Bağımsız bir üçüncü taraf bilgi hizmeti platformu olarak WikiFX, kullanıcılara kapsamlı ve objektif bayi düzenleme bilgileri sorgulama hizmetleri sağlamaya kendini adamıştır. WikiFX herhangi bir döviz ticareti faaliyetine doğrudan katılmaz ve herhangi bir ticaret kanalı tavsiyesi veya yatırım tavsiyesi sağlamaz. WikiFX'in yatırımcılara yönelik derecelendirmesi, kamu kanallarından alınan objektif bilgilere dayanmaktadır ve farklı ülke ve bölgelerdeki düzenleyici politikalardaki farklılıkları tamamen hesaba katmaktadır. Yatırımcı derecelendirmeleri WikiFX'in temel ürünüdür. Objektifliğine ve tarafsızlığına zarar verebilecek her türlü iş uygulamasına kesinlikle karşı çıkıyoruz ve dünya çapındaki kullanıcıların denetimini ve önerilerini memnuniyetle karşılıyoruz. Bildirim hattı: report@wikifx.com

- Takip Ediliyor

- Size Özel

- Anlar

- Iş

FX8176876492

Dollar Trend with high probability setup

#FedRateCutAffectsDollarTrend

As of March 3, 2025, the U.S. dollar (USD) remains robust, influenced by various economic factors. The USD/JPY pair, in particular, has shown potential for a rebound this month.

Current USD Trends

• USD/JPY Performance: Historically, March has been the third strongest month for the USD/JPY pair since the Bretton Woods agreement, suggesting a potential bounce after February’s decline.

• Economic Growth: The U.S. economy is projected to grow by 2.7% in 2024, outpacing the 1.7% growth forecast for other developed markets. This robust growth supports the dollar’s strength.

• Inflation Trends: The U.S. Personal Consumption Expenditure (PCE) Price Index indicates slowing inflation, which may influence the Federal Reserve’s monetary policy decisions.

High-Probability Trading Setups for USD

To capitalize on the current dollar trends, consider the following high-probability trading setups:

1. Trend Following: Align trades with the prevailing USD strength by identifying and entering positions in the direction of the trend.

28m

FX2445613070

Fed rate cuts determination

#FedRateCutAffectsDollarTrend

How the Fed Determines Rate Cuts

The Federal Reserve (Fed) decides to cut interest rates based on several key economic factors. A rate cut is meant to stimulate economic growth by making borrowing cheaper and encouraging spending. Here’s what influences the Fed’s decision:

1. Inflation Trends

• If inflation is too low or falling below the Fed’s 2% target, the Fed may cut rates to prevent deflation.

• Lower rates increase spending and investment, helping push inflation back up.

2. Economic Growth (GDP)

• If economic growth is slowing or the U.S. is at risk of a recession, the Fed cuts rates to boost activity.

• Lower borrowing costs encourage businesses to invest and consumers to spend, helping the economy recover.

3. Employment & Job Market Conditions

• If unemployment is rising, the Fed may cut rates to stimulate hiring and job creation.

• Lower interest rates make business loans cheaper, encouraging companies to expand.

4. Financial Market Stability

• If the stock market or financial system is under stress (e.g., banking crises or liquidity issues), the Fed may lower rates to provide stability.

• Lower rates increase credit availability, preventing economic downturns.

5. Global Economic & Geopolitical Factors

• Economic slowdowns in major economies (e.g., Europe, China) can weaken U.S. exports, prompting the Fed to cut rates.

• Trade wars, geopolitical risks, or oil price shocks may also influence rate decisions.

6. Government Debt & Fiscal Policy

• High government spending or debt concerns can push the Fed to lower rates.

42m

FX3339797889

HOW TO ISE AI TRADING BEFORE TAKING TRADE

#AITradingAffectsForex

How to Use AI Trading Before Taking a Trade

Before executing a trade, AI can help with market analysis, strategy optimization, and risk management. Here’s a step-by-step approach to using AI effectively before taking a trade:

1. Backtest Your Strategy

• Use AI to test your trading strategy on historical data to see how it would have performed.

• Adjust parameters based on AI-generated insights to improve success rates.

2. Analyze Market Conditions

• AI scans real-time market data, including price trends, volatility, and technical indicators.

• AI-powered sentiment analysis can assess news, social media, and economic reports for potential market impact.

3. Identify High-Probability Trade Setups

• AI detects chart patterns, breakouts, and support/resistance levels to find optimal trade entry points.

• Machine learning models can predict potential price movements based on past patterns.

4. Set Risk Management Parameters

• AI recommends stop-loss and take-profit levels based on market volatility.

• Uses position sizing to ensure you don’t risk too much on a single trade.

5. Check Correlations & Market Sentiment

• AI analyzes correlations between currency pairs, stocks, or commodities to avoid conflicting trades.

• Sentiment analysis helps confirm if traders are bullish or bearish on an asset.

6. Automate Execution or Use AI as an Assistant

• You can use AI-powered bots for automatic trading or get AI-generated trade signals for manual execution.

• AI can monitor trades in real time and adjust stop-loss levels dynamically.

7. Monitor Performance & Adjust

• After taking trades, AI continuously tracks performance, learning from past results.

• Uses data-driven insights to refine your strategy over time.

Final Thought

AI trading is a powerful tool for research, risk management, and execution, but it should be used alongside human judgment to adapt to market changes and unexpected events.

36m

FX3194560240

Trade with Ai make you secure your capital

#AITradingAffectsForex

Does AI Trading Secure Your Capital?

AI trading can help reduce risks and protect capital, but it does not guarantee complete security. Here’s how AI helps secure capital and the risks involved:

✅ How AI Trading Helps Secure Capital

1. Automated Risk Management

• AI sets stop-loss and take-profit levels to prevent large losses.

• Uses position sizing to avoid overexposure in a single trade.

2. Emotion-Free Trading

• Eliminates fear, greed, and impulsive decisions that often lead to losses.

• Trades based on data-driven strategies, ensuring consistency.

3. Real-Time Market Analysis

• AI scans market data, news, and price trends instantly, reacting faster than humans.

• Identifies high-probability trades while avoiding risky setups.

4. Backtesting & Strategy Optimization

• AI tests strategies on historical data before using them in live markets.

• Helps traders refine approaches and reduce potential losses.

5. Diversification & Multi-Market Trading

• AI can trade multiple assets and markets.

51m

FX2743587371

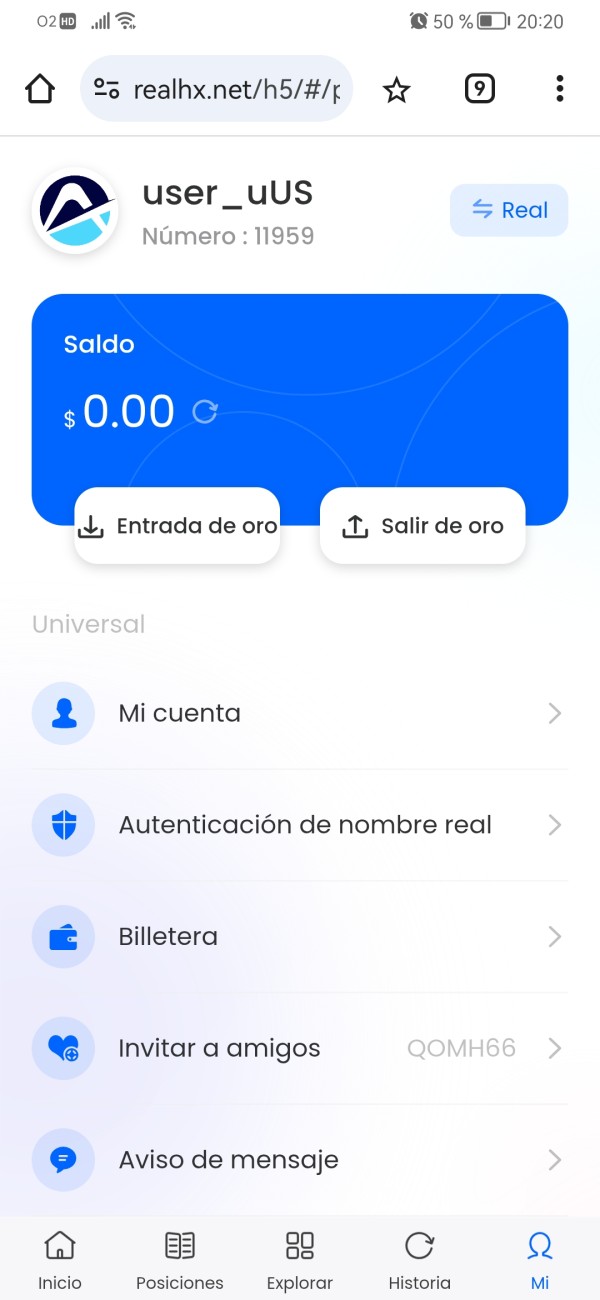

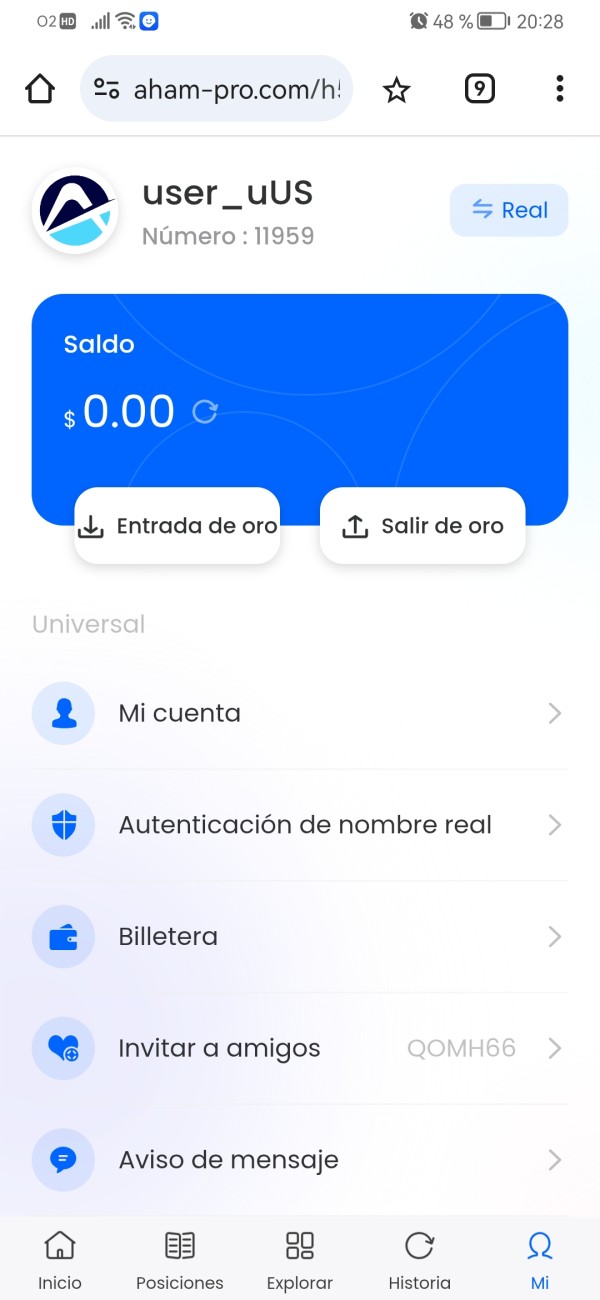

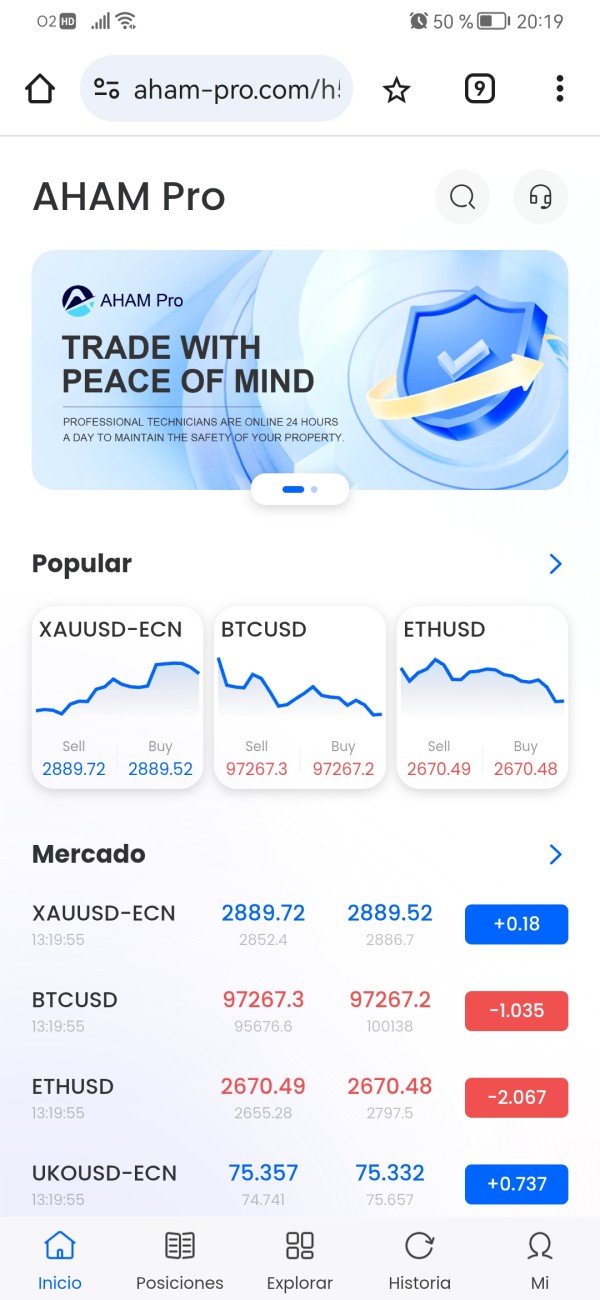

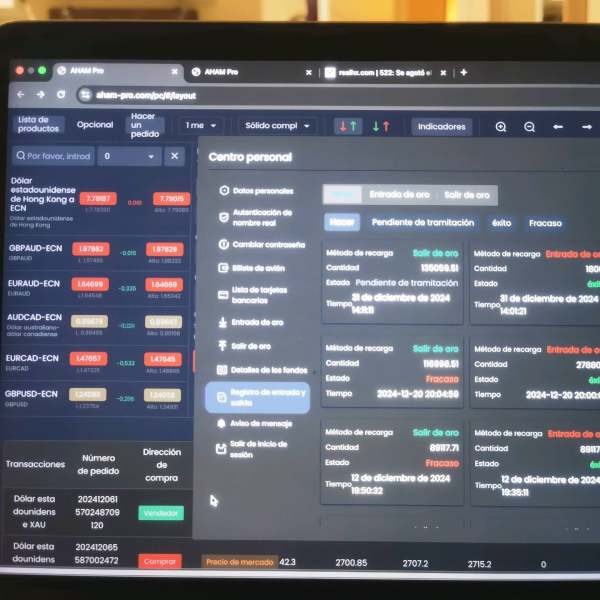

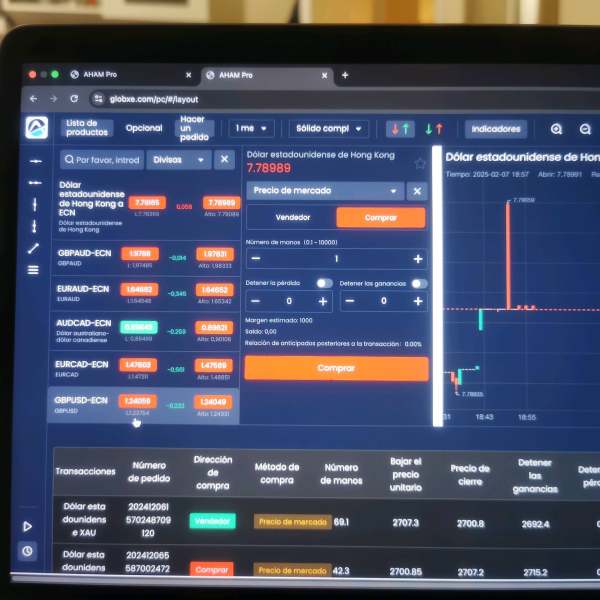

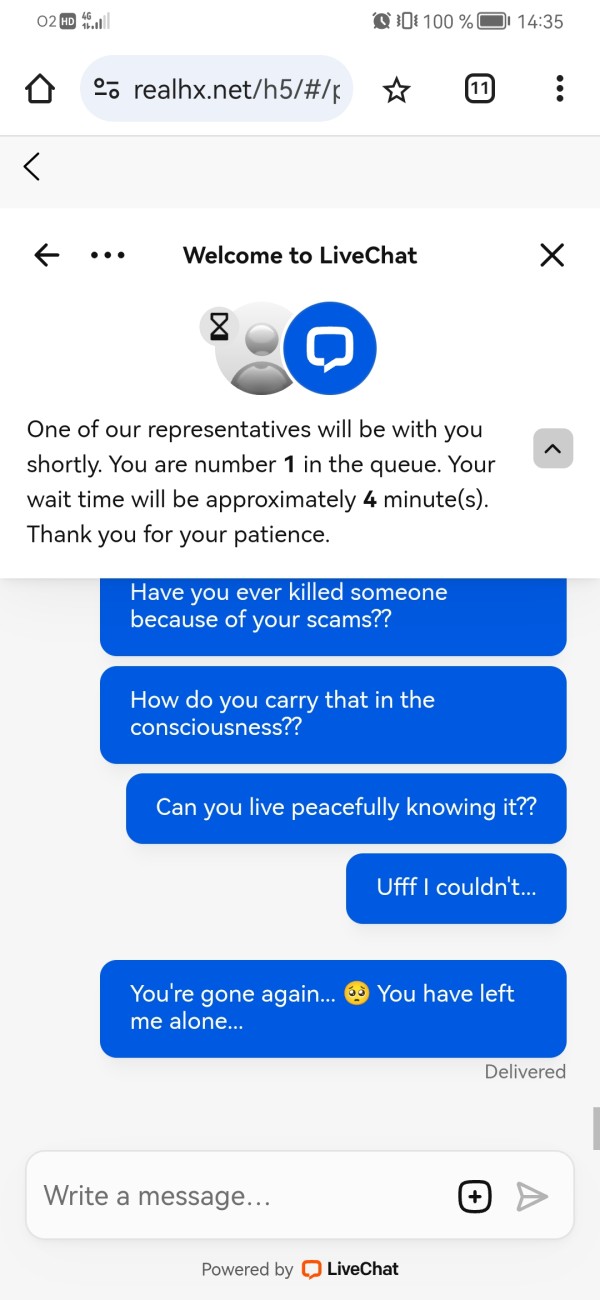

Teşhir Tekrar kimse düşmesin diye açığa çıkmaya devam ediyorum.

Bu dolandırıcılık nedeniyle iletişimde olan iki etkilenmiş kişiyiz. Aynı durumda olan başka biri varsa, ilerlemeye devam etmek için bizimle iletişime geçmesini isteriz.

Size dün itibariyle müşteri hizmetleri sohbetini engellediklerini söylemek istiyorum. Artık onlara daha fazla mesaj gönderemiyorum. Hala farklı adreslerden hesabıma erişebiliyorum, ancak onlarla iletişim kuramıyorum.

Farklı adreslerin ekran görüntülerini ve mobil ve bilgisayardan nasıl göründüklerini ekleyeceğim.

02-08

FX4332677820

dollar trends with fed rate

#FedRateCutAffectsDollarTrend

Dollar Trends with Fed Rate Changes

1. When the Fed Raises Interest Rates

• The U.S. dollar strengthens because higher rates attract foreign investors seeking better returns on U.S. assets.

• Capital inflows increase, boosting demand for the dollar.

• Inflation may slow, but borrowing costs rise, impacting economic growth.

2. When the Fed Lowers Interest Rates

• The U.S. dollar weakens because lower rates make U.S. assets less attractive to investors.

• Capital outflows may increase as investors seek higher returns elsewhere.

• Lower borrowing costs stimulate economic growth but can lead to inflation if excessive.

Key Takeaway

• Higher Fed rates → Stronger dollar (due to higher yields on U.S. investments).

• Lower Fed rates → Weaker dollar (due to reduced investor demand for U.S. assets).

• Other factors, like global economic conditions and geopolitical risks, can also influence dollar trends.

1h

FX2339024865

why some trade does not use ai trade

#AITradingAffectsForex

Why Some Traders Do Not Use AI Trading

Despite its advantages, not all traders use AI trading. Here are some key reasons why:

1. High Initial Costs

• Developing or purchasing AI trading software can be expensive.

• Requires powerful computing resources and data subscriptions.

2. Complexity & Technical Knowledge

• AI trading requires knowledge of programming, machine learning, and data analysis.

• Some traders prefer manual trading because they lack the technical expertise to set up AI bots.

3. Overfitting & Strategy Failures

• AI models may be too dependent on past data, leading to poor performance in new market conditions.

• AI trading strategies can fail in high-volatility or unpredictable market events.

4. Lack of Control & Flexibility

• AI follows predefined algorithms and may not adapt well to sudden news or geopolitical events.

• Some traders prefer human decision-making for better judgment in uncertain situations.

5. Risk of System Failures & Bugs

• AI trading relies on software and technology, which can have bugs or connectivity issues.

• A system failure could lead to unexpected losses.

6. Market Manipulation Risks

• AI bots can be vulnerable to market manipulation tactics like spoofing and fake price signals.

• Some traders prefer manual analysis to avoid being tricked by false market movements.

7. Preference for Fundamental Analysis

• AI is strong in technical and quantitative analysis but struggles with deep fundamental analysis like company earnings reports, central bank policies, and economic trends.

• Traders who rely on macroeconomic data and news may prefer manual trading.

Bottom Line

While AI trading offers speed, efficiency, and automation, it is not foolproof. Many traders still prefer manual trading due to cost, complexity, and the need for human judgment in unpredictable markets.

1h

FX3398403392

affection of dollar trend in forex market

#FedRateCutAffectsDollarTrend

How the Dollar Trend Affects the Forex Market

The U.S. dollar (USD) is the world’s reserve currency and plays a major role in the forex market. Its trends impact currency pairs, global trade, and investment flows.

1. Stronger Dollar (USD Appreciates)

• Impact on Major Currency Pairs:

• EUR/USD ↓ (Euro weakens)

• GBP/USD ↓ (British Pound weakens)

• USD/JPY ↑ (Yen weakens)

• Effect on Emerging Markets:

• Countries with dollar-denominated debt face higher repayment costs.

• Capital flows out of emerging markets as investors seek safer U.S. assets.

• Impact on Commodities:

• Gold and oil prices tend to fall as they are priced in USD.

2. Weaker Dollar (USD Depreciates)

• Impact on Major Currency Pairs:

• EUR/USD ↑ (Euro strengthens)

• GBP/USD ↑ (Pound strengthens)

• USD/JPY ↓ (Yen strengthens)

• Effect on Global Trade:

• U.S. exports become cheaper, boosting trade.

• Other countries’ exports become more expensive, affecting their economies.

• Impact on Commodities:

• Gold and oil prices tend to rise as the dollar weakens.

Factors That Influence the Dollar Trend in Forex

1. Federal Reserve Policy – Higher interest rates strengthen USD, while lower rates weaken it.

2. Economic Data – Strong GDP, employment, and inflation numbers support a stronger dollar.

3. Geopolitical Events – Uncertainty often strengthens USD as a safe-haven currency.

4. Global Trade Balances – A trade surplus can boost USD demand, while a deficit weakens it.

Bottom Line

The dollar’s strength or weakness directly impacts forex trading, influencing currency values, capital flows, and commodity prices

1h

FX3963785166

why fed rate gets affects

#FedRateCutAffectsDollarTrend

Why the Fed Rate Gets Affected

The Federal Reserve’s interest rate (federal funds rate) is influenced by several key economic factors. Here’s why it changes over time:

1. Inflation

• When inflation is high, the Fed raises rates to slow down borrowing and spending, reducing inflationary pressure.

• When inflation is low, the Fed lowers rates to encourage borrowing and stimulate economic growth.

2. Economic Growth (GDP)

• If the economy is growing too fast, the Fed may increase rates to prevent overheating and asset bubbles.

• If the economy is slowing down, the Fed may cut rates to boost investment and consumer spending.

3. Employment & Labor Market

• A strong job market can lead to wage growth and inflation, prompting the Fed to raise rates to cool down demand.

• If unemployment rises, the Fed may lower rates to encourage businesses to hire and expand.

4. Global Economic Conditions

• Economic slowdowns in other countries (e.g., China, Europe) can impact U.S. trade and investments, influencing Fed policy.

• A strong or weak global economy affects capital flows into the U.S., impacting rate decisions.

5. Financial Market Stability

• The Fed may adjust rates to prevent financial crises, such as the 2008 financial crash or banking sector instability.

55m

FX1245216921

AI TRADING HELP TRADERS FROM LOSING

#AITradingAffectsForex

AI trading can help traders minimize losses, but it does not completely eliminate risk. Here’s how AI can assist traders in managing losses and improving profitability:

1. Risk Management

• Stop-Loss Automation: AI trading bots can set and adjust stop-loss orders dynamically to cut losses early before they escalate.

• Position Sizing: AI can determine the optimal trade size based on risk tolerance and market conditions, reducing exposure to large losses.

2. Emotion-Free Trading

• No Fear or Greed: AI follows data-driven strategies without emotional biases, preventing impulsive decisions that often lead to losses.

• Consistent Execution: AI executes trades precisely as programmed, avoiding human errors and hesitation.

3. Advanced Market Analysis

• Pattern Recognition: AI can identify profitable trade setups by analyzing historical data and real-time market movements.

• Sentiment Analysis: AI can scan news and social media to gauge market sentiment and adjust trading strategies accordingly.

4. Adaptive Learning

• Machine Learning Models: AI can improve over time by learning from past trades, optimizing strategies to reduce losses.

1h

Daha fazla yükle

Oturum Aç/Kayıt Ol

Iş

Anlar

Hoşunuza gidebilecek kişiler

Değiştirin

A10_FX

FX1000590668

FX1012783191

FX1015210491

Khaleefamb1

Telif Hakkı Uyarısı

Platformda yayınlanan tüm bilgi içeriklerinin telif hakkının yasal içerik sağlayıcılara veya yetkili WikiFX platformuna ait olduğunu ciddiyetle beyan ederiz. Tüm bilgilerin yasallığını ve uyumluluğunu sağlamak için telif hakkı yasa ve düzenlemelerine sıkı sıkıya uyarız.