简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

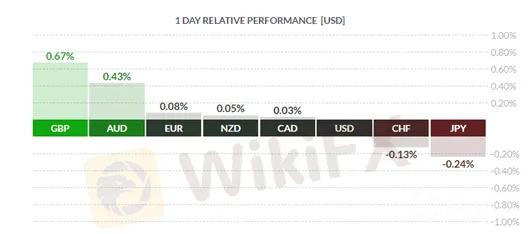

GBPUSD Outperforming, US Dollar Bounces on Strong Retail Sales - US Market Open

概要:GBPUSD Outperforming, US Dollar Bounces on Strong Retail Sales - US Market Open

MARKET DEVELOPMENT – GBPUSD Outperforming, US Dollar Bounces on Retail Sales

市场发展 - 英镑兑美元跑赢大盘,美元兑零售销售反弹

DailyFX 2019 FX Trading Forecasts

DailyFX 2019外汇交易预测

GBP: Outperformance in the Pound this morning following a surprise lift in UK retail sales (headline monthly figure 0.2% vs. Exp. -0.2%). Alongside this, much of the gains in GBPUSD have stemmed from cross related selling seen in EURGBP, which has made a break below the 0.9200 handle. With Brexit uncertainty continuing, gains are likely to be modest at best. Elsewhere, Jeremy Corbyn has called out for leaders and Tory rebels to back his plan for a no-confidence in the government, however, this appears to be a tall order for Corbyn with the Lib Dem leader stating that they will not support his plan.

英镑:今早在突然升力后英镑表现突出英国零售销售数据(总体月度数据为0.2%,而实际数字为-0.2%)。除此之外,英镑兑美元的大部分上涨源于欧元兑英镑的交叉相关抛售,其已跌破0.9200区间。随着英国脱欧的不确定性继续存在,涨幅最多可能是温和的。在其他地方,杰里米·科尔宾呼吁领导人和保守党叛乱分子支持他对政府不信任的计划,然而,对于科尔宾来说,这似乎是一个很高的命令,民主党领导人表示他们不会支持他的计划。

USD: The US Dollar has pared earlier losses following a strong US retail sales report, potentially reducing some concerns of an imminent recession. US retail sales control group rose 1% above expectations of 0.3%, which in turn is likely to boost various GDP trackers given the sizeable weighting that the retail sales data has.

美元:在美国零售销售报告强劲之后,美元已经回吐早前的跌幅,可能减少对即将到来的经济衰退的担忧。美国零售销售控制组比预期的0.3%上涨1%,这反过来可能推动各种GDP跟踪器,因为零售销售数据具有相当大的权重。

NOK: The only hawkish central bank in the G10 complex reiterated that ongoing tightening in 2019 is appropriate. However, the Norges Bank did cite increasing downside risks pertaining to the recent trade war escalation, which in turn saw the NOK take a slight hit as the Norges Bank refrained from explicitly mentioning a September rate hike in order to provide some flexibility with the regard to another rate hike.

NOK: G10综合体中唯一强硬的中央银行重申,2019年的持续紧缩是合适的。然而,挪威银行确实引用了与近期贸易战升级相关的不断下行的风险,而挪威央行因为明确提到9月加息而没有提供一定的灵活性,因此挪威克朗受到轻微打击。另一次加息。

Source: Finviz

来源:Finviz

IG Client Sentiment

IG Client Sentiment

免責事項:

このコンテンツの見解は筆者個人的な見解を示すものに過ぎず、当社の投資アドバイスではありません。当サイトは、記事情報の正確性、完全性、適時性を保証するものではなく、情報の使用または関連コンテンツにより生じた、いかなる損失に対しても責任は負いません。

WikiFXブローカー

レート計算