In this comprehensive article, we have curated a list encapsulating the top 10 largest forex brokers in the world in 2025. These giants are selected based on their daily trade volume.

However, rest assured, our selection process does not stop there. We have personally interacted with the tools and offerings on these brokerage platforms, providing you with our first-hand experience. Importantly, our listed brokers bear approval from multiple higher-level regulatory bodies.

But we don't limit our criteria for trade volume and regulatory licenses. We delve deeper, evaluating crucial elements such as the minimum initial deposit required, accessibility to various markets, variety in account types, flexibility in leverage, cost of trading and non-trading, user experience on their trading platforms, the transparency and efficiency of their deposit and withdrawal processes, quality and range of educational resources provided, responsiveness of customer support, and not forget, the intangible benefits like bonuses and promotions.

We invite you to leverage this article to compare these brokers in terms of their trading conditions and understand the pros and cons of each, ultimately empowering you to identify the most suitable forex broker for your particular trading needs. Happy trading!

Largest Forex Brokers in the World

Both ASIC & CYSEC Regulated Financial Providers offer You Excellent Security.

24/7 Professional and Multilingual Customer Support Easy to Reach.

A multi-regulated (ASIC, FCA, FSA, HK, AMF, CONSOB, FINMA, MAS) broker, reliable to trade with.

Three User-friendly Proprietary Trading Platforms Available: SaxoTraderGo, SaxoTraderPRO, and SaxoInvestor.

A long-established Broker, Strictly Regulated by Multiple Regulatory Bodies in Various Jurisdictions, Offering Sufficient Reliability.

Over 80 Currency Tradable, Competitive Pricing Structure with Tight Spreads from 0.0 Pips.

more

Comparison of Largest Forex Brokers in the World

Forex Broker

License

Minimum Spread

Maximum Leverage

Minimum Deposit

Open account

Details

Compare

Largest Forex Brokers in the World Reviewed

ADVT-based Ranking List

| Largest Broker | ADVT (Billion USD) | Regulation | |

|

IC Markets Global | 29 | ASIC, CYSEC |

|

Saxo | 20.1 | ASIC, FCA, FSA, SFC, AMF, CONSOB, FINMA, MAS |

|

Forex.com | 18.6 | ASIC, FCA, FSA, NFA, CYSEC, CIRO, MAS |

|

XM | 16.08 | ASIC, CYSEC, FSC (offshore), DFSA, FSCA |

|

HFM | 13.8 | CYSEC, FCA, DFSA, FSA (offshore) |

|

OANDA | 12.84 | ASIC, FCA, FSA, NFA, CIRO, MAS |

|

AvaTrade | 9.36 | ASIC, FSA, FFAJ, ADGM, CBI, FSCA |

|

IG | 8.16 | ASIC, FCA, FSA, FMA, MAS, DFSA |

|

Pepperstone | 8.04 | ASIC, CYSEC, FCA, DFSA, SCB (offshore) |

|

FxPro | 7.8 | CYSEC, FCA |

⁕ Data of AVDT (Average Daily Volume Traded) is from the broker's website and Internet (updated in 2025).

① IC Markets Global

Founded in 2007 in Sydney, Australia, IC Markets Global is a well-known Forex and CFD brokerage firm that offers a variety of investment products to its clients. The firm provides traders with the ability to trade in forex pairs, commodities, stocks, cryptocurrencies, indices, bonds, and futures through various trading platforms such as MetaTrader 4, MetaTrader 5, and cTrader. Three account types can be chosen at IC Markets, including Standard, Raw Spread, and cTrader Raw Spread accounts.

|

|

| ⭐⭐⭐⭐⭐ | |

| Daily Trade Volume | $29 billion |

| Min Initial Deposit | $200 |

| Market Access | 2250+, CFDs on forex, commodities, indices, bonds, digital currencies, stocks and futures |

| Demo Account | ✅ (30 days) |

| Islamic Account | ✅ |

| Max Leverage | 1:500 |

| Spreads & Commissions | From 0.8 pips & no commission (Std account) |

| Trading Platforms | MT4, MT5, cTrader |

| Social/Copy Trading | ✅ |

| Deposits & Withdrawals | Credit/debit cards, PayPal, Neteller, Skrill, UnionPay, Wire Transfer, Bpay, Broker to Broker, POLI, Thai/Vietnamese Internet Banking, Rapidpay, Klarna |

| Education | Web TV, webinar, podcast, getting started tutorial videos, forex glossary |

| Customer Support | 24/7 live chat, phone, email |

| Bonus | / |

| Inactivity Fee | / |

According to WikiFX, IC Markets maintains regulatory compliance in both Australia and Cyprus, adhering to the respective financial regulatory standards in these jurisdictions. Regulatory oversight by ASIC and CYSEC helps ensure transparency and accountability in the broker's operations, contributing to a safer trading environment for clients.

IC Markets' Australian entity, INTERNATIONAL CAPITAL MARKETS PTY. LTD., regulated by ASIC under license number 335692, holding a license for Market Making (MM).

IC Markets' European entity, IC Markets (EU) Ltd, regulated by CYSEC under regulatory number 362/18, holds a license for Market Making (MM) as well.

| Jurisdiction | Regulator | Licensed Institution | License Type | License No. | License | |

|

ASIC - Australia Securities & Investment Commission | INTERNATIONAL CAPITAL MARKETS PTY. LTD. | Market Making (MM) | 335692 |  |

|

|

CYSEC -Cyprus Securities and Exchange Commission | IC Markets (EU) Ltd | Market Making (MM) | 362/18 |  |

|

Pros:

√ Broad Range of Trading Options: IC Markets offers access to a wide range of markets beyond Forex, including commodities, indices, stocks, bonds, futures, and cryptocurrencies.

√ Extensive Trading Platforms: They offer popular platforms such as MetaTrader 4, MetaTrader 5, and cTrader, allowing flexibility for all types of traders.

√ Investor Security: IC Markets is well-regulated by the Australian Securities and Investments Commission (ASIC) and the Cyprus Securities and Exchange Commission (CYSEC).

Cons:

× Lack of Additional Services: Unlike some brokers, IC Markets does not provide additional financial services beyond brokerage, such as wealth management or retirement planning.

× No Stocks Trading for European Clients: IC Markets does not offer actual stocks trading for European clients, but rather CFDs on stocks.

② Saxo

Saxo Bank is a Danish investment bank specializing in online trading and investments. It offers access to international markets for online trading of a wide range of assets including, but not limited to, stocks, ETFs, bonds, mutual funds, IP0, forex, futures, forex options, and listed options. The company's online trading platforms, SaxoInvestor, SaxoTraderGO and SaxoTraderPRO, are recognized globally for their user-friendly interface and are available on multiple devices.

|

|

| ⭐⭐⭐⭐⭐ | |

| Daily Trade Volume | HKD 157 billion+ ($20.1 billion+) |

| Min Initial Deposit | $0 |

| Market Access | Stocks, ETFs, bonds, mutual funds, forex, futures, forex options, listed options |

| Demo Account | ✅ (20 days with $100,000 virtual funds) |

| Max Leverage | 1:100 |

| Spreads & Commissions (Forex) | From 0.4 pips & commission-free |

| Trading Platforms | SaxoTraderGo, SaxoTraderPRO, SaxoInvestor |

| Deposits & Withdrawals | Online Banking, Electronic Direct Debit Authorization (eDDA), Bank Transfer (Counter services or ATM) |

| Customer Support | 24/5 phone, email |

According to WikiFX, Saxo is currently regulated by many financial authorities including ASIC (Australia), FCA (UK), FSA (Japan), SFC (Hong Kong), AMF (France), CONSOB (Italy), FINMA (Switzerland), and MAS (Singapore). More detailed info can be found in the table below:

| Jurisdiction | Regulator | Licensed Institution | License Type | License No. | License | |

|

ASIC - Australia Securities & Investment Commission | SAXO CAPITAL MARKETS (AUSTRALIA) LIMITED | Market Making (MM) | 280372 |  |

|

|

FCA - Financial Conduct Authority | Saxo Capital Markets UK Limited | Market Making (MM) | 551422 |  |

|

|

FSA - Financial Services Agency | Saxo Bank Securities Ltd. | Retail Forex License | 関東財務局長(金商)第239号 |  |

|

|

SFC - Securities and Futures Commission of Hong Kong | Saxo Capital Markets HK Limited |

Dealing in futures contracts & Leveraged foreign exchange trading | AVD061 |  |

|

|

AMF - The Autorité des Marchés Financiers | Saxo bank A/S | Retail Forex License | 71081 |  |

|

|

CONSOB - National Commission for Companies and the Stock Exchange | BG SAXO SIM SPA | Market Making (MM) | 296 |  |

|

|

FINMA - Swiss Financial Market Supervisory Authority | SAXO BANK (SCHWEIZ) AG | Financial Service | Unreleased |  |

|

|

MAS - Monetary Authority of Singapore | SAXO CAPITAL MARKETS PTE. LTD. | Retail Forex License | Unreleased |  |

|

Pros:

√ Diverse Product Portfolio: Saxo Bank offers a wide range of financial instruments to trade, including stocks, ETFs, bonds, mutual funds, forex, futures, forex options, and listed options.

√ Advanced Trading Platforms: They provide three platforms, SaxoTraderGo, SaxoTraderPRO, and SaxoInvestor, all recognized for their innovative features and user-friendly interface.

√ Strong Regulatory Oversight: Saxo Bank operates under the supervision of several top-level financial regulatory bodies worldwide, such as ASIC, FCA and FSA, which provides traders with an added level of confidence and security.

Cons:

× Complex Pricing Structure: Their pricing structure can be somewhat layered and difficult to understand, particularly for inexperienced traders.

× Regional Restrictions: Clients from the United States and Japan are not allowed.

③ FOREX.com

Forex.com is a global online broker that specializes in Forex trading. It is one of the largest retail Forex brokers in terms of daily trading volume and offers a range of trading products including currency pairs, precious metals, energies, indices, bonds, cryptocurrencies and equities. The platform is known for its advanced trading features, comprehensive educational resources, and extensive market research reports. It provides three types of trading platforms, namely its proprietary Mobile App, Web Trader, and the industry-leading MT5 platform.

|

|

| ⭐⭐⭐⭐⭐ | |

| Daily Trade Volume | $18.6 billion |

| Min Initial Deposit | $100 |

| Market Access | Forex, indices, stocks, cryptos, gold, oil & commodities, bullion |

| Demo Account | ✅ (90 days risk-free trading with $50,000 in virtual funds) |

| Max Leverage | 1:200 |

| Spreads & Commissions (Forex) | From 0.8 pips & commission-free (Standard account) |

| Trading Platforms | Mobile app, Web Trader, TradingView, MT4/5 |

| Deposits & Withdrawals | Local online transfers, credit/debit card, wire transfer, Neteller, Skrill (no deposit fee) |

| Customer Support | Live chat, contact form, phone, email |

Furthermore, according to WikiFX, it is regulated by multiple financial authorities worldwide, including ASIC (Australia), FCA (UK), FSA (Japan), NFA (USA), CYSEC (Cyprus), CIRO (Canada), and MAS (Singapore), which adds reliability and trustworthiness to its name. More detailed info on regulation can be found in the table below:

| Jurisdiction | Regulator | Licensed Institution | License Type | License No. | License | |

|

ASIC - Australia Securities & Investment Commission | STONEX FINANCIAL PTY LTD | Market Making (MM) | 345646 |  |

|

|

FCA - Financial Conduct Authority | StoneX Financial Ltd | Market Making (MM) | 446717 |  |

|

|

FSA - Financial Services Agency | StoneX証券株式会社 | Retail Forex License | 関東財務局長(金商)第291号 |  |

|

|

NFA - National Futures Association | GAIN CAPITAL GROUP LLC | Market Making (MM) | 0339826 |  |

|

|

CYSEC - Cyprus Securities and Exchange Commission | StoneX Europe Ltd | Market Making (MM) | 400/21 |  |

|

|

CIRO - Canadian Investment Regulatory Organization | GAIN Capital - FOREX.com Canada Ltd | Market Making (MM) | Unreleased |  |

|

|

MAS - Monetary Authority of Singapore | STONEX FINANCIAL PTE. LTD. | Retail Forex License | Unreleased |  |

|

Pros:

√ Regulatory Oversight: Forex.com is regulated by several high-profile financial authorities, including ASIC (Australia), FCA (UK), FSA (Japan), NFA (USA), CYSEC (Cyprus), CIRO (Canada), and MAS (Singapore), which helps ensure that they maintain fair and transparent trading practices.

√ Broad Range of Markets: Beyond Forex, Forex.com also provides trading in products such as forex, indices, stocks, cryptos, gold, oil & commodities, and bullion.

√ Educational Resources: Forex.com offers a wide range of educational materials, such as courses, lessons, platform tutorials, and Glossary, perfect for beginner traders who are looking to expand their knowledge about trading.

Cons:

× Lack of Social Trading Features: Unlike some brokers, Forex.com currently doesn't offer a social trading platform where users can copy trades from more experienced traders.

④ XM

XM is an online broker that provides access to trading 1,400+ financial instruments including forex, commodities, precious metals, shares, Turbo stocks, equity indices, energies, and thematic indices. Founded in 2009, XM has grown to offer its services on a global scale and it's recognized for its strict regulatory compliance.

They offer multiple account types including Standard, Ultra low and Shares accounts. All these accounts involve low minimum deposits and provide access to various currency pairs. XM also provides several trading platforms, including MetaTrader 4 and MetaTrader 5, available on both PC and mobile.

XM is known for its generous bonuses and promotional offers, high-quality customer service, and comprehensive educational resources.

|

|

| ⭐⭐⭐⭐⭐ | |

| Daily Trade Volume | $16.08 billion |

| Min Initial Deposit | $5 |

| Market Access | 1,400+, forex, commodities, precious metals, shares, Turbo stocks, equity indices, energies, thematic indices |

| Demo Account | ✅ (30 days) |

| Islamic Account | ✅ |

| Max Leverage | 1:1000 |

| Spreads & Commissions (Forex) | From 1.6 pips & commission-free (Standard account) |

| Trading Platforms | MT4/5, XM App |

| Social Trading | ✅ |

| Deposits & Withdrawals | Free - credit/debit cards, bank transfers, e-wallets |

| Customer Support | Live chat, phone |

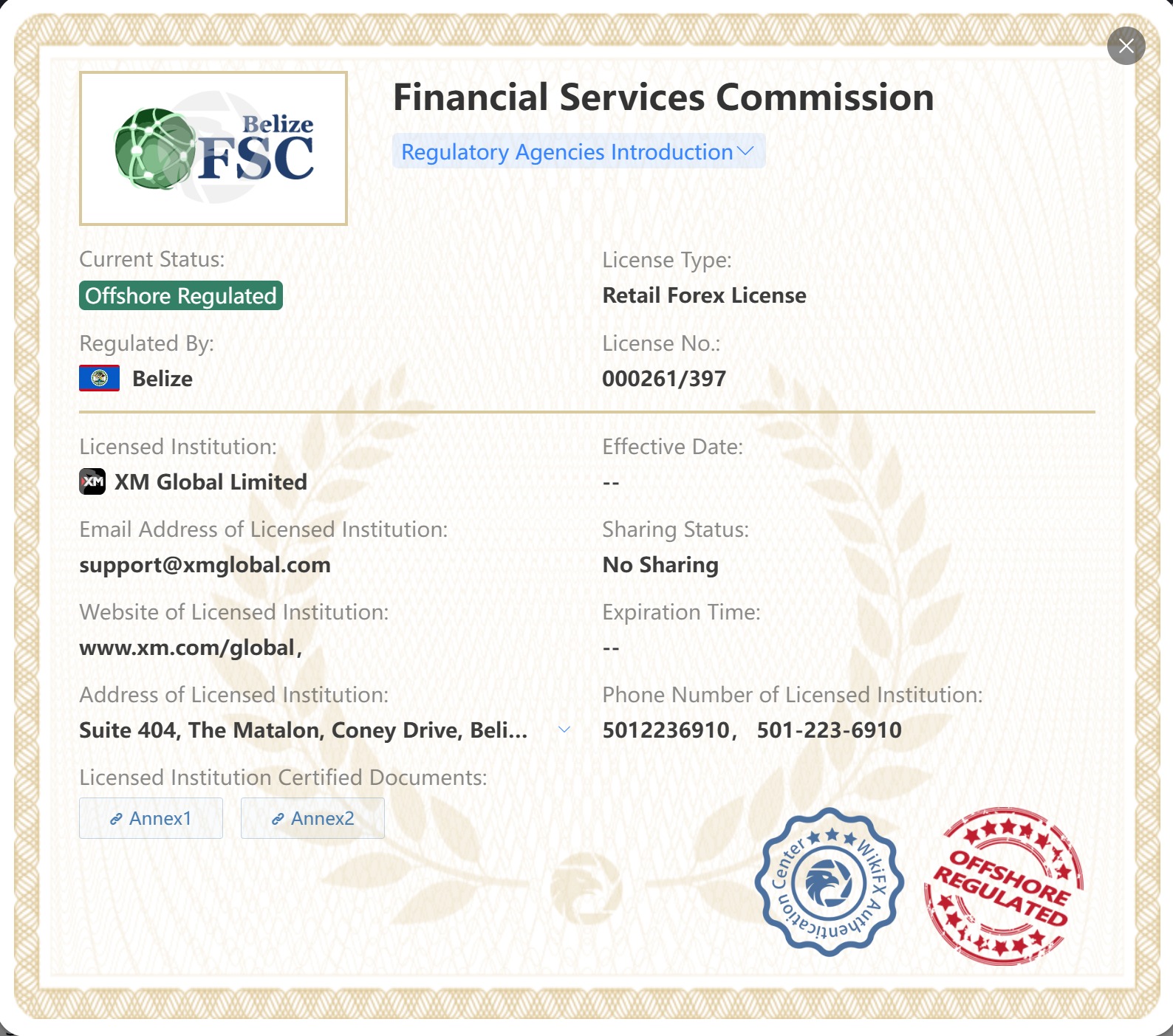

Moreover, according to WikiFX, it's regulated by several financial regulatory bodies, including the ASIC (Australia), CYSEC (Cyprus), DFSA (United Arab Emirates), FSCA (South Africa) and offshore FSC (Belize), which provides clients with greater protection and transparency in their operations.

| Jurisdiction | Regulator | Licensed Institution | License Type | License No. | License | |

|

ASIC - Australia Securities & Investment Commission | TRADING POINT OF FINANCIAL INSTRUMENTS PTY LTD | Market Making (MM) | 443670 |  |

|

|

CYSEC - Cyprus Securities and Exchange Commission | Trading Point Of Financial Instruments Ltd | Market Making (MM) | 120/10 |  |

|

|

DFSA - Dubai Financial Services Authority | Trading Point MENA Limited | Retail Forex License | F003484 |  |

|

|

FSCA - Financial Sector Conduct Authority | XM ZA (PTY) LTD | Financial Service | 49976 |  |

|

|

FSC - Financial Services Commission | XM Global Limited |

Retail Forex License |

000261/397 |  |

|

Pros:

√ Multiple Trading Platforms: XM offers both MetaTrader 4 and MetaTrader 5 platforms, catering to the preferences of a variety of traders.

√ Robust Education and Research: XM offers an extensive selection of educational resources and research tools, such as XM Live, Live education, Educational Videos, Forex & CFDs Webinars, and Platform Tutorials, making it a good choice for beginner traders looking to expand their knowledge.

√ Reputation and Regulation: XM has a solid reputation and is regulated by multiple organizations, including the Australian Securities and Investments Commission (ASIC), the Cyprus Securities and Exchange Commission (CySEC) and more.

Cons:

× Regional Restrictions: Clients from the United States of America, Canada, Argentina, Israel and the Islamic Republic of Iran are not allowed.

⑤ HFM (HF Markets)

HFM is a multi-regulated online forex and commodities brokerage. It provides forex trading services to both professional traders and retail investors globally. Notable instruments that HF Markets offers for trading include 500+ CFDs on Forex, Commodities, Metals, Bonds, Energies, ETFs, Indices, Cryptos, and Stocks.

Founded in 2010, the company prides itself on its client-centred approach and aims to offer the best possible trading conditions. It is known for its tight spreads, flexible leverage, fast trade execution, and various account types that cater to a wide range of traders. The broker provides several trading platforms, including the popular MetaTrader 4 and MetaTrader 5, available on PC, web, and mobile.

|

|

| ⭐⭐⭐⭐⭐ | |

| Daily Trade Volume | $13.8 billion |

| Min Initial Deposit | $0 |

| Market Access | 500+ CFDs on Forex, Commodities, Metals, Bonds, Energies, ETFs, Indices, Cryptos, Stocks |

| Demo Account | ✅ |

| Islamic Account | ✅ |

| Max Leverage | 1:2000 |

| Spreads & Commissions (Forex) | From 1.2 pips pips & commission-free (Cent Account) |

| Trading Platforms | MT4/5, HFM Trading App |

| Copy Trading | ✅ |

| Deposits & Withdrawals | Free - UnionPay (only withdrawal), Wire Transfer, MasterCard, Visa, Crypto, Fasapay, Neteller, Skrill |

| Customer Support | 00:00 Monday to 23:59 Friday (Server Time) - live chat, contact form, phone, fax, email |

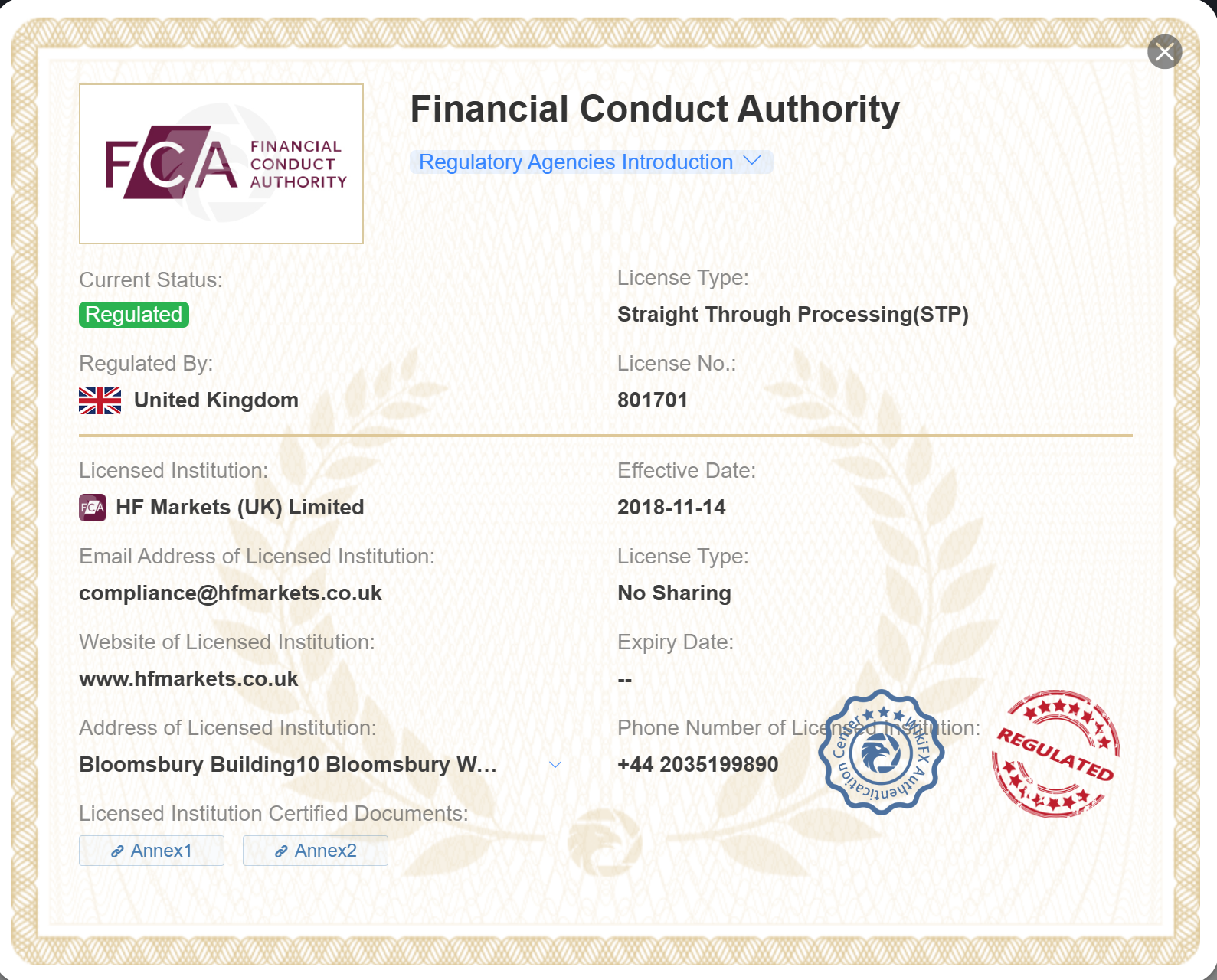

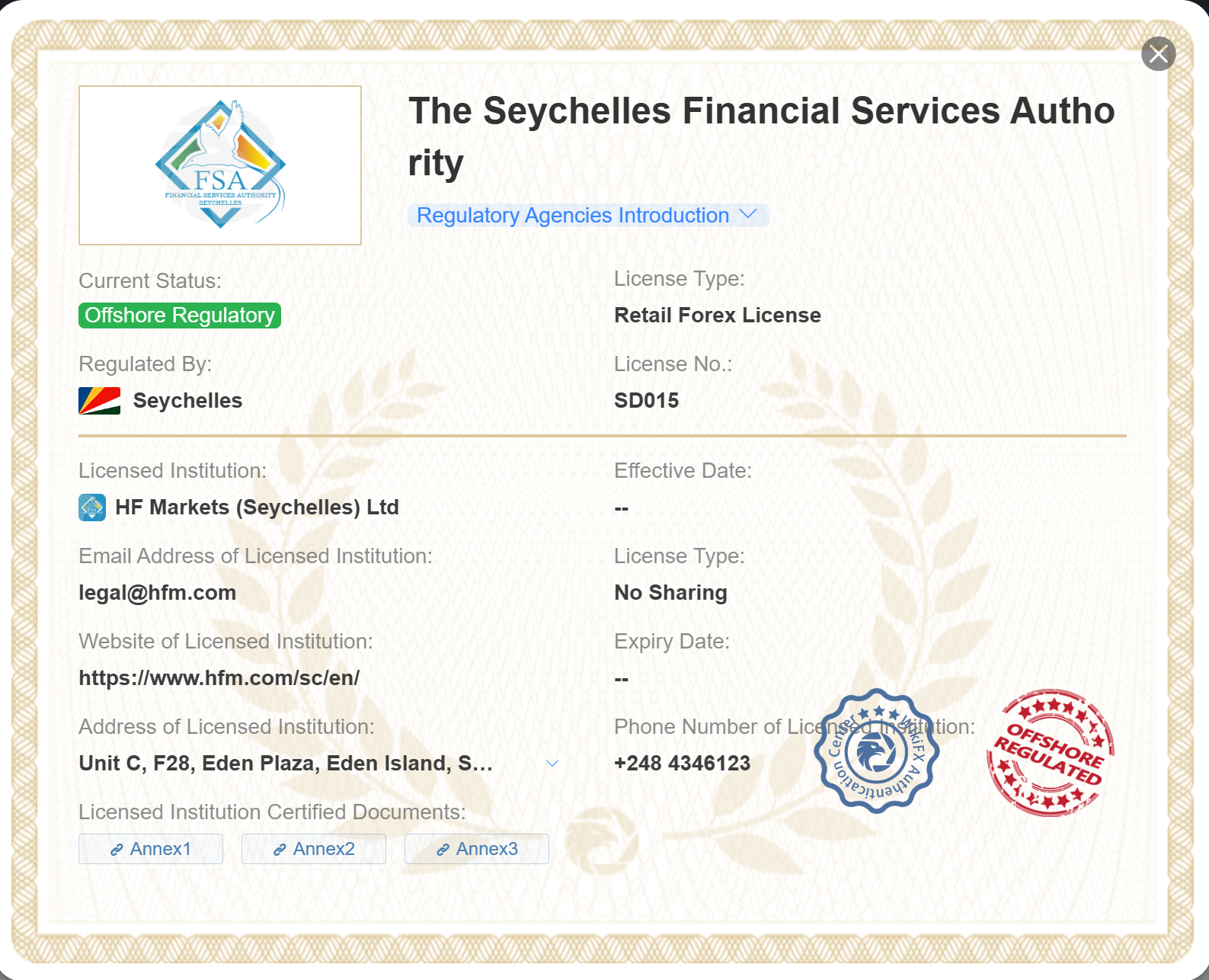

According to WikiFX, HF Markets is regulated by various reputable financial authorities, including the Cyprus Securities and Exchange Commission (CySEC), the Financial Conduct Authority (FCA) of the United Kingdom, DFSA (United Arab Emirates), and offshore FSA (Seychelles). If you want to know more detailed info about HF Markets' regulation, you can view the regulation table below.

| Jurisdiction | Regulator | Licensed Institution | License Type | License No. | License | |

|

CYSEC - Cyprus Securities and Exchange Commission | HF Markets (Europe) Ltd | Market Making (MM) | 183/12 |  |

|

|

FCA - Financial Conduct Authority | HF Markets (UK) Limited | Straight Through Processing (STP) | 801701 |  |

|

|

DFSA - Dubai Financial Services Authority | HF Markets (DIFC) Limited | Retail Forex License | F004885 |  |

|

|

FSA - The Seychelles Financial Services Authority (Offshore regulation) | HF Markets (Seychelles) Ltd | Retail Forex License | SD015 |  |

|

Pros:

√ Multiple Account Types: HF Markets offers various types of accounts, including Cent, Crypto CFD, Zero, Pro, and Premium accounts, catering to different trading requirements.

√ MetaTrader Platforms: HF Markets offers both MetaTrader 4 and MetaTrader 5, two of the most popular trading platforms in the industry.

√ Well-regulated: HF Markets is regulated by several reputable financial authorities, including CySEC and the FCA, which enhances its reliability.

Cons:

× High Leverage: The maximum leverage offered by HF Markets is up to 1:2000, which can be risky for inexperienced traders.

× Regional Restrictions: HF Markets do not provide services to residents of the USA, Canada, Sudan, Syria, Iran, North Korea.

⑥ OANDA

OANDA Corporation is a well-established forex broker that offers online trading services to clients around the globe. Their offering includes a wide range of currency pairs along with various other financial instruments such as CFDs on forex, indices, cryptos, commodities, and bonds.

OANDA has a reputation for its unique tools and services like the historic currency converter and the OANDA Currency Heatmap, which shows the performance of major currency pairs in real-time. They provide popular trading platform choices like MetaTrader 4 (MT4) and TradingView, their proprietary platform like Oanda mobile and Oanda web.

|

|

| ⭐⭐⭐⭐ | |

| Daily Trade Volume | $12.84 billion |

| Min Initial Deposit | $0 |

| Market Access | CFDs on forex, indices, cryptos, commodities, bonds |

| Demo Account | ✅ |

| Max Leverage | 1:20 |

| Spreads & Commissions (Forex) | Floating around 1.1 pips (EUR/USD) |

| Trading Platforms | TradingView, Oanda mobile, Oanda web, MT4 |

| Deposits & Withdrawals | Deposit: free - PayNow, FBS Bill Pay, PayPal, FAST, Bank/Wire transfers |

| Withdrawal: PayPal (free), Bank/Wire transfers (fees) | |

| Customer Support | 24/5 |

| Inactivity Fee | 10 units of the account's base currency per month if there has been no trading activity for 12 months or more |

In terms of regulatory oversight, OANDA is regulated in six different countries by respective financial regulatory bodies, including the National Futures Association (NFA) in the United States, the Financial Conduct Authority (FCA) in the UK, and the Australian Securities and Investments Commission (ASIC). This regulatory oversight enhances the trust and confidence of the traders on their platform.

| Jurisdiction | Regulator | Licensed Institution | License Type | License No. | License | |

|

ASIC - Australia Securities & Investment Commission | OANDA AUSTRALIA PTY LTD | Market Making (MM) | 412981 |  |

|

|

FCA - Financial Conduct Authority | OANDA Europe Limited | Market Making (MM) | 542574 |  |

|

|

FSA - Financial Services Agency | OANDA Japan Inc | Retail Forex License | 関東財務局長(金商)第2137号 |  |

|

|

NFA - National Futures Association | OANDA CORPORATION | Market Making (MM) | 0325821 |  |

|

|

CIRO - Canadian Investment Regulatory Organization | OANDA (Canada) Corporation ULC | Market Making (MM) | Unreleased |  |

|

|

MAS - Monetary Authority of Singapore | OANDA ASIA PACIFIC PTE. LTD. | Retail Forex License | Unreleased |  |

|

Pros:

√ Strong Regulatory Oversight: OANDA is regulated in multiple key regions, such as ASIC, FCA, FSA, and NFA, offering a level of trust for traders.

√ Advanced Trading Platforms: OANDA offers various user-friendly platforms like their proprietary web and mobile platforms, the popular MetaTrader 4 and TradingView.

√ No Minimum Deposit: OANDA has no minimum deposit requirement for opening a new trading account.

Cons:

× Inactivity Fee: If an account is left dormant, OANDA applies an inactivity fee of 10 units of the account's base currency per month if there has been no trading activity for 12 months or more.

× Margin Call Policy: OANDAs margin rules mean that your trades can be closed if your account balance becomes negative, which can be problematic for some traders.

⑦ AvaTrade

AvaTrade is a globally recognized online broker offering trading services in multiple financial instruments, including forex, indices, commodities, crypto CFD, stocks, ETFs, bonds, and FX options. Founded in 2006, AvaTrade is headquartered in Dublin, Ireland.

AvaTrade is known for offering several trading platforms to accommodate different trading styles and preferences. These include AvaTrade Mobile App, Mobile WebTrader, DupliTrade, and popular MT4/5. They also offer a platform for automated trading, AvaOptions for options trading, and AvaSocial, a social trading platform.

|

|

| ⭐⭐⭐⭐ | |

| Daily Trade Volume | $9.36 billion |

| Min Initial Deposit | $100 |

| Market Access | Forex, indices, commodities, crypto CFD, stocks, ETFs, bonds, FX options |

| Demo Account | ✅ ($10,000 in virtual capital, lasts for 21 days and can be renewed upon request) |

| Islamic Account | ✅ |

| Max Leverage | 1:30 (retail)/1:400 (professional) |

| Spreads & Commissions (Forex) | Tight spreads, low commissions |

| Trading Platforms | AvaTrade Mobile App, Mobile WebTrader, AvaSocial, AvaOptions, DupliTrade, MT4/5 |

| Deposits & Withdrawals | MasterCard, Visa, PayPal, Skrill, Neteller, Wire Transfer, Perfect Money, Boleto |

| Customer Support | Live chat, contact form, WhatsApp, phone |

| Inactivity Fee | After 3 consecutive months of non-use (“Inactivity Period”), and every successive Inactivity Period, an inactivity fee will be deducted from the value of the Customers trading account ($/€/£50) |

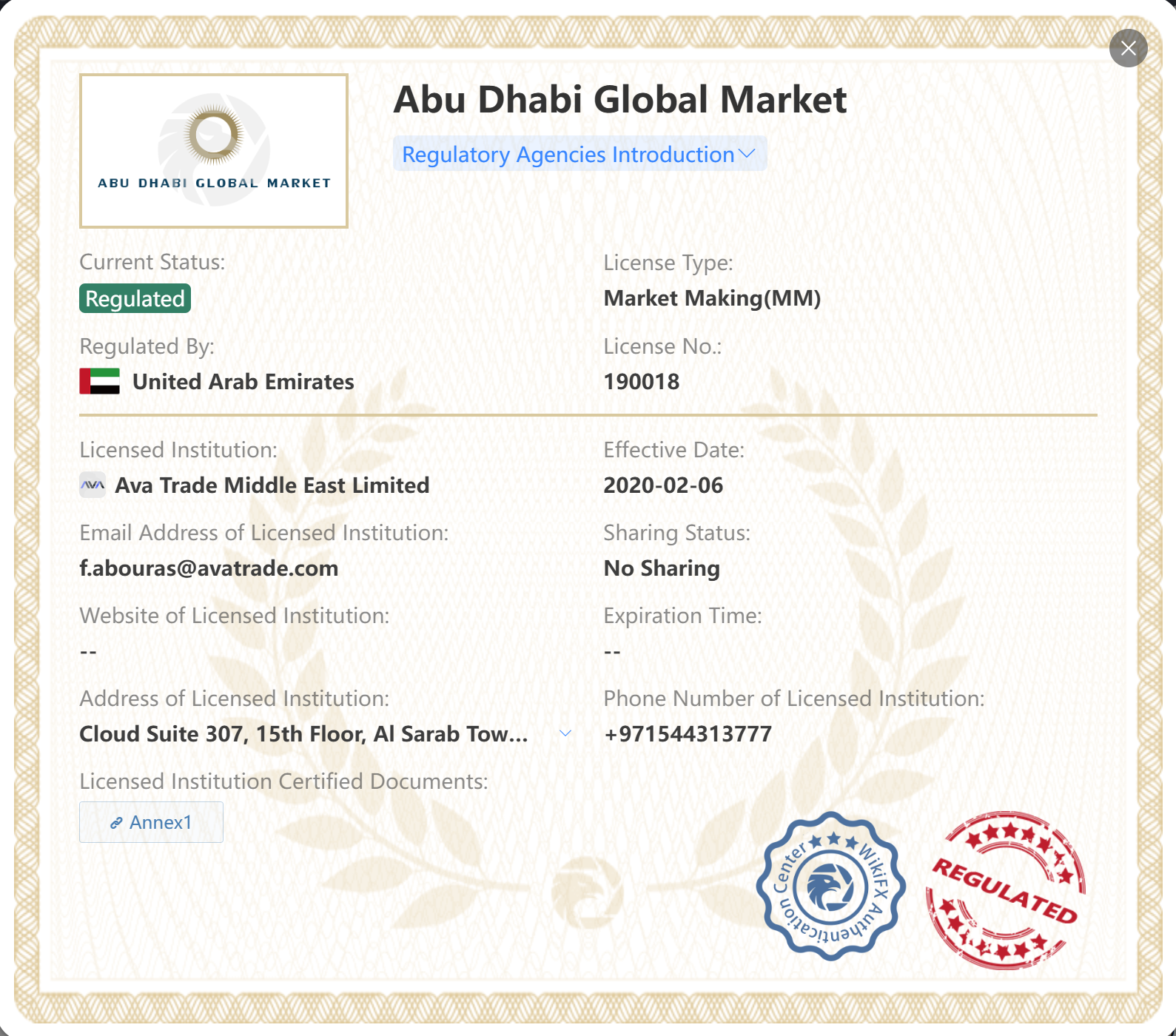

A key attribute of AvaTrade is its strong regulatory oversight. It's regulated across five continents by various global authorities, including the Central Bank of Ireland (CBI), the Australian Securities & Investments Commission (ASIC), and Japan's Financial Services Agency (FSA), which adds to its reliability.

| Jurisdiction | Regulator | Licensed Institution | License Type | License No. | License | |

|

ASIC - Australia Securities & Investment Commission | AVA CAPITAL MARKETS AUSTRALIA PTY LTD | Market Making (MM) | 406684 |  |

|

|

FSA - Financial Services Agency | Ava Trade Japan K.K | Retail Forex License | 関東財務局長(金商)第1662号 |  |

|

|

FFAJ - The Financial Futures Association of Japan | AVA TRADE JAPAN K.K. | Retail Forex License | 1574 |  |

|

|

ADGM - Abu Dhabi Global Market | Ava Trade Middle East Limited | Market Making (MM | 190018 |  |

|

|

CBI - Central Bank of Ireland | AVA Trade EU Limited | Retail Forex License | C53877 |  |

|

|

FSCA- Financial Sector Conduct Authority | AVA CAPITAL MARKETS (PTY) LTD | Retail Forex License | 45984 |  |

|

Pros:

√ Global Regulation: AvaTrade is regulated by several organizations worldwide, including the Central Bank of Ireland (CBI), the Australian Securities & Investments Commission (ASIC), and the Japanese Financial Services Agency.

√ Diverse Trading Platforms: They offer a variety of trading platforms, including their proprietary AvaTradeGo, as well as MetaTrader 4, MetaTrader 5, AvaOptions for options trading, and AvaSocial.

√ Wide Range of Financial Instruments: AvaTrade offers a good selection of trading instruments, including forex, indices, commodities, crypto CFD, stocks, ETFs, bonds, and FX options.

Cons:

× Slow Withdrawal Process: Some users have reported a slow withdrawal process with AvaTrade.

× Inactivity Fee Charged: After 3 consecutive months of non-use (“Inactivity Period”), and every successive Inactivity Period, an inactivity fee will be deducted from the value of the Customers trading account. This fee is outlined below and subject to client relevant currency based account:

USD Account: $50

EUR Account: €50

GBP Account: £50

⑧ IG

IG is one of the world's largest online trading and investment providers, offering spread betting and CFD trading across 17,000+ instruments, including forex, indices, shares, commodities, and cryptocurrencies. Established in 1974, IG is a well-known, respected, and regulated online broker globally.

Their platform includes innovative trading technology with a focus on speed, stability, and improved accessibility. They offer an array of professional-grade trading platforms including the popular MetaTrader 4 and TradingView, ProRealTime and L2 Dealer for advanced traders looking for direct market access.

|

|

| ⭐⭐⭐⭐ | |

| Daily Trade Volume | $8.16 billion |

| Min Initial Deposit | $0 |

| Market Access | 17,000+, forex, indices, shares, commodities, cryptocurrencies |

| Demo Account | ✅ ($20,000 virtual funds) |

| Max Leverage | 1:400 |

| Spreads & Commissions (Forex) | From 0.6 pips (EUR/USD) |

| Trading Platforms | L2 dealer, ProRealTime, MT4, TradingView |

| Copy Trading | ✅ |

| Deposits & Withdrawals | Credit/debit cards (MasterCard/Visa), bank transfer |

| Customer Support | 24h/day, except from 6 am to 4 pm on Saturday (UTC+8) - live chat, phone, email |

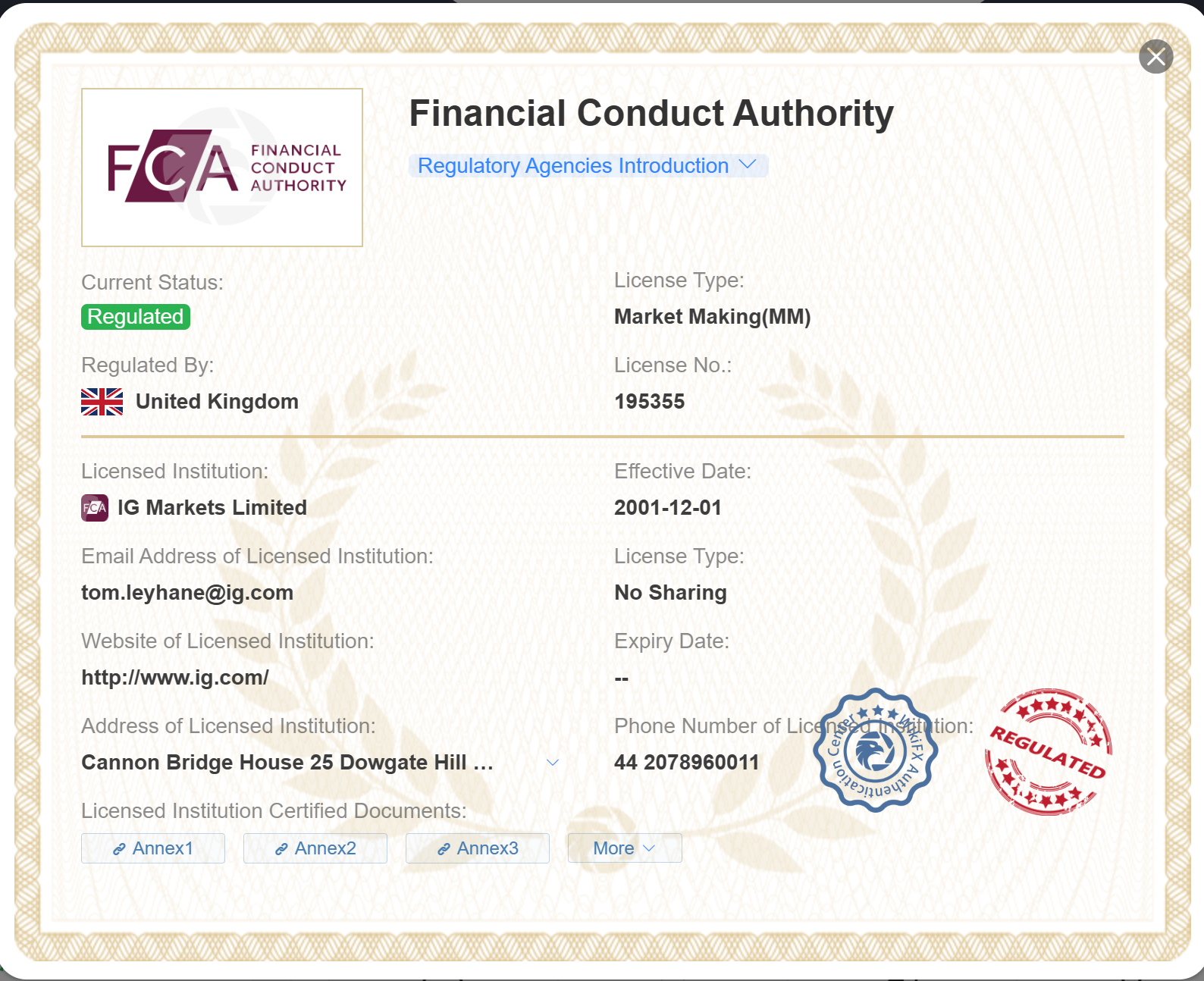

According to WikiFX, IG is regulated by several leading authorities globally, such as the Australian Securities and Investments Commission (ASIC) and the Financial Conduct Authority (FCA) in the UK, enhancing its reputation and the trust of its customers. More detailed regulation info is as follows:

| Jurisdiction | Regulator | Licensed Institution | License Type | License No. | License | |

|

ASIC - Australia Securities & Investment Commission | IG AUSTRALIA PTY LTD | Market Making (MM) | 515106 |  |

|

|

FCA - Financial Conduct Authority | IG Markets Limited | Market Making (MM) | 195355 |  |

|

|

FSA - Financial Services Agency | IG証券株式会社 | Retail Forex License | 関東財務局長(金商)第255号 |  |

|

|

FMA - Financial Markets Authority | IG AUSTRALIA PTY LTD | Straight Through Processing (STP) | 684191 |  |

|

|

MAS - Monetary Authority of Singapore | IG ASIA PTE LTD | Retail Forex License | Unreleased |  |

|

|

DFSA - Dubai Financial Services Authority | IG Limited | Retail Forex License | F001780 |  |

|

Pros:

√ Well-Established and Regulated: IG is one of the earliest brokers in the industry, and it's regulated by leading authorities like the ASIC and FCA, lending it significant trust and credibility.

√ Advanced Trading Platforms: IG offers L2 dealer, ProRealTime, MT4, and TradingView.

Cons:

× Limited Educational Resources: There is very limited info on educational resources, and it is not friendly for beginners.

× Regional Restrictions: US clients are not accepted.

⑨ Pepperstone

Pepperstone is an Australian online brokerage that provides traders with access to the forex and CFD markets. Established in 2010, Pepperstone has grown rapidly and is now considered one of the largest forex brokers globally.

Pepperstone is best known for offering over 1,200 tradable instruments – including forex, commodities, indices, currency indices, cryptocurrencies, shares, and ETFs – with competitive spreads and low fees. They offer two main industry-leading trading platforms: MetaTrader 4 (MT4) and MetaTrader 5 (MT5), cTrader, TradingView and Smart Trader Tools, which include sophisticated tools and indicators to enhance trading analysis and performance.

|

|

| ⭐⭐⭐⭐ | |

| Daily Trade Volume | $8.04 billion |

| Min Initial Deposit | $0 |

| Market Access | Forex, shares, ETFs, indices, commodities, currency indices, cryptocurrencies, CFD forwards |

| Demo Account | ✅(30 days, $50,000 virtual funds) |

| Max Leverage | 1:500 |

| Spreads & Commissions (Forex) | Average 1.1 pips (EUR/USD) & commission-free (Standard account) |

| Trading Platforms | TradingView, MT4/5, Pepperstone platform, cTrader |

| Copy/Social Trading | ✅ |

| Deposits & Withdrawals | Apple Pay, Google Pay, Visa, MasterCard, Bank Transfer, PayPal, Neteller, Skrill, Union Pay, and USDT |

| Customer Support | 24/7 - phone, email |

| Inactivity Fee | ❌ |

The broker is regulated by several financial authorities, such as the Australian Securities and Investments Commission (ASIC) and the Financial Conduct Authority (FCA) in the UK, affirming Pepperstone's commitment to adhere to the stringent regulatory standards of these organizations.

| Jurisdiction | Regulator | Licensed Institution | License Type | License No. | License | |

|

ASIC - Australia Securities & Investment Commission | PEPPERSTONE GROUP LIMITED | Market Making (MM) | 414530 |  |

|

|

CYSEC - Cyprus Securities and Exchange Commission | Pepperstone EU Limited | Market Making (MM) | 388/20 |  |

|

|

FCA - Financial Conduct Authority | Pepperstone Limited | Straight Through Processing (STP) | 684312 |  |

|

|

DFSA - Dubai Financial Services Authority | Pepperstone Financial Services (DIFC) Limited | Retail Forex License | F004356 |  |

|

|

SCB - The Securities Commission of The Bahamas (Offshore regulation) | Pepperstone Markets Limited | Retail Forex License | SIA-F217 |  |

|

Pros:

√ Strong Regulatory Framework: Pepperstone is regulated by the ASIC and FCA, two reputable financial regulatory authorities, as well as other regulators.

√ Multiple Trading Platforms: The broker supports MetaTrader 4, MetaTrader 5, cTrader, and TradingView - all popular platforms in the trading community.

√ No Inactivity Fee: Unlike many other brokers, Pepperstone does not charge an inactivity fee.

Cons:

× High minimum deposit: The minimum deposit requirement to open a swap-free account is AUD$200 or equivalent.

× No clear info on deposits and withdrawals: Pepperstone does not specifically set the 'Deposit & Withdrawal' on the menu like other brokers. Traders can only get fragmented information from their website.

⑩ FxPro

FxPro is an online broker that offers trading in forex and a diverse range of CFDs, including those in cryptos, metals, indices, futures, energy, shares. It was established in 2006 and has its headquarters in London, UK.

FxPro has won several awards over the years and is well known for its excellent execution speed and diverse trading platform options. The broker offers a variety of platforms, including the popular MetaTrader 4, MetaTrader 5, cTrader, and FxPro Mobile App/WebTrader.

|

|

| ⭐⭐⭐⭐ | |

| Daily Trade Volume | $7.8 billion |

| Min Initial Deposit | $100 |

| Market Access | Forex, crypto CFDs, metals, indices, futures, energy, shares |

| Demo Account | ✅ (up to 100k in virtual funds, 180-day life span) |

| Max Leverage | 1:500 |

| Spreads & Commissions (Forex) | From 1.2 pips & commission-free (Standard account) |

| Trading Platforms | FxPro Mobile App, FxPro WebTrader, MT4/5, cTrader |

| Deposits & Withdrawals | Bank transfer, broker-to-broker transfer, Visa, Maestro, MasterCard, Skrill, Neteller, etc. (vary by the company) |

| Customer Support | 24/5 live chat, request a callback, phone, email |

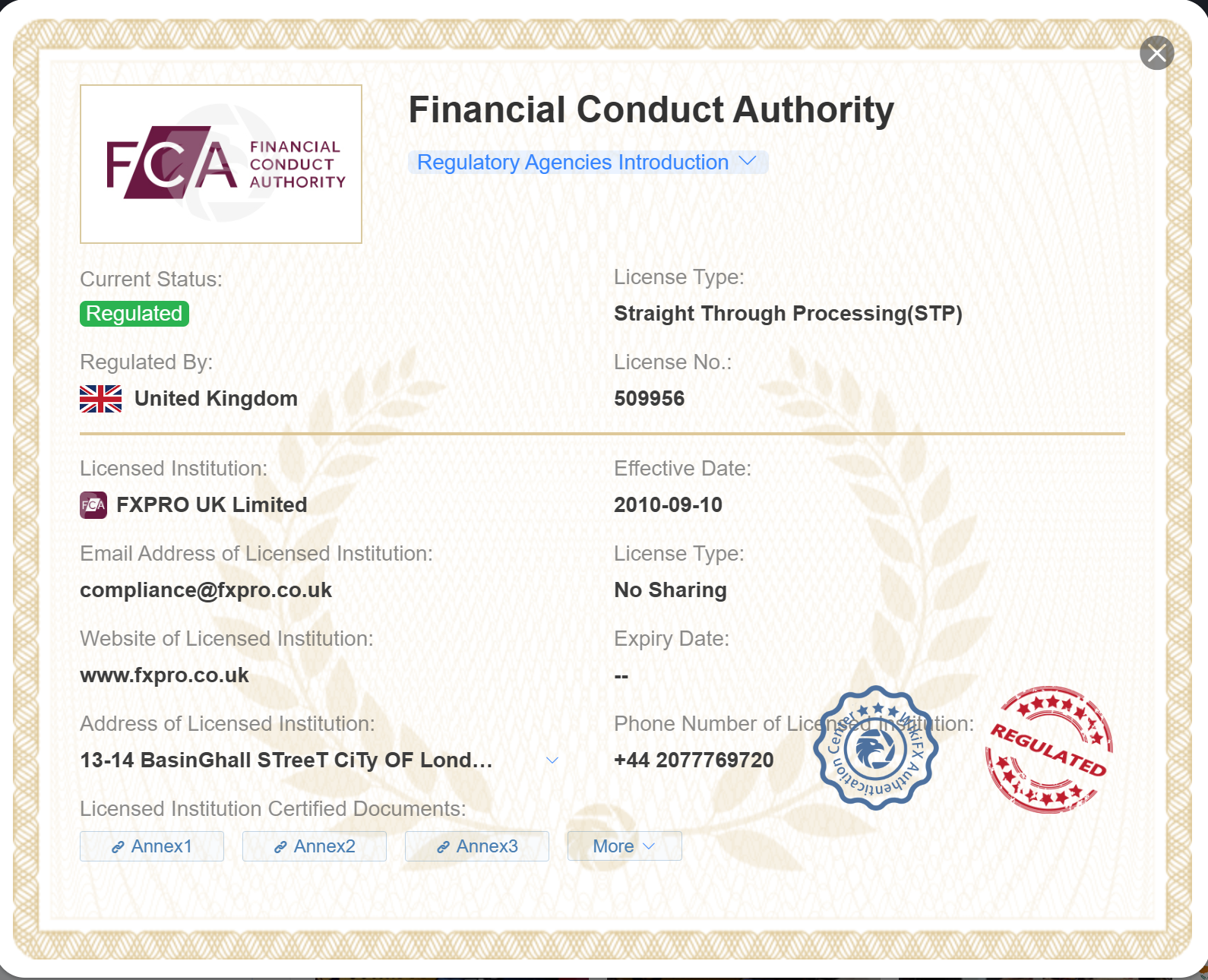

In terms of regulation, FxPro is authorized and regulated by the Cyprus Securities and Exchange Commission (CySEC) and the Financial Conduct Authority (FCA) in the UK. This high level of regulatory oversight helps to enhance the credibility and reliability of the broker.

| Jurisdiction | Regulator | Licensed Institution | License Type | License No. | License | |

|

CYSEC - Cyprus Securities and Exchange Commission | FXPRO Financial Services Ltd | Market Making (MM) | 078/07 |  |

|

|

FCA - Financial Conduct Authority | FXPRO UK Limited | Straight Through Processing (STP) | 509956 |  |

|

Pros:

√ Strong Regulation: FxPro is regulated by multiple well-respected regulators, including the Cyprus Securities and Exchange Commission (CySEC) and the UK's Financial Conduct Authority (FCA).

√ Multiple Trading Platforms: They offer several trading platforms to suit different trading styles, including FxPro Mobile App, FxPro WebTrader, MT4/5, and cTrader.

√ Execution Speed: FxPro is known for its fast trade execution speed, a crucial factor in trading.

Cons:

× Lack of Comprehensive Educational Materials: Compared to some other brokers, FxPro's educational resources for beginners are limited.

× Regional Restrictions: FxPro does not offer Contracts for Difference to residents of certain jurisdictions including the USA, Iran and Canada.

Largest Forex Brokers in the World by Volume FAQs

What is ADVT?

ADVT stands for Average Daily Volume Traded. In the context of forex brokers, it refers to the average amount of currency that is traded through the broker each day. A high ADVT is often indicative of a broker with a large number of active users and high liquidity.

Why is trading volume important?

Trading volume is important for several reasons:

Liquidity

Higher trading volumes often equate to easier liquidity. This means transactions can usually be executed more quickly and with less slippage.

Momentum and Interest

High volumes often indicate strong investor sentiment and can often be associated with the start of new trends. A sudden increase in trading volume could signal an upcoming price move or potential trend reversal.

Confirmation

Trading volume can be used to confirm price trends and chart patterns. For instance, higher volumes may strengthen the validity of breakouts.

Volatility

High trading volumes can sometimes result in higher volatility, which can present both risk and opportunity for traders.

Therefore, trading volume can provide valuable information about market activity and the potential direction of a security's price movement.

How is the trading volume of a forex broker measured?

The trading volume of a forex broker is typically measured in terms of the total number of currency units traded through that broker during a certain period. This information is usually provided by the broker based on internal data. The measurement is often presented in daily, weekly, monthly or yearly volumes. It can include all trades made across all types of trading accounts and platforms offered by the broker. As the foreign exchange market is decentralized, there's no universal or official measure of total forex volume. Each forex broker typically only knows their volume of trades.

What are the benefits of trading with the largest forex brokers?

Stability

Larger brokers tend to be more stable and have better financial security. This can offer more reassurance for your funds due to their capital sufficiency.

Reputation

Big brokers usually have a good track record and established reputation which they would want to preserve.

Regulation

They tend to be regulated by several international regulatory authorities, offering an extra layer of security for traders.

Comprehensive Customer Service

They typically have extensive customer support, possibly in multiple languages and across multiple communication channels.

Educational Resources

Many large brokers offer educational materials and resources for traders to improve their market knowledge and trading skills.

Are the largest forex brokers also the most reliable ones?

Not necessarily. While size and trading volume can indicate the success and popularity of a forex broker, they do not always guarantee reliability.

Are these forex brokers friendly for beginners?

Yes, many of the largest forex brokers often cater to beginners by providing comprehensive educational resources, user-friendly trading platforms, and practice environments like demo accounts where new traders can learn and develop their skills without financial risk. However, it is also beneficial for beginners to consider factors such as the broker's minimum initial deposit requirements, the complexity of their trading platforms, the availability of customer support, and the broker's overall reputation in addition to their educational offerings. You can learn about these from this article.

Forex Risk Disclaimer

Trading Forex (foreign exchange) carries a high level of risk, and may not be suitable for all investors. Before deciding to trade foreign exchange, you should carefully consider your investment objectives, level of experience, risk appetite, and the possibility of incurring losses. There is a possibility that you may sustain a loss of some or all of your initial investment and therefore you should not invest money that you can not afford to lose. You should be aware of all the risks associated with foreign exchange trading and seek advice from an independent financial advisor if you have any doubts.

You Also Like

Top 10 Most Volatile Currency Pairs in 2025

Discover lucrative opportunities in Forex Trading by exploring our comprehensive guide on the Top 10 Most Volatile Forex Pairs.

7 Best Funded Trader Programs in 2025

Want to trade with big money without risking your own? Explore funded trader programs and unlock a path to success!

10 Largest Forex Brokers in the World by Volume (2025)

Unlock your trading dream with our detailed guide on the top 10 Forex big players, chosen for their high trading action and more.

Best Brokers with Instant Deposits for 2025

In this article, we’ll explore five top brokers that offer instant deposits, allowing you to quickly fund your trading account and seize market opportunities without delay.