Overview

Theo Brokerage is an online forex broker offering a diverse range of tradable assets, including Forex, commodities, indices, cryptocurrencies, and futures. The brokerage provides two types of accounts: a Standard Account with a markup of 1 pip and a Raw Spread Account with raw inter-bank spreads. Maximum leverage is available up to 1:300 across both account types. While the platform supports multiple operating systems like Windows, iOS, and Android, customer support is limited to email. Payment options are comprehensive, including methods like Bank/Wire Transfer, Paypal, and credit cards among others.

Pros and Cons

Market Instruments

Theo offers a wide range of instruments that traders and investors can buy, sell, or trade. Each type of market instrument has its unique characteristics, trading hours, risks, and advantages. Here's a brief overview of them:

Forex (Foreign Exchange)

- What It Is: Forex refers to the trading of currencies against each other, typically in currency pairs like EUR/USD, GBP/USD, etc.

- Trading Hours: 24 hours a day, five days a week, with a short break over the weekend.

- Risks: High leverage means high risk; exposure to geopolitical events; currency manipulation.

- Advantages: High liquidity, low transaction costs, and the ability to trade almost anytime.

Commodities

- What It Is: Commodities include physical goods like gold, oil, and agricultural products. These can be traded in the spot market (immediate delivery) or through futures contracts (future delivery).

- Trading Hours: Varies by commodity and exchange but generally not 24/7.

- Risks: Price volatility due to supply and demand, geopolitical risks, storage costs for physical commodities.

- Advantages: Diversification, hedging against inflation, potential for high returns.

Indices

- What It Is: Stock indices represent a basket of companies and give a broad overview of market performance. Examples include the S&P 500, Dow Jones, and NASDAQ.

- Trading Hours: Corresponds to the opening hours of the relevant stock exchange, although some trading can occur outside these hours.

- Risks: Market risk, systemic risk.

- Advantages: Diversification as you're investing in a range of companies at once; often less volatile than individual stocks.

Digital Currencies (Cryptocurrencies)

- What It Is: Digital or virtual currencies like Bitcoin, Ethereum, and other altcoins that use cryptography for security.

- Trading Hours: 24/7, 365 days a year.

- Risks: Extreme volatility, regulatory risk, security risks (hacking).

- Advantages: Potential for high returns, low transaction costs, financial privacy.

Futures

- What It Is: A financial contract obligating the buyer to purchase, or the seller to sell, an asset like a commodity, currency, or financial instrument, at a predetermined future date and price.

- Trading Hours: Varies by the type of future and exchange but often nearly 24/5.

- Risks: High leverage, complexity, and potential for significant losses.

- Advantages: Hedging against price changes, the ability to go long or short, generally lower margin requirements compared to spot trading.

Account Types

Standard Account:

- Pricing: Markup of 1 pip added to the raw inter-bank rate.

- Commission: None.

- Leverage: Up to 1:300.

- Best for: Casual traders who prefer no commission and a simple fee structure.

Raw Spread Account:

- Pricing: Raw inter-bank spreads from liquidity providers.

- Commission: $7 per standard lot round turn.

- Leverage: Up to 1:300.

- Best for: Experienced or high-volume traders looking for narrow spreads, despite the commission.

Both accounts offer fast order execution and deep liquidity. Choose based on your trading volume and preference for fee structure.

Leverage

The broker Theo offers a maximum trading leverage of up to 1:300 for both its Standard and Raw Spread Accounts. In the context of Forex trading, this means that a trader can control a position size up to 300 times larger than their initial investment.

For example, with just $1,000 in their trading account, a trader could take positions worth up to $300,000. This high level of leverage allows for significant capital efficiency, giving traders the opportunity to potentially achieve high returns on smaller investments.

Spreads & Commissions

Theo offers two types of trading accounts with different pricing structures for spreads and commissions: the Standard Account and the Raw Spread Account.

Standard Account:

In the Standard Account, Theo doesn't charge any commission. Instead, there is a markup of 1 pip on the raw inter-bank rates, which serves as the trading cost. This markup is added to the buy and sell prices of currency pairs, essentially widening the spread.

Raw Spread Account:

In the Raw Spread Account, traders get the raw inter-bank spreads directly from liquidity providers, without any markup. This generally results in narrower spreads but comes with a commission charge. The commission varies depending on the base currency of the trading account. For example, for AUD it's $7.00 round turn, for USD it's $7.00 round turn, for EUR it's €5.50 round turn, and so on.

Deposit & Withdrawal

- Bank Methods:

- Bank/Wire Transfer: This is a traditional and commonly used method, suitable for transferring large sums of money.

- Online Payment Systems:

- Paypal: This is a widely-used online payment system.

- Skrill: This e-wallet is another option for online transactions.

- Neteller: Like Skrill, Neteller is also commonly used for online trading.

- Credit Card:

- Credit Card: This offers a quick and straightforward way to fund an account.

- Region-Specific Methods:

- UnionPay: This is mainly used in China and surrounding areas.

- Bpay: This is an electronic bill payment system commonly used in Australia.

- FasaPay: This is an online payment gateway frequently used in Indonesia.

- Poli: This service is available in Australia and New Zealand for online payments.

- Further Information:

- For additional details about each deposit method, Theo directs its customers to their funding page.

- Withdrawals:

- Although not specifically mentioned, withdrawals are usually available through the same methods used for deposits.

By offering a wide range of options for both deposits and likely withdrawals, Theo aims to accommodate a diverse customer base with different financial preferences.

Trading Platforms

Theo offers a versatile trading platform accessible via Windows, iOS, and Android devices. It supports a variety of asset classes including forex, stocks, and cryptocurrencies. The platform is available on both Raw Pricing and Standard accounts.

- Platform Types:

- Windows Client Terminal (also Mac-compatible)

- iOS App for iPhone/iPad

- Android App

- Key Features:

- Tight spreads with Raw Pricing

- Up to 1:300 leverage

- Fast execution via NY4 data center servers

- Special Tools:

- Advanced charting

- Level II Pricing for market depth

- No trading restrictions

- Mobile Access:

- Full features on iOS and Android apps, including advanced charting and 30+ technical indicators.

Customer Support

While Theo's trading platform offers a range of features to enhance the trading experience, it falls disappointingly short when it comes to customer support. The sole method of contact is via email, a medium that often doesn't allow for immediate responses. The single-channel support via email at info@theotechcl.com leaves much to be desired in terms of accessibility and timeliness.

FAQs

What trading platforms does Theo Brokerage offer?

Theo supports multiple platforms including Windows, iOS, and Android.

What types of assets can I trade with Theo?

Theo offers a wide range of tradable assets, including Forex, commodities, indices, cryptocurrencies, and futures.

What payment methods does Theo accept?

Theo offers a variety of payment options, including Bank/Wire Transfer, Paypal, Skrill, Neteller, and Credit Card, along with some region-specific methods like UnionPay and Bpay.

Does Theo Brokerage offer demo account?

No.

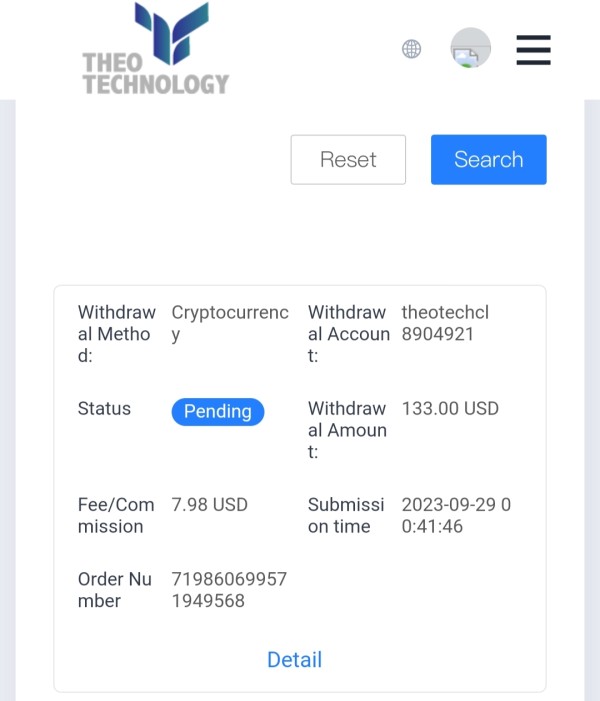

Arjun lucky

India

I'm existing client in theo, i tried to withdrawal my money on 29th September 2023 but still now i don't received money. I raised a complaint in theo broker but no response and they removed complaint option. Also mail my problem to them but no response

Exposure

2023-10-18

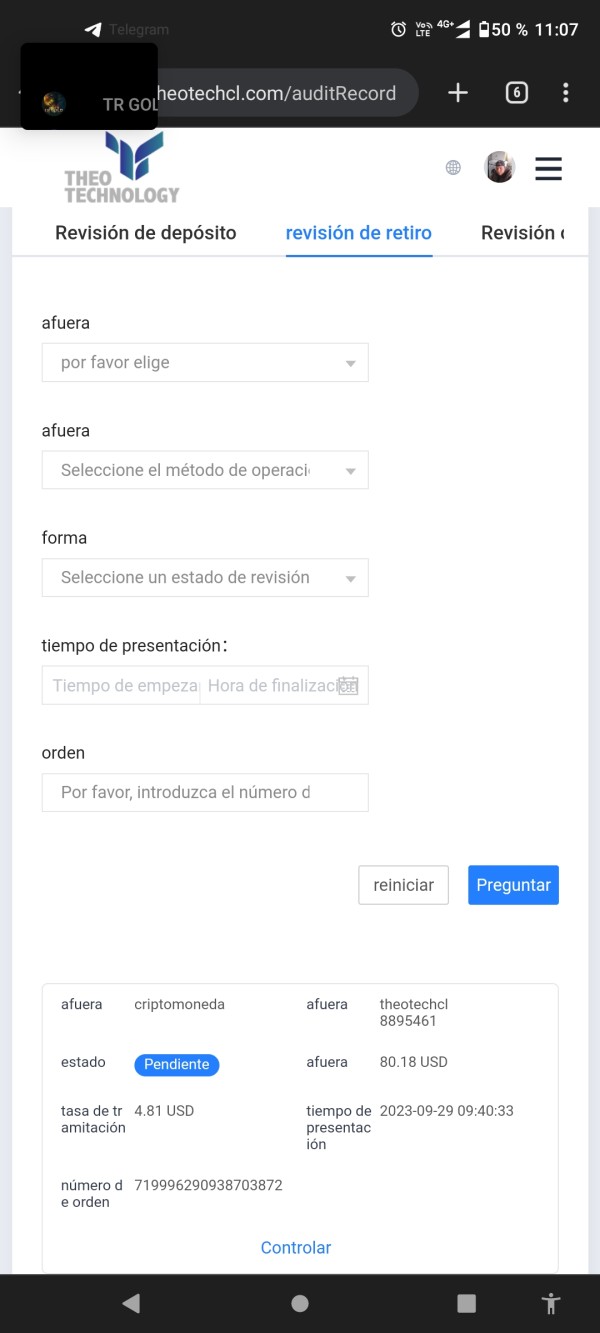

jader3840

Colombia

I have not been able to withdraw. I have been waiting for my withdrawal for more than 15 days and it has not arrived.

Exposure

2023-11-02

Lysandra Staunton-Smith

New Zealand

Here's my perspective on Theo. The platform design is quite user-friendly, with resources particularly helpful for new traders. They have an array of account types, making it easy for traders of all levels. Their spreads and fees structure seem fair. However, their customer service can be inconsistent in terms of its speed and effectiveness. Also, the variety of trading instruments leaves something to be desired. But for those just beginning their trading experience, Theo serves as a decent starting point.

Neutral

2023-12-01

Guine

United Kingdom

I've been trading with Theo for a while and my overall experience has been quite positive. The spreads and fees are competitive, very balanced in my opinion. They have a range of account options, which caters to beginners as well as experienced traders. However, they could certainly improve their range of trading instruments. Overall, I would say that the experience with Theo has been commendable.

Neutral

2023-11-30

82346

Japan

Trading with Theo is a good experience, especially because of the low spreads on the ECN account. I like how smoothly MT4 runs with their setup. But I think they could beef up their trading guides to cover more than just the basics.

Positive

2024-06-27

yun38502

United States

1:300 maximum leverage is quite generous! Transaction Educational tools were handy and did help enhance my trading knowledge. Thx!!!

Positive

2024-05-15