简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

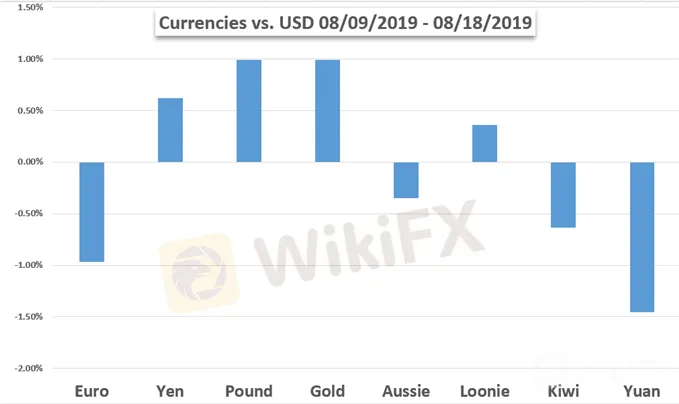

Trading Forecast: EURUSD and Dow Bearings Rest on Jackson Hole, Trump

Özet:Scheduled event risk is starting to give way to sentiment and systemic fundamental concerns a prospect that threatens volatility at a time of year when quiet is supposed to prevail. Trade wars are finding guidance from headlines that President Trump regularly tops, while recession fears are tied more closely to

Scheduled event risk is starting to give way to sentiment and systemic fundamental concerns – a prospect that threatens volatility at a time of year when quiet is supposed to prevail.

Australian Dollar Bears Rule But May Not Turn Up Heat This Week

The Australian Dollar remains close to notable lows against its US counterpart and the market is still betting on aggressive rate cuts from the RBA

Sliding Crude Oil Can't Look to Jackson Hole For Price Support

Crude oil prices continue to drop as the economic data keep huge question marks glowering over likely demand levels.

US Dollar May Rise if Fed Minutes and Jackson Hole Spook Markets

The US Dollar may rise if the Fed meeting minutes and commentary at the Jackson Hole symposium spooks markets and boost demand for liquidity.

Sterling Price Weekly Forecast: Brexit Newsflow and Political Manoeuvres

Next weeks UK data vacuum will be filled by the latest political shenanigans with rumor and counter-rumor focusing on who is up to what, with who and why.

S&P 500, DAX Fundamental Forecast

The ominous sign stemming from the inversion of the US 2s10s provides yet another reminder that the global economic outlook is weakening.

Euro May Fall as ECB Easing Looms, Italy Flirts with Early Elections

The Euro may fall as dovish ECB meeting minutes and soft PMI data set the stage for easing in September while Italy flirts with early elections.

Chart Legend

Black = Oil (CL Futures)

Yellow = Gold (XAUUSD)

Green = USD (DXY Index)

Feragatname:

Bu makaledeki görüşler yalnızca yazarın kişisel görüşlerini temsil eder ve bu platform için yatırım tavsiyesi teşkil etmez. Bu platform, makale bilgilerinin doğruluğunu, eksiksizliğini ve güncelliğini garanti etmez ve makale bilgilerinin kullanılması veya bunlara güvenilmesinden kaynaklanan herhangi bir kayıptan sorumlu değildir.

WikiFX Broker

Son Haberler

Cumhurbaşkanı Erdoğan: Sosyal konut seferberliği başlatmayı planlıyoruz

Bakan Şimşek: Asgari ücret enflasyonun üzerinde artıyor

Ekonomiye güven 8 ayın zirvesine çıktı

Yeni teşvik sistemi geliyor

Türkiye'nin not takvimi belli oldu

Cumhurbaşkanı Erdoğan'dan asgari ücret mesajı: Sapma olursa değerlendiririz

Çiftçilerin kayıt için son tarihi 31 Aralık

Borsada haftanın kazandıranları

Memur ve emekli zam beklentisi 2025: : Memur ve emekli maaşı zammı ne kadar, yüzde kaç olur? Zam oranı ayın kaçında açıklanacak?

Adıyaman Diyarbakır arası 30 dakika kısalıyor

Kur Hesaplayıcı