Score

TRADELINK SECURITIES LIMITED

Nigeria|5-10 years|

Nigeria|5-10 years| http://www.tradelinksecurities.com.ng/

Website

Rating Index

Contact

Licenses

Licenses

No valid regulatory information, please be aware of the risk!

- It has been verified that this broker currently has no valid regulation. Please be aware of the risk!

Basic Information

Nigeria

NigeriaUsers who viewed TRADELINK SECURITIES LIMITED also viewed..

XM

- 10-15 years |

- Regulated in Australia |

- Market Maker (MM) |

- MT4 Full License

EC Markets

- 10-15 years |

- Regulated in Australia |

- Market Maker (MM) |

- MT4 Full License

ATFX

- 5-10 years |

- Regulated in Australia |

- Market Maker (MM) |

- MT4 Full License

FXCM

- Above 20 years |

- Regulated in Australia |

- Market Maker (MM) |

- MT4 Full License

Website

tradelinksecurities.com.ng

Server Location

United States

Website Domain Name

tradelinksecurities.com.ng

Server IP

107.151.3.66

Genealogy

VIP is not activated.

VIP is not activated.Relevant Enterprises

Company Summary

| Aspect | Information |

| Company Name | TRADELINK SECURITES LIMITED |

| Registered Country/Area | Nigeria |

| Founded Year | 2019 |

| Regulation | Unregulated |

| Minimum Deposit | $500 |

| Market Instruments | Forex,Commodities,Crypto currencies |

| Account Types | Individual account,joint account |

| Spreads&commissions | As low as 0 pips |

| Trading Platforms | MetaTrader 4,Meta Trader 5 |

| Demo Account | Available |

| Customer Support | Email:info@tradelinksecurities.com.ng,Phone:08034747292 |

| Deposit & Withdrawal | Bank transfer,credit/debit card |

Overview of Tradeline Securities Limited

Tradeline Securities Limited, established in 2019 and based in Nigeria, is an unregulated financial trading company. It requires a minimum deposit of $500 to start trading and offers a range of market instruments including Forex, Commodities, and Cryptocurrencies.

The company provides two types of accounts: Individual and Joint accounts, catering to different trader needs. Tradeline Securities boasts competitive spreads and commissions, advertising rates as low as 0 pips. They offer the popular MetaTrader 4 and MetaTrader 5 platforms, along with a demo account for practice trading.

Customer support can be reached via email at info@tradelinksecurities.com.ng or by phone at 08034747292. For deposit and withdrawal, Tradeline Securities accepts bank transfers and credit/debit card transactions, providing flexible options for managing funds.

Is Tradeline Securities Limited Legit or a Scam?

Tradeline Securities Limited, a financial trading company based in Nigeria and founded in 2019, operates as an unregulated entity in the trading industry. This lack of regulation means that Tradeline Securities does not fall under the oversight of any major financial regulatory authority.

While offering services in Forex, Commodities, and Cryptocurrencies trading, the absence of regulatory oversight can be a significant factor for potential clients to consider, as it may impact the company's adherence to certain standards of financial security, transparency, and client protection.

This unregulated status highlights the need for traders to exercise caution and conduct thorough due diligence when considering Tradeline Securities' services.

Pros and Cons

| Pros | Cons |

| Diverse Market Instruments | Unregulated Status |

| Advanced Trading Platforms | Higher Minimum Deposit |

| Competitive Spreads and Commissions | Limited Geographical Reach |

| Demo Account Availability | Customer Support Limitations |

| Flexible Account Types | Risk Factor Due to Unregulated Nature |

Pros of Tradeline Securities Limited

Diverse Market Instruments: Tradeline Securities offers trading in Forex, Commodities, and Cryptocurrencies, providing a good range of options for traders looking to diversify their portfolio.

Advanced Trading Platforms: The availability of both MetaTrader 4 and MetaTrader 5 allows traders to use some of the most popular and advanced trading platforms in the industry, suitable for both beginners and experienced traders.

Competitive Spreads and Commissions: With spreads as low as 0 pips, Tradeline Securities offers competitive pricing, which can be beneficial for traders looking to minimize trading costs.

Demo Account Availability: The provision of a demo account is advantageous for new traders to practice and familiarize themselves with the trading platforms and strategies without risking real money.

Flexible Account Types: Offering both individual and Joint accounts provides flexibility for different trading needs, whether trading solo or with a partner.

Cons of Tradeline Securities Limited

Unregulated Status: The lack of regulation is a significant drawback, as it raises concerns about the security and legitimacy of the firm and its adherence to industry standards.

Higher Minimum Deposit: A minimum deposit of $500 might be relatively high for beginners or small-scale traders, potentially limiting accessibility.

Limited Geographical Reach: Being based in Nigeria, the firm's services might primarily cater to a specific regional market, which could be a limitation for international traders.

Customer Support Limitations: While customer support is available via email and phone, the absence of instant support options like live chat could impact the efficiency and timeliness of assistance.

Risk Factor Due to Unregulated Nature: The unregulated nature of the firm can pose various risks including potential issues with financial transparency, client fund security, and fair trading practices.

Market Instruments

Tradeline Securities Limited offers a diverse range of market instruments, enabling traders to broaden their investment portfolios across various asset classes:

Forex (Foreign Exchange):

Tradeline Securities allows traders to participate in the forex market, offering a wide array of currency pairs for trading. This includes major, minor, and possibly exotic pairs, providing opportunities for traders to take advantage of the fluctuations in the global currency markets.

Commodities:

The platform offers opportunities for trading in commodities. This could include both hard commodities, like metals and energy, and soft commodities such as agricultural products. Trading in commodities allows traders to diversify their portfolios and potentially hedge against market volatility and inflation.

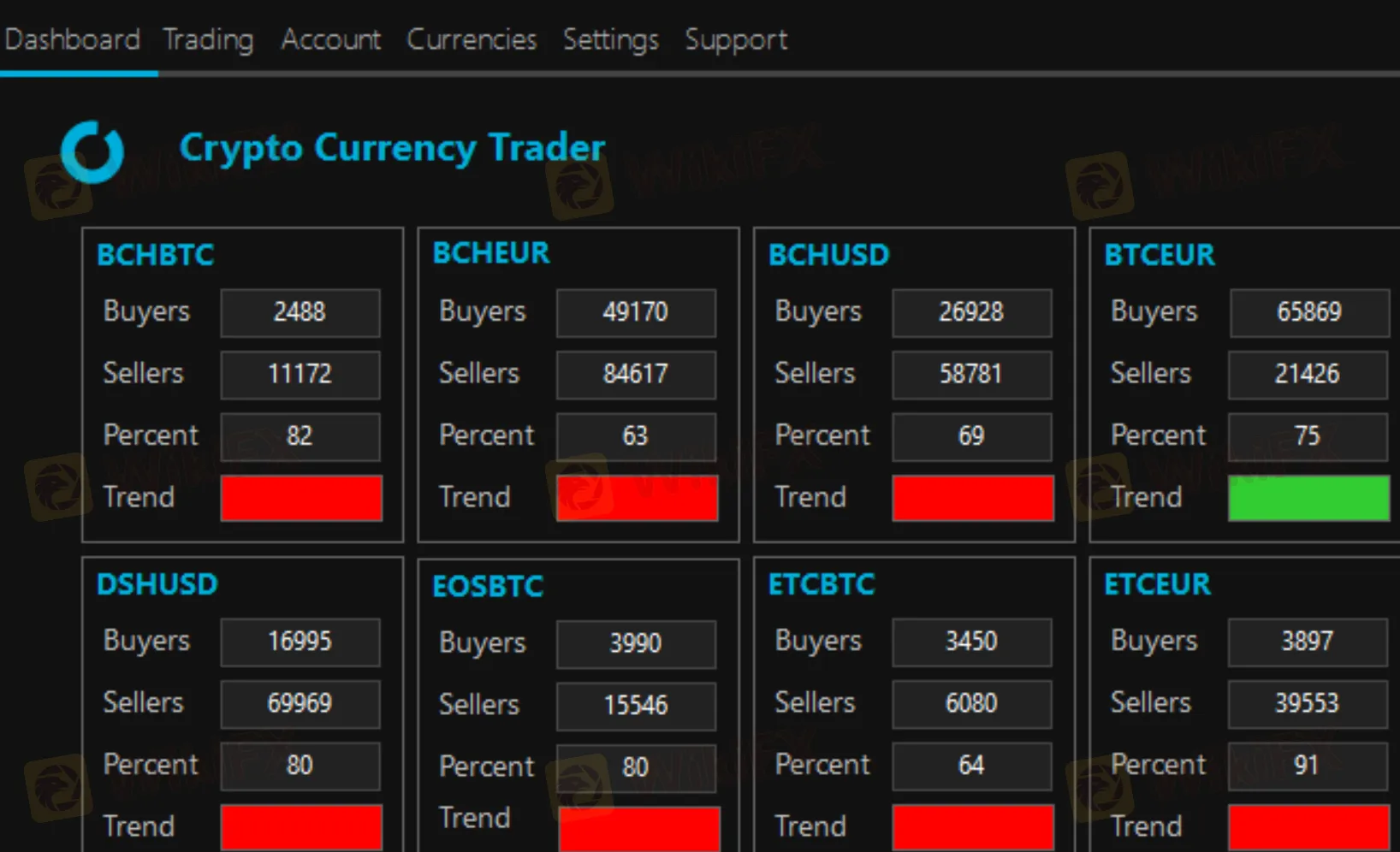

Cryptocurrencies:

Recognizing the growing interest in digital assets, Tradeline Securities also includes cryptocurrency trading in its offerings. This allows traders to engage in the highly dynamic and evolving market of digital currencies, trading in popular as well as potentially emerging cryptocurrencies.

By providing such a varied array of market instruments, Tradeline Securities meets the diverse needs and interests of traders, allowing them to invest in different markets, from the traditional forex and commodities to the innovative and rapidly-changing world of cryptocurrencies.

Account Types

Tradeline Securities Limited offers two primary types of trading accounts, catering to different trading preferences and requirements:

Individual Account:

This account type is designed for single traders managing their own portfolio. It allows individual traders to independently engage in trading activities across the various market instruments offered by Tradeline Securities, such as Forex, Commodities, and Cryptocurrencies. The individual account is ideal for those who prefer personal control over their trading strategies and decisions.

Joint Account:

The Joint account option is suited for two or more individuals who want to manage a trading account collaboratively. This type of account is beneficial for partners, friends, or family members who wish to combine their investment strategies and share the management of their trading activities. It provides a way for multiple users to access and operate a single trading account.

Both account types provide access to the same range of trading instruments and platforms, but differ in terms of account management and decision-making structures, offering flexibility to meet various trader needs.

How to Open an Account?

Opening an account with Tradeline Securities Limited involves a straightforward four-step process:

Visit the Tradeline Securities Website:

Start by going to the official website of Tradeline Securities. This is where you'll find all relevant information about their services, account types, and trading platforms.

Choose Your Account Type:

Decide between an individual account and a Joint account based on your trading needs and preferences. Individual accounts are suitable for solo traders, while Joint accounts are ideal for those planning to trade with partners or as a group.

Complete the Registration Form:

Fill out the online registration form available on the website. This will typically require you to provide personal details, contact information, and possibly some financial information. Make sure all the information you provide is accurate to ensure a smooth verification process.

Verification and Initial Deposit:

Once you submit your registration form, you'll need to go through a verification process, which may include submitting identification documents. After verification, you can proceed to make your initial deposit, keeping in mind the minimum deposit requirement of $500. Tradeline Securities accepts deposits via bank transfer and credit/debit cards.

After completing these steps, your account will be set up, and you'll be ready to start trading on the Tradeline Securities platform.

Spreads & Commissions

Tradeline Securities Limited offers competitive trading conditions with its spreads and commissions structure. They advertise spreads as low as 0 pips, which is particularly appealing to traders seeking to minimize their trading costs, especially those engaged in high-frequency trading or those who deal in large volumes.

The exact spreads and commission rates can vary depending on the market instrument being traded and the type of account held. For example, trading major currency pairs in the Forex market typically results in tighter spreads compared to other instruments like commodities or cryptocurrencies.

Understanding the specific details of the spreads and commissions for their chosen trading instruments and account types is essential for traders, as these factors can significantly influence their trading strategies and overall profitability.

Trading Platform

Tradeline Securities Limited provides its clients with access to two of the industry's most renowned and widely-used trading platforms: MetaTrader 4 (MT4) and MetaTrader 5 (MT5).

MetaTrader 4 (MT4):

MT4 is highly favored among traders globally for its user-friendly interface, robust charting tools, and comprehensive array of technical indicators. It supports automated trading through Expert Advisors (EAs), making it a popular choice for both novice and experienced traders. MT4's versatile nature makes it suitable for trading a wide range of instruments offered by Tradeline Securities, including Forex, Commodities, and Cryptocurrencies.

MetaTrader 5 (MT5):

As an advanced version of MT4, MetaTrader 5 encompasses additional features like more timeframes, advanced charting tools, an economic calendar, and more indicators. It is designed to offer a more comprehensive trading experience, supporting a broader range of trading instruments, including those available with Tradeline Securities. MT5 is ideal for traders looking for an advanced trading platform with enhanced analytical capabilities.

Both platforms provide a powerful and efficient trading environment, allowing Tradeline Securities' clients to choose the platform that best fits their trading needs and style.

Deposit & Withdrawal

Tradeline Securities Limited offers its clients a range of convenient options for depositing and withdrawing funds, focusing mainly on bank transfers and credit/debit card transactions.The minimum deposit is $500.

Bank Transfers:

Bank transfers are a reliable and traditional method for moving large sums of money. While secure, these transfers can take several days to process, depending on the banks and countries involved. This method is typically preferred for substantial transactions or initial deposits due to its security and widespread acceptance.

Credit/Debit Card Transactions:

For quicker and smaller transfers, credit and debit card transactions are generally more expedient and convenient. These transactions are processed more rapidly than bank transfers, offering more immediate access to funds. This method is particularly favored by traders who value speed and ease for frequent transfers or deposits.

Both methods are designed with security and ease of use in mind, allowing clients to manage their funds efficiently.

Customer Support

Tradeline Securities Limited offers dedicated customer support to address various client needs and inquiries. Clients can reach out to the support team via email at info@tradelinksecurities.com.ng for a range of queries, from account setup to trading issues.

Additionally, for more direct and immediate assistance, customers can contact the support team by phone at 08034747292. This dual-channel approach ensures that clients have multiple ways to get support, catering to different preferences and requirements.

While Tradeline Securities does not mention support through instant messaging or social media platforms, the available email and phone support are designed to provide efficient and responsive service to their clients.

Conclusion

In conclusion, Tradeline Securities Limited is a Nigeria-based trading company established in 2019, offering a variety of trading services in Forex, Commodities, and Cryptocurrencies.

Despite its unregulated status, it provides competitive trading conditions with spreads as low as 0 pips and access to popular MetaTrader 4 and MetaTrader 5 platforms. With a $500 minimum deposit requirement, it caters to both individual and joint account holders.

The company supports its clients through email and phone-based customer service but lacks a wider range of customer support channels. For managing funds, Tradeline Securities accepts bank transfers and credit/debit card transactions.

This makes it a viable option for traders in its operational region, but its unregulated nature and limited customer support channels call for careful consideration by potential clients.

FAQs

Q:Is Tradeline Securities Limited regulated?

A:No, Tradeline Securities Limited is currently unregulated.

Q:What is the minimum deposit required to start trading with Tradeline Securities?

A:The minimum deposit required is $500.

Q:What types of trading accounts does Tradeline Securities offer?

A:Tradeline Securities offers individual and Joint trading accounts.

Q:Which trading platforms are available with Tradeline Securities?

A:Tradeline Securities provides MetaTrader 4 (MT4) and MetaTrader 5 (MT5) trading platforms.

Q:How can I contact Tradeline Securities' customer support?

A:Customer support can be reached via email at info@tradelinksecurities.com.ng or by phone at 08034747292.

Q:What are the deposit and withdrawal methods at Tradeline Securities?

A:The company accepts deposits and processes withdrawals through bank transfers and credit/debit card transactions.

Q:Does Tradeline Securities offer a demo account?

A:Yes, a demo account is available for clients to practice trading without risking real money.

Keywords

- 5-10 years

- Suspicious Regulatory License

- Suspicious Scope of Business

- High potential risk

Content you want to comment

Please enter...

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now