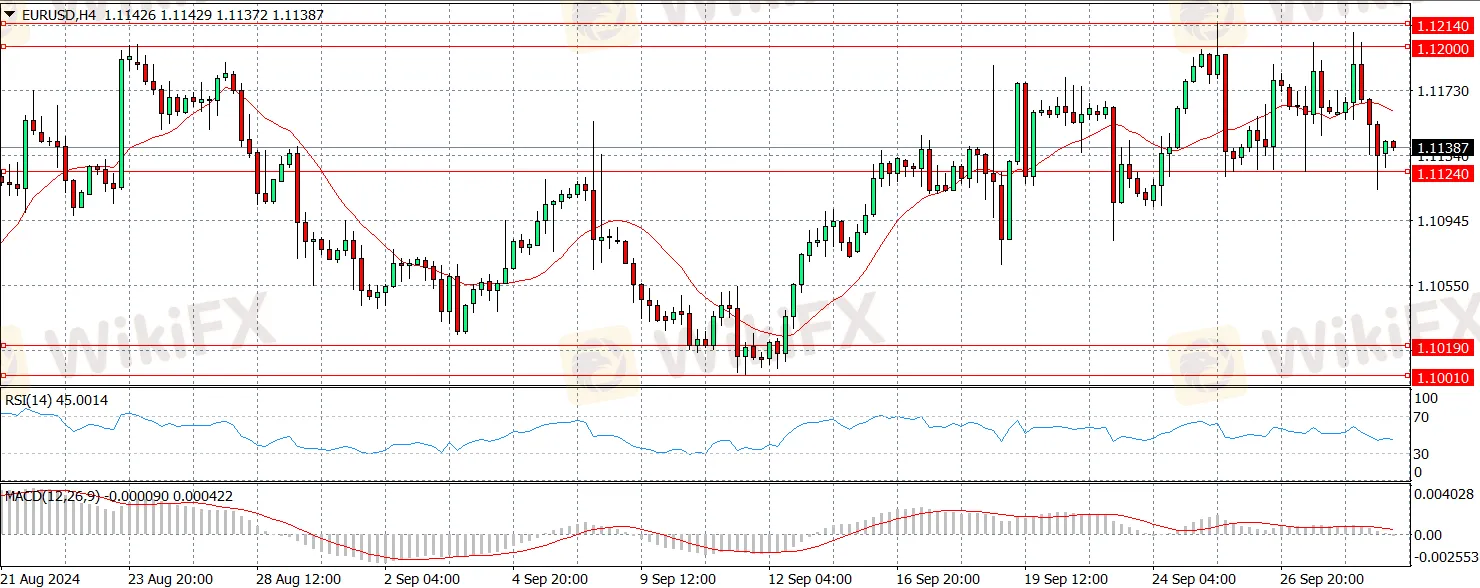

Technical Analysis:

Further increases in EUR/USD are likely to face initial resistance at the 2024 high of 1.1214, followed by the 2023 peak of 1.1275.

On the downside, the next target is the provisional 55-day SMA at 1.1019, then the September low of 1.1001, and the weekly low of 1.0881.

The upward trend is expected to continue as long as the pair stays above the key 200-day SMA at 1.0874. The four-hour chart shows a return of bearish momentum, with initial resistance at 1.1214 and 1.1275. Support levels are at 1.1113, the 200-SMA at 1.1101, and 1.1082, while the relative strength index has fallen to around 45.

Product: XAU/USD

Prediction: Increase

Fundamental Analysis:

Gold prices are finding support around $2,625-2,624, having stalled their pullback from last week's record high. Geopolitical risks and mixed performances in Asian equity markets are driving safe-haven flows toward XAU/USD. On Monday, gold dipped into the $2,650s as traders took profits after a nearly 1.4% rally to new highs. A strong rise in Chinese stocks, particularly a 7.5% gain in the CSI 300, and a positive outlook for the Chinese property market due to lower mortgage rates are diverting interest from gold.

Investor opinions on gold's future vary. Darin Newsom from Barchart.com expects the uptrend to continue amid rising global uncertainties, while Ole Hansen from Saxo Bank sees momentum fading. Adrian Day anticipates little short-term change but remains bullish over the next six to twelve months as Western investors begin to buy gold.

Technical Analysis:

Gold continues to pull back after reaching record highs, but it remains in an uptrend over the short, medium, and long term. In technical analysis, the principle that “the trend is your friend” suggests further upside for the metal.

Currently, gold is considered overbought according to the Relative Strength Index, nearing neutral territory (below 70). If it closes daily within this neutral zone, traders may close long positions and consider shorting. For now, being overbought advises against adding to long positions.

If a deeper correction occurs, strong support is at $2,600, $2,550, and $2,544. However, given golds strong uptrend, any correction may be short-lived, allowing bulls to push prices higher. Upside targets are $2,700 and $2,750.

Product: USD/JPY

Prediction: Decrease

Fundamental Analysis:

USD/JPY is pulling back toward 143.50 in Tuesday's Asian session after recent highs. Mixed economic data from Japan and the Bank of Japan's hawkish stance on rate hikes are supporting the Yen, causing a slight dip amidst a steady U.S. Dollar.

Shigeru Ishiba stated that monetary policy should remain accommodative given current conditions. Investors are awaiting the BoJ's Summary of Opinions from the September 20 meeting, where rates were held at 0.1%-0.25%.

A slight recovery in the U.S. Dollar has also impacted the pair, with the U.S. Dollar Index near 100.50 ahead of Fed Chair Jerome Powell's speech at 17:00 GMT. Powell's guidance is anticipated as the CME FedWatch tool indicates a potential total cut of 75 basis points, with another 50 basis points expected in November and December. The Fed began its rate-cut cycle on September 18 with a 50 basis point reduction.

Technical Analysis:

The USD/JPY pair still has a downward bias, despite recent gains that pushed it above the Tenkan-Sen and Kijun-Sen levels of 143.46 and 143.39, respectively. However, the price remains below the 200-day moving average and the Ichimoku Cloud, indicating that sellers are in control.

The Relative Strength Index suggests that buyers are gaining some momentum but need to break through key resistance levels.

If USD/JPY surpasses 144.00, the next target will be 145.00, then the 50-day moving average at 145.92, with a potential stop at the bottom of the Kumo around 148.00-148.20.

Conversely, if it stays under 144.00, a pullback to the Tenkan-Sen at 143.46 is possible, followed by the Kijun-Sen at 143.39 and the 143.00 level.

Disclaimer:

Le opinioni di questo articolo rappresentano solo le opinioni personali dell’autore e non costituiscono consulenza in materia di investimenti per questa piattaforma. La piattaforma non garantisce l’accuratezza, la completezza e la tempestività delle informazioni relative all’articolo, né è responsabile delle perdite causate dall’uso o dall’affidamento delle informazioni relative all’articolo.

WikiFX Trader

Vantage

GO MARKETS

Pepperstone

EC Markets

Tickmill

XM

Vantage

GO MARKETS

Pepperstone

EC Markets

Tickmill

XM

WikiFX Trader

Vantage

GO MARKETS

Pepperstone

EC Markets

Tickmill

XM

Vantage

GO MARKETS

Pepperstone

EC Markets

Tickmill

XM

Rate Calc