Overview of Da Di

Da Di (Hong Kong) Financial Services Limited is a company based in Hong Kong that has been operating for 2-5 years. They offer trading services in indices, interest instruments, currencies, metals, energy, agriculture, and commodities. They utilize the Esunny Polestar trading platform to facilitate trading activities and offer various deposit/withdrawal methods, including bank transfer, online banking, ATM, and cheque.

Da Di Financial Services Limited is regulated by the Securities and Futures Commission of Hong Kong (SFC), but this is in the form of an offshore regulatory, which suggests some inherent risks. Customer support is available through email and telephone. Specific details about tradable assets, account types, minimum deposit, leverage, spread, educational content, and bonus offerings are not available.

Regulation

Da Di (Hong Kong) Financial Services Limited is offshore regulated by the Securities and Futures Commission of Hong Kong (SFC). Offshore regulation refers to regulatory frameworks established in offshore jurisdictions with more relaxed financial regulations compared to established financial centers. While offshore regulation may offer certain advantages such as reduced red tape and tax benefits, it also comes with significant disadvantages and risks.

The main drawbacks include limited oversight and investor protection, unclear legal frameworks, reputation concerns, volatility and political risk, and limited cooperation with international authorities. Offshore regulatory environments are prone to illicit activities like money laundering and fraud, and clients may face challenges in terms of understanding their rights, resolving disputes, and ensuring the safety of their funds. Lack of transparency and cooperation with international regulators further compound these risks.

Pros and Cons

Da Di (Hong Kong) Financial Services Limited's use of the Esunny Polestar trading platform provides clients with access to an established trading system. With a focus on futures contracts, Da Di (Hong Kong) caters to the needs of both institutional and individual clients, offering various deposit/withdrawal methods for convenience. Their customer support options, including email and telephone, allow for communication and assistance when needed.

One potential drawback is the limited information provided about tradable assets, account types, minimum deposits, leverage, spread, educational content, and bonus offerings. This lack of detailed information may hinder potential clients in evaluating the suitability of the company's services for their specific needs. Additionally, the absence of specific details about the company's regulatory licenses, such as license numbers, limits a comprehensive understanding of the level of regulatory oversight and investor protection provided. Clients may need to conduct additional research and due diligence to fully assess the risks and advantages associated with engaging with Da Di (Hong Kong) Financial Services Limited.

Market Instruments

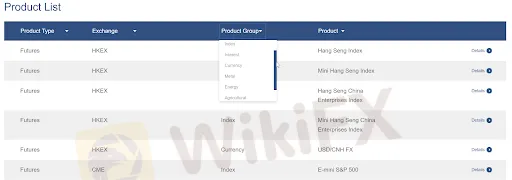

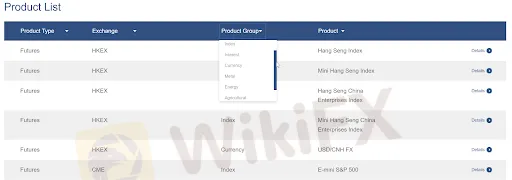

DA DI offers a diverse range of market instruments for trading, including indices, interest instruments, currencies, metals, energy, agricultural commodities, and various other commodities, specific descriptions of these are as follows:

Index: Trading indices provides opportunities to monitor and speculate on the performance of specific markets or sectors by tracking a collection of stocks.

Interest: By engaging in interest instruments, such as bonds and fixed-income securities, traders can speculate on changes in interest rates and potentially earn returns through interest payments.

Currency: Participating in the currency market allows traders to take advantage of fluctuations in exchange rates, offering opportunities to profit from the price movements between different currency pairs.

Metal: Trading in metals, including precious metals like gold, silver, platinum, and palladium, enables speculating on the price movements of these commodities, which are often influenced by factors such as economic conditions and global demand.

Energy: Engaging in energy instruments like crude oil and natural gas allows traders to speculate on price movements driven by supply and demand dynamics, geopolitical events, and other factors influencing the energy market.

Agricultural: Trading agricultural instruments involves commodities like wheat, corn, soybeans, coffee, and sugar, providing opportunities to profit from price fluctuations influenced by factors such as weather conditions and global supply and demand.

Commodity: Trading commodities encompasses a broad range of raw materials, including metals, energy resources, agricultural products, and more. Traders can engage in speculative trading or hedge against price fluctuations in diverse commodity markets.

The following is a table which compares Da Di Financial Services Limited's market instruments compared to four other like companies:

Account Types

Da Di (Hong Kong) Financial Services Limited offers two types of accounts: Standard and Demo accounts.

Standard Account: The standard account provided by Da Di (Hong Kong) Financial Services Limited is designed for live trading. It offers real-time market access and allows clients to trade with real money. Traders can utilize the full range of services and features offered by the company, including accessing various market instruments, executing trades, managing positions, and monitoring account balances.

Demo Account: The demo account offered by Da Di (Hong Kong) Financial Services Limited is a practice account that allows traders to engage in simulated trading without using real money. It provides a risk-free environment for clients to familiarize themselves with the trading platform, test their strategies, and gain practical trading experience. The demo account allows traders to explore the available market instruments, practice executing trades, and evaluate the platform's functionality, all using virtual funds.

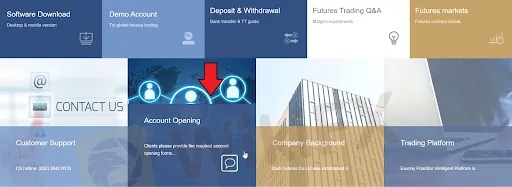

How to make an account?

To open an account with Da Di (Hong Kong) Financial Services Limited, follow these step-by-step instructions:

Gather Required Documents: Prepare the necessary documents to complete the account opening process. Typically, you will need a signed application form, copies of identification documents (such as ID card or passport), address proof, and bank account proof. For corporate accounts, additional documents like business registration certificates and memorandum and articles of association may be required.

2. Choose Account Type: Determine the type of account you want to open, such as a standard or demo account. Understand the features and benefits of each account type to make an informed decision.

3. Submit Application: Download and fill out the application form accurately and completely. Ensure that all required fields are filled in and any supporting documents are attached.

4. Certify Documents: If necessary, ensure that the original documents are certified as true copies. This may involve obtaining certifications from licensed professionals or company representatives. Follow the instructions provided by Da Di (Hong Kong) Financial Services Limited for document certification.

5. Submit Application Package: Send the completed application form and supporting documents to Da Di (Hong Kong) Financial Services Limited. You can choose to submit the documents either by post or in person.

- By post: Mail the documents to the designated address provided by the company.

- In person: Contact the customer service representative at Da Di (Hong Kong) Financial Services Limited to arrange an appointment for submitting the documents in person. Ensure that you bring all the required documents with you to the meeting.

6. Verification and Approval: After submitting the application, the company will review and verify your documents. Once your application is approved, you will be notified about the status of your account opening.

7. Fund Your Account: Once your account is successfully opened, you can proceed to fund your trading account using the designated deposit methods provided by Da Di (Hong Kong) Financial Services Limited. Follow the instructions provided by the company to complete the funding process.

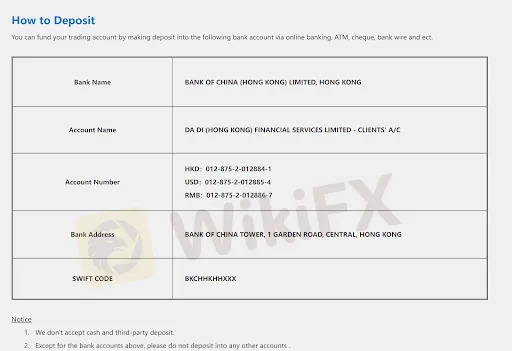

Deposit & Withdrawal

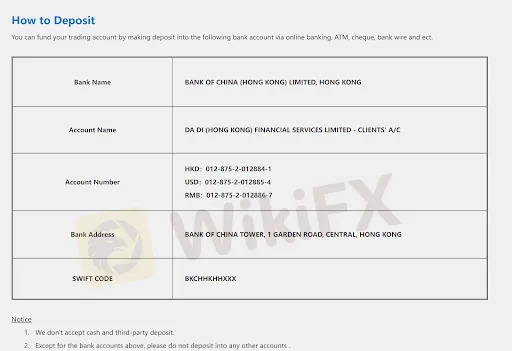

Da Di (Hong Kong) Financial Services Limited offers multiple deposit and withdrawal methods to facilitate transactions with their clients. Clients can fund their trading accounts through various channels, including online banking, ATM transfers, cheque deposits, and bank wire transfers. These methods allow for convenient and secure transactions, enabling clients to deposit funds into their accounts easily. Similarly, when it comes to withdrawals, clients can request fund withdrawals by filling out and signing a “Fund Withdrawal Form” and submitting it via fax or email. Da Di (Hong Kong) Financial Services Limited aims to provide deposit and withdrawal processes to cater to the diverse needs of their clients.

Trading Platforms

Da Di (Hong Kong) Financial Services Limited offers the Esunny Polestar trading platform. This platform allows clients to access and trade various financial instruments, including futures contracts. Esunny Polestar provides a real-time market data, advanced charting tools, and order management functionalities. Clients can execute trades, monitor positions, and manage their accounts efficiently using this platform.

Customer Support

Da Di (Hong Kong) Financial Services Limited offers various customer support options for clients to seek assistance and address their concerns. The available customer support options include:

Phone Support: Clients can reach customer support by calling the provided phone number, +852 3842 0018, during the company's office hours from Monday to Friday, 0900-1800 (except public holidays).

Email Support: Clients can contact customer support by sending an email to cs@ddfs.com.hk. This allows for written communication, enabling clients to provide detailed information and receive responses from the support team.

Conclusion

Da Di (Hong Kong) Financial Services Limited is a financial broker headquartered in Hong Kong. As a subsidiary of Dadi Futures Co., Ltd and part of Zhejiang Orient Financial Holdings Group, the company offers a range of services in the global financial industry. Regulated by the Securities and Futures Commission of Hong Kong (SFC), Da Di (Hong Kong) operates under offshore regulatory standards.

Through their Esunny Polestar trading platform, clients can access various market instruments, including futures contracts, enabling them to engage in trading and manage their positions. With a focus on client support, Da Di (Hong Kong) provides customer assistance through phone and email channels, ensuring prompt responsiveness to client inquiries and concerns.

FAQs

Q: What types of market instruments can be traded through Da Di (Hong Kong) Financial Services Limited?

A: Indices, interest rates, currencies, metals, energy, and agricultural commodities.

Q: How can clients deposit funds into their trading accounts with Da Di (Hong Kong) Financial Services Limited?

A: Clients can deposit funds into their trading accounts using various methods, such as online banking, ATM transfers, cheque deposits, and bank wire transfers.

Q: What trading platform is available for clients of Da Di (Hong Kong) Financial Services Limited?

A: Da Di (Hong Kong) Financial Services Limited provides the Esunny Polestar trading platform for clients to trade and manage their positions effectively.

Q: What customer support options are available to clients of Da Di (Hong Kong) Financial Services Limited?

A: Da Di (Hong Kong) Financial Services Limited offers customer support through phone and email channels, ensuring prompt assistance to client inquiries and concerns.

Q: Is Da Di (Hong Kong) Financial Services Limited regulated?

A: Yes, Da Di (Hong Kong) Financial Services Limited is regulated by the Securities and Futures Commission of Hong Kong (SFC).

Q: Can clients open demo accounts with Da Di (Hong Kong) Financial Services Limited?

A: Yes, Da Di (Hong Kong) Financial Services Limited provides demo accounts for clients to practice trading and familiarize themselves with the platform before trading with real funds.