Overview of Oriental Huijin

Oriental Huijin, an established Chinese financial firm, operates within the China Financial Futures Exchange regulatory framework, offering futures trading services. Founded five to ten years ago, the company's headquarters are based in China, with additional office locations in Hong Kong, Singapore, and Japan. Oriental Huijin provides traders access to a range of tradable assets, including commodities, metals, energies, and indices, offering three distinct account types: Standard, Pro, and VIP. With a minimum deposit requirement of $100 and leveraging up to 1:100 (varies by trading instrument).

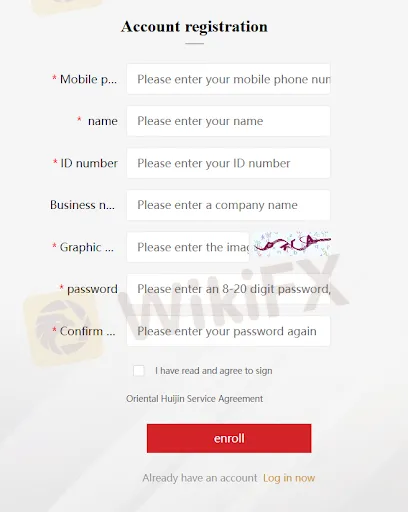

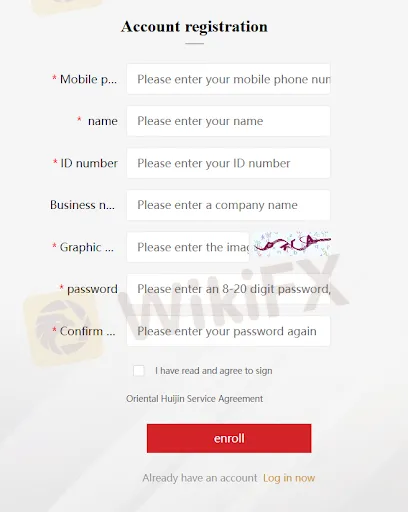

However, it's worth noting that due to the requirement for a Chinese ID during the signup process, this is likely a Chinese-only company. Oriental Huijin is contactable through customer support via email at public@dfhjqh.com.

Regulation

Oriental Huijin operates under regulatory oversight by the China Financial Futures Exchange (CFFEX). The company holds a Futures License, identified by License No. 0285, granted by CFFEX, authorizing them to conduct futures trading activities within China. This license allows Oriental Huijin to participate in futures trading, subject to the rules and regulations stipulated by the CFFEX.

A Futures License, such as the one held by Oriental Huijin, is a legal authorization issued by a relevant regulatory authority, in this case, the CFFEX, permitting a company to engage in futures trading activities. This form of regulation establishes a framework within which the company must operate, ensuring adherence to industry-specific rules and standards.

Pros and Cons

Pros:

Regulated Trading: Oriental Huijin operates within the regulatory framework of the China Financial Futures Exchange (CFFEX). This regulation establishes a structured environment for futures trading, ensuring compliance with industry-specific standards and rules.

Wide Range of Tradable Assets: Oriental Huijin offers access to various tradable assets, including commodities, metals, energies, and indices. This selection provides traders with options to diversify their portfolios.

User-Friendly Trading Platforms: The company provides multiple trading platforms, including Hang Seng Futures Online Trading System V5.0 and others, offering traders a choice in their trading interface.

Cons:

Language Barrier: Oriental Huijin's website is available exclusively in Chinese, which may pose challenges for non-Chinese users who are not proficient in the language, limiting accessibility.

Chinese ID Requirement: The registration process mandates the submission of an official Chinese ID number, effectively excluding non-Chinese individuals from using the platform.

Inaccessible Website

The Oriental Huijin website is exclusively available in the Chinese language, which limits its accessibility to individuals proficient in Chinese. This linguistic restriction poses a significant barrier for potential users who do not possess Chinese language skills, as it may hinder their ability to navigate the website, understand the content, and engage in its services. The absence of multi-language support may exclude an international audience, particularly those who rely on other languages for their financial transactions and investment activities.

Furthermore, the registration process for Oriental Huijin necessitates the provision of an official Chinese ID number. This requirement effectively excludes non-Chinese individuals from creating an account and participating in the company's services. The demand for a Chinese ID number serves as a stringent prerequisite, limiting the platform's accessibility to a broader global user base. As a result, individuals who lack a Chinese ID may find themselves unable to engage with Oriental Huijin's offerings.

Market Instruments

Oriental Huijin offers futures, metals, energies, and indices. Details are as follows:

Futures: Futures allow traders to speculate on the future price movements of various assets. Oriental Huijin offers futures trading in commodities like Corn, Soybeans, Wheat, as well as metals such as Gold and Silver, and energy resources like Oil. These contracts enable traders to profit from price changes without owning the physical assets.

Metals: Metals instruments focus on the trading of precious and base metals. Oriental Huijin provides access to trading metals like Copper, Iron ore, Zinc, Lead, and Nickel. These instruments allow traders to take positions on the price movements of metals, making it a part of their trading portfolio.

Energies: Energies encompass trading in energy commodities. Oriental Huijin offers trading opportunities in Natural gas, Brent crude oil, and WTI crude oil. Traders can speculate on energy price fluctuations using these instruments.

Indices: Indices enable traders to invest in the performance of stock market indices. While Oriental Huijin offers indices trading, including popular indices such as S&P 500, Nasdaq 100, and Dow Jones Industrial Average, traders can take positions based on their views of the broader market trends.

The following is a table that compares Oriental Huijin to competing brokerages:

Account Types

Account types offered by Oriental Huijin Futures include Standard, Pro, and VIP. Specifics are as follows:

Standard Account:

The Standard account at Oriental Huijin Futures serves as the entry-level option, providing traders with a basic trading experience. This account type offers a maximum leverage of 1:100 for most commodities and 1:20 for indices, making it suitable for those who prioritize capital preservation. However, traders should note that the Standard account features wider spreads and higher commissions compared to other account types. With a minimum deposit requirement of $100, this account is a cost-effective choice, although it comes with higher margin and trading volume requirements.

Pro Account:

Oriental Huijin Futures' Pro account is designed for traders seeking a balance between cost-efficiency and enhanced trading conditions. It offers a maximum leverage of 1:50 for most commodities and 1:10 for indices, making it ideal for traders with moderate risk tolerance. Compared to the Standard account, the Pro account features tighter spreads and lower commissions. Traders looking for improved terms will appreciate this account, which requires a minimum deposit of $500 and comes with reduced margin and trading volume requirements.

VIP Account:

The VIP account at Oriental Huijin Futures is tailored to experienced traders who prioritize the best possible trading conditions. This account type offers the lowest leverage, with a maximum of 1:20 for most commodities and 1:5 for indices. With the tightest spreads and lowest commissions among all three account types, the VIP account ensures optimal trading conditions. However, it comes with a higher minimum deposit requirement of $10,000 and reduced margin and trading volume requirements, making it the top choice for traders who demand the utmost in trading quality.

Here is a small table outlining the notable differences between account types:

How to open an account?

To register with Oriental Huijin, a Chinese ID is required. Customers who fulfill this requirement can register by doing the following:

Visit the website of Oriental Huijin, https://www.dfhjqh.com/

Locate the “Member Registration” button in the top right, and navigate to its page.

Enter the required information in the registration form.

Minimum Deposit

Oriental Huijin Futures provides a range of minimum deposit rates across its account types to cater to different trader preferences and experience levels. The Standard account, designed for those seeking a cost-effective entry point, requires a minimum deposit of $100. The Pro account, offering a balance between affordability and improved trading conditions, mandates a minimum deposit of $500. For traders prioritizing optimal trading quality, the VIP account necessitates a higher minimum deposit of $10,000. These varying minimum deposit rates allow traders to select an account that best suits their individual needs and financial capacity.

Leverage

Oriental Huijin Futures offers a range of maximum leverage ratios tailored to different account types and trading instruments. For commodities, the maximum leverage can go up to 1:100 with the Standard account, 1:50 with the Pro account, and 1:20 with the VIP account. When it comes to trading indices, the leverage varies as well, with the Standard account offering 1:20, the Pro account 1:10, and the VIP account 1:5.

To provide context, a comparison table of maximum leverage ratios for commodities and indices has been included below, taking into account the offerings of Alpari, HotForex, IC Markets, and RoboForex:

Deposit & Withdrawal

Oriental Huijin offers several deposit and withdrawal methods to facilitate funding and managing trading accounts. These methods include wire transfers, bank transfers, and UnionPay. Traders can conveniently deposit and withdraw funds using these options. The minimum deposit requirement starts at $100, making it accessible for traders to begin their trading journey with the company.

Trading Platforms

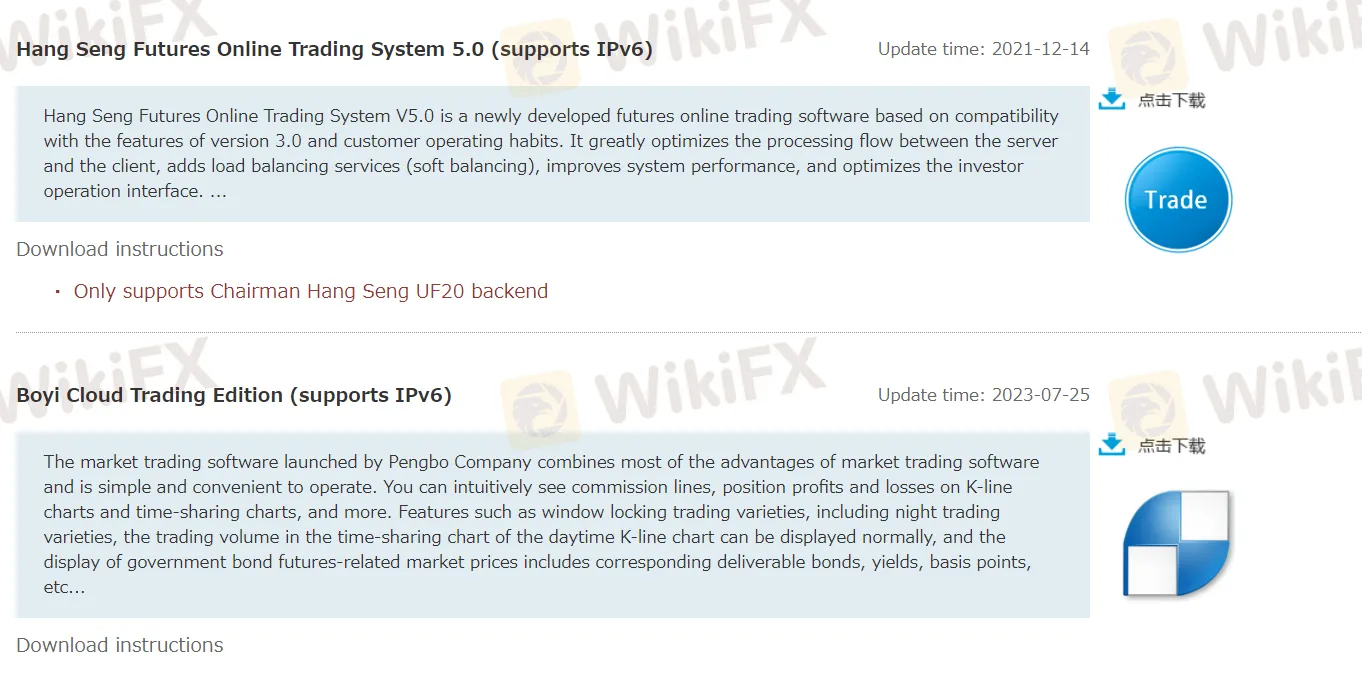

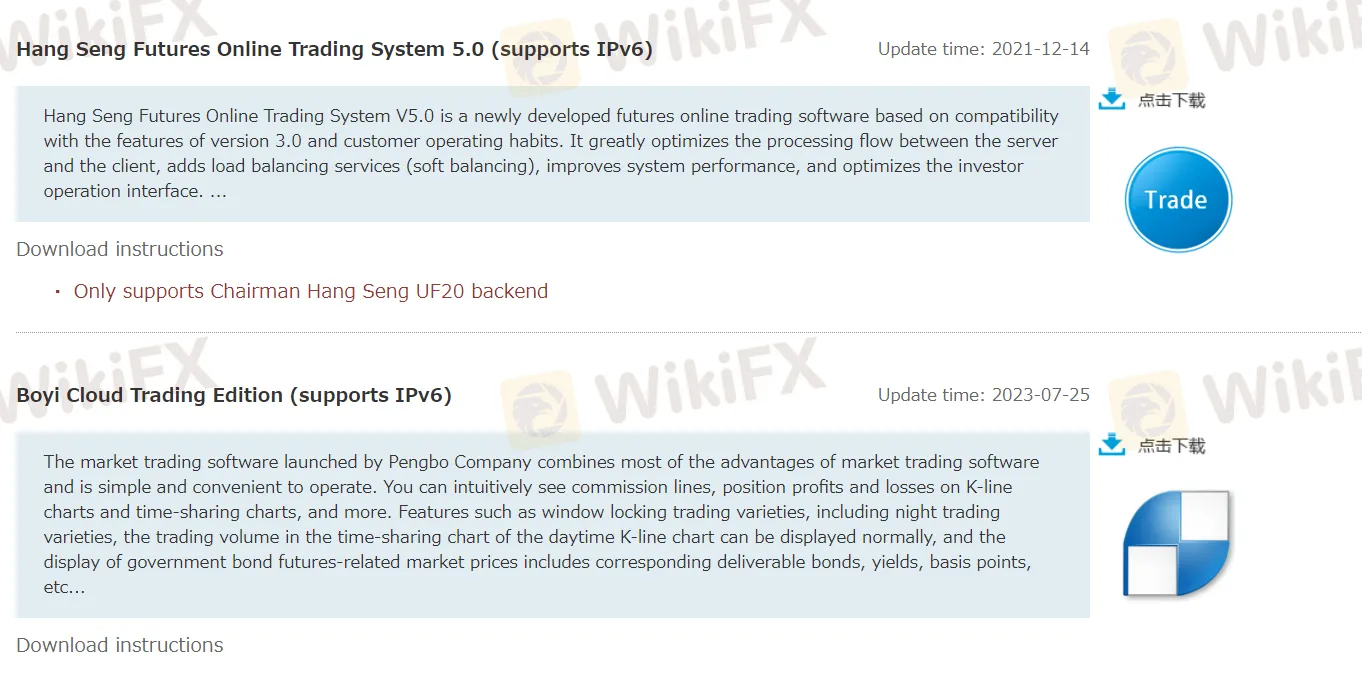

Oriental Huijin provides a range of trading platforms designed to cater to different trader preferences. Notably, the absence of the widely popular MetaTrader platforms, which are commonly offered by other brokers like Alpari, HotForex, IC Markets, and RoboForex, is worth mentioning. Instead, Oriental Huijin offers a wide variety of Chinese Trading Platforms and a proprietary platform, which are as follows:

Hang Seng Futures Online Trading System V5.0 is a cutting-edge online platform for trading Hang Seng Index futures, offering advanced features and tools for traders to manage their positions effectively.

Fast Trading Software V2 and Fast Trading Software V3 are high-speed trading applications designed to execute trades rapidly, making them suitable for traders who require quick and efficient order execution in fast-moving markets.

Pyramid Decision Trading System is a specialized trading tool that helps traders make strategic decisions by analyzing market data and trends, aiding in the development of trading strategies.

Oriental Huijin Futures Hang Seng Online Trading 5.0 is a comprehensive online trading platform specifically tailored for Hang Seng Index futures trading, offering traders a range of features and resources to enhance their trading experience on this particular market.

Customer Support

Oriental Huijin provides traders with both email-based and phone-based customer support options, offering written documentation and immediate assistance, respectively.

Email: Oriental Huijin provides traders with the option to contact customer support via email at public@dfhjqh.com. This email-based support channel is available for traders to seek assistance, raise inquiries, or address any concerns they may have. It offers a written record of communication, which can be helpful for documenting discussions and resolutions.

Phone: In addition to email support, Oriental Huijin also offers phone support for traders. Traders can contact the company's customer support team by dialing 4000-700-555. Phone support allows for more immediate and direct communication, making it suitable for urgent matters or those that require real-time assistance.

Conclusion

Oriental Huijin emerges as a futures brokerage with a noteworthy regulated status under the China Financial Futures Exchange, signifying its adherence to regulatory standards. Traders can select from Standard, Pro, and VIP accounts, each differing in leverage, spreads, commissions, and minimum deposit requirements. Furthermore, Oriental Huijin offers a selection of market instruments, encompassing commodities, metals, energies, and indices, catering to various trading preferences.

However, notable limitations include the absence of industry-standard options like MetaTrader, the language barrier for non-Chinese individuals, as well as registration mandating a Chinese ID number. This brokerage equips traders with multiple support channels, including email and phone, offering accessible communication avenues to address queries and concerns.

FAQs

Q: What types of market instruments can traders access through Oriental Huijin?

A: Traders can access a range of market instruments, including commodities, metals, energies, and indices.

Q: How can traders contact Oriental Huijin's customer support?

A: Traders can contact customer support via email at public@dfhjqh.com or by phone at 4000-700-555.

Q: Are there different account types available at Oriental Huijin?

A: Yes, Oriental Huijin offers three distinct account types: Standard, Pro, and VIP.

Q: What distinguishes the Standard account from the other account types?

A: The Standard account typically features lower leverage, wider spreads, and higher commissions compared to the Pro and VIP accounts.

Q: Does Oriental Huijin have a regulated status?

A: Yes, Oriental Huijin is regulated by the China Financial Futures Exchange.

Q: Can non-Chinese individuals sign up with Oriental Huijin?

A: No, registration requires a Chinese ID number, suggesting that the company primarily caters to Chinese traders.