LINQ Capital Information

LINQ Capital, based in the United Kingdom, operates as an unregulated entity offering a variety of trading instruments including forex, cryptocurrencies, indices, commodities, and shares. They provide access to the popular MT4 trading platform and offers Standard, Premium, Pro, and VIP accounts. The company offers leverage options ranging from up to 1:200 to as high as 1:1000 across their account tiers, alongside different spreads and commissions.

Pros & Cons

Pros of LINQ Capital:

Variety of Account Types: LINQ Capital offers a range of account types—Standard, Premium, Pro, and VIP—allowing traders to choose an account that fits their investment level and trading needs.

Flexible Leverages: The platform provides flexible leverage options from 1:200 to 1:1000, allowing traders to potentially maximize their trading positions according to their risk tolerance and strategy.

Multiple Deposit and Withdrawal Methods: LINQ Capital supports various convenient methods for deposits and withdrawals, including credit/debit cards, bank wire transfers, and online payment systems.

MT4 Trading Platform: By providing access to the popular MT4 trading platform, LINQ Capital enables traders to utilize robust tools and features for effective trading and analysis.

Cons of LINQ Capital:

Unregulated Status: Operating as an unregulated entity means LINQ Capital lacks oversight from financial authorities, potentially exposing traders to higher risks such as fraud or mismanagement, with limited legal protections.

No 24/7 Support: Unlike some competitors, LINQ Capitals customer support is available during business hours only (24/5), which may be insufficient for traders needing assistance outside regular trading hours.

Is LINQ Capital Legit?

LINQ Capital operates without any regulatory oversight, which presents significant risks for investors. The absence of government or financial authority regulation means that there are no established standards or checks on LINQ Capital's operations. This lack of oversight extends to how the company handles investors' funds and operates its platform.

Investing with LINQ Capital under these circumstances is fraught with potential dangers. Since there are no regulatory requirements to adhere to, the individuals running the platform could potentially misuse investors' funds without consequence. They have the freedom to mismanage or even embezzle funds entrusted to them, as they are not legally obligated to safeguard investors' interests.

Market Instruments

LINQ Capital offers forex, crypto, indices, commodities and shares.

Forex (Foreign Exchange): This involves trading currency pairs, such as EUR/USD or GBP/JPY, where investors speculate on the exchange rate fluctuations between different currencies.

Cryptocurrencies: This includes popular digital currencies like Bitcoin (BTC), Ethereum (ETH), and other altcoins. Cryptocurrency trading allows investors to capitalize on price movements within the volatile crypto market.

Indices: LINQ Capital offers trading opportunities on major stock indices like the S&P 500, NASDAQ, FTSE 100, and others. Index trading allows investors to speculate on the performance of a basket of stocks representing a particular market segment.

Commodities: This category includes trading in physical commodities such as gold, silver, oil, natural gas, agricultural products (like wheat and corn), and more. Commodity trading provides exposure to the prices of these essential resources.

Shares: Investors can trade shares (also known as stocks or equities) of publicly listed companies across various global stock exchanges. This allows them to invest in specific companies and potentially benefit from capital appreciation and dividends.

Account Types

LINQ Capital offers Standard Account, Premium Account, Pro Account and VIP Account with different minimum deposit requirements.

Standard Account: With a minimum deposit of $250, this account is ideal for beginners or casual traders. Its designed to offer a balanced mix of features and services, allowing traders to start trading with a modest investment.

Premium Account: The Premium Account requires a minimum deposit of $25,000. It is tailored for more experienced traders who have a higher net worth and require more advanced resources and support.

Pro Account: For traders with a more substantial trading capital, the Pro Account requires a minimum deposit of $50,000. It is suited for experienced investors who are actively involved in trading and desire even greater features and amenities.

VIP Account: The VIP Account is the highest tier, available to clients who deposit a minimum of $100,000. This account is tailored for professional traders and large investors, offering them premium services, expertise, and discretion that they require.

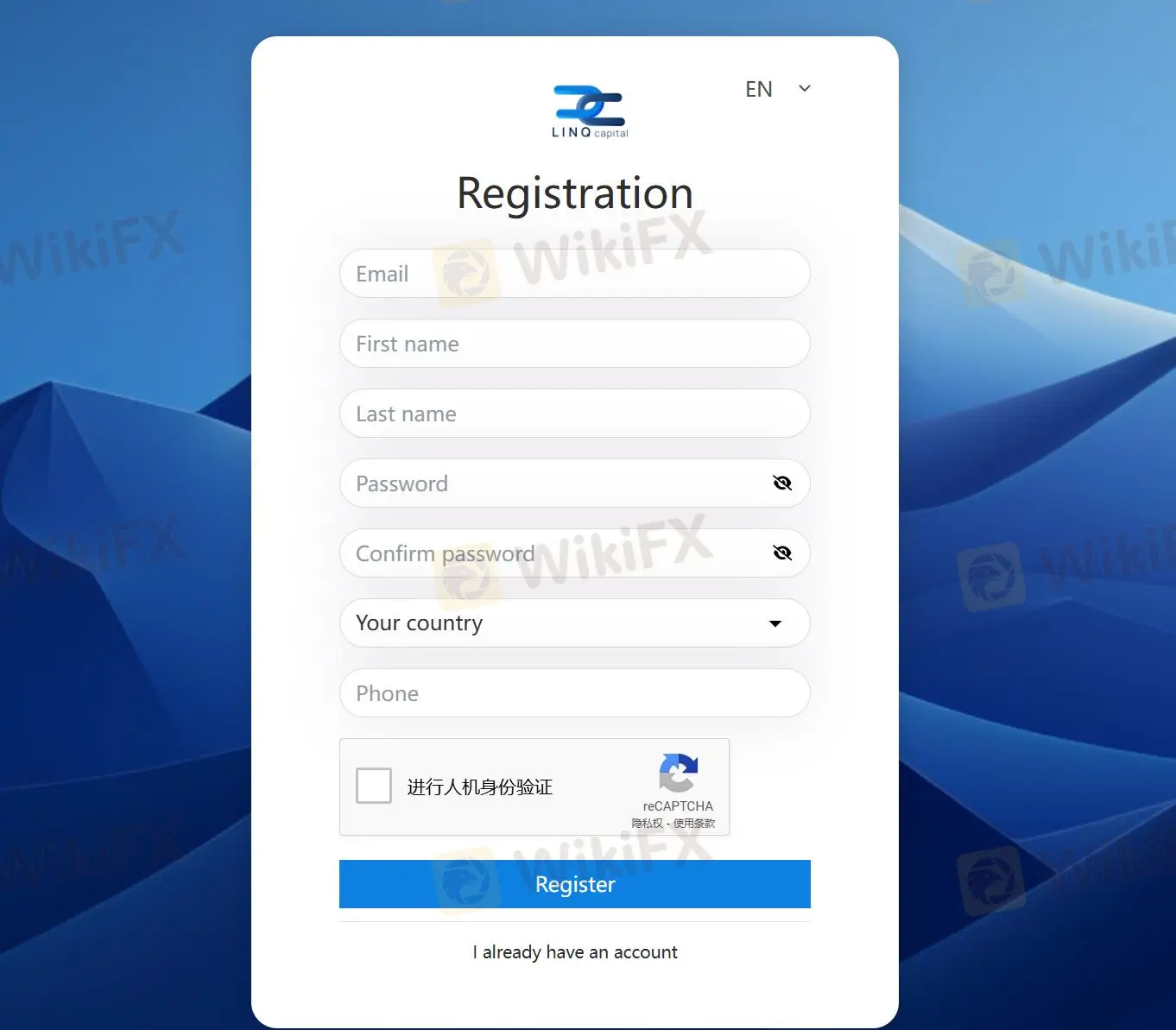

How to Open an Account?

To open an account with LINQ Capital, please follow these steps:

Leverage

Standard Account: This account provides leverage of up to 1:200, making it suitable for beginners who are looking to gain exposure to the market without taking on excessive risk.

Premium Account: Also offering leverage up to 1:200, this account caters to more experienced traders.

Pro Account: This account features a significantly higher leverage of up to 1:1000, which is ideal for seasoned traders seeking to maximize their trading potential.

VIP Account: Similarly, the VIP Account also offers leverage up to 1:1000, providing professional traders the flexibility to execute high-stakes trades.

Spreads & Commissions

Standard Account: This account features spreads starting from 0.5 pips with no commissions per trade. It is designed to provide cost-effective trading for beginners and casual traders who prefer straightforward fee structures without additional transaction costs.

Premium Account: Traders opting for the Premium Account can benefit from spreads starting from 0 pips, albeit with a commission of USD 3.5 per side.

Pro Account: With spreads starting from 1.5 pips and a lower commission of USD 1 per side, the Pro Account targets active investors seeking competitive trading conditions with manageable transaction costs.

VIP Account: The VIP Account offers spreads starting from 1.8 pips. This account is geared towards professional traders who prioritize premium services and trading support.

Trading Platform

LINQ Capital provides the popular MetaTrader 4 (MT4) platform, renowned for its robust features and user-friendly interface. MT4 offers a comprehensive suite of tools essential for effective trading in various financial markets, including forex, commodities, and indices.

MT4 from LINQ Capital provides real-time news updates and economic calendar integration, keeping traders informed about market events and their potential impact. This helps traders make informed decisions and react promptly to market movements.

Deposits & Withdrawals

LINQ Capital accepts deposits and withdrawals via credit/debit cards, bank wire transfer, and online payments systems.

Credit/Debit Cards: Customers can use their credit or debit cards to fund their LINQ Capital accounts.

Bank Wire Transfer: For larger amounts or those preferring a more traditional method, bank wire transfers are available.

Online Payment Systems: LINQ Capital also accepts deposits through online payment systems like Skrill, Neteller, and BitPay. These platforms provide an additional layer of convenience, especially for customers who prefer digital payment methods or those dealing in cryptocurrencies.

Customer Service

Customers can visit their office or get in touch with customer service line using the information provided below:

Live chat

Telephone: +441618183438 (24/5)

Email: support@linq-capital.net

Address: 4 Griffiths Plains, New Kelly, Richardschester, United Kingdom

Whats more, LINQ Capital provides a Frequently Asked Questions (FAQ) section on their website to assist their clients with commonly asked questions and provide relevant information.

Conclusion

LINQ Capital offers a range of account types and flexible leverage options. The availability of multiple deposit methods and the MT4 platform enhance its appeal for traders seeking convenience and robust trading tools. However, its unregulated status poses inherent risks, including limited regulatory protections and potential challenges in dispute resolution. Therefore, while LINQ Capital provides opportunities for varied trading strategies, users should carefully consider their unregulated environment.

Frequently Asked Questions (FAQs)

Is LINQ Capital regulated by any financial authority?

No. It has been verified that this broker currently has no valid regulation.

How can I contact LINQ Capital?

You can contact via phone, +441618183438 (24/5), email: support@linq-capital.ne, and live chat.

What platform does LINQ Capital offer?

MT4.

What is the minimum deposit for LINQ Capital?

The minimum initial deposit to open an account is $250.

Risk Warning

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information provided in this review may be subject to change due to the constant updating of the company's services and policies.