Its products

MoreBroker selection

Filter and present a comprehensive evaluation of multiple brokers. You can view regulatory information, company services, deposits and withdrawals, spreads, news, user reviews, complaints, and more. Our search filters help you learn more about brokers and their information, assisting you in selecting high-quality brokers for account opening or information verification.

Broker comparison

Choose comprehensive information pages for two or more brokers to compare their regulations, deposits and withdrawals, spreads, reviews, complaints, and other details. By making a comprehensive assessment of the brokers, you can analyze their strengths and weaknesses, helping you select a quality broker that meets your current requirements.

Popular Regulators

Its products

MoreBroker selection

Filter and present a comprehensive evaluation of multiple brokers. You can view regulatory information, company services, deposits and withdrawals, spreads, news, user reviews, complaints, and more. Our search filters help you learn more about brokers and their information, assisting you in selecting high-quality brokers for account opening or information verification.

Broker comparison

Choose comprehensive information pages for two or more brokers to compare their regulations, deposits and withdrawals, spreads, reviews, complaints, and other details. By making a comprehensive assessment of the brokers, you can analyze their strengths and weaknesses, helping you select a quality broker that meets your current requirements.

Popular Regulators

Its products

MoreBroker selection

Filter and present a comprehensive evaluation of multiple brokers. You can view regulatory information, company services, deposits and withdrawals, spreads, news, user reviews, complaints, and more. Our search filters help you learn more about brokers and their information, assisting you in selecting high-quality brokers for account opening or information verification.

Broker comparison

Choose comprehensive information pages for two or more brokers to compare their regulations, deposits and withdrawals, spreads, reviews, complaints, and other details. By making a comprehensive assessment of the brokers, you can analyze their strengths and weaknesses, helping you select a quality broker that meets your current requirements.

Popular Regulators

Its products

MoreBroker selection

Filter and present a comprehensive evaluation of multiple brokers. You can view regulatory information, company services, deposits and withdrawals, spreads, news, user reviews, complaints, and more. Our search filters help you learn more about brokers and their information, assisting you in selecting high-quality brokers for account opening or information verification.

Broker comparison

Choose comprehensive information pages for two or more brokers to compare their regulations, deposits and withdrawals, spreads, reviews, complaints, and other details. By making a comprehensive assessment of the brokers, you can analyze their strengths and weaknesses, helping you select a quality broker that meets your current requirements.

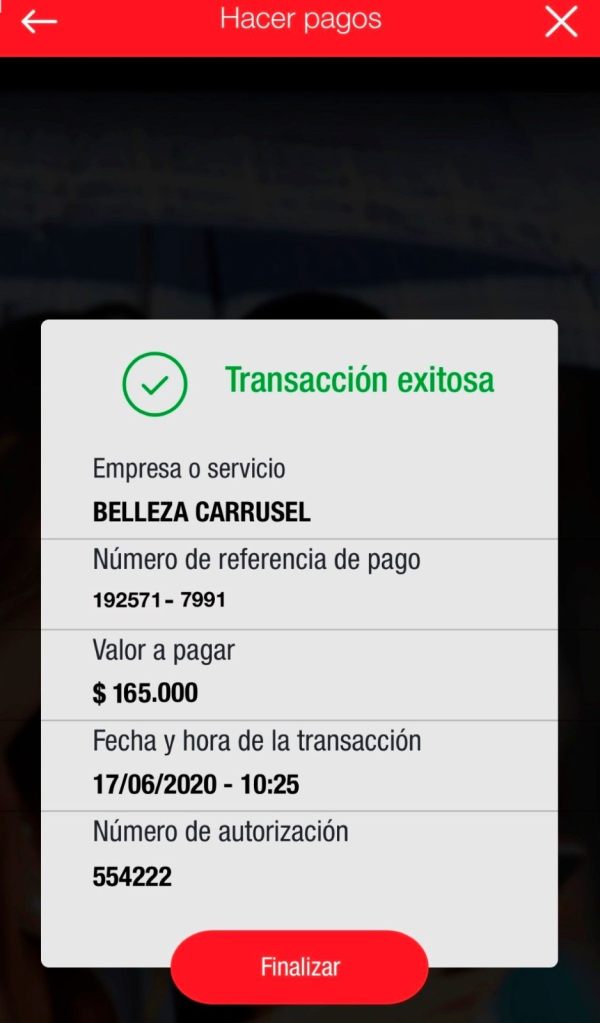

FX2411385624

Mexico

My name is Marín. I deposited $165 but was unable to withdraw. They blocked me from the platform.

Exposure

2021-09-21

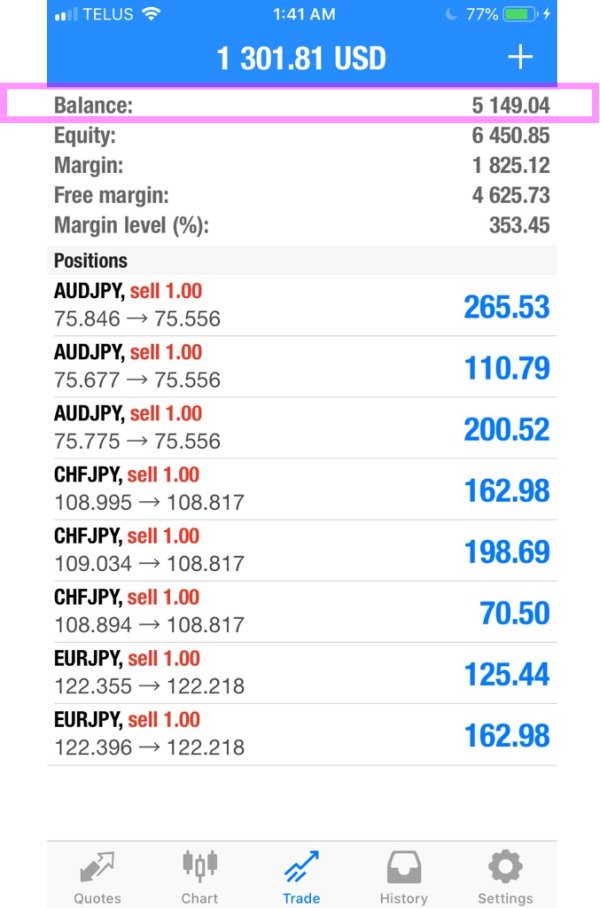

FX2046354843

Philippines

I deposited $8,500 in a free account. Dennis phoned me to tell me it’s too little they need more. So I took my morgue payment and deposited another $1000. After reading all the reviews online, I changed my mind. I requested a withdrawal. After 11 days nothing. When I send e-mails they tell me they must take to me over the phone. I lost money I didn’t have and am now 1 month in arrears on my home loan.

Exposure

2021-09-13

Reynan Guillemer Baron

Philippines

Stay away from it. They promised high profits but actually I was unable to withdraw.

Exposure

2021-08-28

FX3726149608

Paraguay

我入金5,000,但是出金的时候他们打电话让我不要操作,他们会处理好。之后每次出金都失败了,已经过去三周。

Exposure

2021-08-05

FX3600774846

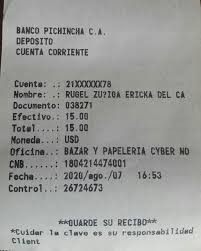

Colombia

I deposited $100 after 100% verification, and paid $15 of insurance and taxes as they required. The agent asked me for money at first but he did not recorded anything on the platform. Finally they blocked me.

Exposure

2021-08-05

FX4510664142

Colombia

They promised me that if I invested 200usd ... 730 thousand in Colombian pesos, they would bring it with it through forex and multiply it, I received trust mail and I continued, this is the time they do not respond to me. What a disappointment.

Exposure

2021-07-09

FX8718994162

Peru

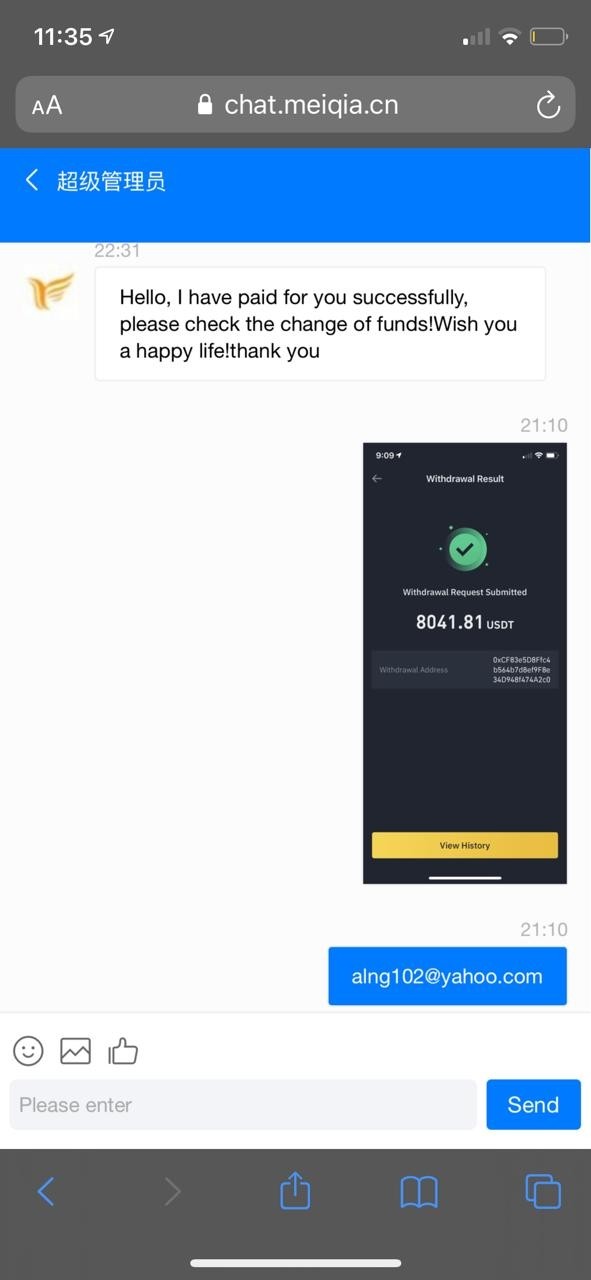

Hello, I also invested my money in Experiamarkets. A girl contacted me Fernanda Duarte and told me everything was fine. She also saved a sum of money and gave me a consultant named Martin Ocampos who asked me to invest in Tesla. But he was at that time, and then he stopped talking to me, one Pablo Anderson called me, he told me to invest in Pfizer and accepted, then another Pablo called me and said Pablo Anderson I made a mistake and was fired. This will be my consultant. He deposited 5000 USD in my account. When I withdrew, he sent me a form. I withdrew 3000 USD, he told I have to pay 560 dollars in taxes in his country, and I paid it confidently, and then he told me that I have to pay 18% of my country’s taxes, and I also paid... Then some Jaime Vega Santana called Here it is. He told me that Mr. Pablo made a mistake on many accounts. He suggested that I pay for the policy. I will deposit an extra $250 and pay.. Then Jaime Vega Santana sent it to me I got the voucher, the next day I blocked the contact, I didn’t know anything about it... I went to a consultant and he told me that my money was in my country and so on... But I don’t believe it anymore They are. .. I just know that I should inform myself before paying so much. I feel terrible because I invested my high school payment in the place where I studied, and now I owe...help and don't believe them

Exposure

2021-06-29

FX3672056133

Ecuador

A person contacted me and said that if I want to invest with them, only $250 can generate a huge income. I deposited and everything is fine. I have money in my account. I did some operations and generated One day I want to withdraw more money. The person who contacted me told me that he could not do this because my initial deposit was very low. I had to deposit more than 500 to withdraw. I told him no, he did not reply to me again.

Exposure

2021-06-28

FX8718994162

Peru

A girl named Fernanda Duarte chatted with me and recommended a consultant named Martin Ocampos to me who asked me to invest here. I did so but when I was going to withdraw funds, I was asked to pay a tax of $560 for his country and a 18% tax fee in mine. Please help me

Exposure

2021-06-24

FX3361956830

Bolivia

At first, they tried to persuade u to invest more.

Exposure

2021-06-23

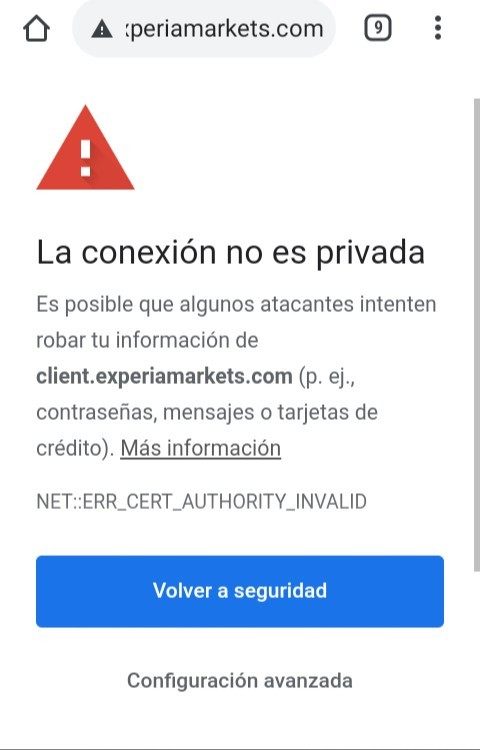

FX5281737212

Mexico

It has been several days since my withdrawal. I have contacted the support staff, they did not reply to my email, and the person who recommended the broker did not reply to me via WhatsApp, there seems to be a kind of connection to experiamarkets Scam network.

Exposure

2021-06-07

FX3049666604

Ecuador

Regarding the advertisement of Experia Markets, I asked for information, then they contacted me and gave me a management account, they asked to deposit 2500 USD, and get 60% to 70% profit every month, I never had it again after a few months After receiving the information, Nicolle, the so-called financial consultant, contacted me and asked for a refund of my money to Salas. I asked for a deposit of 500 dollars to withdraw the profit. I did it. They never refunded a penny. After that, the lady said Very rude

Exposure

2021-05-22

FX6847978062

Salvador

I've invested 3,100 in total in Experia Markets. But I am unable to iwthdraw now. This is a scam

Exposure

2021-04-15

FX5281737212

Mexico

I've deposited $300 and I gained profits immediately. But then I reazed that they cheated many people after the investigation. So I tried withdraw funds and asked for my refund via emails(experiamarkets2021@gmail.com,support@experiamarkets.com). But I haven't received my money till yet!

Exposure

2021-04-07