Overview of coinbase

Coinbase, founded in 2012, is a highly renowned cryptocurrency trading platform established in the United States. It provides a broad spectrum of tradable crypto assets and offers both individual and business accounts. Among its features, Coinbase offers a low minimum deposit threshold of $2 and a flexible spread structure. Moreover, its user-friendly trading platforms, available for both web and mobile, come with a helpful demo account for new traders. Besides this, the platform provides multiple deposit and withdrawal options, including bank transfers, debit cards, wire transfers, and even cryptocurrency transactions. Finally, Coinbase bolsters its customer service with responsive email and phone support and provides educational resources to assist new traders in navigating the crypto market.

Regulatory Authority

This broker, Coinbase, has been confirmed to lack valid regulatory oversight at the moment. It is crucial to be mindful of the associated risks when engaging with this unregulated trading platform.

Pros and cons

Pros:

Variety of Tradable Cryptocurrencies: Coinbase offers a broad spectrum of cryptocurrencies for trading. This allows traders to diversify their portfolio and allows them to take advantage of opportunities in various cryptocurrencies.

Low Minimum Deposit: For those starting out or with limited capital, the low minimum deposit threshold at Coinbase makes it accessible to many potential traders.

User-Friendly Platforms: Coinbase's web-based and mobile trading platforms are intuitive and easy to use, which is particularly beneficial for new users who are still familiarizing themselves with the trading process.

Demo Account: The availability of a demo account on the platform allows inexperienced traders to practice and develop their skills before trading with real money.

Multiple Deposit & Withdrawal Methods: Coinbase allows for a variety of deposit and withdrawal methods, making it convenient for users to conduct their transactions.

Cons:

No Traditional FX/CFD: Coinbase is strictly a cryptocurrency trading platform. Therefore, traders who are also interested in conventional FX or CFD trading may need to look for additional platforms.

Too Basic for Advanced Traders: While its simplicity works for beginners, more advanced traders might find Coinbase's platform lacking in depth, complexity, and advanced analysis tools.

No Leverage for Cryptocurrency Trading: The absence of leverage in cryptocurrency trading could be a drawback for some traders who are looking to maximize their potential returns.

Customer Support Could Be Improved: Faster response times and more comprehensive assistance can make the trading experience more seamless.

Market Instruments

As a premier cryptocurrency platform, Coinbase provides a wide array of market instruments that traders can use. These primarily include cryptocurrencies. Coinbase supports various cryptocurrencies for trading such as Bitcoin, Ethereum, Litecoin, Bitcoin Cash, and a plethora of others. Its important to mention that the availability of certain cryptocurrencies may depend on the trader's geographical location.

In terms of products and financial services, Coinbase provides quite a few unique offerings. One of the most popular among these is the Coinbase Wallet. This is a decentralized wallet where users can store their cryptocurrencies, ensuring secure storage and management of their digital assets.

Coinbase also offers a service called Coinbase Earn, where users can learn about different cryptocurrencies and earn those respective cryptocurrencies while doing so. This is an excellent way for users to accumulate cryptocurrencies while also broadening their knowledge about the various coins available.

Coinbase Pro is another service offered by the platform. This service is more advanced and offers more sophisticated and detailed charts, an increased number of order types and expanded trading options. It is oriented more towards experienced and professional traders.

Finally, for businesses and institutions, Coinbase offers its Coinbase Custody offering. This service is specifically designed for institutional investors, providing them with secure custodial storage for their digital assets. This product is delivered with the robust security measures that institutions require when dealing with sizeable cryptocurrency assets.

Account Types

Coinbase primarily offers two types of accounts, namely Individual and Business accounts.

1. Individual Account: This type of account is primarily intended for personal use. It supports a wide range of cryptocurrencies for trading, with features designed to facilitate secure and intuitive trading. Traders can easily buy, sell, and manage their cryptocurrency portfolio from this account. It's also worth noting that this account comes with a minimum deposit requirement of just $2, making it accessible to traders with varying levels of investment capital.

2. Business Account: This account is designed for businesses and corporate entities who want to incorporate cryptocurrency into their operations, an option that has increasingly grown in popularity over the years. A business account allows companies to accept cryptocurrency as payment for goods or services, pay employees and contractors in cryptocurrency, or keep a portion of their treasury reserves in cryptocurrency. This account also facilitates the use of various APIs for secure and seamless integration with existing systems.

It is important to note that regardless of the account type, all Coinbase users have access to the platform's high-quality customer support, educational resources, and user-friendly trading platform.

How to Open an Account of coinbase?

Opening an account with Coinbase is a straightforward process, primarily performed online. Here is a detailed walkthrough of the procedure:

1. Visit the Coinbase Website: Go to Coinbase's official website.

2. Sign Up: Click on the “Get Started” button usually located at the top right corner of the home page.

3. Fill in Personal Information: Provide your personal details in the signup form, including name, email address. You'll also need to create a password.

4. Verify Email Address: After completing the signup form, confirm your email address by clicking on the verification link sent to your email.

5. Provide More Details: Post-verification, you will be asked to provide additional personal details such as your phone number for 2-Step Verification. This assists with the security of your account.

6. Identity Verification: In compliance with KYC (Know Your Customer) regulations, you'll need to provide proof of identity. This could be a passport, driving license, or any other government-approved ID. The procedure may also require a selfie to confirm that the ID belongs to the person who's making the account.

7. Set Up Payment Method: Once your identity is verified, you'll be able to link your bank account or debit card as your payment method. Details required include the account number for bank transfers, or card details for debit cards.

8. Make a Deposit: You can make your first deposit once the payment method is confirmed. Remember that the minimum deposit is $2.

9. Start Trading: Once your deposit clears, you can commence trading by buying the cryptocurrency of your choice.

At all stages of this process, if any difficulties or complications arise, Coinbase has a support team that can be contacted for assistance. New users should also be aware of their resident country's regulations and legal considerations when registering and trading.

Spreads & Commissions

Coinbase operates using a spread model for its trading transactions. This means that when placing an order, the price paid for a cryptocurrency will usually be slightly higher than the current market price, and inversely, when selling, the price received will usually be a slight bit lower. This difference is known as the 'spread'. Coinbase typically applies a spread of about 0.50% for digital currency purchases and digital currency sales.

However, this spread may fluctuate based on market conditions and the size of the order. Therefore, the actual spread may be higher, depending on transaction size, market volatility, and other factors.

Apart from the spread, Coinbase also charges a Coinbase Fee, which is the greater of a flat fee or a variable percentage based on your location, product feature, and payment type. For example, if you are a U.S. customer buying $100 of Bitcoin with a U.S. bank account, the flat fee would be calculated as $2.99. Since the flat fee is greater than 1.49% of the total transaction, your fee would amount to $2.99.

Hence, it's crucial for traders to consider both the spread and the Coinbase Fee when calculating the costs associated with trading on Coinbase. It's also advisable to always check the latest fee structure and terms on Coinbase's official site, as these can change over time.

Trading Platform

Coinbase offers a user-friendly and intuitive trading platform, making it a great option for beginner and intermediate traders. This platform is available in two main forms: a web-based platform and a mobile application.

1. Web-Based Platform: The web-based platform is accessible from any device with an internet connection and a web browser. The interface is simple to navigate and offers seamless functionality. It provides real-time charts of every available cryptocurrency pair and their market prices. Furthermore, it allows traders to easily place a variety of order types, manage their cryptocurrency portfolio, and keep track of historical data.

2. Mobile Application: For those who prefer trading on the go, Coinbase offers a mobile application available for both iOS and Android devices. Mirroring its web-based counterpart, the mobile application also provides a clean, user-friendly interface and important features needed for trading, like real-time charts, order management, and a secure wallet for your crypto assets.

Deposit & Withdrawal

Coinbase supports a variety of payment methods to facilitate deposits and withdrawals by its users. These can include:

1. Bank Account Transfers: Coinbase supports direct bank transfers for both deposits and withdrawals are available. This can be done via ACH in the U.S and via SEPA in the EU.

2. Debit Cards: Deposits can be made instantly using a debit card. However, withdrawals to a debit card are not supported.

3. Wire Transfers: Coinbase also supports wire transfers, a more traditional payment method that usually involves higher fees but also higher limits.

4. Cryptocurrency: Users can deposit and withdraw using cryptocurrencies. They can transfer cryptocurrencies from their external wallets to their Coinbase account and vice versa.

The fees associated with deposits and withdrawals vary based on the payment method and the country. For example:

- For US customers using a bank account or Coinbase wallet, deposits are free, while withdrawals also do not carry a fee.

- Instant Card Withdrawal costs up to 1.5% of any transaction and a minimum fee of $0.55.

- Users transacting from outside the U.S. may experience varying fees based on their location and chosen payment method.

For the most accurate and recent information regarding Coinbase's deposit and withdrawal fees, users should refer to the ‘Pricing and Fees Disclosures’ section of Coinbase's website.

Conclusion

In conclusion, Coinbase is an accessible platform for cryptocurrency trading, offering a range of tradable cryptocurrencies in a secure and regulated environment. Its distinct advantages lie in its user-friendly interface, a vast array of educational resources, and its wide selection of cryptocurrencies. It also offers valuable features like a demo account and a variety of deposit and withdrawal methods. On the other hand, some vulnerabilities include a lack of leverage for cryptocurrency trading, a platform that may seem overly simplistic for advanced traders, and potentially higher spread charges in comparison to its competitors. While there is room for improvement, particularly in its trading tools and customer support, Coinbase offers reliable and user-friendly services that are suited to beginners and experienced traders alike. Like with any broker, potential users should thoroughly understand its offerings, and review their trading needs before signing up.

FAQs

Q: What cryptocurrencies can I trade on Coinbase?

A: Coinbase offers an extensive collection of cryptocurrencies like Bitcoin, Ethereum, Litecoin, Bitcoin Cash, among others. The availability may depend on your location.

Q: Does Coinbase offer any leverage for trading?

A: No, as it primarily focuses on cryptocurrency trading, Coinbase does not currently provide trading on leverage.

Q: What are the deposit and withdrawal methods on Coinbase?

A: Payment methods on Coinbase include bank account transfers, debit cards, wire transfers, and cryptocurrency transfers.

Q: What kind of educational content does Coinbase provide?

A: Coinbase offers a comprehensive set of educational tools, including video tutorials, FAQs, a blog, a glossary of terms, and the unique Coinbase Earn program, where users can earn cryptocurrency while learning.

Q: Are there any fees for depositing and withdrawing funds on Coinbase?

A: Yes, the fees is based on the payment method and location. For instance, U.S. customers can deposit and withdraw funds for free using a bank account or Coinbase wallet, whereas instant card withdrawals involve a fee.

Q: What trading platforms are offered by Coinbase?

A: Coinbase provides a web-based platform and a mobile app for trading, and also offers an advanced platform called Coinbase Pro for more seasoned traders.

Risk Warning

Online trading poses substantial risks, with the potential for complete loss of invested capital, rendering it unsuitable for all traders. It is imperative to comprehend the inherent risks and acknowledge that the information provided in this review is subject to change due to continuous updates in the company's services and policies.

Additionally, the review's generation date is a critical consideration, as information may have evolved since then. Readers are strongly advised to verify updated details directly with the company before making any decisions, as the responsibility for utilizing the information herein rests solely with the reader.

Mus’ab Sani

Nigeria

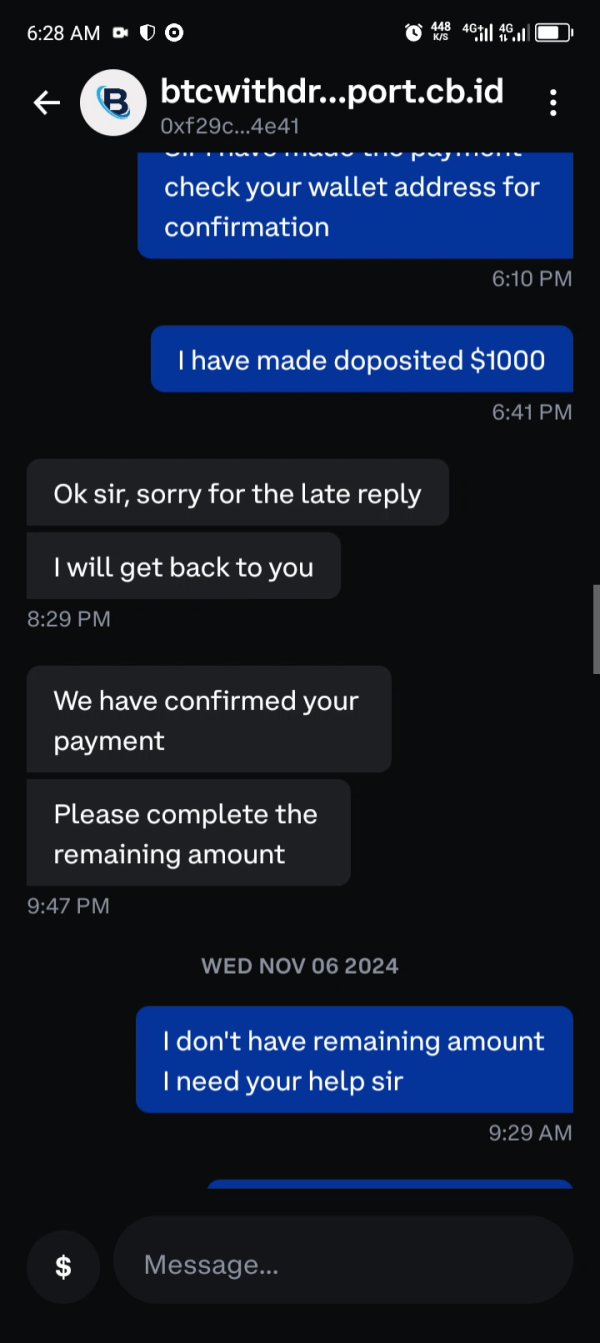

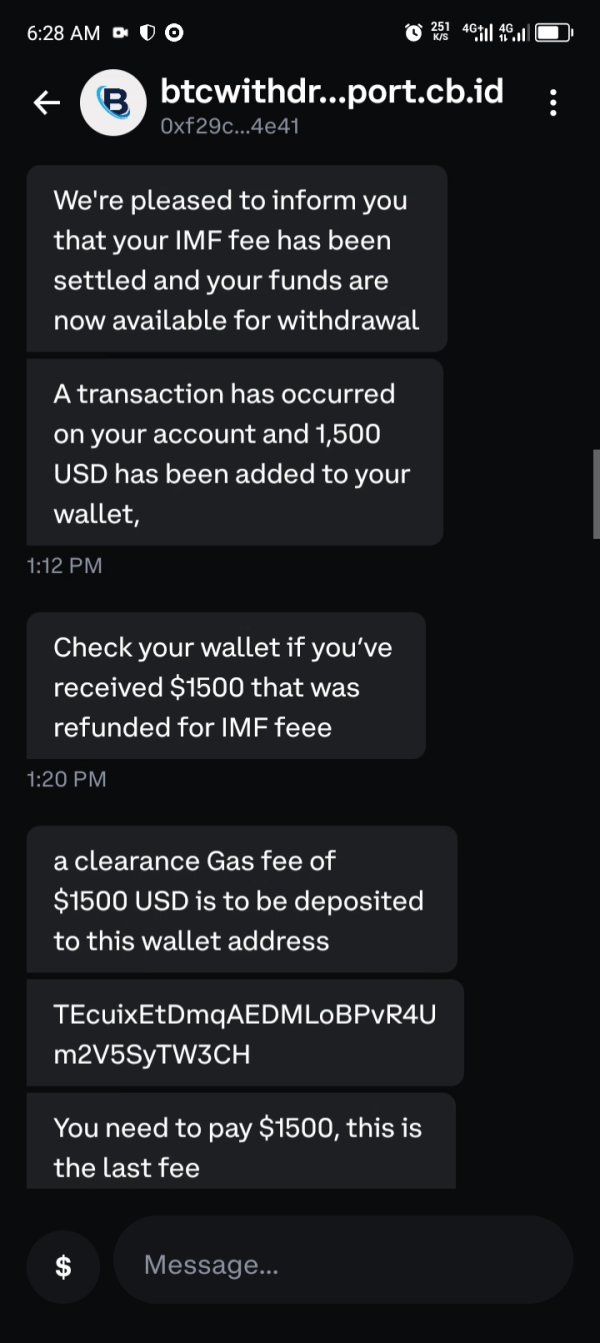

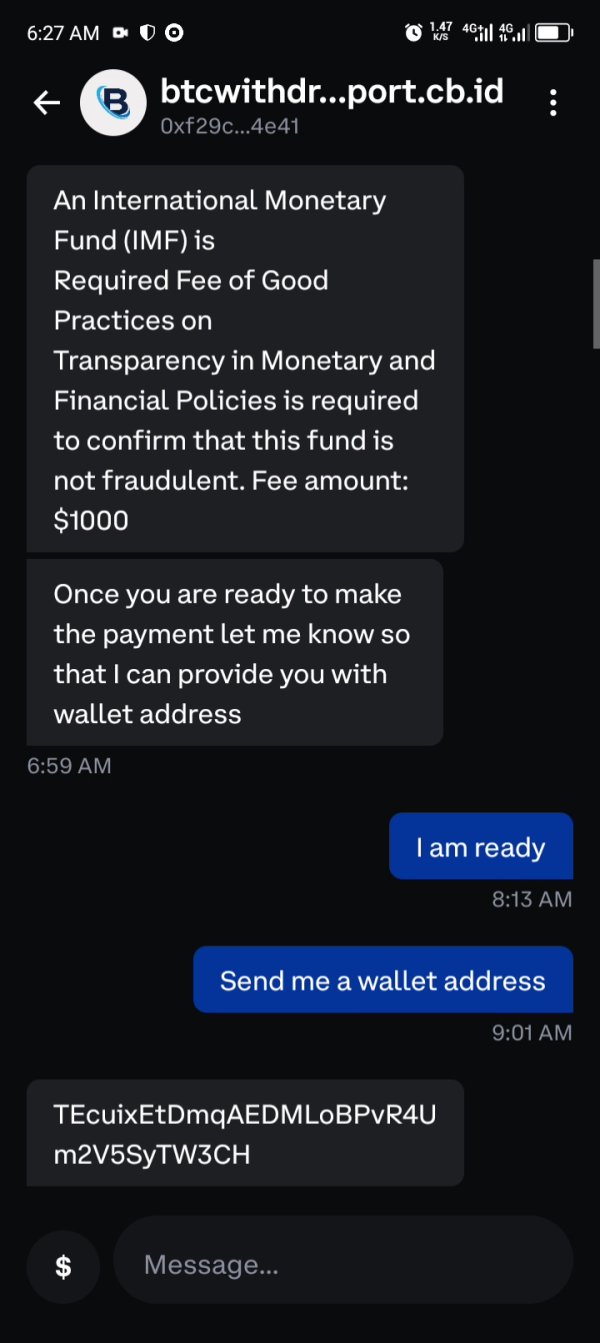

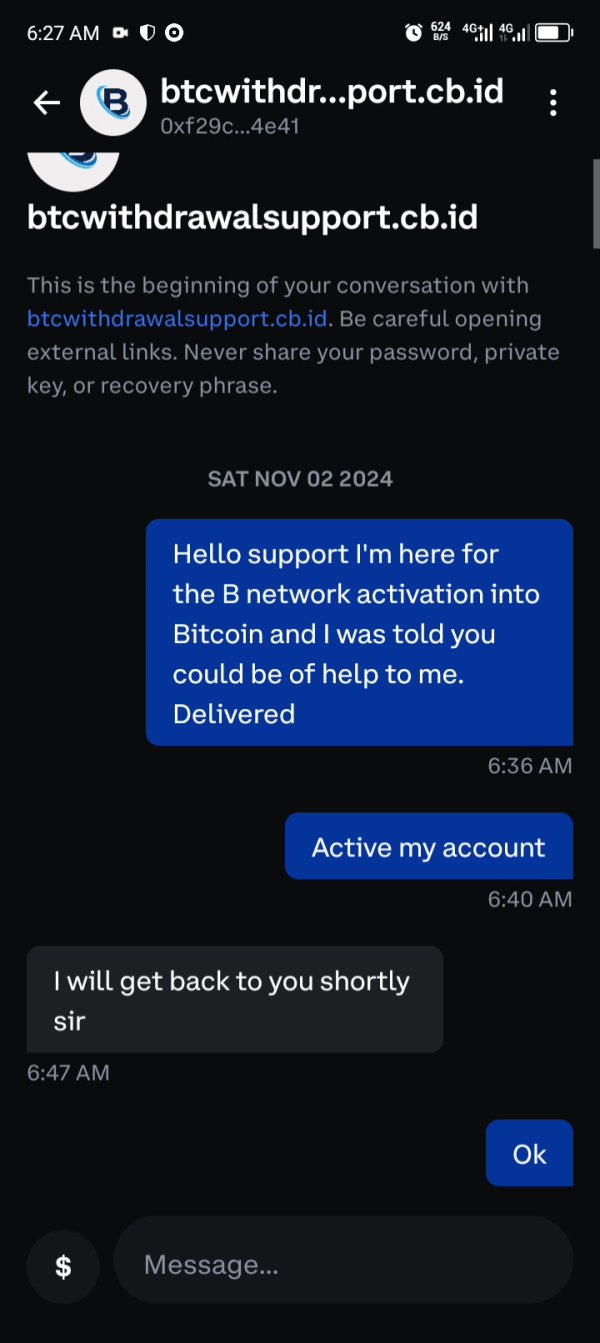

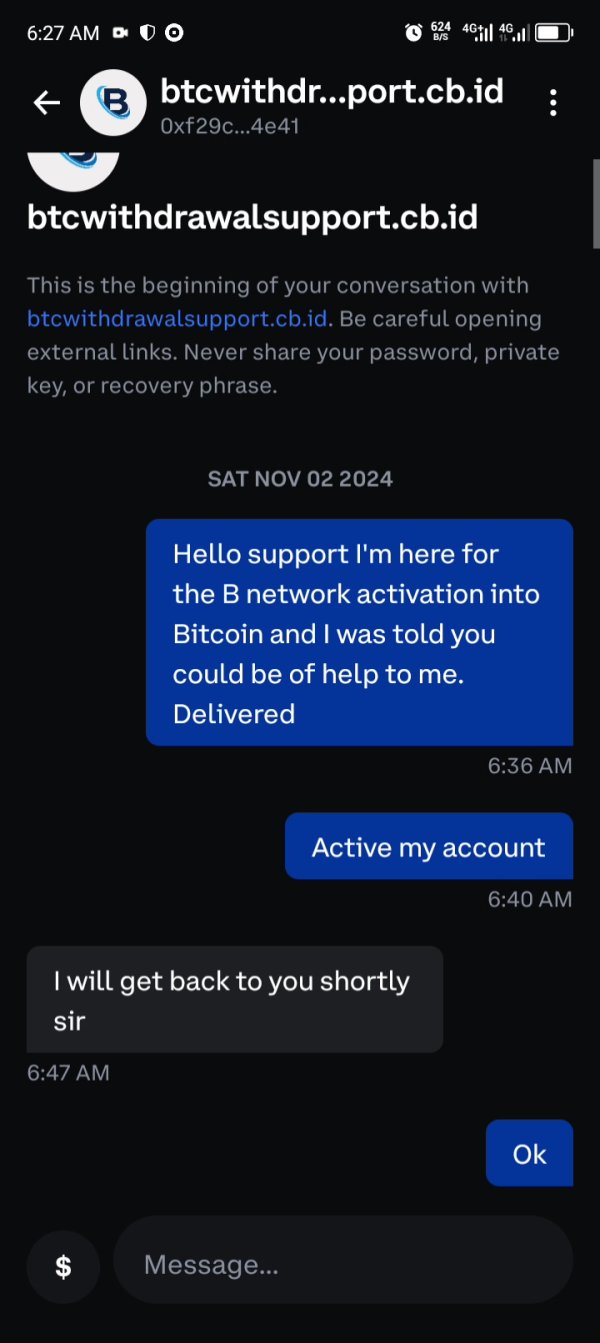

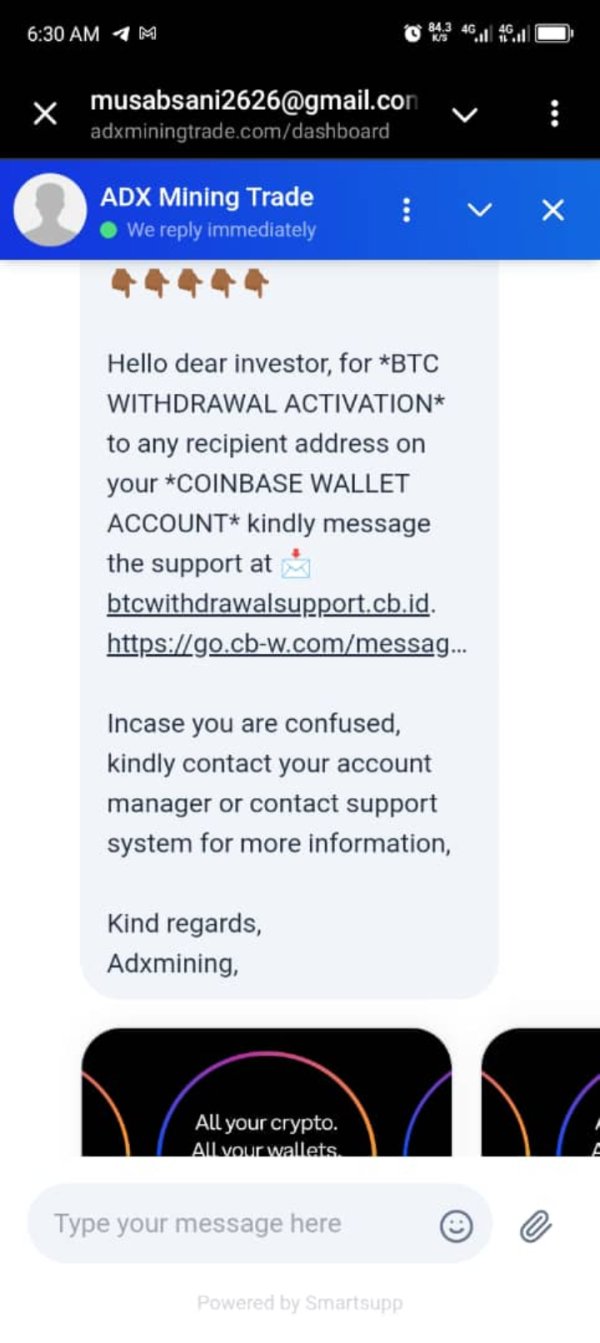

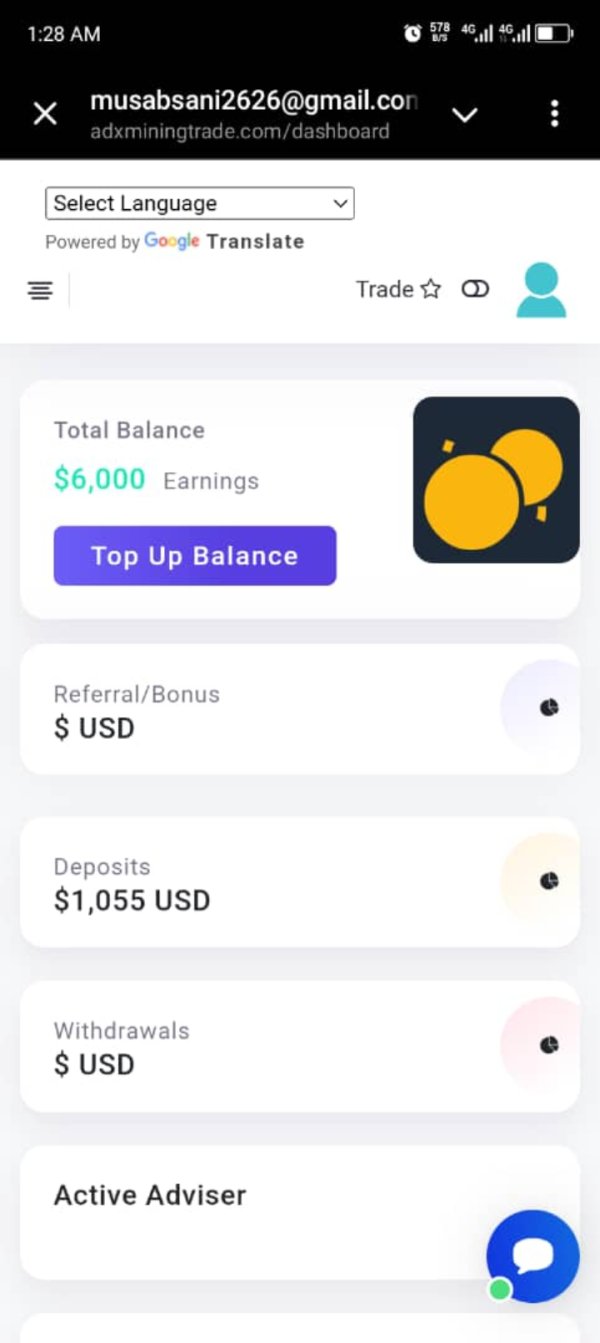

The broker adxmining trade sent to me my money into Coinbase wallet $6000 and told me to contact btcwithrawlsuppotcbid in coinbase wallet and I paid $2500 for to withdraw my money but they didn't give me

Exposure

2024-12-05

Hiếu Đẹp trai

Taiwan

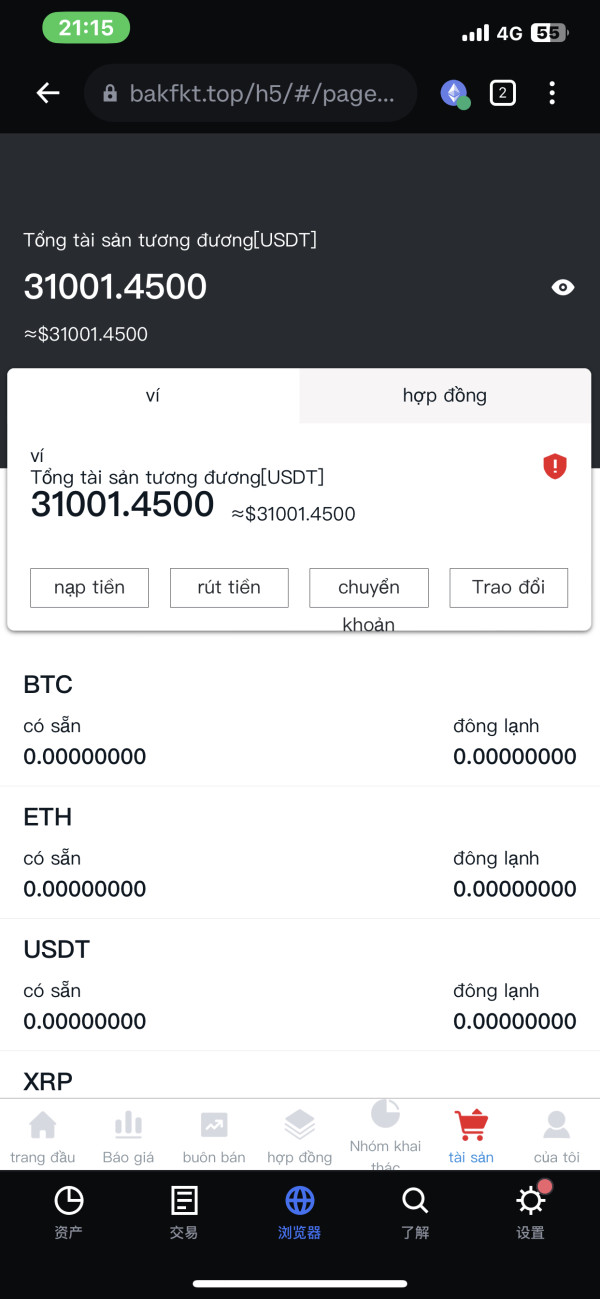

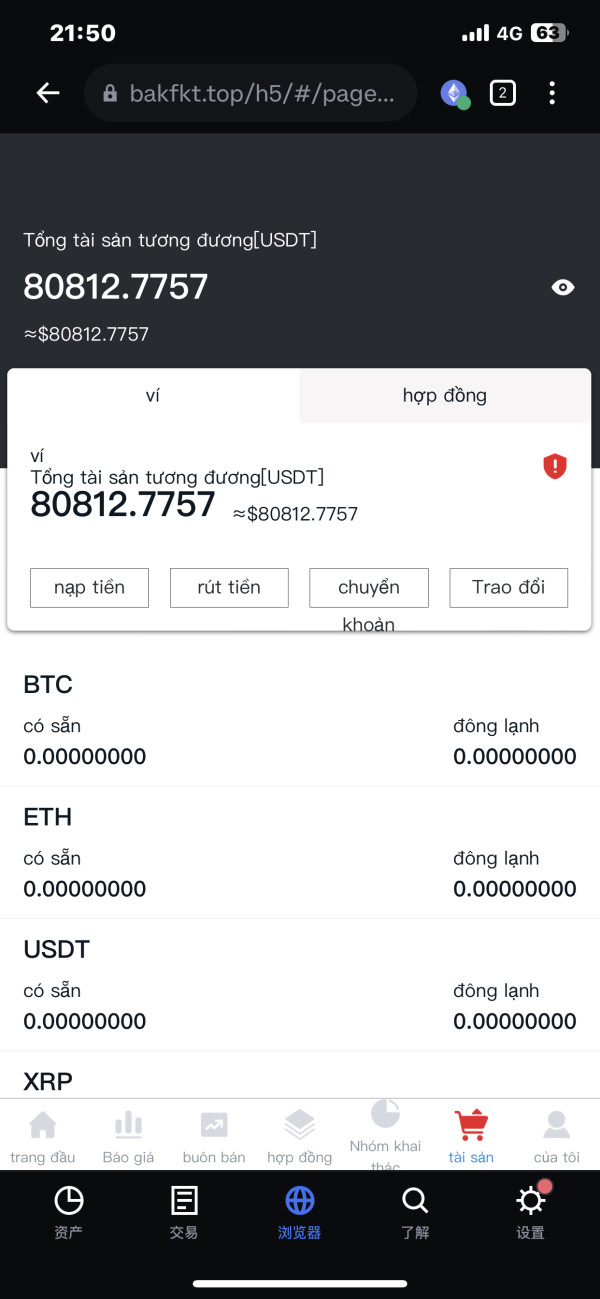

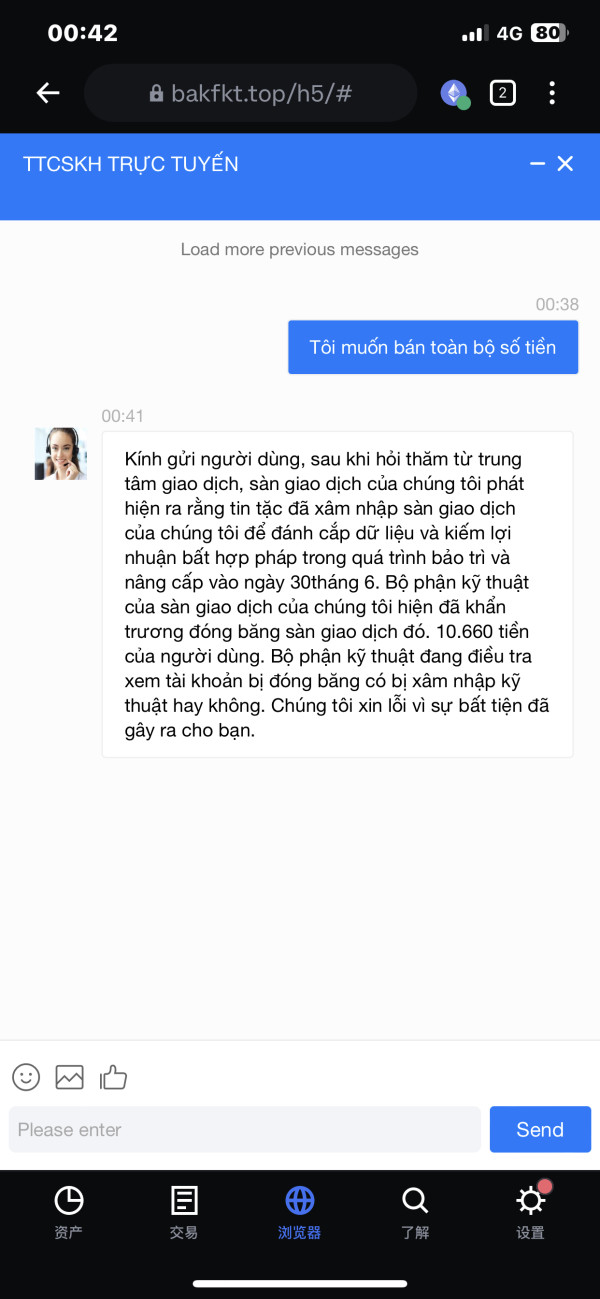

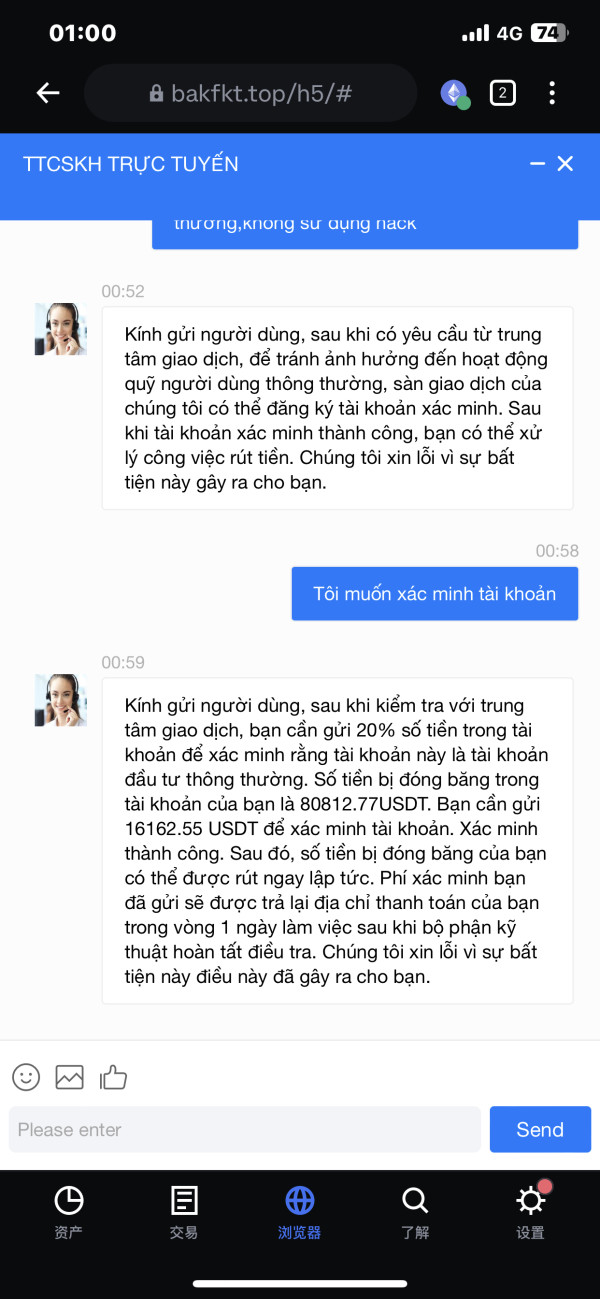

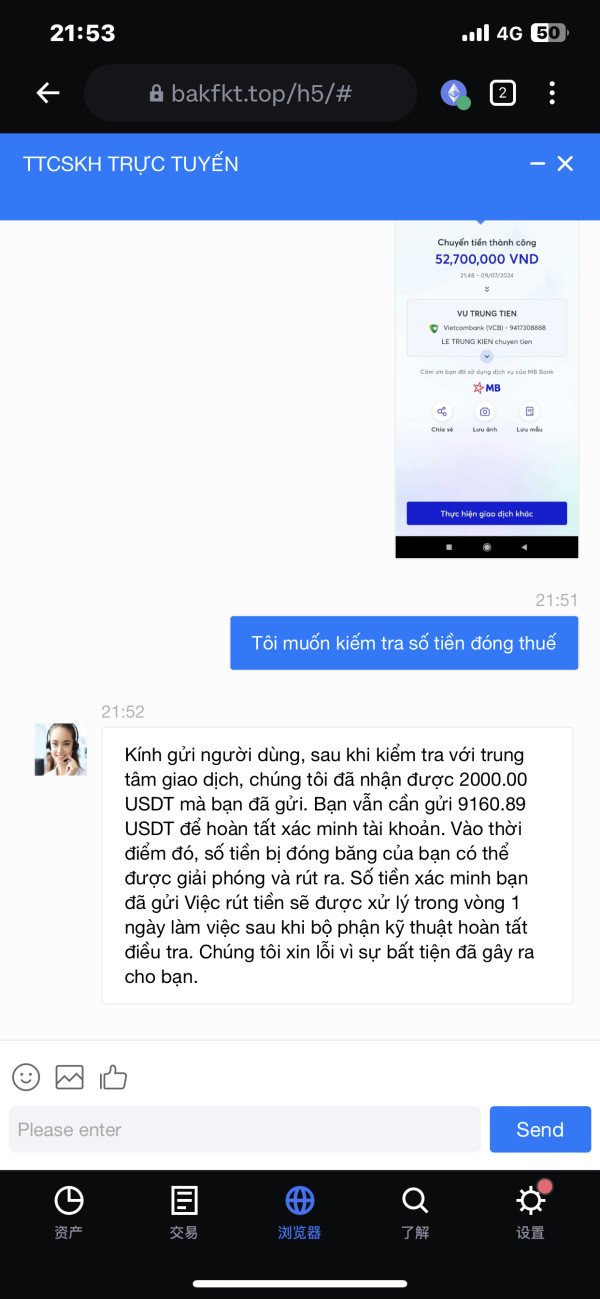

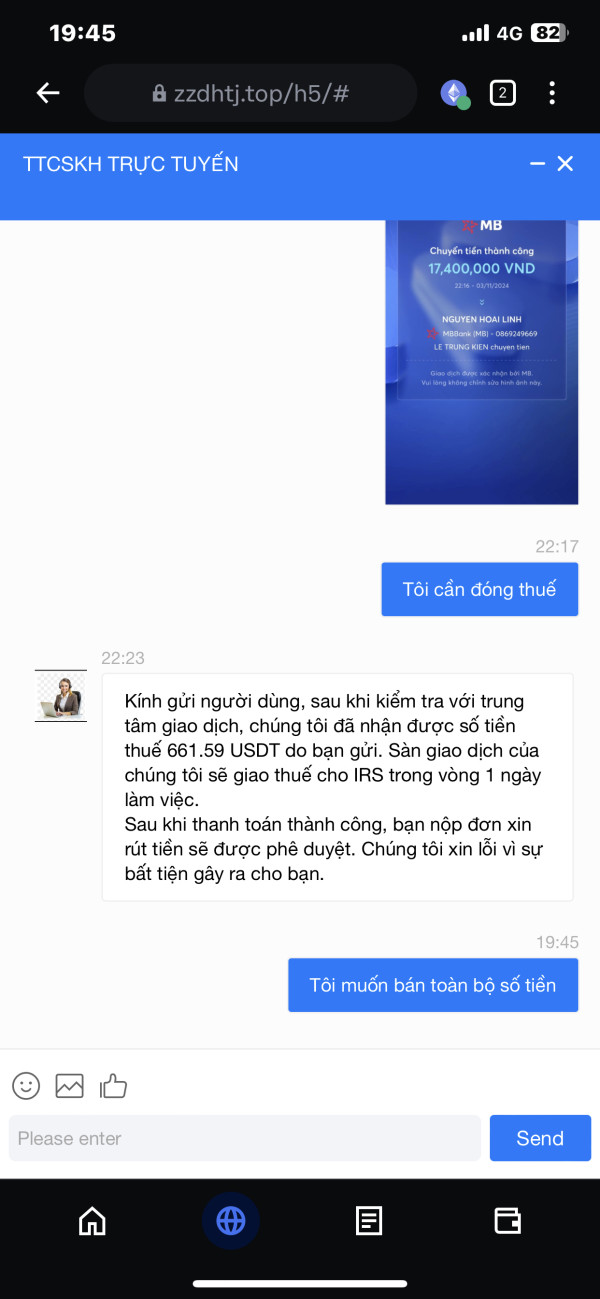

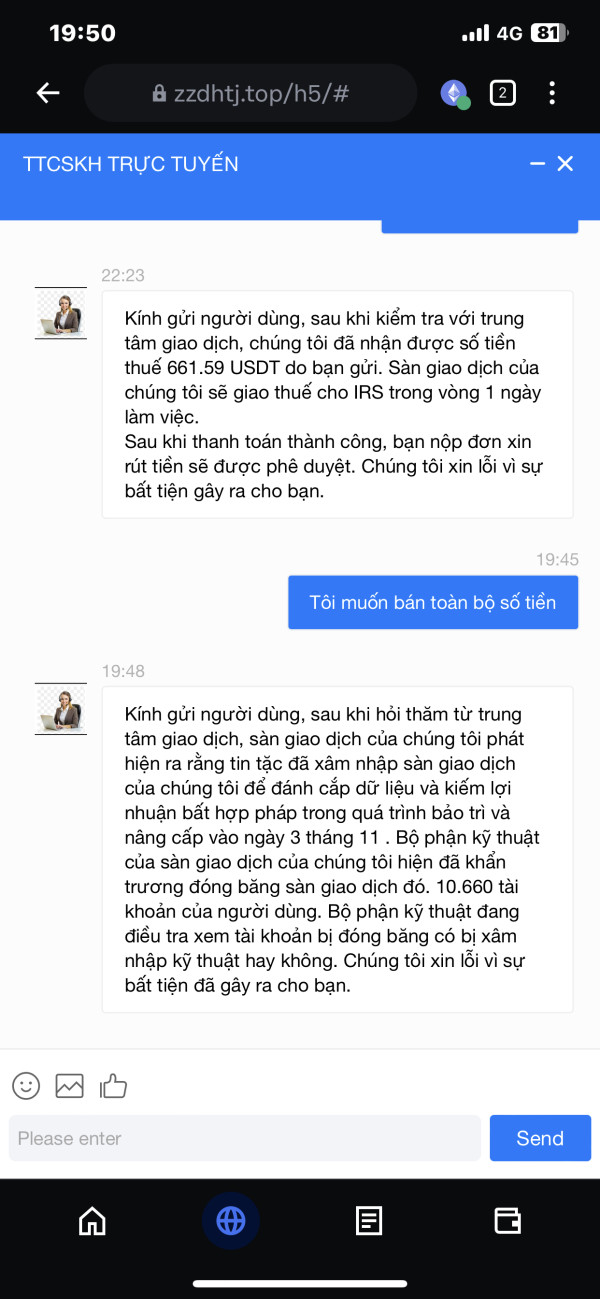

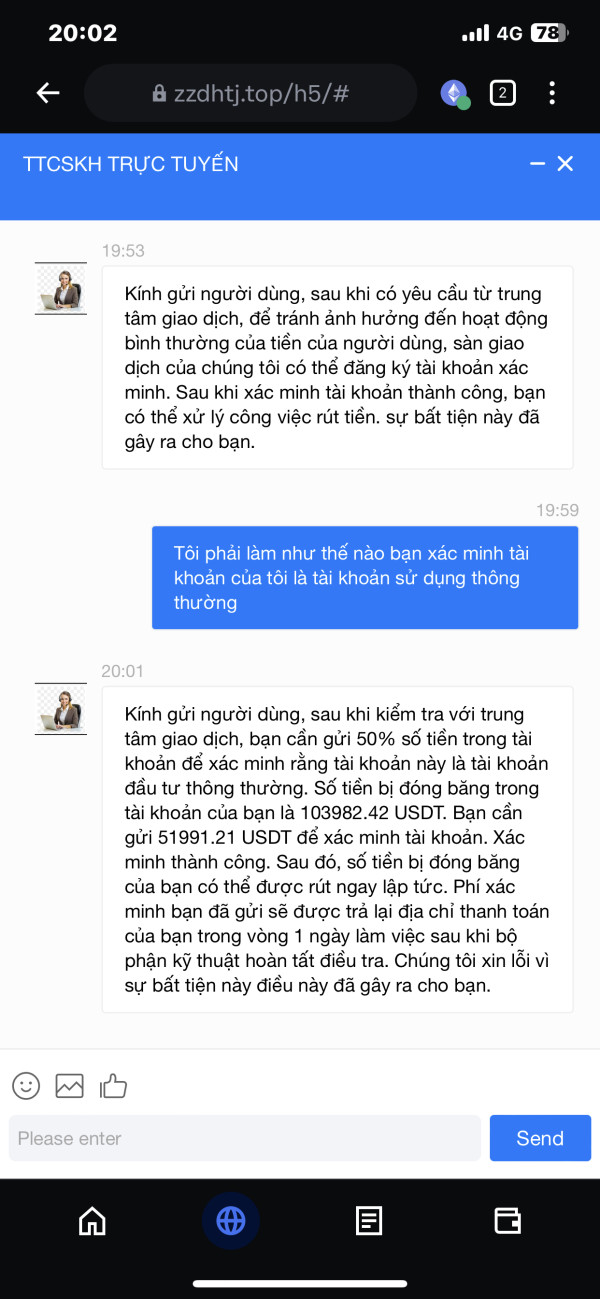

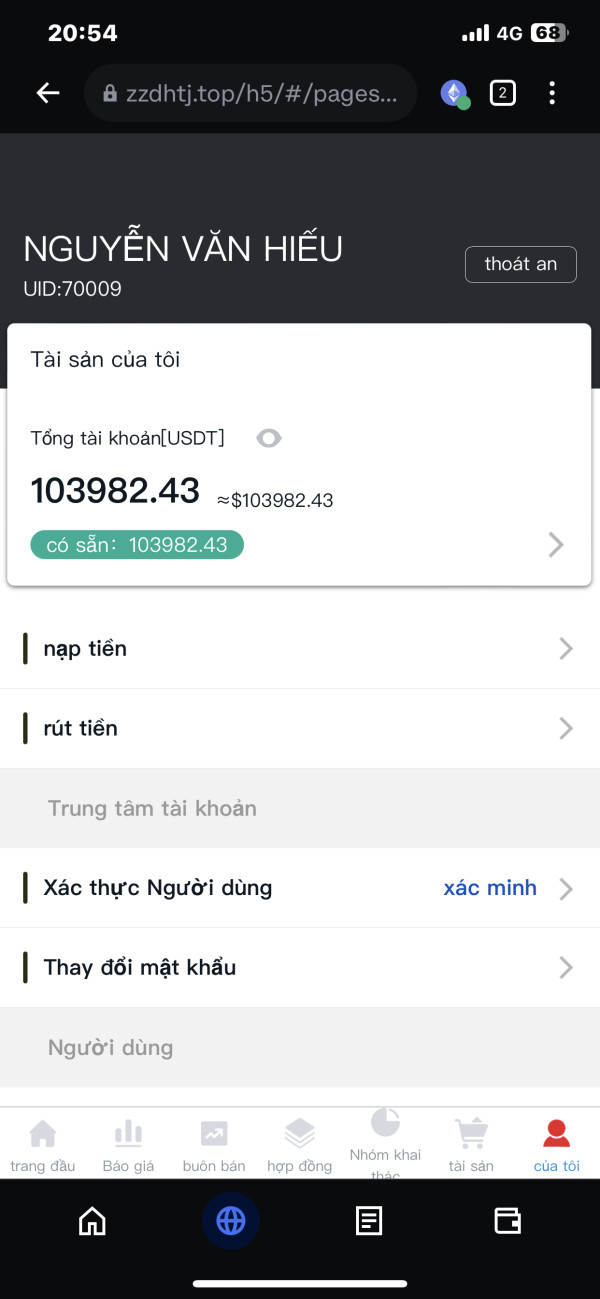

I traded on the Coinbase wallet exchange on 26/6/2024. I deposited 31001.45 USDT and traded up to 80812.78 USDT. When I tried to withdraw the entire amount, they told me that my account had been hacked and data had been stolen. They said I had to verify my account before I could withdraw money. So I went to verify my account. They calculated that based on my amount of 80812.78 USDT, I had to deposit 20% of the amount, which is 16162.55 USDT, in order to withdraw money. After I paid the tax amount, I tried to withdraw money and it said I had to wait one business day for approval. After the approval, I tried to withdraw money again and it said my account had been hacked and data had been stolen. However, my account had no transactions since the day I paid the tax to withdraw money. The amount I paid was added to my account. When the amount was added, it said I had to verify my account again based on my amount, which is 103982.43 USDT. This means I have to deposit 50% of the amount, which is 51991.21 USDT. They don't want to let me withdraw money, so they make it difficult for me to deposit more money. I hope everyone can help me recover my money. Thank you.

Exposure

2024-11-08

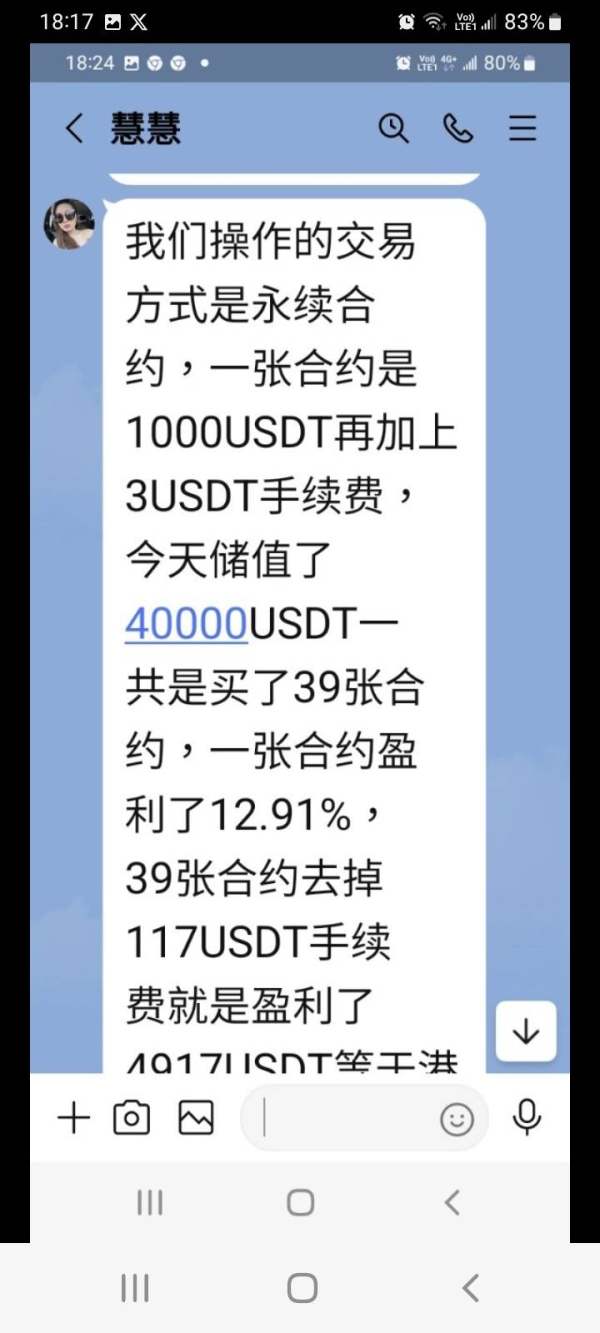

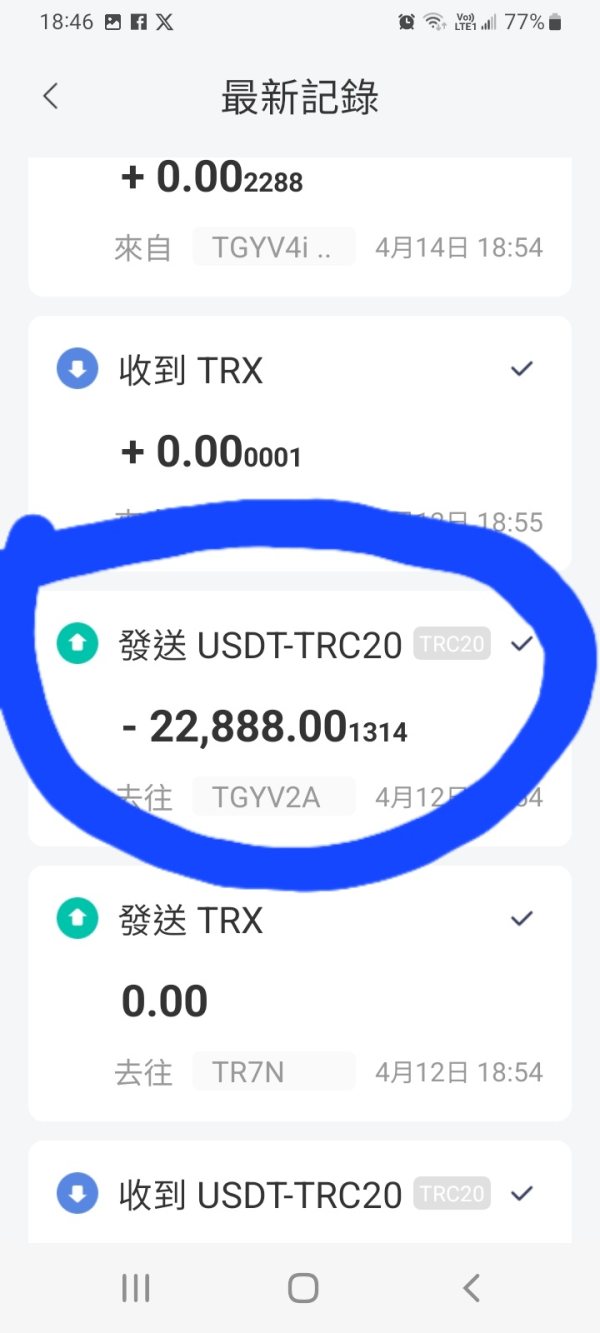

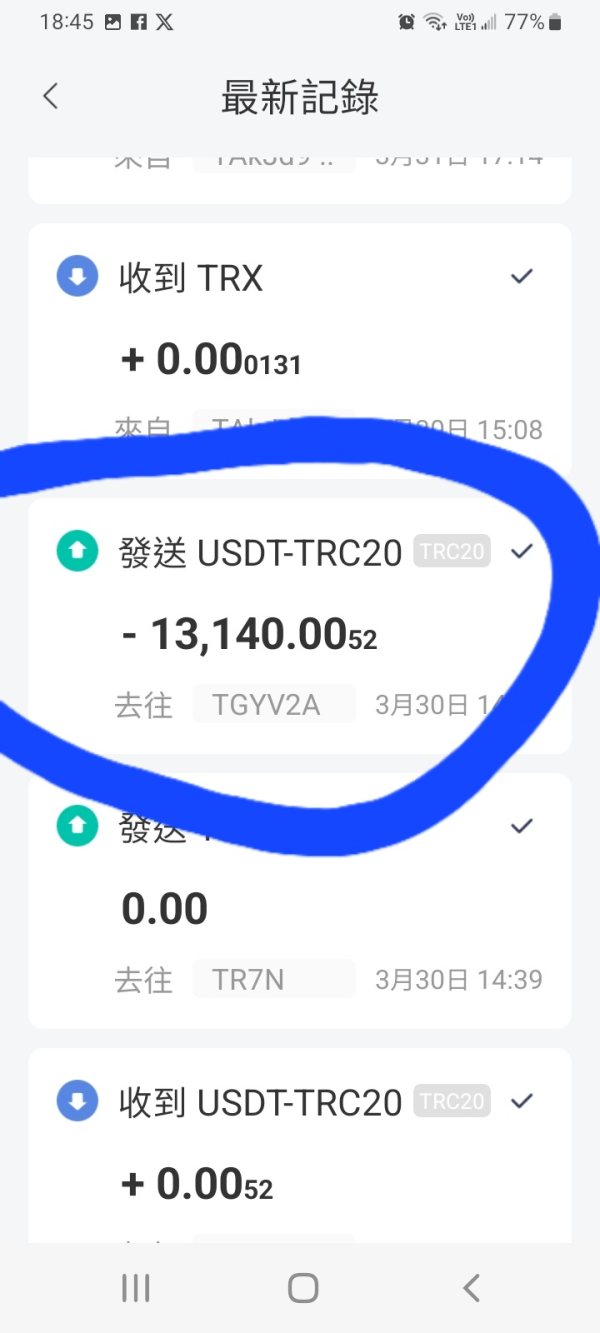

FX1324139884

Taiwan

https://coinbeneaeg.com/#/home While socializing on Facebook, I added a friend on LINE. I was persuaded to deposit money into the coinbase, introduced to a coin merchant, and bought Tether to operate on the platform. When I made a profit and wanted to withdraw, the platform demanded that I pay a 20% personal income tax. After paying this tax, my withdrawal still couldn't be processed because the review failed; they said I was a large withdrawal user and my account funds were frozen. They required an additional security deposit before I could withdraw. I paid part of it but ran out of money for more payments. Then, the platform told me that my account funds would be managed under third-party bank supervision. I feel like I've been scammed.

Exposure

2024-07-16

筱雅

Taiwan

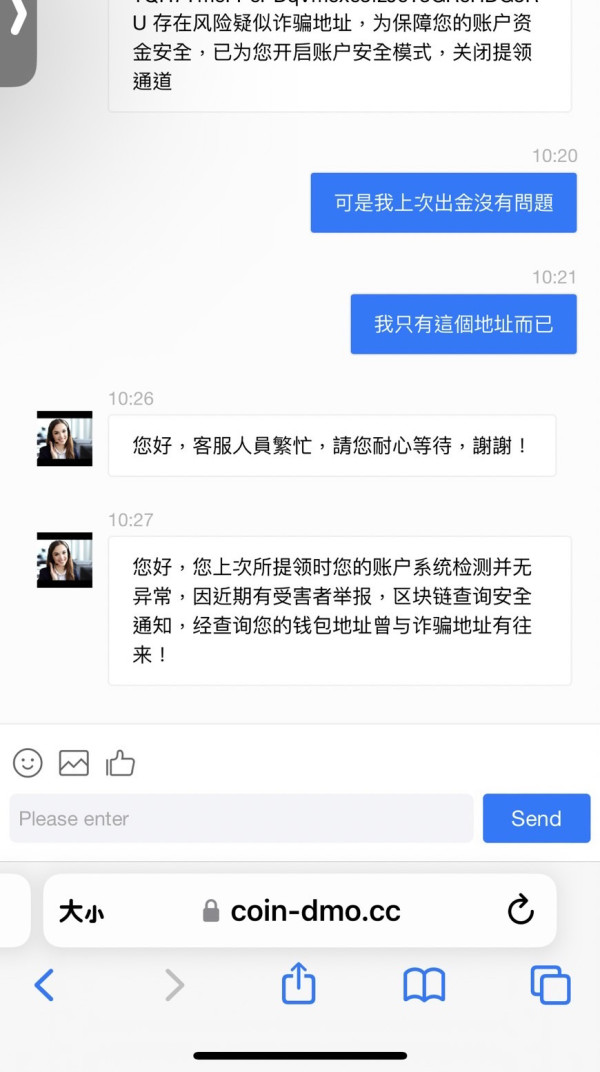

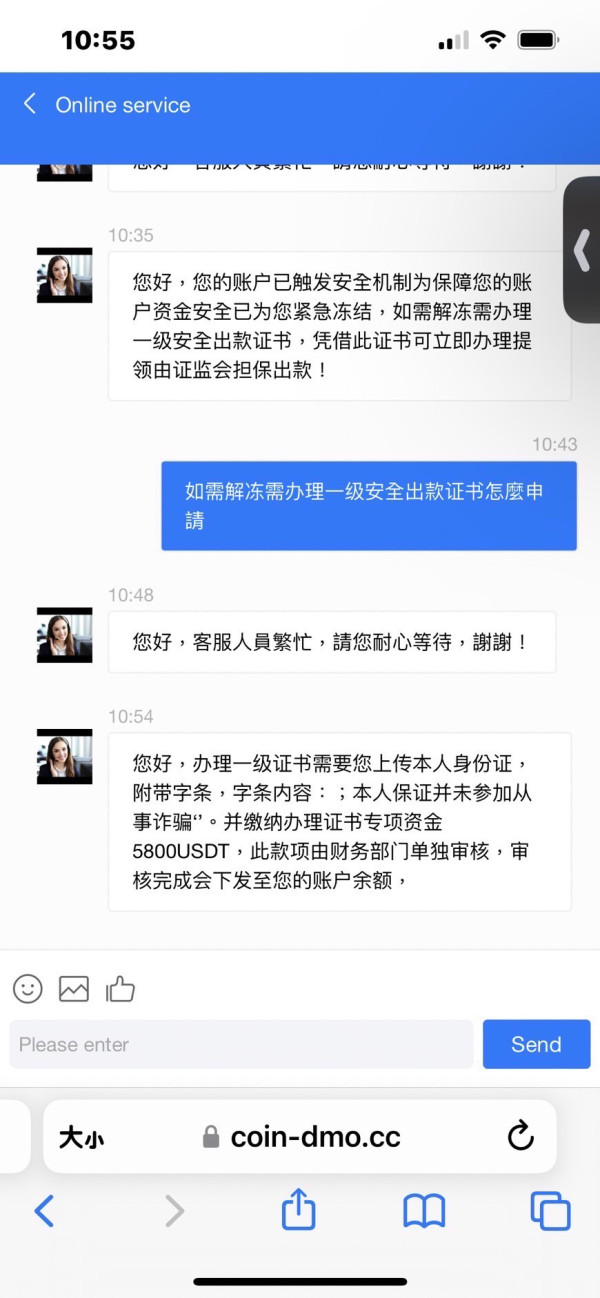

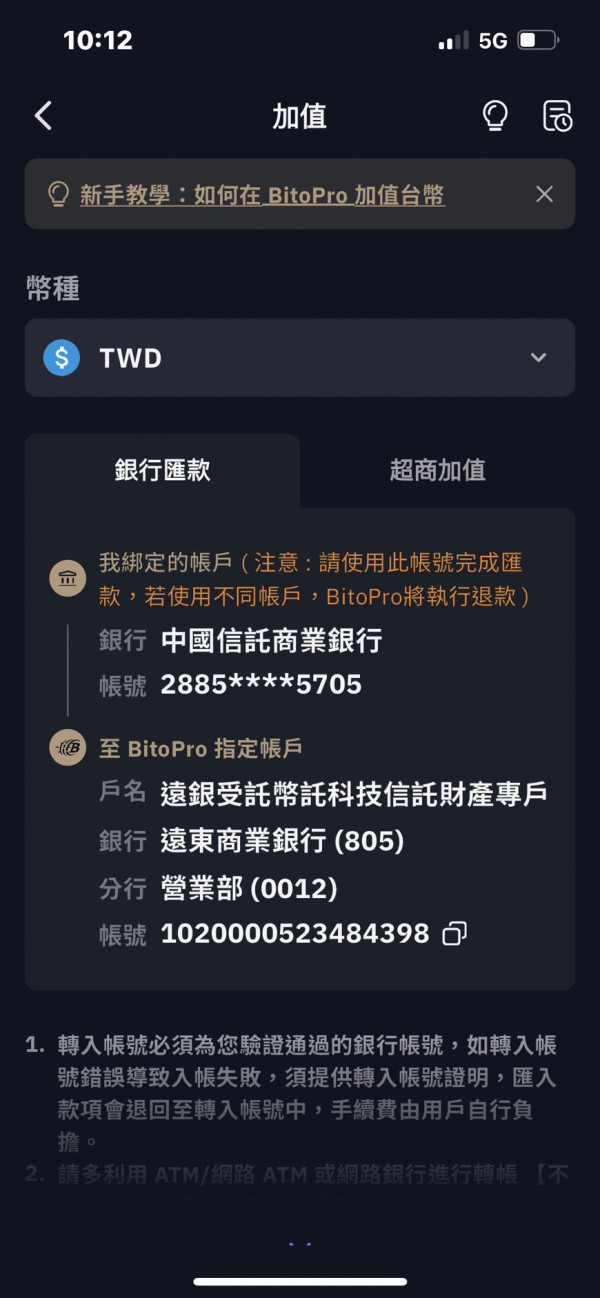

I processed a withdrawal on June 17 but did not receive the money. On June 18, I asked the customer service, and they said that the system checked your withdrawal address: Xxxxxxxxxxxxxxxxxxxxx and found that it was a risky and suspected fraudulent address. To protect the safety of your account funds, the account safety mode has been turned on for you. To close the withdrawal channel, you need to apply for a first-level certificate, which requires you to upload your ID card and the accompanying content: I guarantee that I have not participated in fraud. I also need to pay a special fund of 5800 USDT for the certificate. This amount will be reviewed separately by the financial department and will be issued to your account balance after the review is completed. This is the only solution. Since the account has transactions with a fraudulent address, a guarantee is required to process the withdrawal for you. The CSRC guarantee requires you to apply for a first-level certificate, which can be as a guarantee.

Exposure

2024-06-19